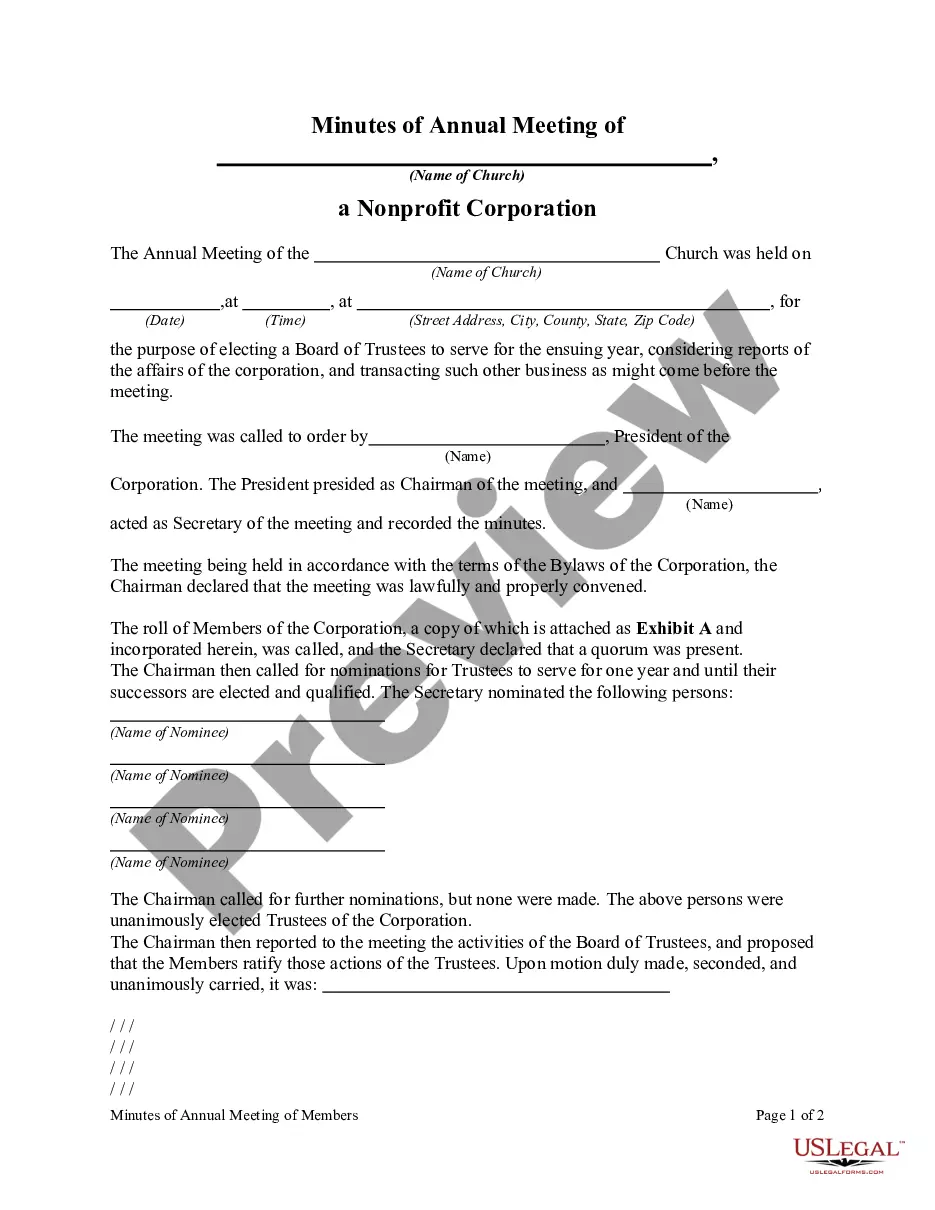

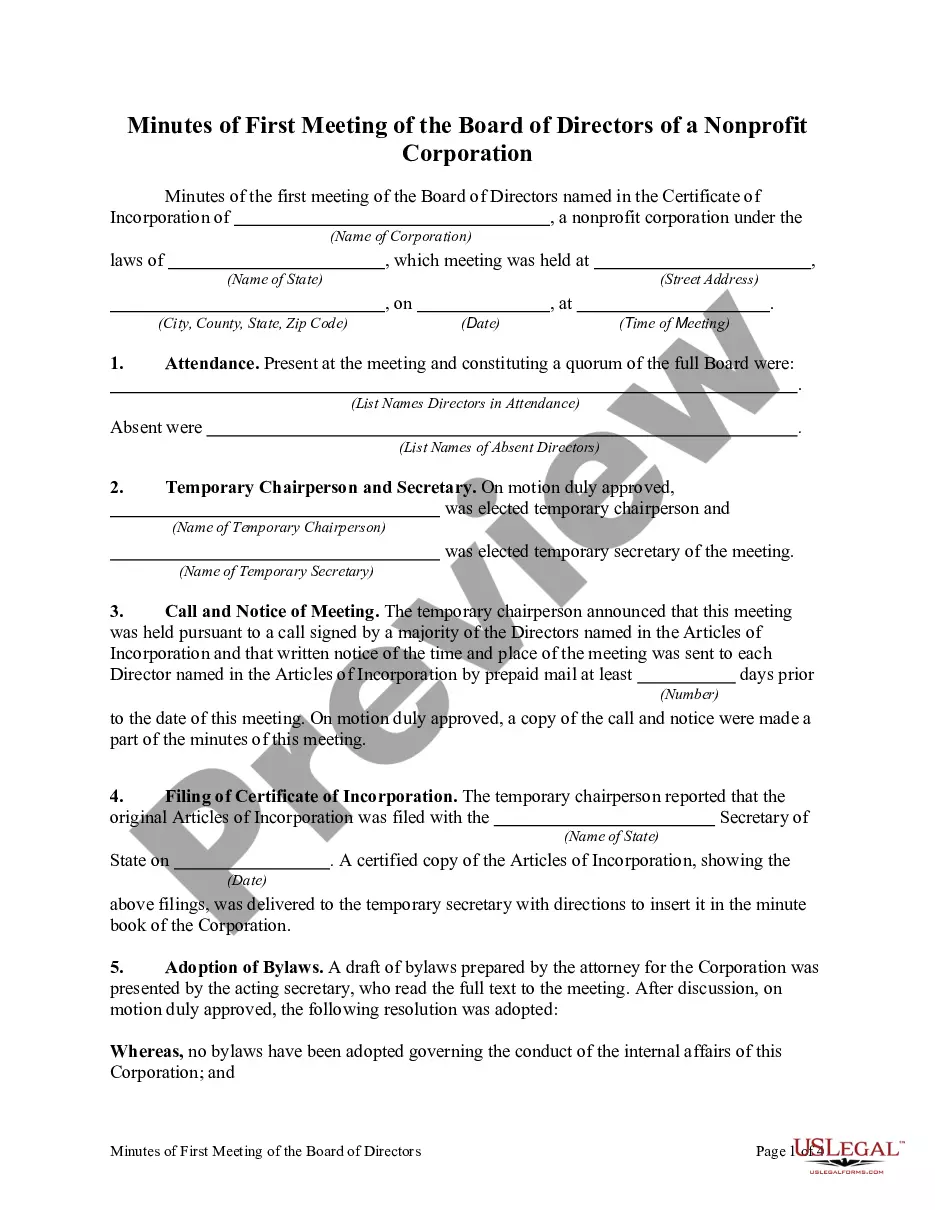

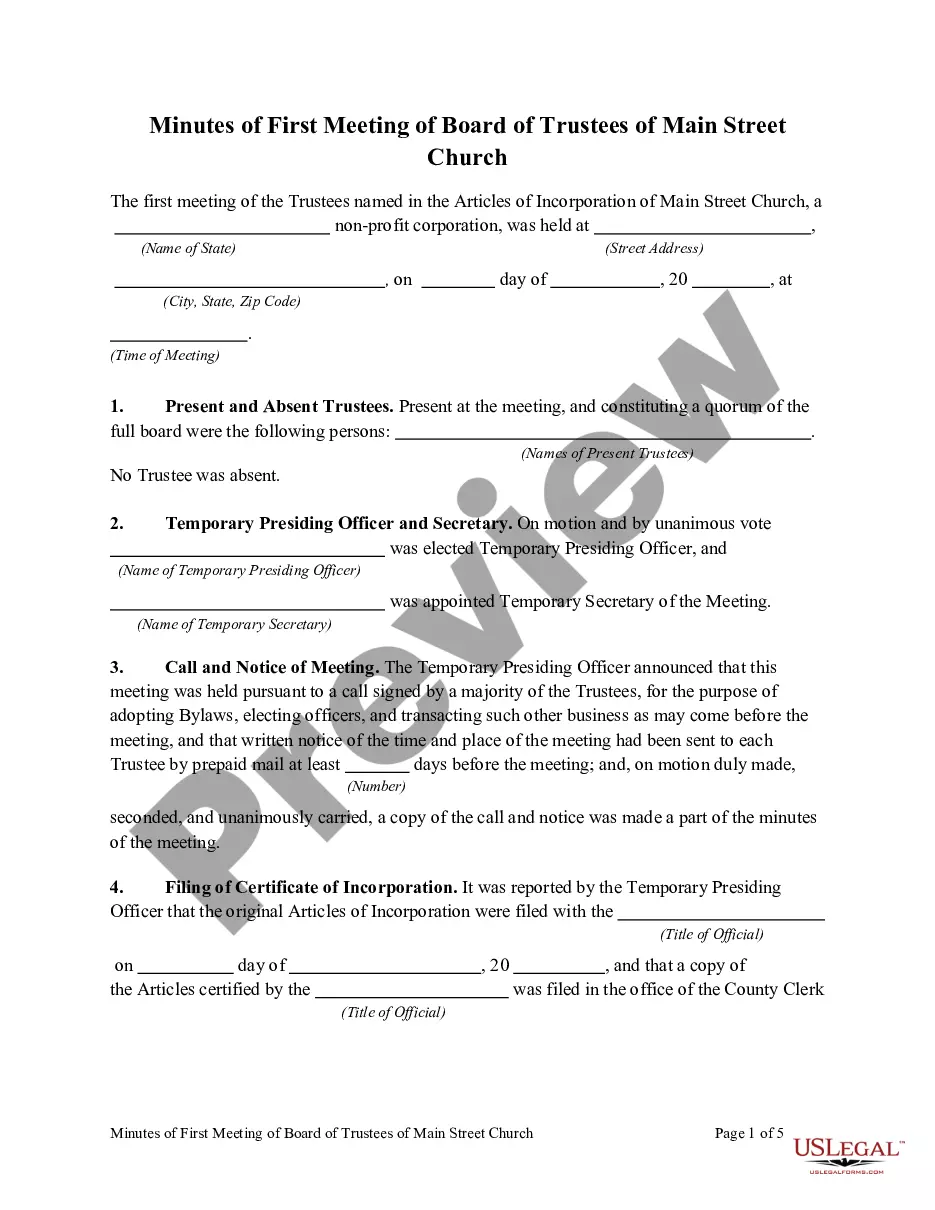

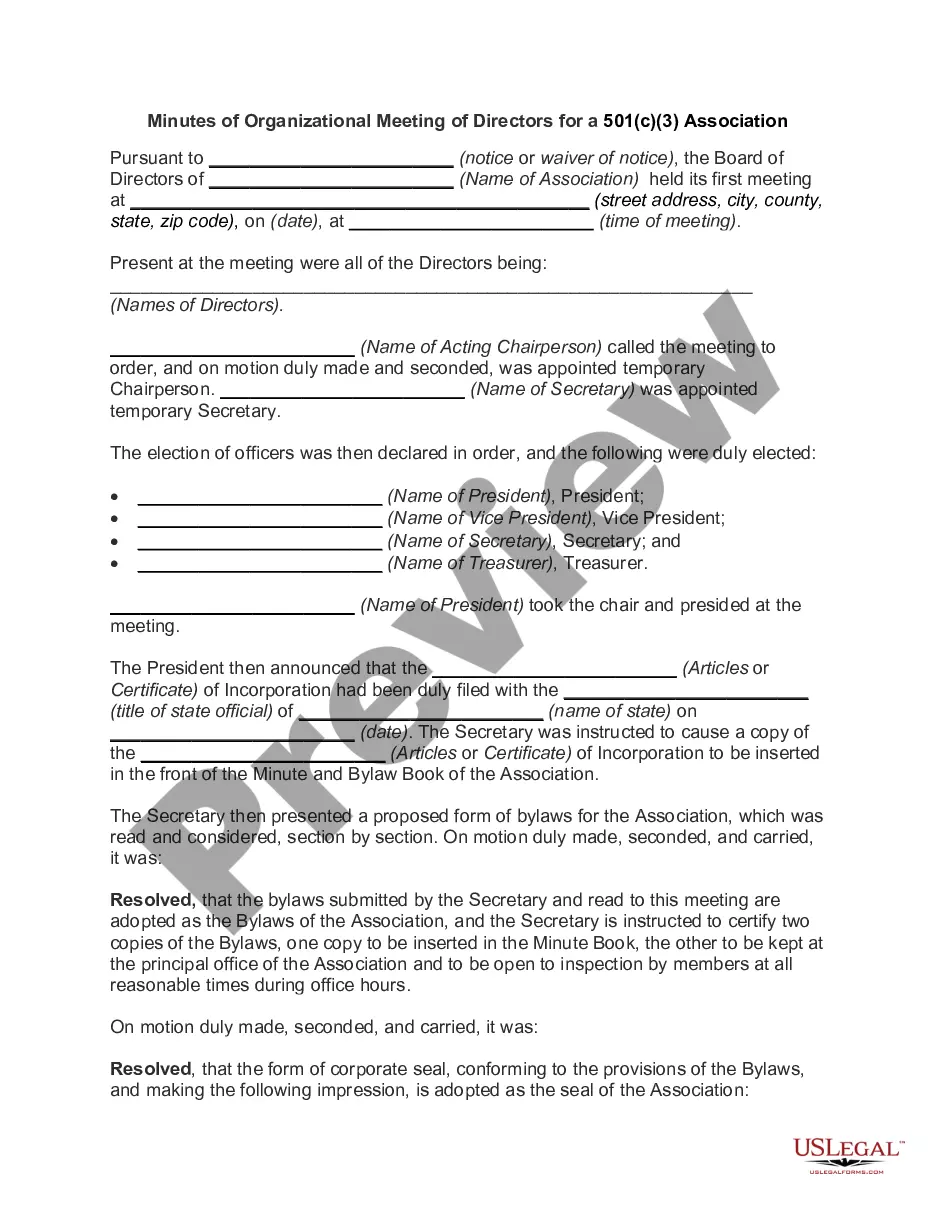

Generally, the members of a nonprofit corporation must exercise their control of corporate policies at regularly called meetings of the members. A corporation has a duty to keep a record of the meetings of its members, showing the dates such meetings were held and listing the members present or showing the number of voting shares represented at the meeting in person or by proxy. It is the duty of the secretary to prepare and enter the minutes of such meetings in the corporate records.

Minnesota Minutes of Annual Meeting of a Non-Profit Corporation

Description

How to fill out Minutes Of Annual Meeting Of A Non-Profit Corporation?

If you wish to finish, acquire, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require.

An array of templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to process the payment. Step 6. Select the format of the legal document and download it onto your device. Step 7. Complete, modify, and print or sign the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation.

- Utilize US Legal Forms to acquire the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to locate the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you’re using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

