Minnesota Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets

Description

How to fill out Checklist Of Matters To Be Considered In Drafting Agreement For Sale Of Corporate Assets?

You are capable of dedicating time online to find the valid document format that fulfills the state and federal criteria you desire.

US Legal Forms provides an extensive selection of authorized forms that have been examined by professionals.

You can easily obtain or print the Minnesota Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets from our services.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Minnesota Checklist of Matters to be Considered in Drafting Agreement for Sale of Corporate Assets.

- Every legal document you obtain is yours permanently.

- To acquire another copy of any obtained form, navigate to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct format for your region/area of interest. Check the form description to ensure you have selected the correct document.

- If available, utilize the Preview button to view the document format as well.

- If you wish to find another version of the document, use the Search field to locate the format that satisfies your needs and preferences.

Form popularity

FAQ

Parts of an Asset Purchase AgreementRecitals. The opening paragraph of an asset purchase agreement includes the buyer and seller's name and address as well as the date of signing.Definitions.Purchase Price and Allocation.Closing Terms.Warranties.Covenants.Indemnification.Governance.More items...

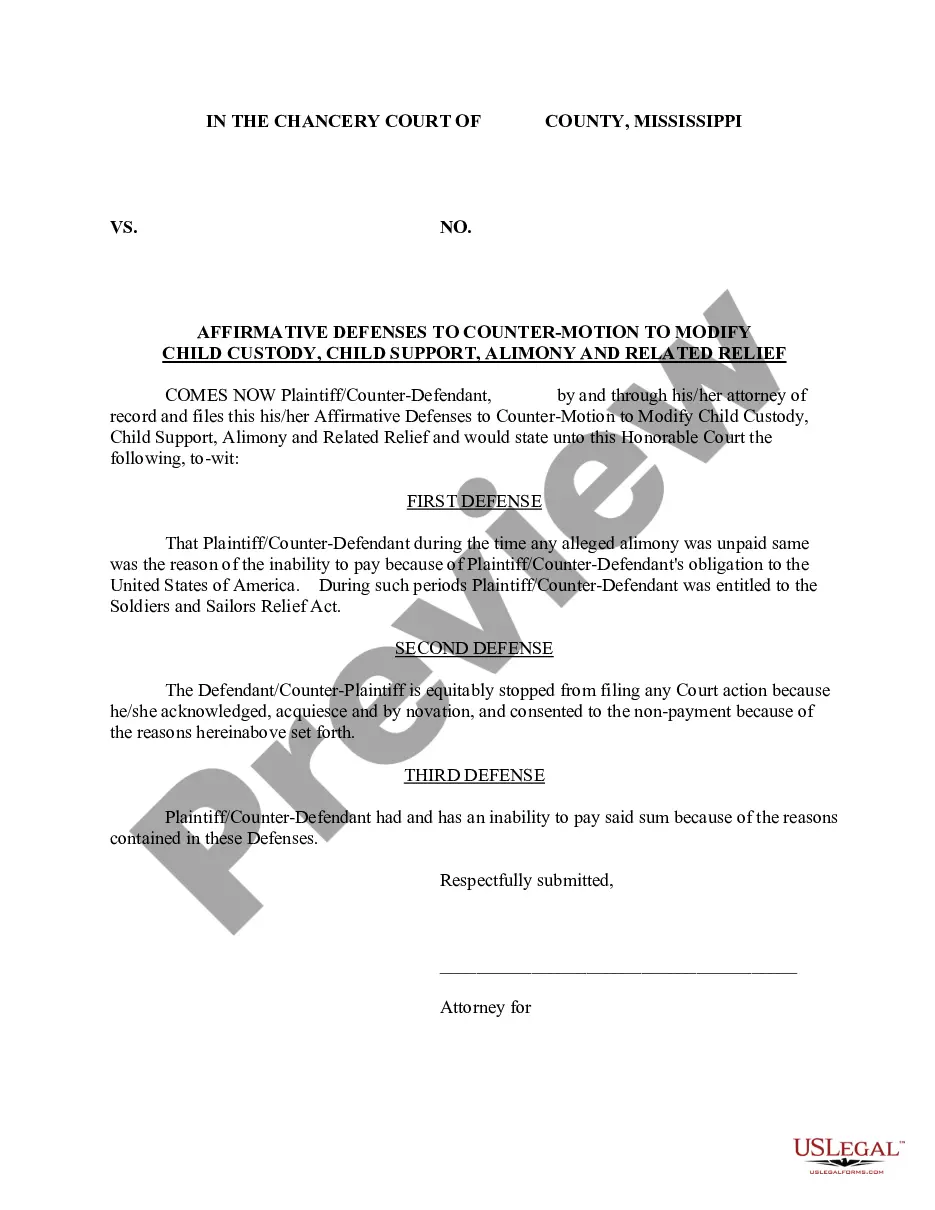

The basic elements required for the agreement to be a legally enforceable contract are: mutual assent, expressed by a valid offer and acceptance; adequate consideration; capacity; and legality.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

In an asset sale, the seller retains possession of the legal entity and the buyer purchases individual assets of the company, such as equipment, fixtures, leaseholds, licenses, goodwill, trade secrets, trade names, telephone numbers, and inventory.

