Minnesota Proposal to ratify the prior grant of options to each directors to purchase common stock

Description

How to fill out Proposal To Ratify The Prior Grant Of Options To Each Directors To Purchase Common Stock?

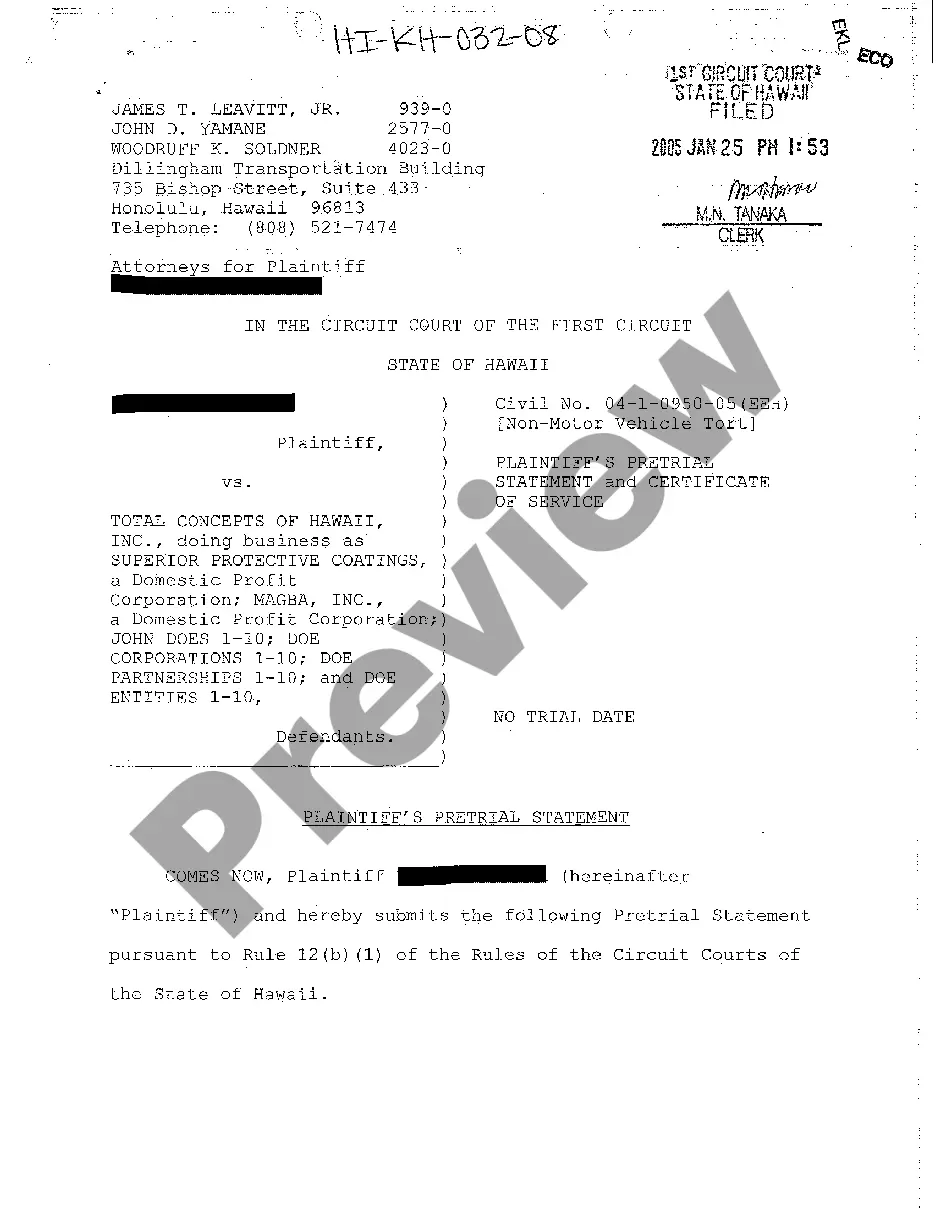

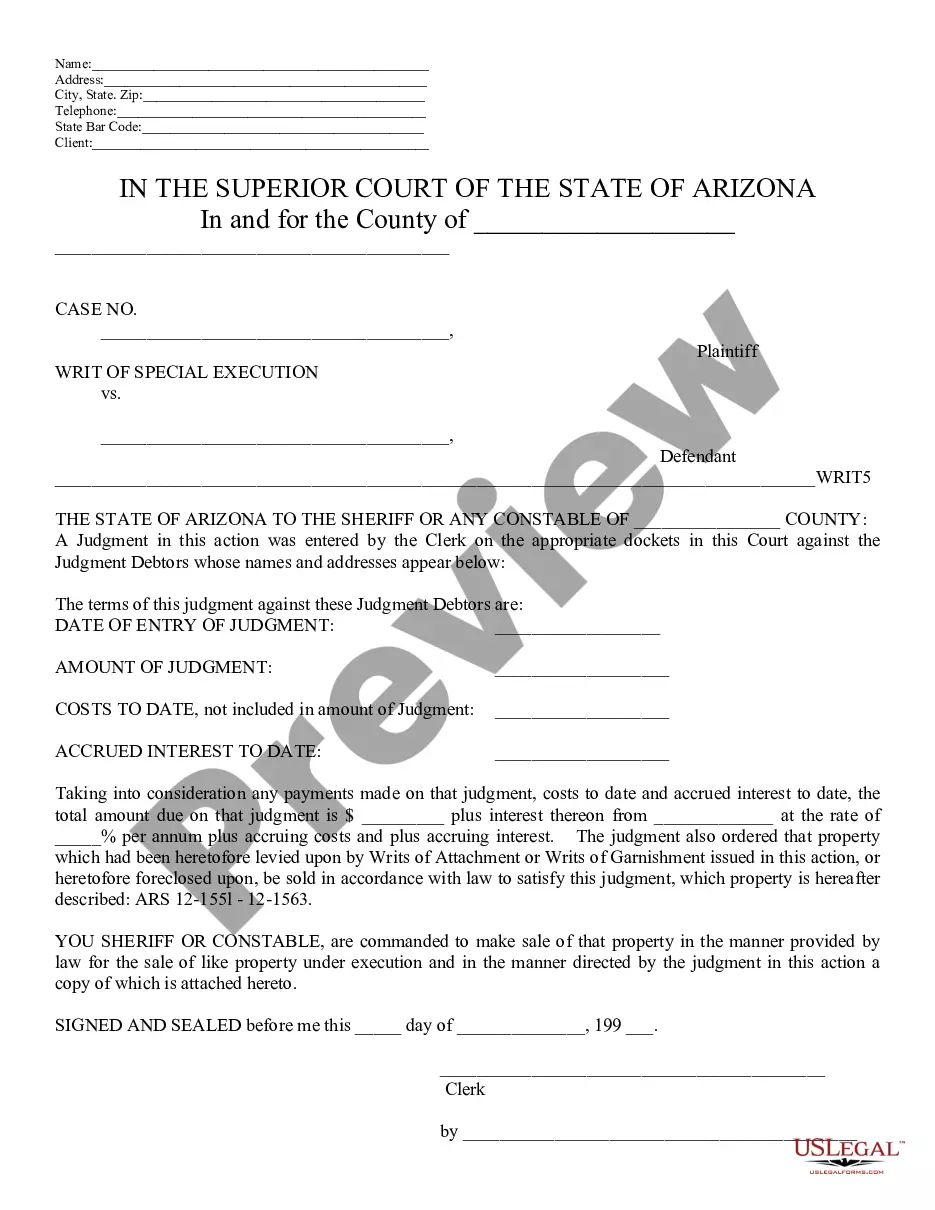

It is possible to spend hours on the Internet trying to find the legitimate record template that suits the state and federal demands you will need. US Legal Forms supplies thousands of legitimate forms which are examined by professionals. It is simple to down load or print out the Minnesota Proposal to ratify the prior grant of options to each directors to purchase common stock from your assistance.

If you have a US Legal Forms account, you may log in and click the Obtain key. Following that, you may complete, edit, print out, or signal the Minnesota Proposal to ratify the prior grant of options to each directors to purchase common stock. Each legitimate record template you get is the one you have forever. To acquire an additional duplicate of the acquired kind, proceed to the My Forms tab and click the corresponding key.

Should you use the US Legal Forms website initially, follow the simple directions under:

- Initially, ensure that you have selected the right record template to the region/town of your liking. Browse the kind information to ensure you have picked out the correct kind. If readily available, make use of the Preview key to check throughout the record template at the same time.

- If you would like discover an additional model from the kind, make use of the Look for field to obtain the template that meets your needs and demands.

- Upon having found the template you need, simply click Acquire now to continue.

- Pick the rates strategy you need, type in your accreditations, and register for a merchant account on US Legal Forms.

- Total the deal. You should use your bank card or PayPal account to cover the legitimate kind.

- Pick the format from the record and down load it to your device.

