Minnesota Department Time Report for Payroll

Description

How to fill out Department Time Report For Payroll?

Are you presently in a scenario where you consistently require documentation for either business or individual reasons.

There are numerous legal document templates accessible online, but sourcing reliable ones can be challenging.

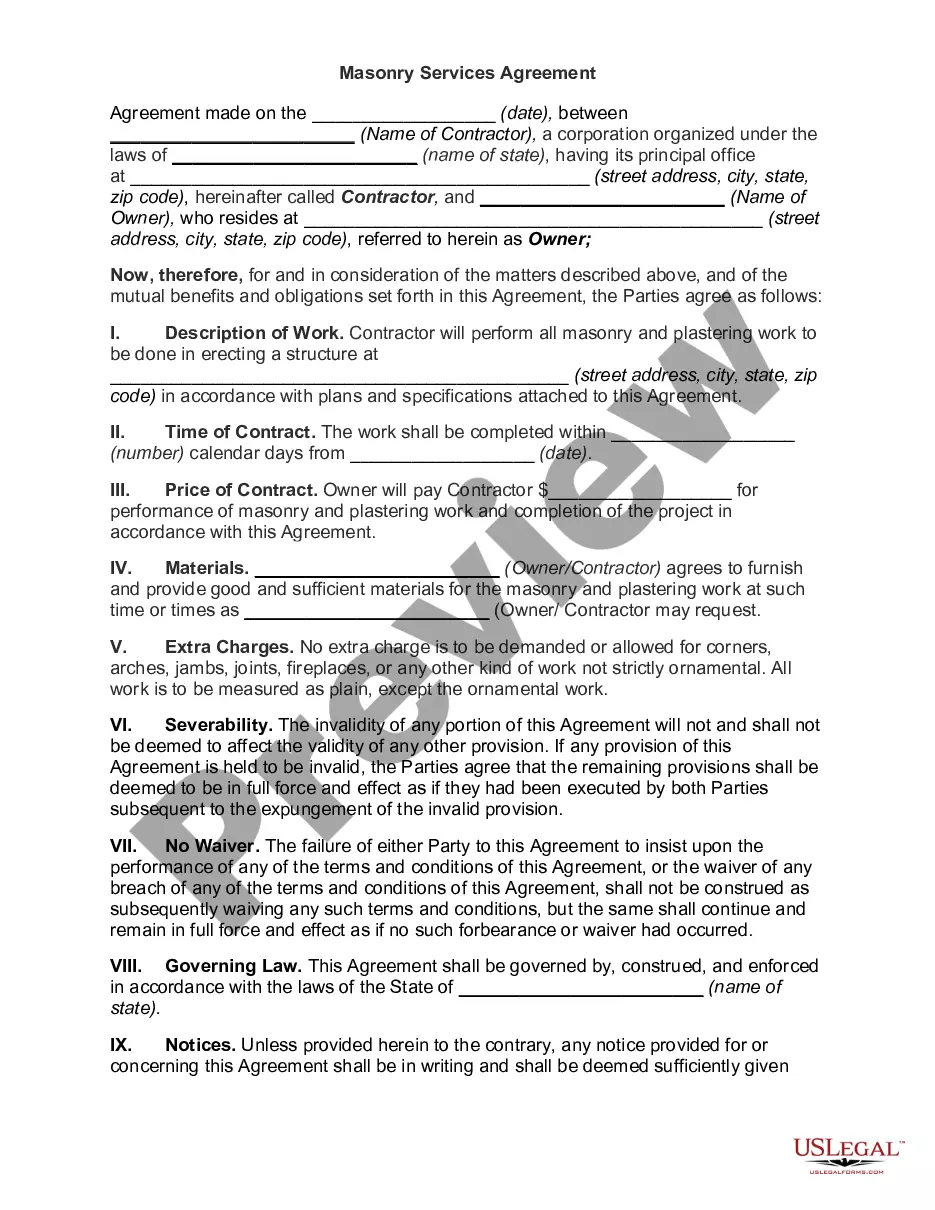

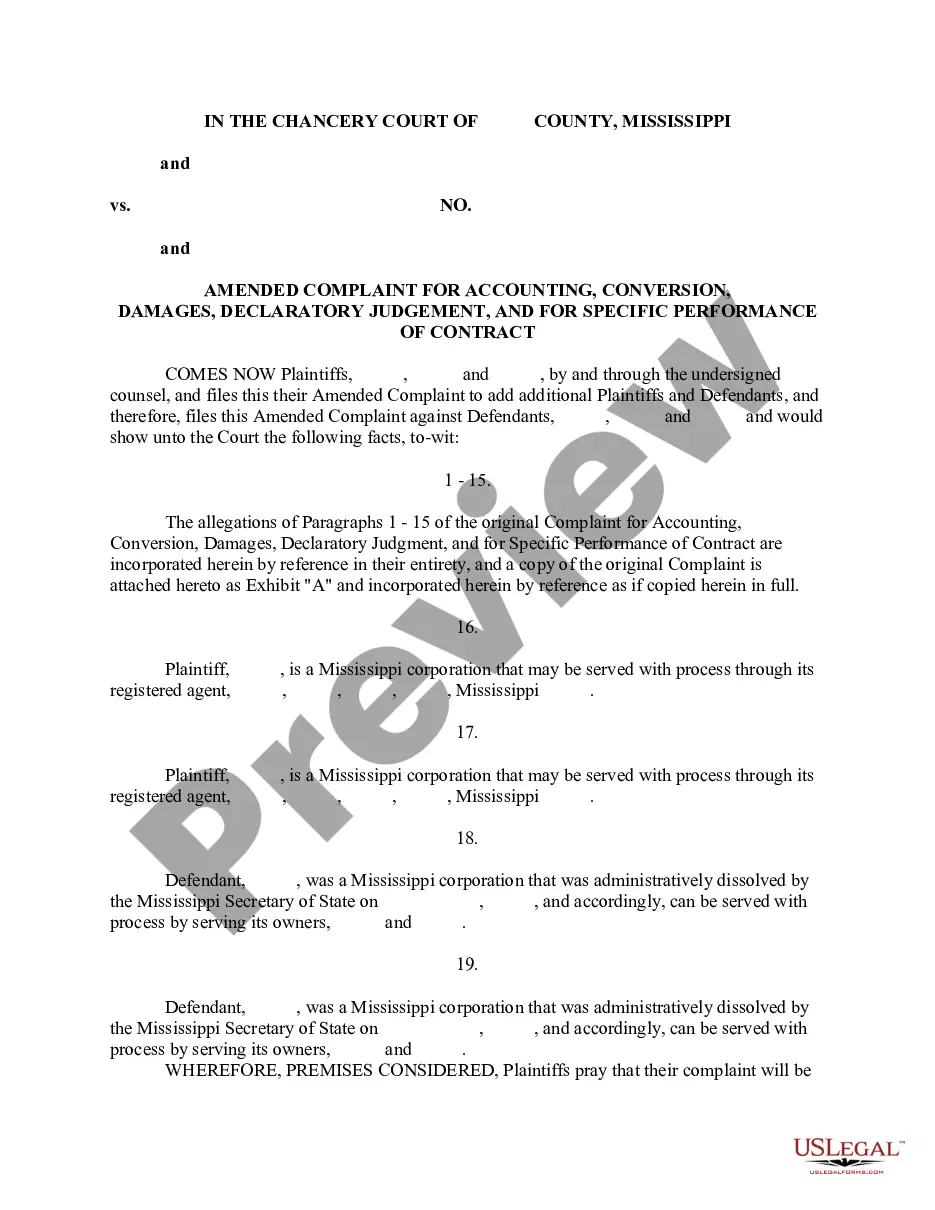

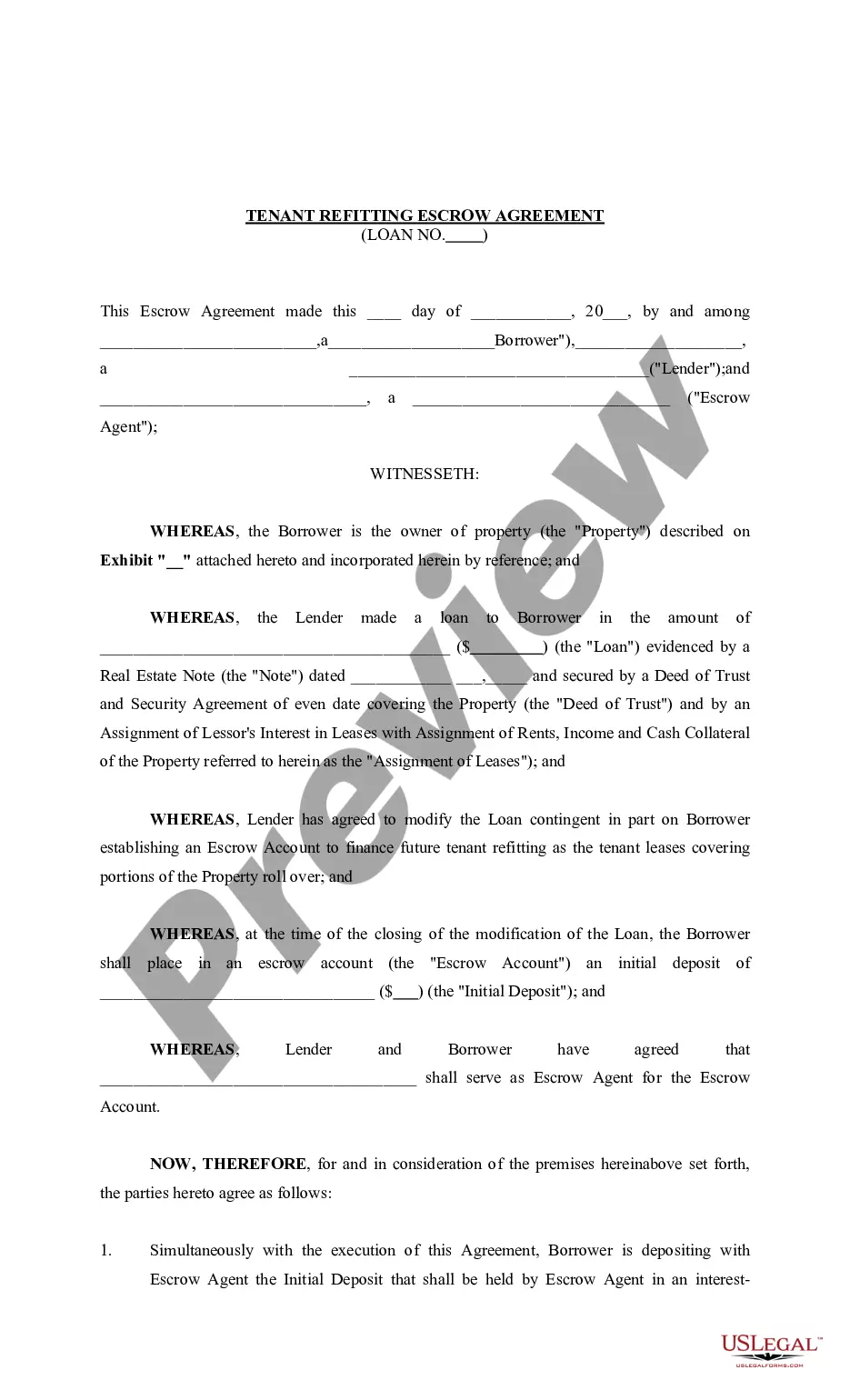

US Legal Forms offers a wide array of template options, such as the Minnesota Department Time Report for Payroll, designed to comply with both state and federal regulations.

Pick a convenient format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Minnesota Department Time Report for Payroll whenever necessary; just select the appropriate template to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal documents, to save time and avoid mistakes. This service provides accurately crafted legal document templates for various purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can obtain the Minnesota Department Time Report for Payroll template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- 1. Find the template you need and ensure it is for the correct city/state.

- 2. Use the Review button to examine the form.

- 3. Check the description to confirm you have the right template.

- 4. If the template isn’t what you seek, utilize the Lookup field to find the form that meets your needs.

- 5. Once you find the correct template, click Buy now.

- 6. Choose the pricing plan you prefer, enter the necessary information to create your account, and process your order via PayPal or credit card.

Form popularity

FAQ

Employers are required to provide all employees with a wri en statement of earnings. Earnings statements (or paystubs, check stubs) are important payroll records for employers and employees that document informa on about wages paid, hours worked, deduc ons made and benefits accrued by an employee.

Your employer must give you reasonable notice of any changes to your working hours, such as cancelling your shifts. They may request last minute changes, such as ringing you that morning to say that they do not require you to work. You can choose to agree to this change.

