Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation

Description

How to fill out Minutes Of First Meeting Of The Board Of Directors Of A Nonprofit Corporation?

Are you currently in a location where you frequently require paperwork for either business or personal purposes.

There are numerous legitimate document templates available online, but it isn't easy to find ones you can trust.

US Legal Forms offers a vast array of form templates, such as the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation, designed to comply with state and federal regulations.

Once you locate the right form, simply click Buy now.

Choose the pricing plan you prefer, fill in the required information to process your payment, and pay for your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

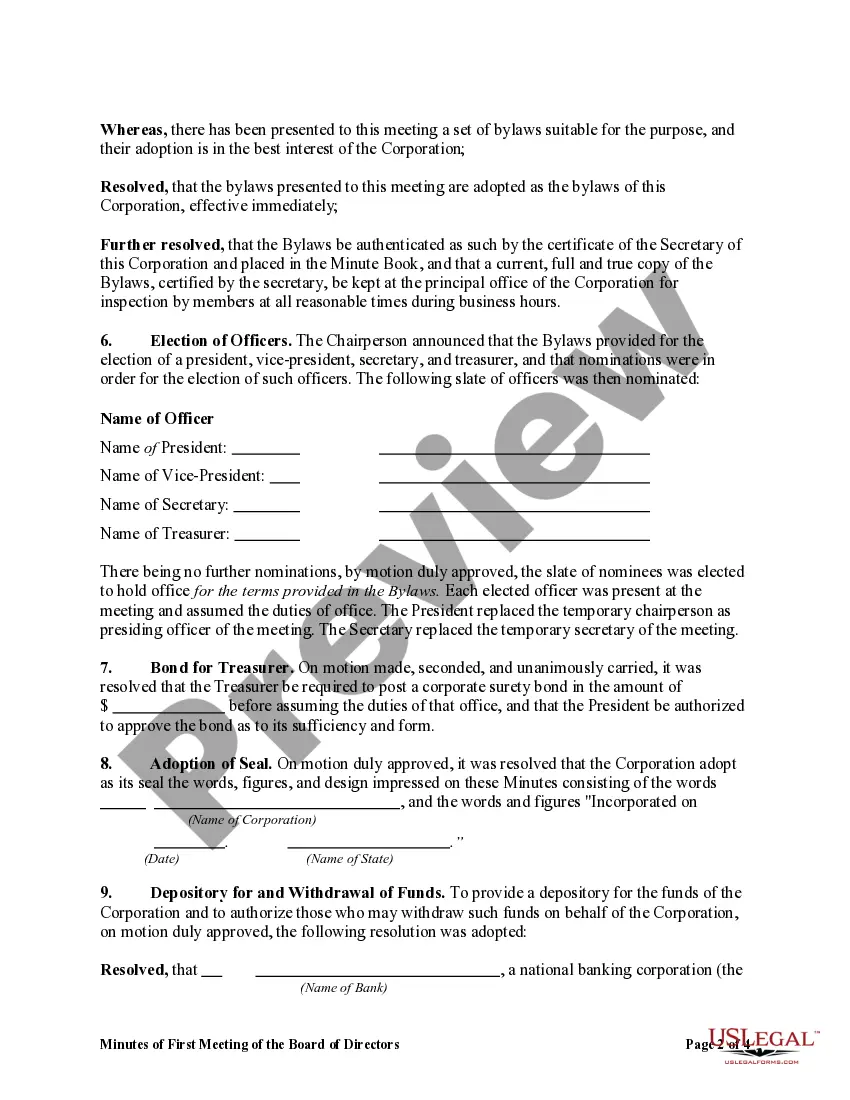

- Utilize the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

To write effective minutes for a nonprofit board meeting, start by drafting a template that includes essential elements like date, attendees, and agenda items. Summarize discussions and clearly outline decisions made. Using tools like USLegalForms can simplify the process of creating Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation, ensuring accuracy and compliance with state guidelines.

