Minnesota Pay in Lieu of Notice Guidelines

Description

How to fill out Pay In Lieu Of Notice Guidelines?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest iterations of documents like the Minnesota Pay in Lieu of Notice Guidelines within minutes.

If you already possess a monthly subscription, Log In to download the Minnesota Pay in Lieu of Notice Guidelines from the US Legal Forms library. The Download button will be visible on every form you view. You can access all previously downloaded forms from the My documents section of your account.

If you want to use US Legal Forms for the first time, here are some easy steps to get started: Ensure you have selected the correct form for your city/state. Click the Review button to examine the form's details. Check the form information to confirm you have chosen the correct template. If the form does not suit your needs, use the Search field at the top of the screen to find one that does.

Thus, to download or print another version, simply return to the My documents section and click on the form you need.

Obtain access to the Minnesota Pay in Lieu of Notice Guidelines with US Legal Forms, one of the most extensive repositories of legal document templates. Utilize a multitude of professional and state-specific templates that fulfill your business or personal requirements.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your details to create an account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Choose the file format and download the form to your device.

- Make edits. Fill out, modify, print, and sign the downloaded Minnesota Pay in Lieu of Notice Guidelines.

- Every template added to your account has no expiry date and is yours indefinitely.

Form popularity

FAQ

To process payment in lieu of notice, first confirm your eligibility according to your employment contract and applicable Minnesota laws. Notify your employer of your intentions and ensure that they understand your request for compensation during the notice period. Utilize resources like uslegalforms to assist you in creating the necessary documentation and to ensure compliance with the Minnesota Pay in Lieu of Notice Guidelines. Ultimately, processing these payments should be a straightforward conversation, but it’s wise to document everything for clarity.

Payment in lieu of leave occurs when an employer compensates an employee for unused leave days instead of allowing them to take the time off. This can happen when an employee leaves the company or when the employer cannot provide the necessary time off. Understanding the Minnesota Pay in Lieu of Notice Guidelines can help you navigate your rights regarding this type of payment. Always track your accrued leave to ensure you receive fair compensation when necessary.

Yes, payments in lieu of notice typically attract superannuation contributions. According to the Minnesota Pay in Lieu of Notice Guidelines, these payments are considered earnings, so employers are mandated to contribute to your super fund based on this compensation. It is advantageous to confirm how these contributions will be calculated, as they can significantly affect your retirement savings. Consulting with your payroll or HR department may clarify this for you.

To obtain payment in lieu of notice, you should first review your employment contract and company policies regarding notice periods. If your employer decides to terminate your role without the required notice, you may be entitled to receive compensation based on your salary during that notice period. Always communicate your understanding of the Minnesota Pay in Lieu of Notice Guidelines with your employer. You can also consult legal resources or professionals to ensure your rights are protected.

Minnesota law requires employers to provide notice to employees under certain circumstances, particularly during mass layoffs or plant closings. The Minnesota Pay in Lieu of Notice Guidelines essentially give employees insight into their rights regarding notice periods. Understanding this law can empower employees when facing potential job termination. The US Legal Forms platform offers valuable information and tools to help you grasp these regulations clearly.

In Minnesota, there are no specific laws mandating severance pay. However, many employers choose to offer severance packages as part of their employment contracts or in connection with layoffs. It’s important for employees to review the Minnesota Pay in Lieu of Notice Guidelines, which may outline aspects of severance related to notice periods. If you're navigating severance agreements, consider using the resources available on the US Legal Forms platform.

Payment in lieu of leave refers to compensation offered to an employee instead of allowing them to take their earned leave days. This practice is often seen in scenarios where an employee leaves the company and is entitled to unused vacation or sick leave. According to Minnesota Pay in Lieu of Notice Guidelines, it is vital for employers to clearly communicate such policies to prevent misunderstandings.