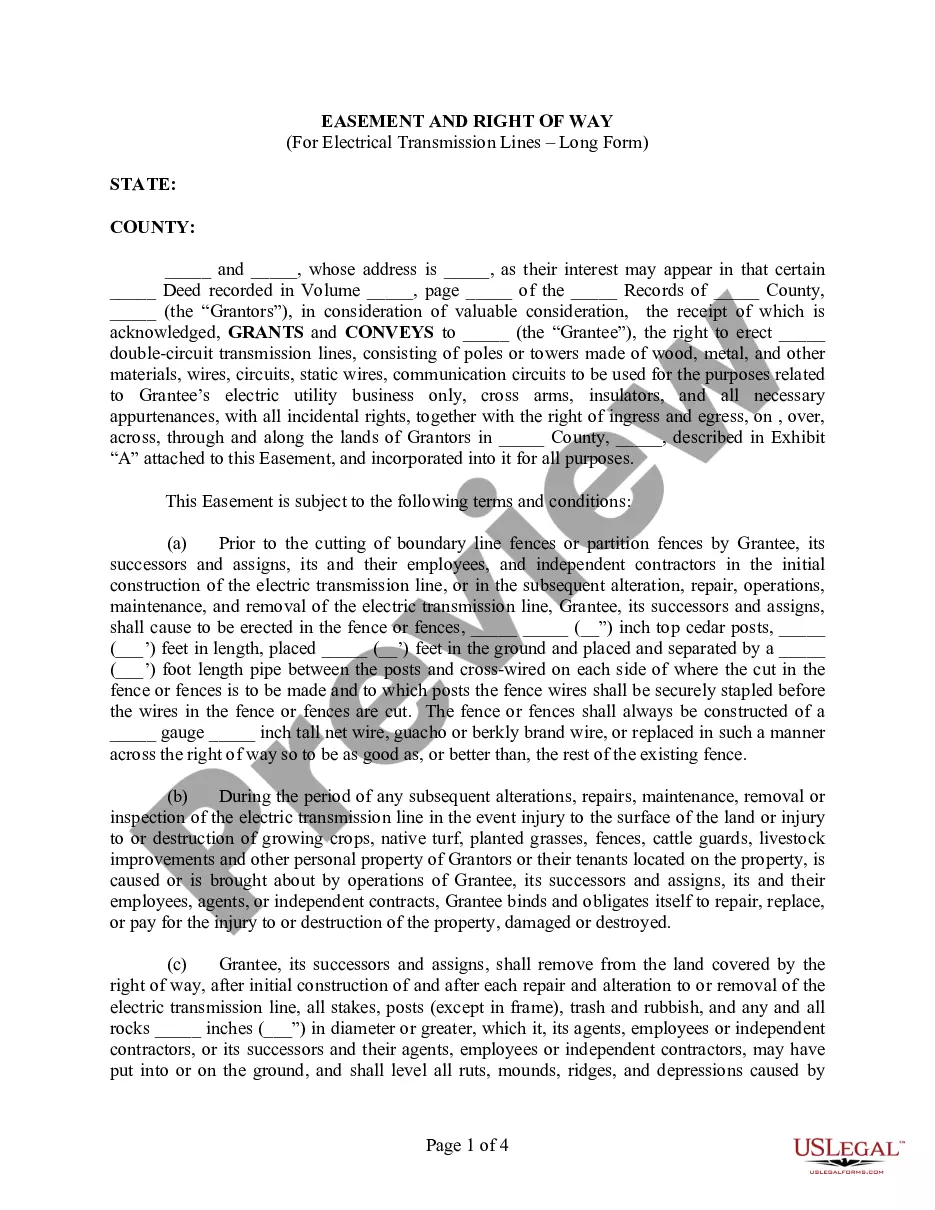

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

In an asset sale, you retain the legal entity of the business and only sell the business' assets. For example, say you run a rental car company owned by Harry Smith Pty Ltd. You decide that you need to sell 50% of your fleet to upgrade your vehicles and want to sell those vehicles in one transaction to one buyer.

General contract provisions are requirements including standard conditions in contracts like terms of payment, terms