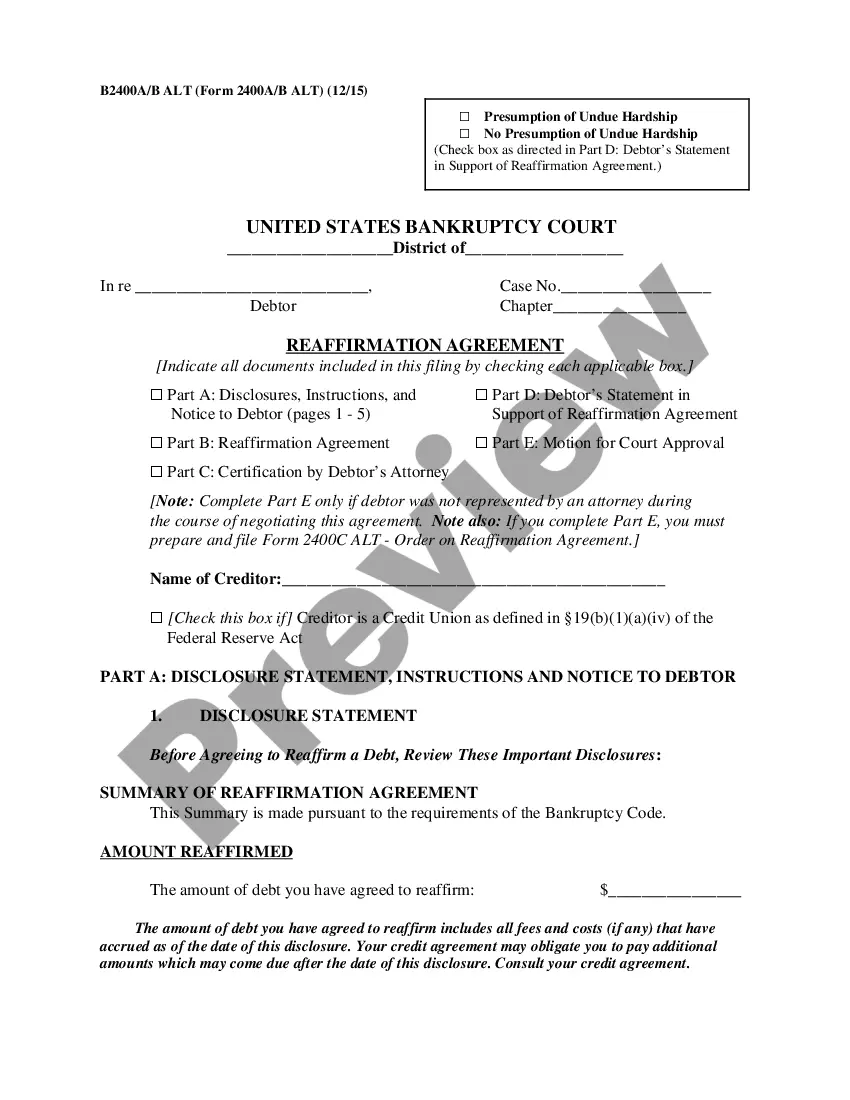

Minnesota Reaffirmation Agreement, Motion and Order

Description

How to fill out Reaffirmation Agreement, Motion And Order?

You may invest hours on the Internet looking for the authorized record design that suits the federal and state demands you need. US Legal Forms provides thousands of authorized forms that are reviewed by professionals. It is possible to acquire or produce the Minnesota Reaffirmation Agreement, Motion and Order from our assistance.

If you already possess a US Legal Forms profile, you are able to log in and then click the Download key. Following that, you are able to complete, modify, produce, or indicator the Minnesota Reaffirmation Agreement, Motion and Order. Each and every authorized record design you get is your own property permanently. To get an additional version for any bought kind, proceed to the My Forms tab and then click the related key.

If you work with the US Legal Forms website the first time, adhere to the simple recommendations beneath:

- Initial, make certain you have chosen the best record design to the state/area of your liking. See the kind outline to make sure you have picked out the proper kind. If offered, utilize the Review key to check throughout the record design also.

- If you wish to find an additional edition from the kind, utilize the Look for field to find the design that meets your needs and demands.