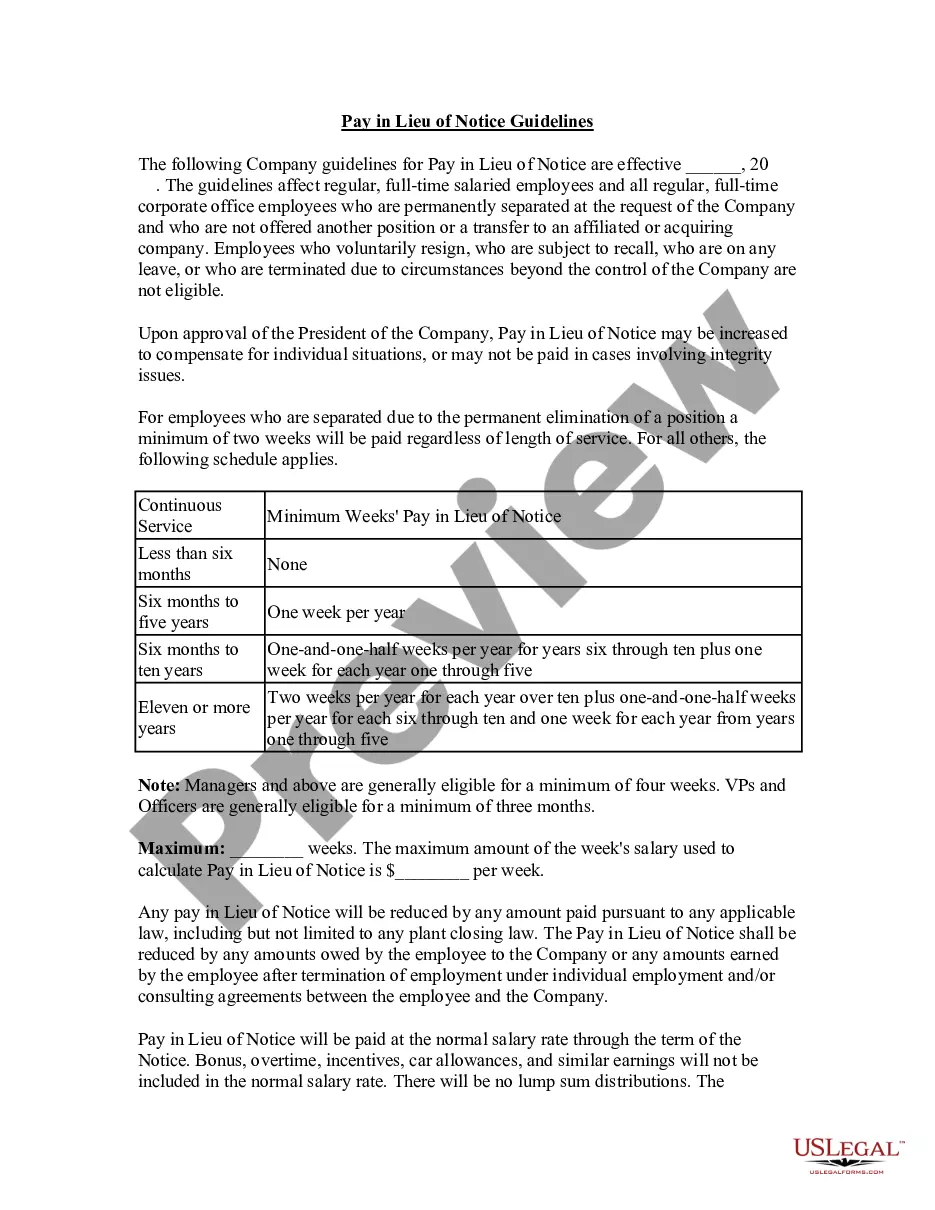

To calculate payment in lieu of notice, you need to identify the employee's regular wage and multiply it by the number of days in the notice period. As outlined in the Minnesota Pay in Lieu of Notice Guidelines, this calculation must also include any applicable benefits that would have accumulated during that time. This method ensures that employees receive fair compensation for their expected work.

A letter payment in lieu of notice by an employer is a formal communication informing the employee of their severance terms, which includes financial compensation instead of notice. This aligns with the Minnesota Pay in Lieu of Notice Guidelines, ensuring clarity on the payment amount and method. It serves as documentation protecting both the employer and the employee.

To process payment in lieu of notice, employers should first determine the employee's regular wage and the duration of the notice period. Based on the Minnesota Pay in Lieu of Notice Guidelines, the employer must then calculate the total payment owed. This can be issued as a lump sum payment, reflecting the time the employee would have worked during the notice period.