of delivery, and recommended measures against contract violation. Parties usually add boilerplate conditions to their contracts for the following reasons: For increased efficiency.

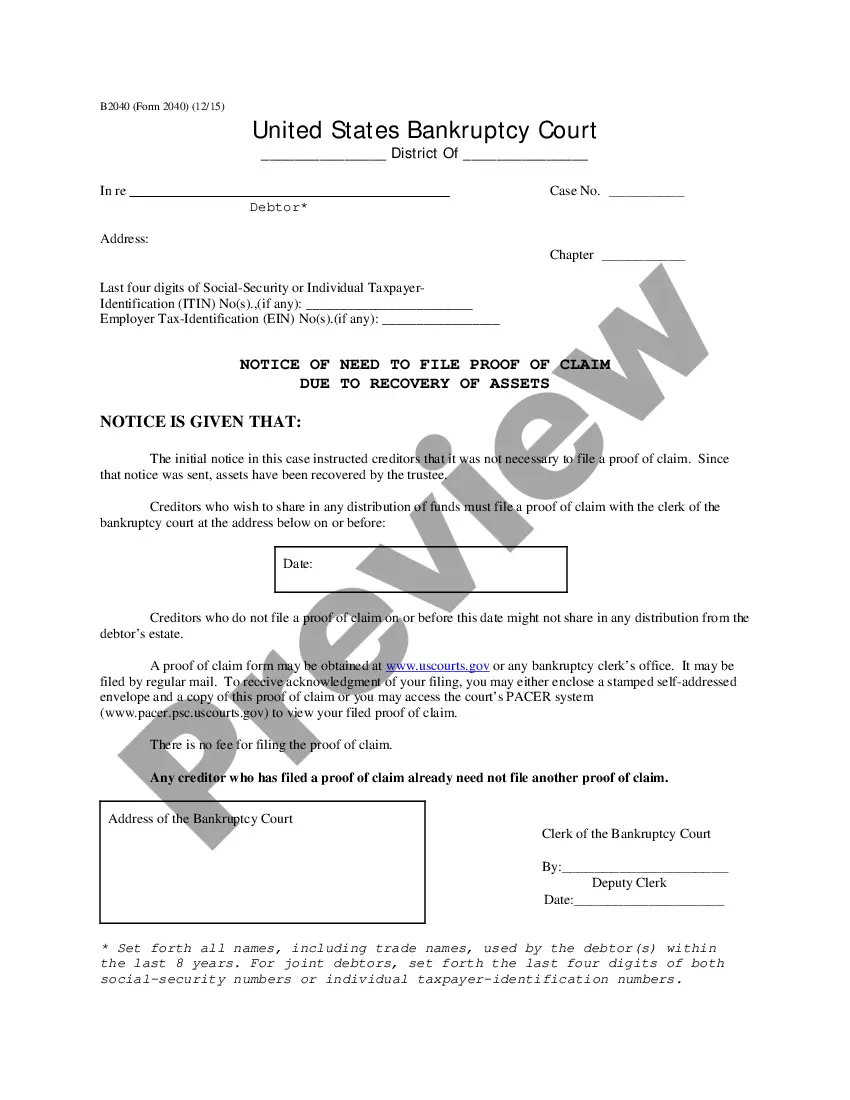

Asset Sale ChecklistList of Assumed Contracts.List of Liabilities Assumed.Promissory Note.Security Agreement.Escrow Agreement.Disclosure of Claims, Liens, and Security Interests.List of Trademarks, Trade Names, Assumed Names, and Internet Domain Names.Disclosure of Licenses and Permits.More items...?