- Make alterations to your record if necessary. It is possible to complete, edit and signal and print out Minnesota Proposal to ratify the prior grant of options to each directors to purchase common stock.

Obtain and print out thousands of record layouts while using US Legal Forms site, which provides the largest variety of legitimate forms. Use professional and condition-particular layouts to handle your company or personal demands.

Form popularity

FAQ

The board of directors normally can remove a corporate officer at any time with or without cause. A director or officer is not liable to the corporation for a bad business decision. Directors are entitled to use confidential corporate information for their personal advantage.

Sometimes an act which is ultra vires can be regularized by the shareholders of the company. For example, If an act is ultra vires the power of directors, then the shareholders can ratify it. If an act is ultra vires the Articles of the company, then the company can alter the Articles.

If any of the above breaches occur, either ASIC or a liquidator appointed as agent of the company may commence proceedings against the director personally.

Ratification applies where the breach has already taken place. If capable of ratification, breach by a director of his duties may be ratified by a shareholders' resolution. However, neither the director nor any person connected with him, if a shareholder, may vote on the resolution to ratify (section 239 CA2006).

The best way to resolve this issue is for these individuals to obtain the approval of the board with a corporate resolution to ratify actions. A meeting and vote may be taken to approve the actions of the individual within the company.

What happens if a director breaches their duties? If a director breaches their fiduciary duties towards their company, the company can take legal action against the director. This action is usually instigated by the stakeholders seeking restitution for financial loss or damage.

What is a stock option grant? Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.