Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

If you need to full, down load, or print legal file templates, use US Legal Forms, the greatest assortment of legal types, which can be found on the web. Use the site`s simple and easy hassle-free look for to find the papers you require. Different templates for business and individual reasons are categorized by types and says, or keywords and phrases. Use US Legal Forms to find the Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan within a few click throughs.

When you are previously a US Legal Forms buyer, log in for your profile and click the Download switch to find the Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan. You can even gain access to types you in the past delivered electronically from the My Forms tab of your profile.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the correct area/region.

- Step 2. Take advantage of the Preview choice to look through the form`s information. Do not overlook to read through the description.

- Step 3. When you are unsatisfied with all the form, make use of the Research discipline at the top of the monitor to get other versions from the legal form web template.

- Step 4. After you have discovered the form you require, click the Acquire now switch. Choose the rates plan you favor and add your credentials to register on an profile.

- Step 5. Procedure the deal. You should use your charge card or PayPal profile to finish the deal.

- Step 6. Choose the format from the legal form and down load it on the system.

- Step 7. Complete, revise and print or sign the Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan.

Every single legal file web template you acquire is your own forever. You might have acces to every single form you delivered electronically within your acccount. Go through the My Forms portion and pick a form to print or down load yet again.

Compete and down load, and print the Minnesota Proposal to Approve Adoption of Employees' Stock Option Plan with US Legal Forms. There are millions of expert and condition-particular types you may use for your business or individual needs.

Form popularity

FAQ

Employees who receive stock grants or options may be willing to put more effort into their work since they stand to gain from company stock price increases. For the employer, providing stock grants or options to employees offers the additional benefit of not requiring a cash outlay upfront.

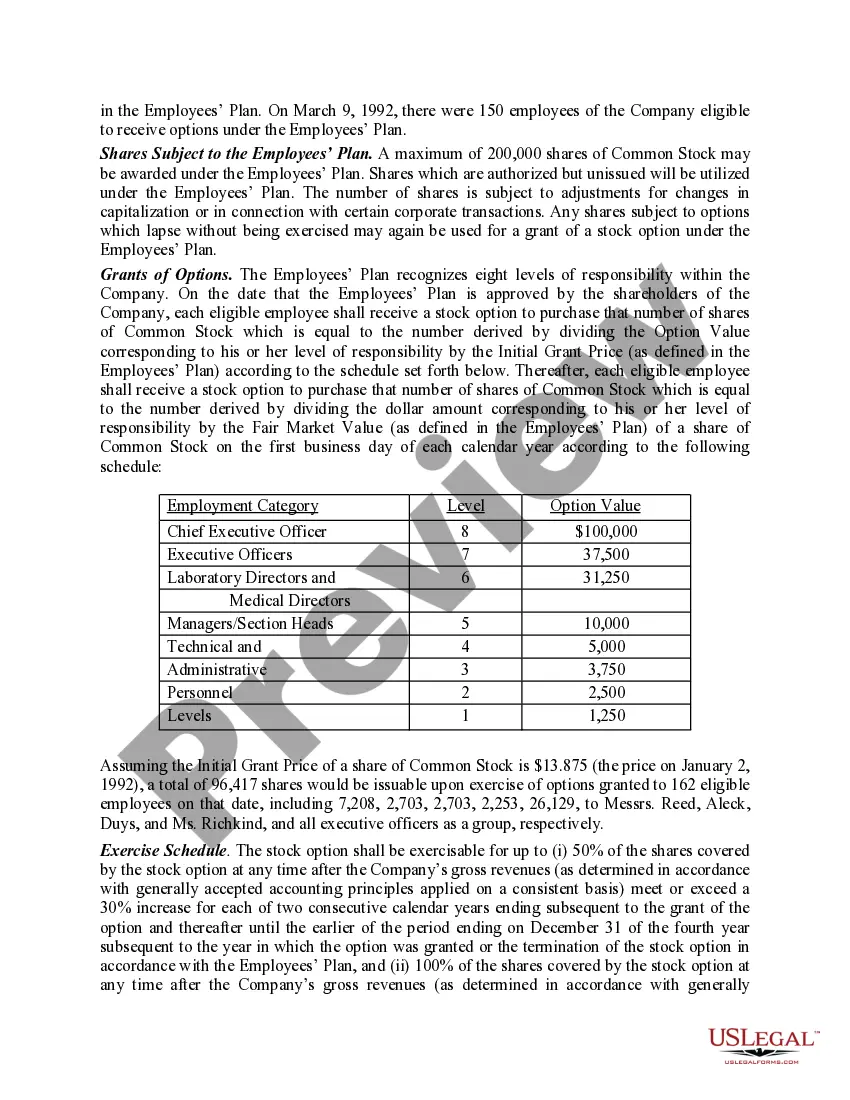

There are two main ways to allocate options to your team: As a percentage of the salary - companies offer options to their team based on their salary, seniority, and type of role. As a percentage of the company - in this case, key people might get allocated a fixed % of the company's total equity.

Alert: You may need to formally accept the grant with a print or online signature. If you do not, you may forfeit the grant. Alternatively, your ability to exercise options or receive awarded shares upon vesting may be suspended until you have formally accepted the grant.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

Making ESO Offers Declare the type of stock options employees will receive (ISOs or NSOs). Explain the value in terms of the number of shares rather than the percentage of the company. State that the board must approve all stock option grant amounts before the offer letter becomes valid.

These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time. ESOs can have vesting schedules that limit the ability to exercise.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).