- After you have found the design you need, click on Acquire now to move forward.

- Find the costs prepare you need, type your accreditations, and sign up for an account on US Legal Forms.

- Full the purchase. You can utilize your bank card or PayPal profile to purchase the authorized kind.

- Find the formatting from the record and acquire it in your system.

- Make adjustments in your record if necessary. You may complete, modify and indicator and produce Minnesota Reaffirmation Agreement, Motion and Order.

Download and produce thousands of record themes using the US Legal Forms web site, that offers the largest assortment of authorized forms. Use skilled and condition-distinct themes to handle your business or specific needs.

Form popularity

FAQ

Agreeing to repay the excess loan amount in ance with the terms of the promissory note is called ?reaffirmation.? You can reaffirm an excess loan amount by signing a reaffirmation agreement with your loan servicer.

Creditors holding a security interest that they want to protect post-bankruptcy will request that a Reaffirmation Agreement is signed. They will prepare it and provide it to your attorney's office for review.

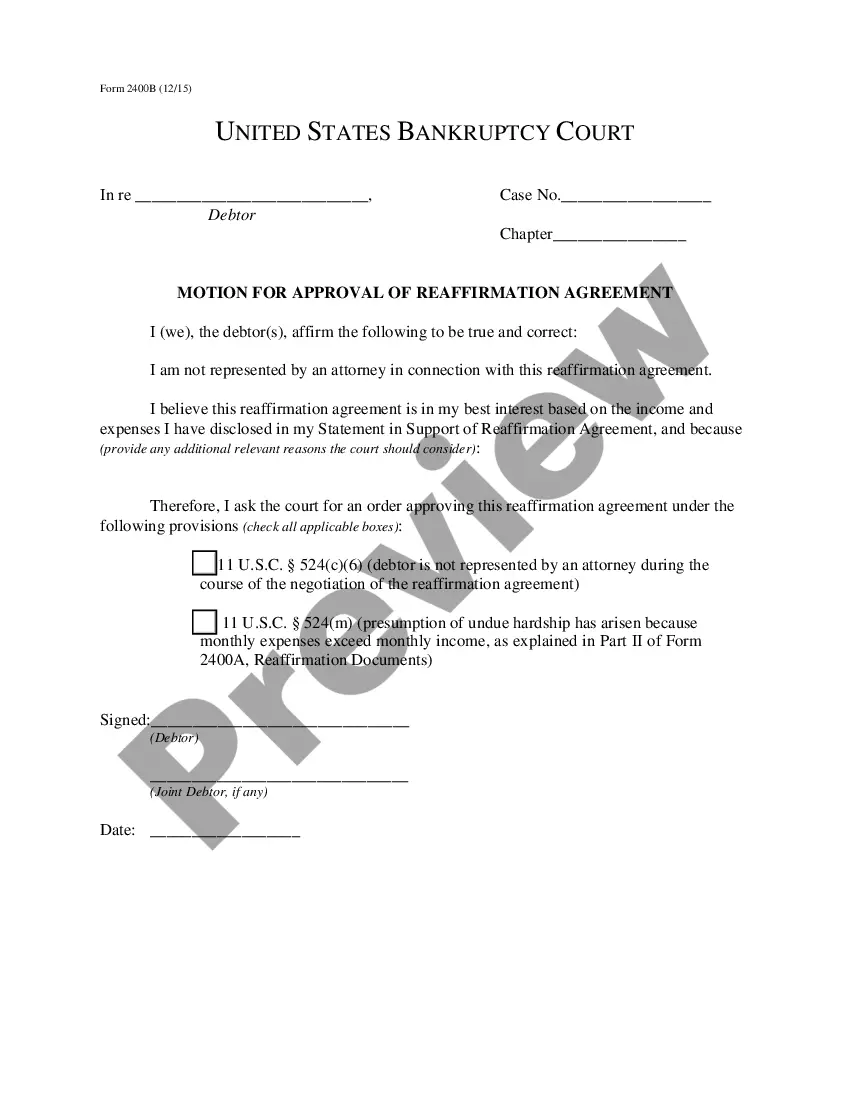

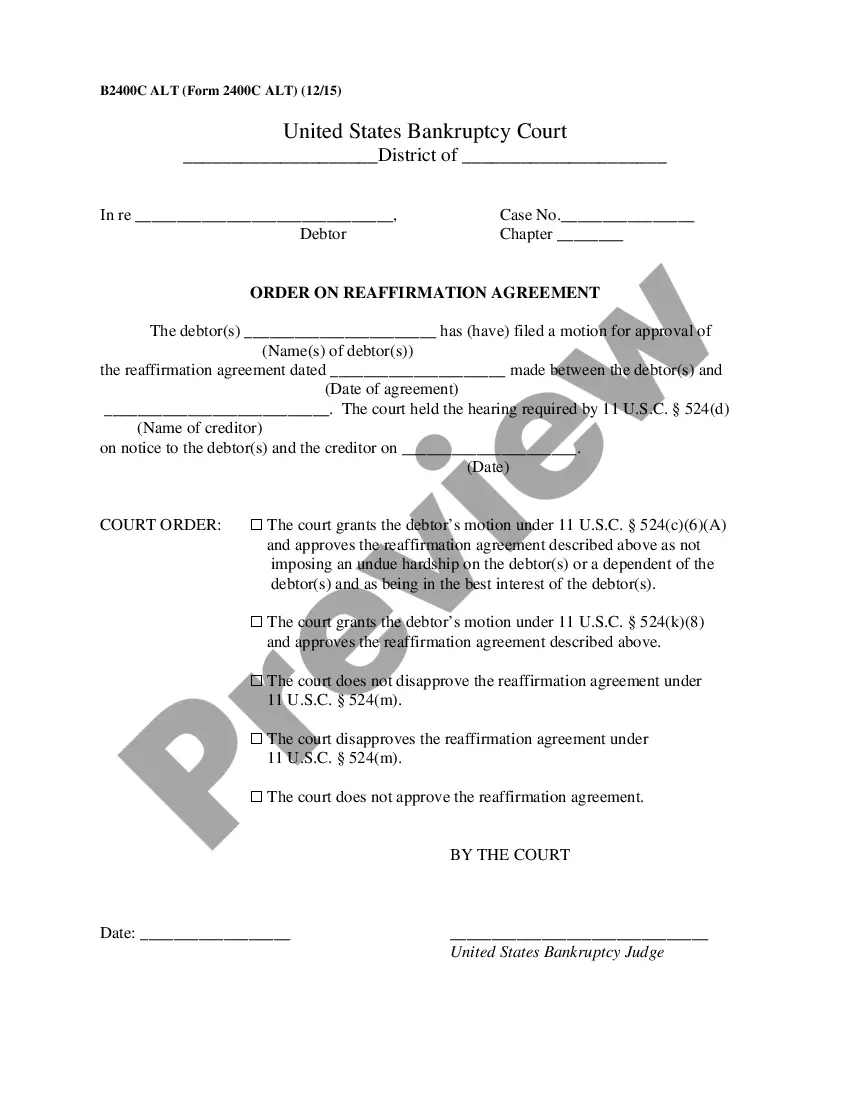

You and the creditor must agree to any change in terms. Also, you or the lender must file the agreement in court as part of the bankruptcy case. The bankruptcy court must review the agreement in a reaffirmation hearing if an attorney does not represent you.

After you have entered into a reaffirmation agreement and all parts of this form that require a signature have been signed, either you or the creditor should file it as soon as possible.

In this article, you'll learn that lenders sometimes agree to new terms when completing a reaffirmation agreement, including lowering the amount owed, interest rate, or monthly payment. A local bankruptcy lawyer can help you with the negotiation process.

Making a reaffirmation agreement can be helpful if you want to stay in your home or you need to keep driving your car during a bankruptcy settlement. However, this type of agreement means you are still responsible for some sort of payment on the loan.

Reaffirmation is an agreement by a debtor, to a lender, to repay some or all of their debt. Debtors make reaffirmation agreements purely voluntarily. When a borrower reaffirms a debt, this is noted by credit reporting agencies, which then register that the person will make regular on-time payments.

Any agreement to reaffirm must be made before the discharge is entered. If you are in the process of reaffirming a debt and feel it will not be filed before the discharge deadline, notify the clerk's office in writing to delay entry of the discharge until the reaffirmation is filed.