Minnesota Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

If you wish to compile, obtain, or create official document templates, utilize US Legal Forms, the largest selection of legal documents available online.

Employ the website's straightforward and user-friendly search tool to find the documents you require. A range of templates for business and individual needs are organized by categories and states, or keywords.

Use US Legal Forms to procure the Minnesota Purchase Agreement by a Corporation of Assets of a Partnership in just a few clicks.

Every legal document template you acquire is yours indefinitely.

You have access to all forms you have downloaded in your account. Click the My documents section and select a form to print or download again. Engage actively and download and print the Minnesota Purchase Agreement by a Corporation of Assets of a Partnership with US Legal Forms. There are thousands of professional and state-specific templates available for your business or personal needs.

- If you are a US Legal Forms user, Log In to your account and click the Obtain button to locate the Minnesota Purchase Agreement by a Corporation of Assets of a Partnership.

- You can also access documents you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Make sure you have selected the form for the correct area/state.

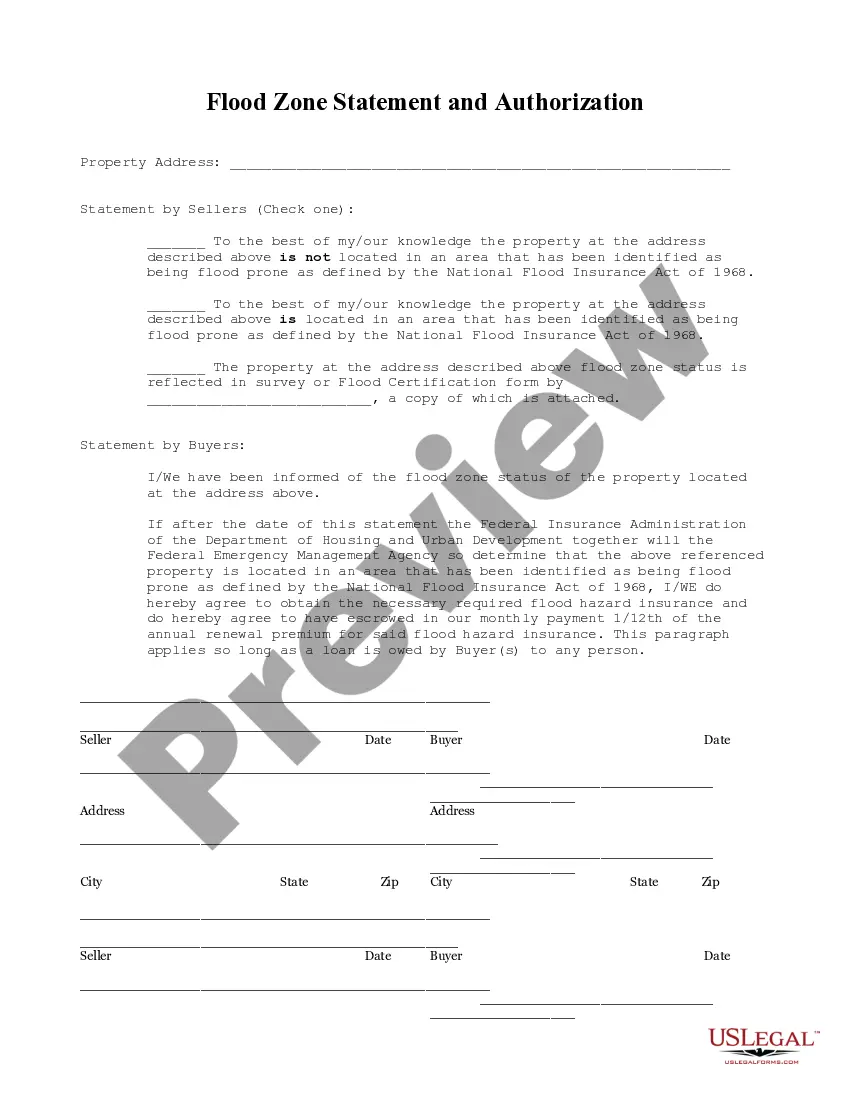

- Step 2. Use the Preview option to review the form’s details. Do not forget to read the information.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal document format.

- Step 4. Once you have located the form you need, click the Get now button. Select the payment plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Purchase Agreement by a Corporation of Assets of a Partnership.

Form popularity

FAQ

NOTE: To cancel your Limited Liability Partnership registration, you must write Cancellation on the form in box four. A signature of at least 2 partners or authorized agent is required. Use this form to file your annual renewal once every calendar year.

To dissolve your Minnesota corporation after it has issued shares, you must first file the Intent to Dissolve form with the Minnesota Secretary of State (SOS). Then the corporation will file the Articles of Dissolution Chapter 302A. 7291 or 302A. 727.

In a business partnership, you can split the profits any way you want, under one conditionall business partners must be in agreement about profit-sharing. You can choose to split the profits equally, or each partner can receive a different base salary and then the partners will split any remaining profits.

LEGAL RECOGNITION OF ELECTRONIC RECORDS AND SIGNATURES. APPLICATION. 302A.021.

General partnership In most cases, partners form their business by signing a partnership agreement. Ownership and profits are usually split evenly among the partners, although they may establish different terms in the partnership agreement.

Under 322C, the ability of a member, or anyone else, to act as an agent of the LLC is to be addressed, if at all, in an operating agreement. An LLC may file statements of authority with the Office of Minnesota Secretary of State (similar to those filed by partnerships) with respect to non-members.

Instead, the partner owns a 15% stake in the total value of the entire partnership. Thus, partnership property will be distributed as such. Property in a partnership may only be distributed to partners after all debts, liabilities, and taxes of the partnership are paid off in full.

Without a formal agreement stating otherwise, the assets of the partnership belong equally to all partners. If one partner works three day weeks and the other six day weeks, the profit from the harder working partner is shared with the other equally.

Do Partners Own Partnership Assets? Partnerships are not taxable entities, but they are required to file their tax returns at the end of each accounting year. If they have agreed to share equally a partnership asset, it is owned by both partners.

A partnership agreement will govern important matters that arise in your business, including how to make decisions and resolve disputes amongst partners. Once you have written your agreement, each partner must sign the document, making it legally binding and enforceable.