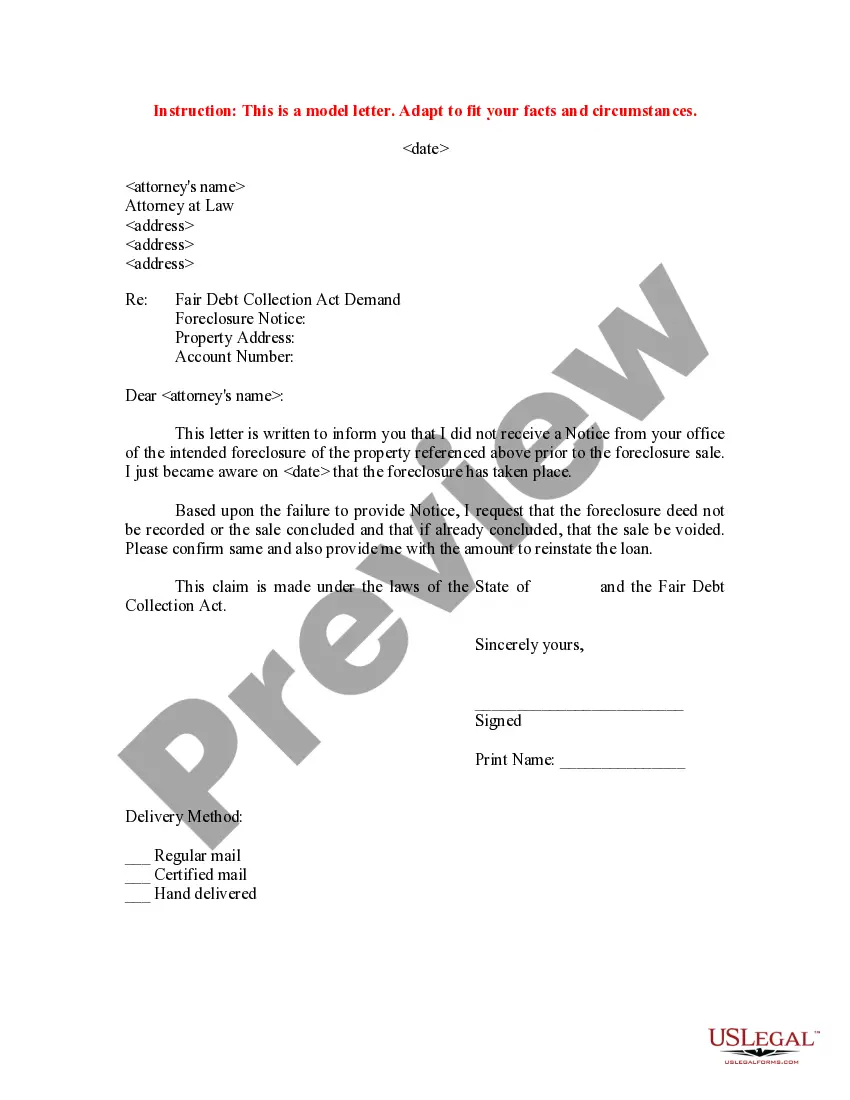

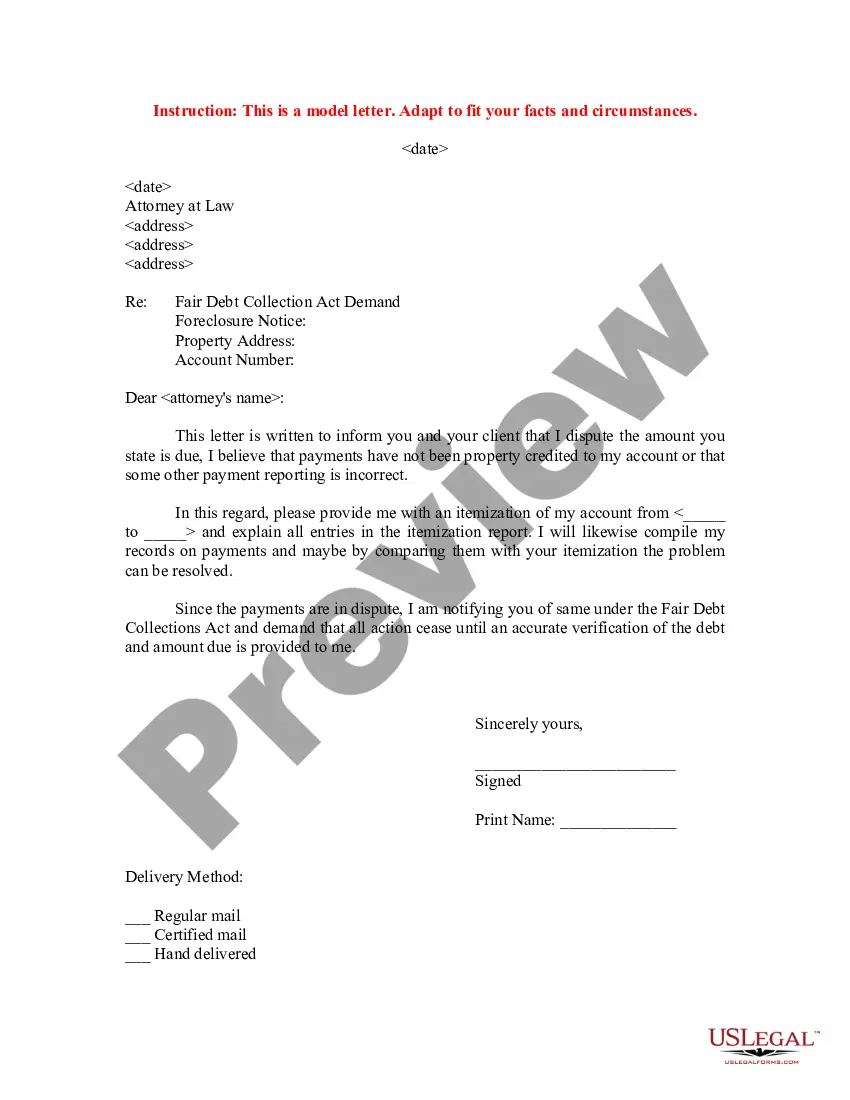

Minnesota Sample Letter to Foreclosure Attorney - Payment Dispute

Description

How to fill out Sample Letter To Foreclosure Attorney - Payment Dispute?

If you have to total, download, or print lawful document layouts, use US Legal Forms, the largest variety of lawful kinds, that can be found on the web. Take advantage of the site`s basic and handy lookup to discover the paperwork you need. A variety of layouts for company and personal purposes are categorized by classes and claims, or keywords. Use US Legal Forms to discover the Minnesota Sample Letter to Foreclosure Attorney - Payment Dispute in just a few click throughs.

When you are currently a US Legal Forms customer, log in to your bank account and click the Acquire switch to get the Minnesota Sample Letter to Foreclosure Attorney - Payment Dispute. You can also accessibility kinds you formerly acquired in the My Forms tab of your own bank account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the form for the appropriate town/country.

- Step 2. Utilize the Preview option to examine the form`s content material. Don`t forget about to learn the outline.

- Step 3. When you are unhappy with all the form, make use of the Lookup field near the top of the screen to get other variations of the lawful form template.

- Step 4. Once you have located the form you need, go through the Purchase now switch. Choose the costs strategy you like and include your references to sign up for the bank account.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Select the structure of the lawful form and download it on your product.

- Step 7. Total, modify and print or indicator the Minnesota Sample Letter to Foreclosure Attorney - Payment Dispute.

Each and every lawful document template you buy is yours eternally. You possess acces to each form you acquired within your acccount. Select the My Forms portion and select a form to print or download yet again.