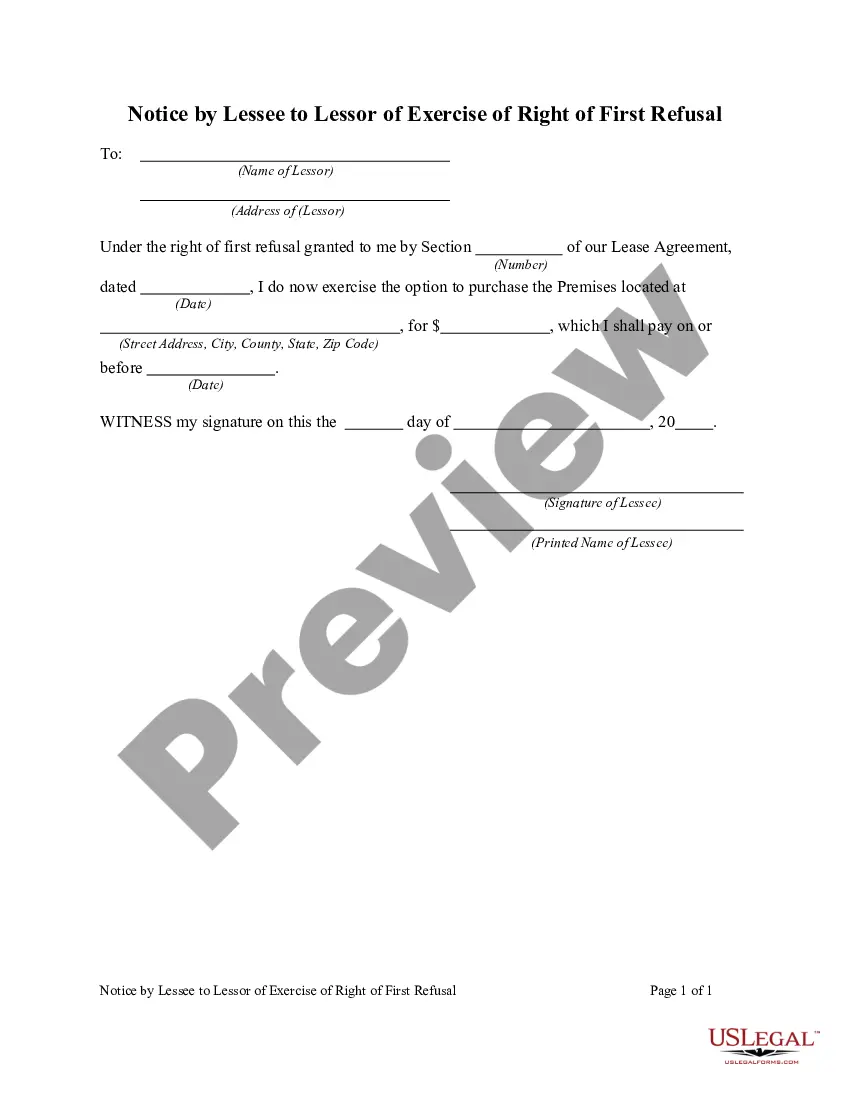

- Step 2. Utilize the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Typically, the Secretary of the board is responsible for taking minutes at a nonprofit board meeting. However, any designated person can fulfill this role, especially in smaller organizations or in the case of a temporary absence. During the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation, this individual must focus on capturing key details accurately. Assigning someone reliable ensures that the meeting's essential information is recorded and preserved.

To take non-profit meeting minutes effectively, begin by noting the date, time, and attendees. Use a consistent format to document agenda items, discussions, and decisions, staying focused on the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation. It’s also helpful to summarize discussions without inserting personal opinions or unnecessary details. By following these guidelines, you will produce clear and useful minutes that serve your non-profit well.

Taking minutes for a non-profit requires active listening and concise note-taking. Focus on recording important points, such as attendees, agenda items, decisions made, and any action items regarding the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation. Structure the minutes clearly, using headings and bullet points where appropriate, to enhance readability. This method will help create an effective record that fulfills legal requirements and aids future reference.

Collecting meeting minutes involves designating a person to take notes during the meeting. This individual captures key discussions, decisions, and action items related to the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation. After the meeting, it is important to distribute the minutes to board members for review and approval. Following this process ensures that the minutes are accurate and reflect the true essence of the meeting.

Yes, non-profits are generally required to maintain minutes of their meetings, including the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation. These minutes serve as an official record of the discussion and decisions made during meetings. Maintaining accurate minutes also promotes transparency and accountability within the organization. By adhering to these practices, non-profits can ensure they meet legal requirements and foster trust among their stakeholders.

Yes, the Minnesota Minutes of Annual Meeting of a Non-Profit Corporation for a 501c3 organization are generally considered public records. This means that interested individuals can request access to these minutes to review what transpired during these meetings. Transparency is crucial for non-profits, and maintaining accessible records helps build trust within the community. If you need assistance in drafting or organizing these minutes, consider using the US Legal Forms platform to simplify the process.

Nonprofit board meeting minutes should be clear, concise, and well-organized. They commonly include the meeting’s date, time, list of attendees, key discussions, and decisions made. Utilizing a standard format for Minnesota Minutes of Annual Meeting of a Non-Profit Corporation will ensure consistency and make it easier for members to reference past meetings.

Public meetings are not always required for nonprofits but can be beneficial for community engagement. Holding public meetings allows stakeholders to voice their opinions, promote transparency, and foster a sense of community ownership. When conducting these sessions, be sure to prepare accurate Minnesota Minutes of Annual Meeting of a Non-Profit Corporation to record the feedback gathered during the discussions.

Writing effective meeting minutes involves clearly documenting the date, time, attendees, topics discussed, and decisions made during the meeting. Use a straightforward format that highlights key points rather than a verbatim transcript of discussions. Preparing Minnesota Minutes of Annual Meeting of a Non-Profit Corporation can streamline the process and enhance clarity for board members and stakeholders.

The frequency of board meetings can vary, but it is common for nonprofits to hold quarterly or bi-monthly meetings. Regular meetings are essential for effective oversight and strategic planning. Documenting these meetings with Minnesota Minutes of Annual Meeting of a Non-Profit Corporation helps ensure that important discussions and decisions are clearly recorded for future reference.