Minnesota Sample LLC Operating Agreement

Description

How to fill out Sample LLC Operating Agreement?

Are you in a situation where you often need documentation for organizational or personal purposes nearly every day.

There are many official document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, including the Minnesota Sample LLC Operating Agreement, designed to meet state and federal requirements.

Utilize US Legal Forms, the most extensive collection of official documents, to save time and minimize errors.

This service offers professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Sample LLC Operating Agreement template.

- If you do not have an account and want to start using US Legal Forms, follow these instructions.

- Choose the document you need and ensure it corresponds to the appropriate city or county.

- Use the Review function to examine the document.

- Read the details to confirm that you have selected the correct document.

- If the document is not what you are looking for, utilize the Search field to find the template that suits your needs.

- Once you locate the right document, click Purchase now.

- Select the pricing plan you wish to use, enter the required information to create your account, and pay for your order using PayPal or a credit card.

- Choose a preferred file format and download your copy.

- Access all document templates you have purchased in the My documents menu. You can retrieve another copy of the Minnesota Sample LLC Operating Agreement anytime you need it. Just follow the necessary steps to download or print the document template.

Form popularity

FAQ

Every Minnesota LLC owner should have an operating agreement in place to protect the operations of their business. While not legally required by the state, having an operating agreement will set clear rules and expectations for your LLC while establishing your credibility as a legal entity.

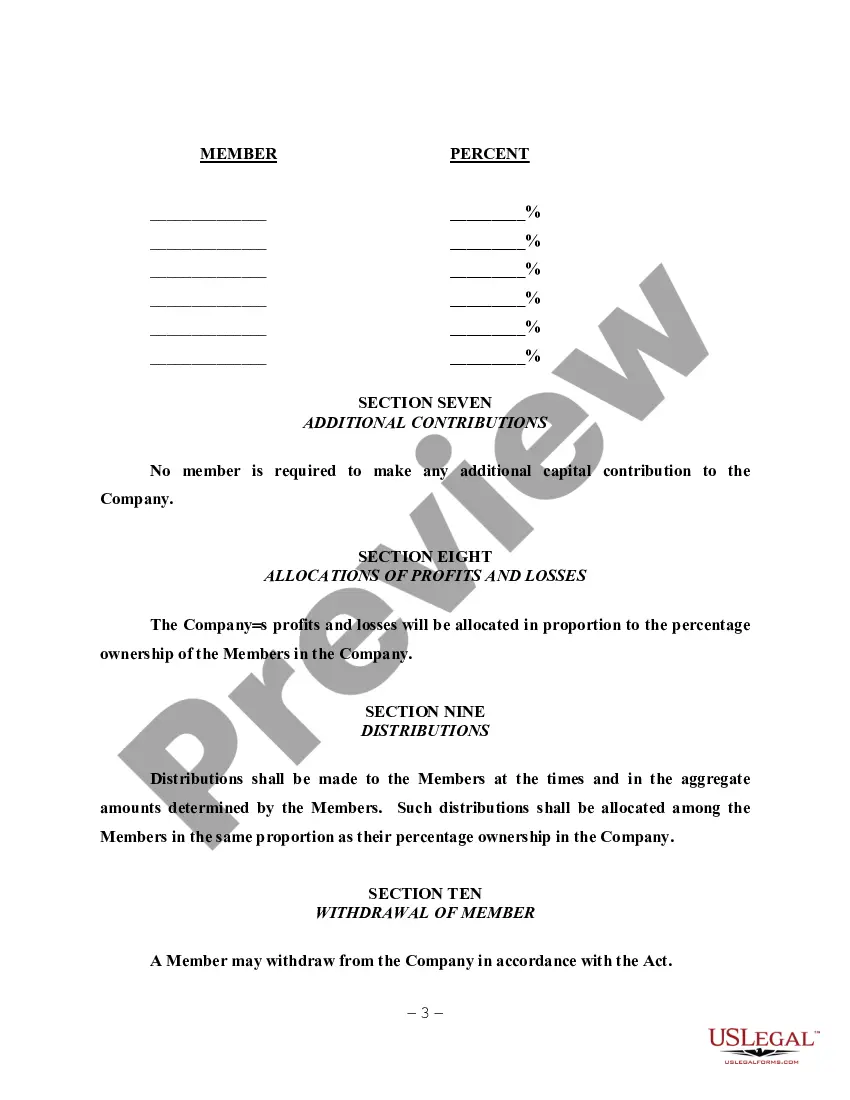

What should an LLC operating agreement include?Basic company information.Member and manager information.Additional provisions.Protect your LLC status.Customize the division of business profits.Prevent conflicts among owners.Customize your governing rules.Clarify the business's future.

The form and contents of operating agreements vary widely, but most will contain six key sections: Organization, Management and Voting, Capital Contributions, Distributions, Membership Changes, and Dissolution.

Why do you need an operating agreement? To protect the business' limited liability status: Operating agreements give members protection from personal liability to the LLC. Without this specific formality, your LLC can closely resemble a sole proprietorship or partnership, jeopardizing your personal liability.

In Minnesota, this corporate tax generally is a flat 9.8% of taxable income. However, additional or alternative taxes may also apply. In general, if your Minnesota LLC is taxed as a corporation, it will need to pay some kind of income taxes or fees to the state.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.