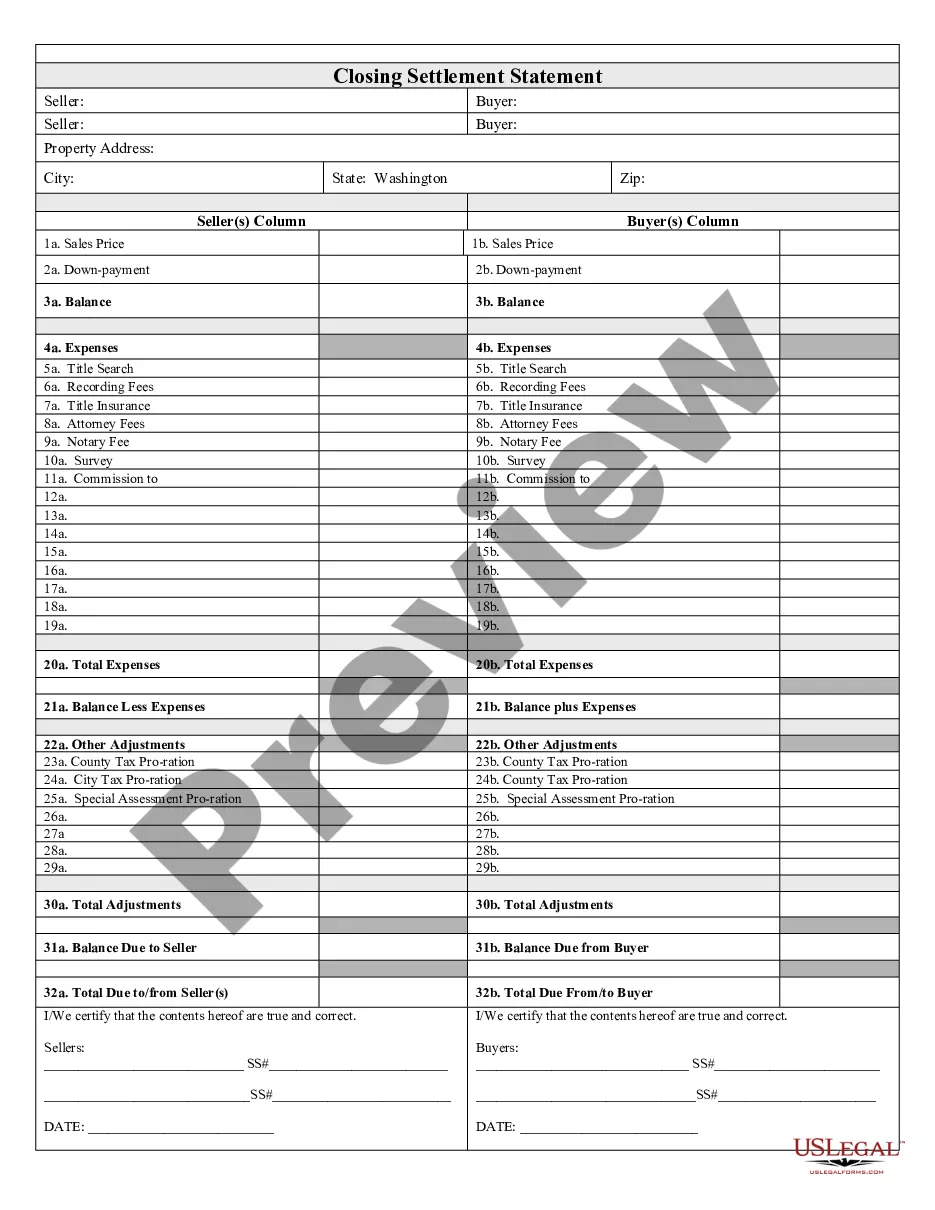

CLOSING. The closing of an acquisition transaction can be a simultaneous sign and close or a sign and then later close. In a sign and then later close, a buyer may continue its due diligence after signing, and there are usually pre-closing obligations the parties must meet in order to close.

Noun. a clause in a legal instrument, a law, etc., providing for a particular matter; stipulation; proviso. the providing or supplying of something, especially of food or other necessities. arrangement or preparation beforehand, as for the doing of something, the meeting of needs, the supplying of means, etc.