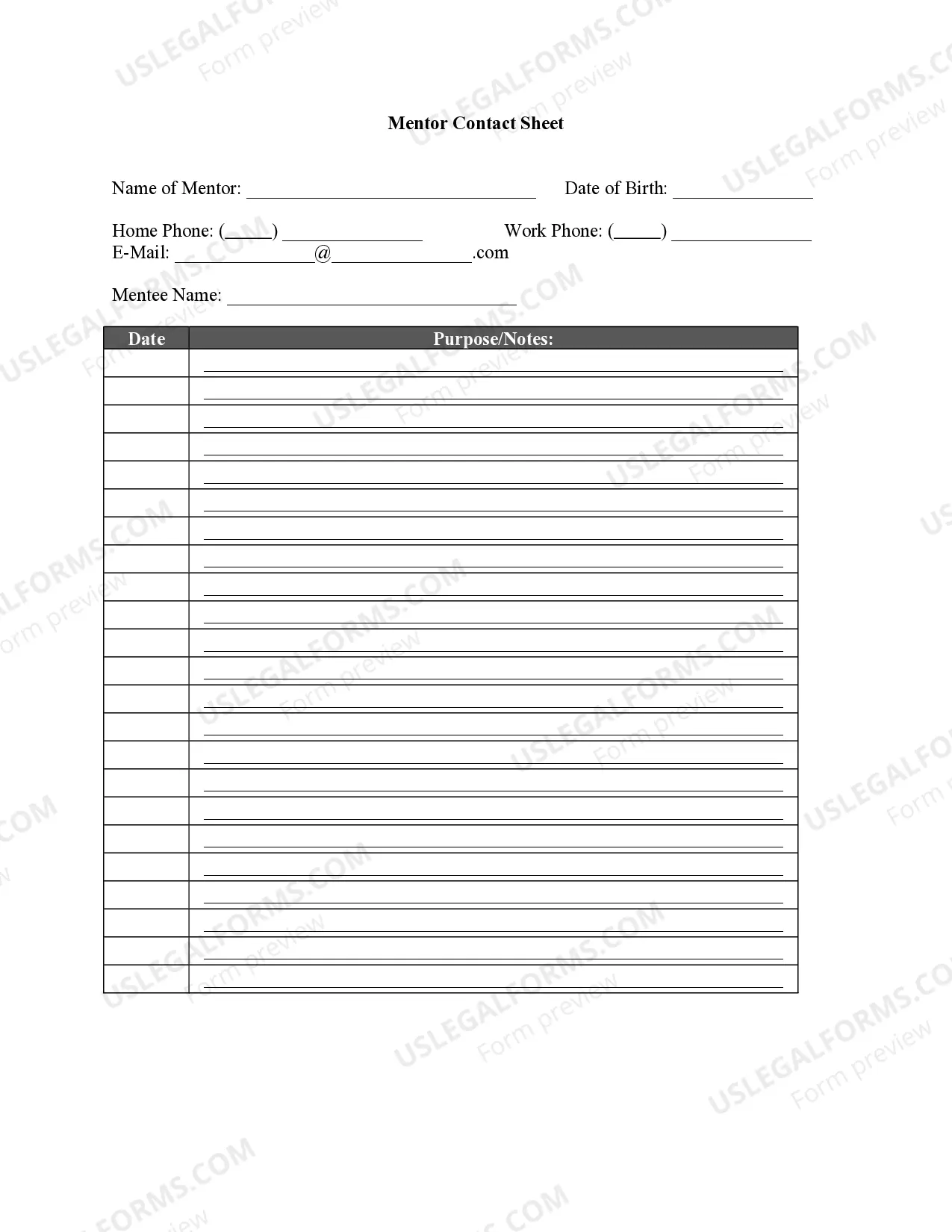

TLDR. A payroll report is a document that includes specific financial and tax information, including pay rates, hours worked, federal and state income taxes withheld, vacation or sick days used, overtime incurred, tax withholdings, and benefit costs.

Displays information such as payroll dates, active deductions, and. check stub messages. Master Control. Displays the information used to calculate wages by employee as well. as cumulative earnings and deductions by employee.

A payroll report is a document that includes specific financial and tax information, including pay rates, hours worked, federal and state income taxes withheld, vacation or sick days used, overtime incurred, tax withholdings, and benefit costs.

Create a payroll summary reportGo to the Reports menu.Find the Payroll section, then Payroll Summary.Set a date range from the drop-down.Select a single employee or group of employees.Lastly, select Run Report.

The employer has the authority to establish the work schedule and determine the hours to be worked. There are no limits on the overtime hours the employer can schedule. Employees who refuse to work the scheduled hours may be terminated. Advance notice by an employer of the change in hours is not required.

If an employer fails to pay the full wages owed, and if the employee submits a written demand for payment, the employer may have to pay a penalty if the employer fails to pay within 24 hours. (Minn. Stat. ? 181.13-.

While it's just Oregon at this point, other states have considered predictive scheduling laws, including Connecticut, Illinois, Maine, Michigan, Minnesota, New Jersey, North Carolina and Rhode Island.

A payroll report is a document employers use to notify government agencies (e.g., IRS) about payroll and employment tax liabilities. Payroll reports summarize payroll data, such as: Wages paid to employees. Federal income taxes withheld.