Remain competitive and download, and print the Minnesota Sample Letter to Foreclosure Attorney - Payment Dispute with US Legal Forms. There are millions of professional and state-distinct kinds you can utilize for the company or personal demands.

Form popularity

FAQ

A foreclosure is simply the closing of a Home Loan by paying off the entire amount borrowed in one lump sum amount. It is part of the regular Home Loan process and allows you to pay off the borrowed amount before the EMI schedule. You can opt for a foreclosure even after having made a few EMI payments.

What Is the Foreclosure Process in Minnesota? If you default on your mortgage payments in Minnesota, the lender may foreclose using a judicial or nonjudicial method.

In most cases, this is 6 months. However, some Mortgage Foreclosures are subject to federal regulations, in which case there is no redemption period. A Certificate of Redemption can be obtained from the Sheriff's Office of the county in which the foreclosure occurred or from the Mortgagee (lending institution).

Again, Minnesota foreclosures typically go through a nonjudicial process. Judicial foreclosures can also happen, but are uncommon. In the nonjudicial process, the foreclosing bank must mail you (the defaulting borrower) a written notice of any default before officially starting a foreclosure.

Put your name, address, phone number, loan number, and date on the top of the letter. List the name and address of your lender. information about any money you have saved for a workout agreement. Tell the lender you are working with a foreclosure counselor and include their name and agency.

Most Minnesota foreclosures are handled out of court through a power-of-sale clause contained in the mortgage. Under most mortgages, a lender must mail a default notice to the borrower before scheduling a sale.

Minnesota is generally considered to be a ?non-recourse? state, although in certain situations mortgage-holders (or other creditors) may seek a deficiency judgment. Generally, if a foreclosure sale of a home is done by advertisement in Minnesota, no deficiency judgment is allowed.