Minnesota Hardware Purchase and Software License Agreement

Description

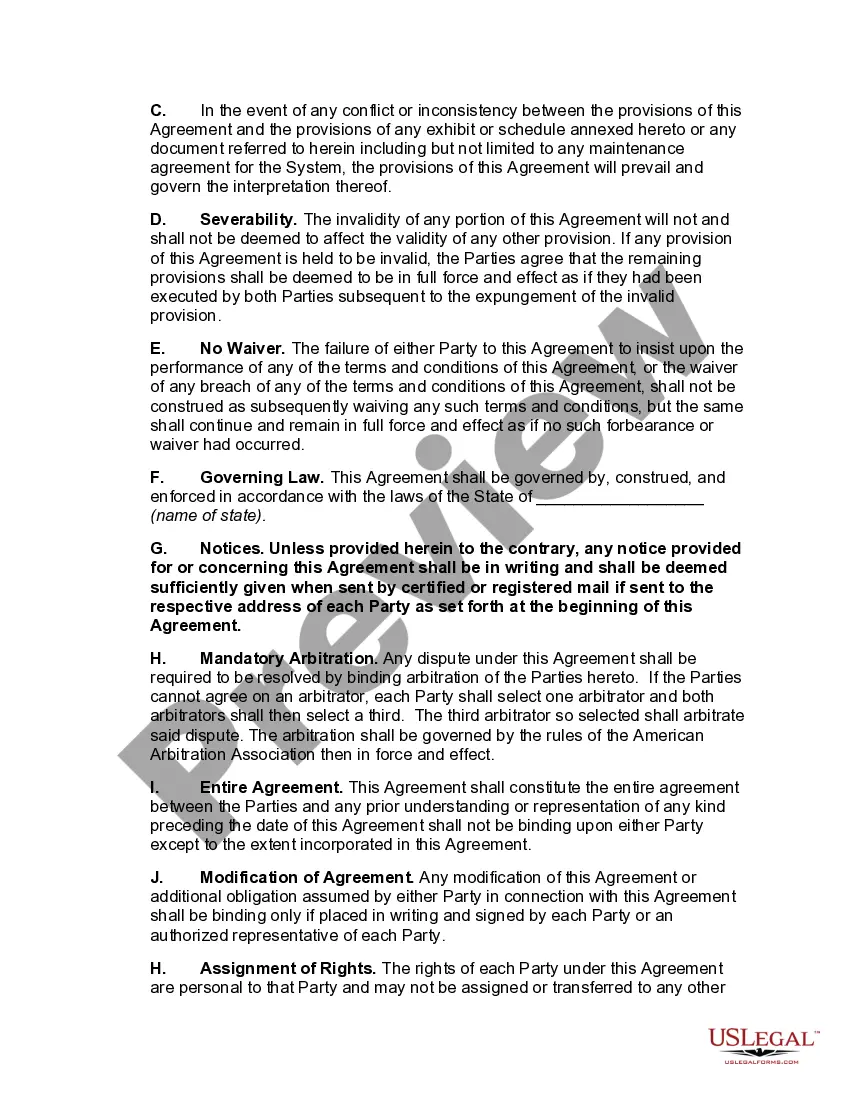

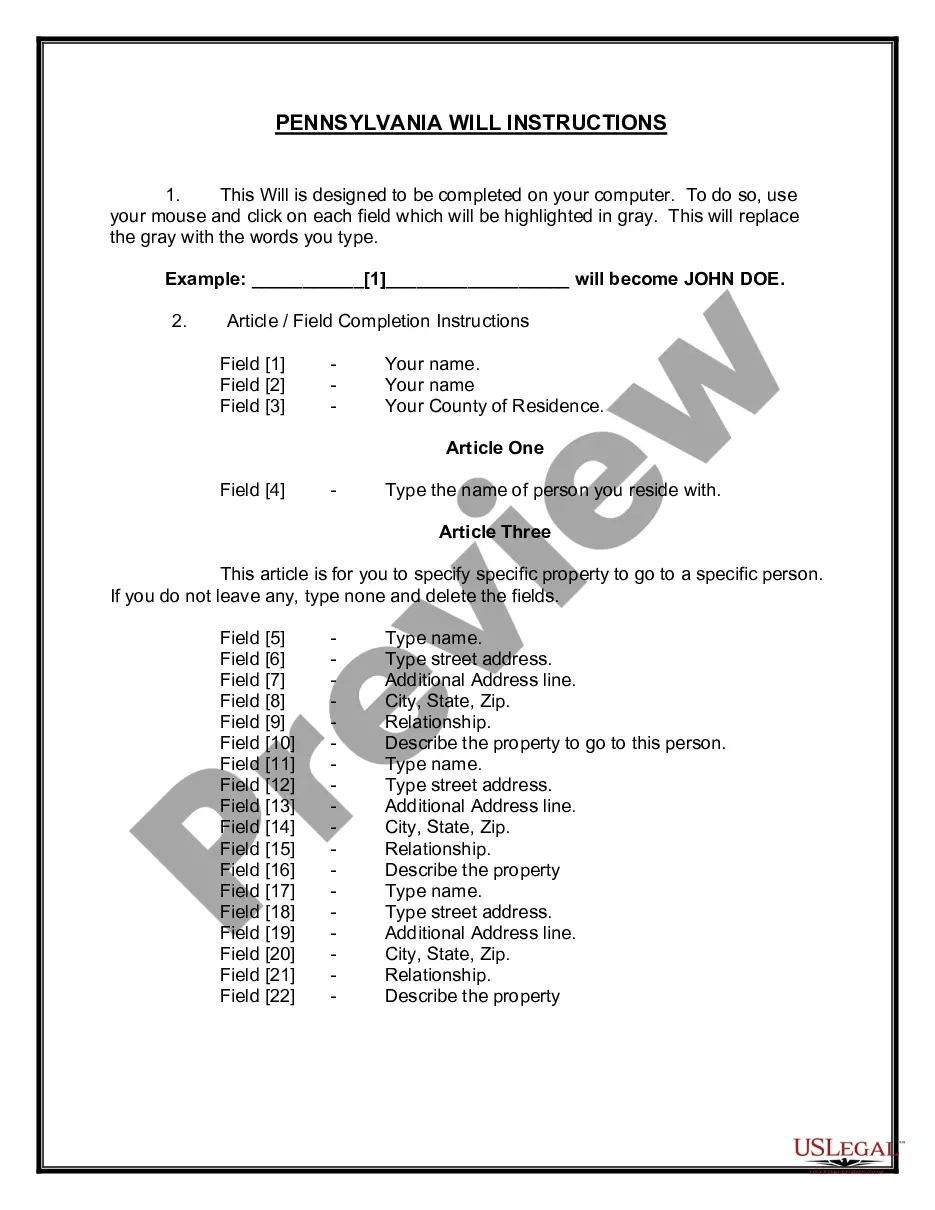

How to fill out Hardware Purchase And Software License Agreement?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

Using the website, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent forms like the Minnesota Hardware Purchase and Software License Agreement in seconds.

If the form does not meet your requirements, use the Search field at the top of the screen to find an appropriate one.

Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- If you have an account, Log In to download the Minnesota Hardware Purchase and Software License Agreement from the US Legal Forms library.

- The Download button will be visible on each form you view.

- You can access all previously downloaded forms by going to the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

Sales of canned software - downloaded are subject to sales tax in Minnesota. Sales of custom software - delivered on tangible media are exempt from the sales tax in Minnesota. Sales of custom software - downloaded are exempt from the sales tax in Minnesota.

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs....For more information, see:Personal Services.Professional Services.Taxable Services.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

Materials used or consumed in the industrial production of a retail product, including digital products, are exempt from Minnesota Sales Tax. To buy these materials exempt from tax, the purchaser must provide a completed Form ST3, Certificate of Ex- emption.

Introduction. The sale and use of certain computer system hardware is exempt from sales tax. Computer system hardware that qualifies for the exemption may be purchased, rented, or leased using Form ST-121.3, Exemption Certificate For Computer System Hardware.

For more accurate rates, use the sales tax calculator. The Minnesota (MN) state sales tax rate is currently 6.875%.

Computers or computer accessories: If you've been waiting to buy a laptop or desktop computer, you'll be in luck on tax-free weekend. No sales tax will be charged on your new MacBook, Dell Inspiron or other brands. However, computer parts are not tax free.

Digital goods, which are nontangible versions of tangible goods, such as e-books, streaming music, and online video games, are not taxable unless specifically included. Intangible personal property, such as stocks and bonds, are not subject to the sales tax.

Requirements for prewritten software are still subject to sales and use tax regardless of the method of delivery (whether with a physical medium, downloadable or accessed via the Internet) or if possession or control is given.

Tax is only due on the initial installation of an item. Delivery charges for taxable products, such as computer hardware or prewritten software, are taxable.