Minnesota Approval of deferred compensation investment account plan

Description

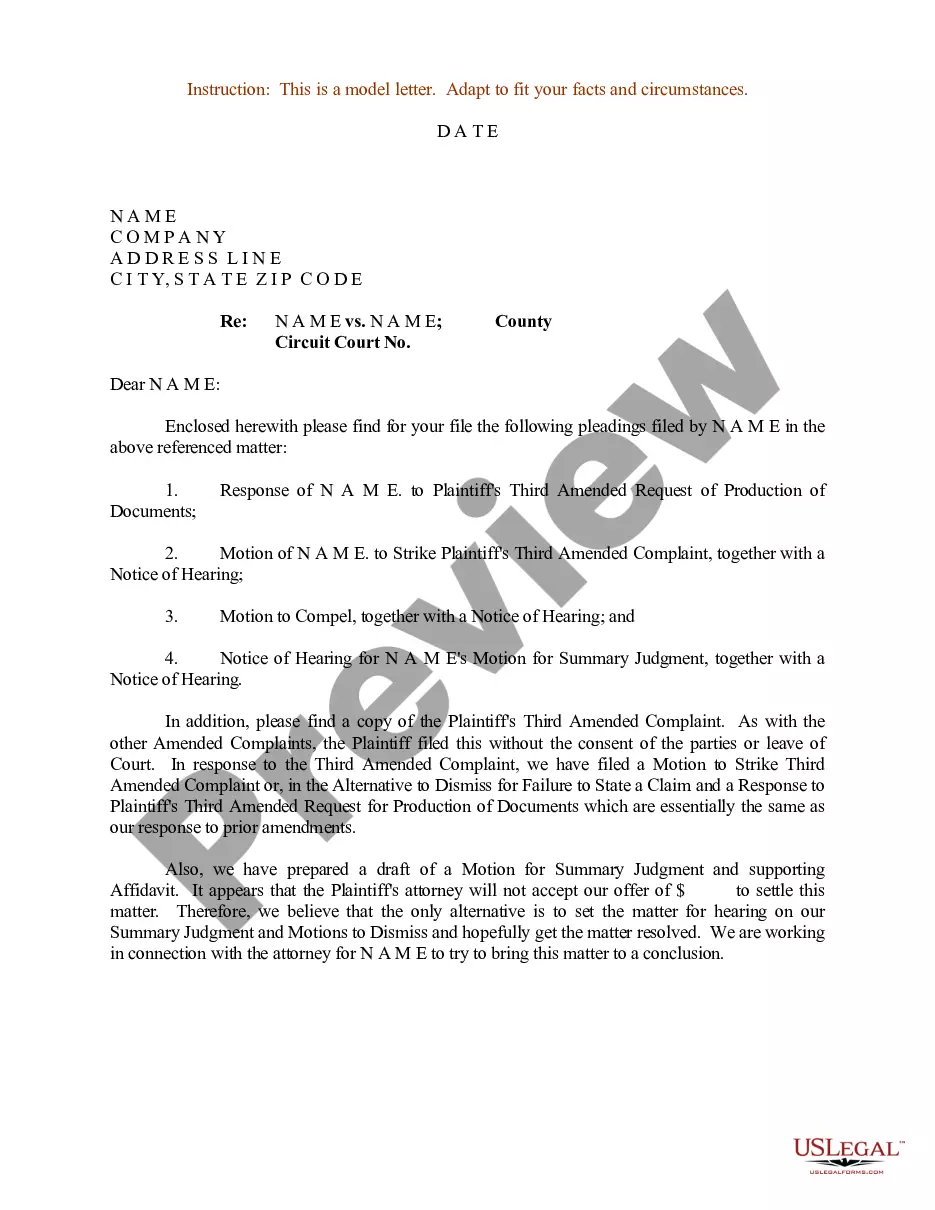

How to fill out Approval Of Deferred Compensation Investment Account Plan?

You are able to invest time on-line searching for the legitimate document design that fits the state and federal needs you require. US Legal Forms gives thousands of legitimate forms that happen to be analyzed by experts. It is possible to down load or print the Minnesota Approval of deferred compensation investment account plan from our services.

If you already have a US Legal Forms accounts, you may log in and click the Acquire switch. Afterward, you may comprehensive, revise, print, or signal the Minnesota Approval of deferred compensation investment account plan. Every single legitimate document design you get is the one you have forever. To obtain another version of any purchased form, proceed to the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site initially, adhere to the easy guidelines beneath:

- Very first, make certain you have chosen the proper document design for the county/area of your choice. Browse the form explanation to ensure you have picked out the correct form. If available, take advantage of the Review switch to look through the document design as well.

- If you wish to discover another model of the form, take advantage of the Search industry to discover the design that fits your needs and needs.

- After you have discovered the design you need, just click Purchase now to proceed.

- Select the pricing prepare you need, type your qualifications, and sign up for a merchant account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal accounts to purchase the legitimate form.

- Select the format of the document and down load it to the device.