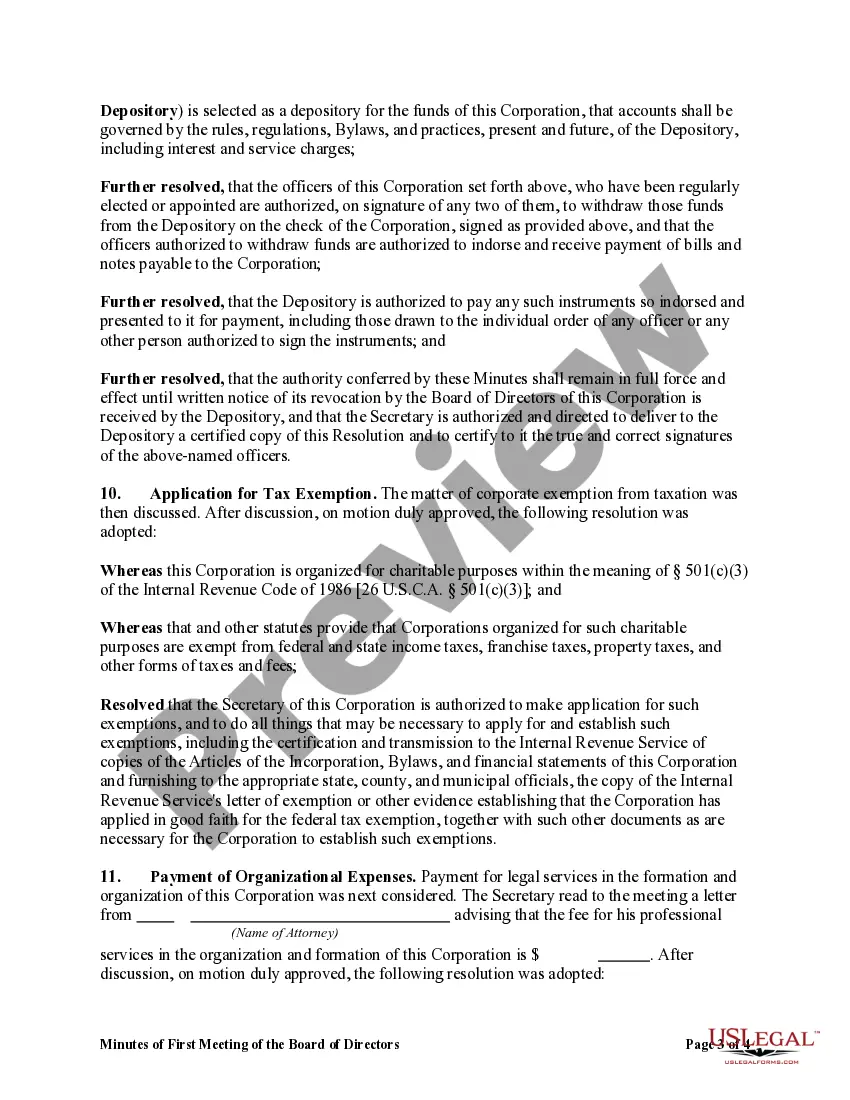

The minutes of the first meeting of the board of directors outline the initial activities and decisions of the governing body of a nonprofit. These minutes typically include the formation of the nonprofit, election of officers, and establishment of by-laws. Properly documented, the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation create a solid foundation for your organization’s governance.

Minutes from a board meeting usually include the title of the organization, date, time, and location of the meeting, along with a list of attendees and absentees. They also document the agenda items discussed, decisions made, and any actions assigned. These elements ensure that the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation serve as a reliable record for future reference.

Board meeting minutes should provide enough detail to capture the essence of the discussions and decisions made. While they should note key points, they do not need to transcribe everything verbatim. For the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation, aim for a balance that accurately represents the meeting without overwhelming readers with unnecessary details.

Nonprofit board meeting minutes should be clear, concise, and structured. They usually include the date, time, attendees, agenda items, discussions, and resolutions made during the meeting. Specifically, the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation should capture all vital decisions to ensure that future meetings can reference them easily.

Yes, nonprofit board meeting minutes are often considered public documents. This means that they can be requested and reviewed by the public, promoting transparency in nonprofit operations. Especially in Minnesota, understanding the public nature of these documents is essential for maintaining accountability and trust in your organization.

Typically, the chairperson of the meeting and the secretary sign the minutes of a board of directors meeting. This signature confirms that the minutes accurately reflect what occurred during the meeting. In Minnesota, as part of the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation, these signed minutes provide legal documentation of the decisions made.

When laying out the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation, use a simple and clean layout that emphasizes readability. Start with the title and date, then present attendees in a list format, followed by the agenda items clearly outlined. Keeping the layout consistent allows for easier updates and accessibility.

The most accepted format for the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation usually includes headings, subheadings, and a clear sequence of topics discussed. It often starts with a call to order, followed by a roll call, and then a summary of discussions, decisions, and action items. This format keeps the minutes professional and easy to reference.

To organize the Minnesota Minutes of First Meeting of the Board of Directors of a Nonprofit Corporation effectively, start by dividing the minutes into clear sections. You can use bullet points for discussions and decisions, making it easier for readers to find information quickly. Additionally, numbering the agenda items can enhance navigation through the document.