- Make changes to the document if required. You are able to comprehensive, revise and signal and print Minnesota Approval of deferred compensation investment account plan.

Acquire and print thousands of document web templates making use of the US Legal Forms website, that offers the biggest assortment of legitimate forms. Use expert and express-specific web templates to deal with your company or person demands.

Form popularity

FAQ

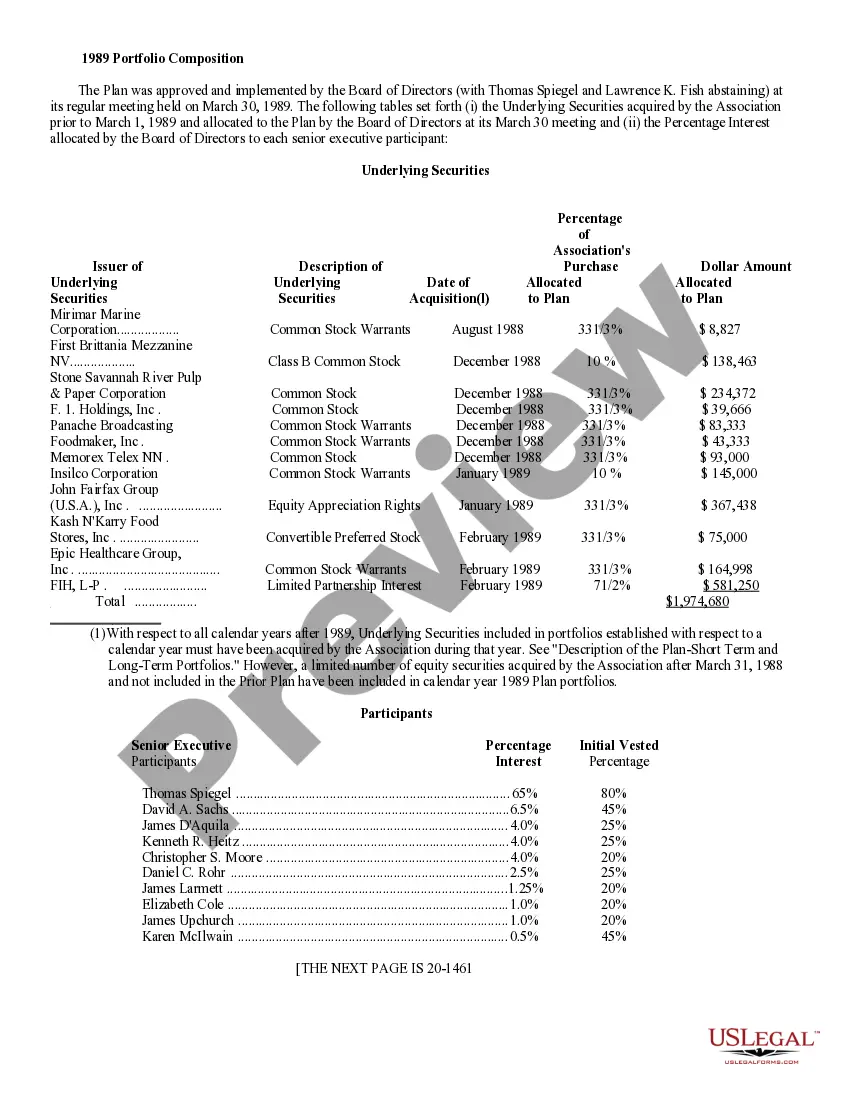

Investing your deferred compensation Your plan might offer you several options for the benchmark?often, major stock and bond indexes, the 10-year US Treasury note, the company's stock price, or the mutual fund choices in the company 401(k) plan.

Deferred compensation plans are an incentive that employers use to hold onto key employees. Deferred compensation can be structured as either qualified or non-qualified under federal regulations. Some deferred compensation is made available only to top executives.

You can request a loan by logging in to your DCP account, completing a Loan Application Form, or calling the Service Center at 844-523-2457.

You can process a distribution request by logging in to your account and navigating to Loans & Withdrawals > Taking a Withdrawal > Request a Withdrawal. If you have questions about distributions, call the Service Center at 844-523-2457.

A hardship distribution is a withdrawal from a participant's elective deferral account made because of an immediate and heavy financial need, and limited to the amount necessary to satisfy that financial need. The money is taxed to the participant and is not paid back to the borrower's account.

You can take out small or large sums anytime, or you can set up automatic, periodic payments. If your plan allows it, you may be able to have direct deposit which allows for fast transfer of funds. Unlike a check, direct deposit typically doesn't include a hold on the funds from your account.

The Minnesota Deferred Compensation Plan (MNDCP) is a voluntary savings plan intended for long-term investing for retirement.

The 457 plan is a retirement savings plan and you generally cannot withdraw money while you are still employed. When you leave employment, you may withdraw funds; leave them in place; transfer them to a 457, 403(b) or 401(k) of a new employer; or roll them into an Individual Retirement Account (IRA).