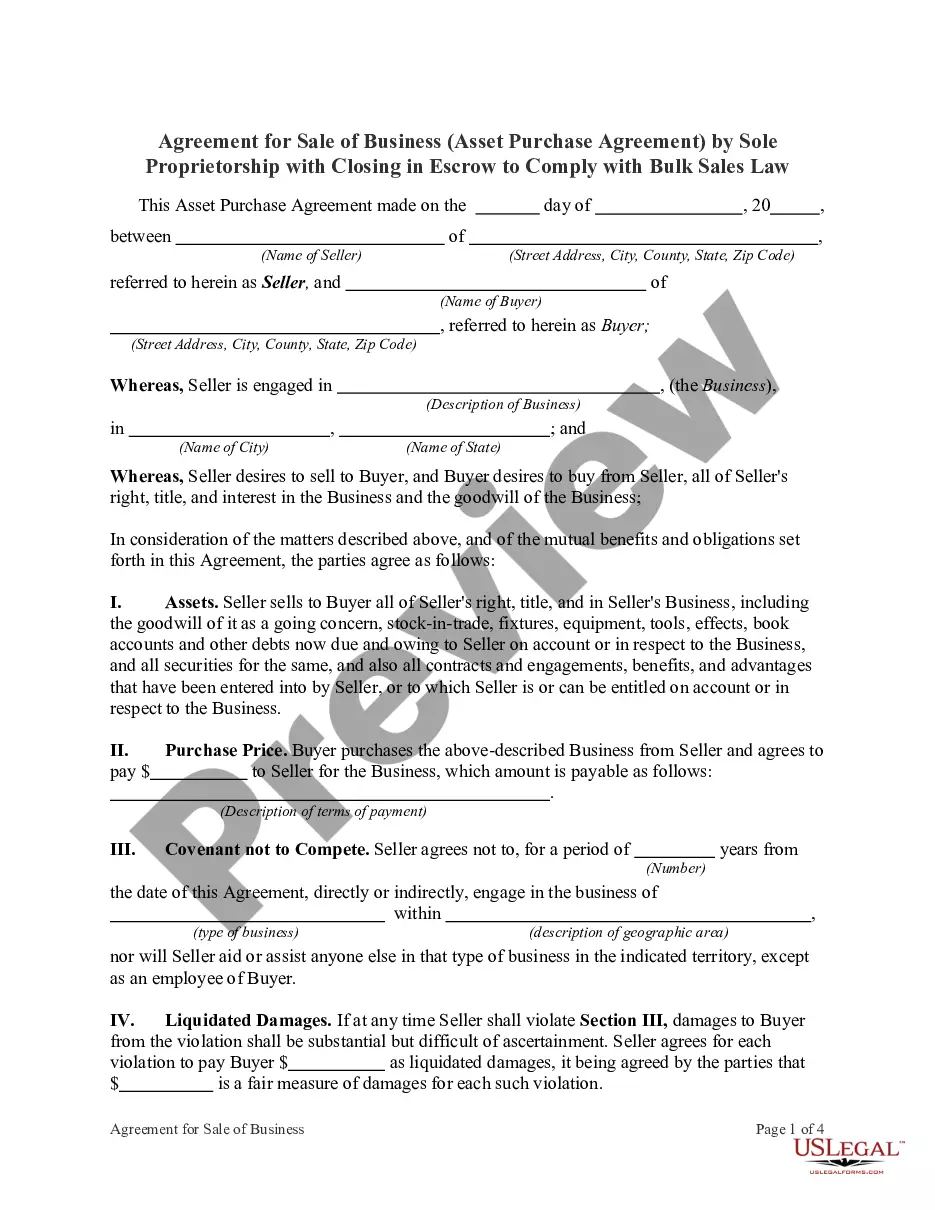

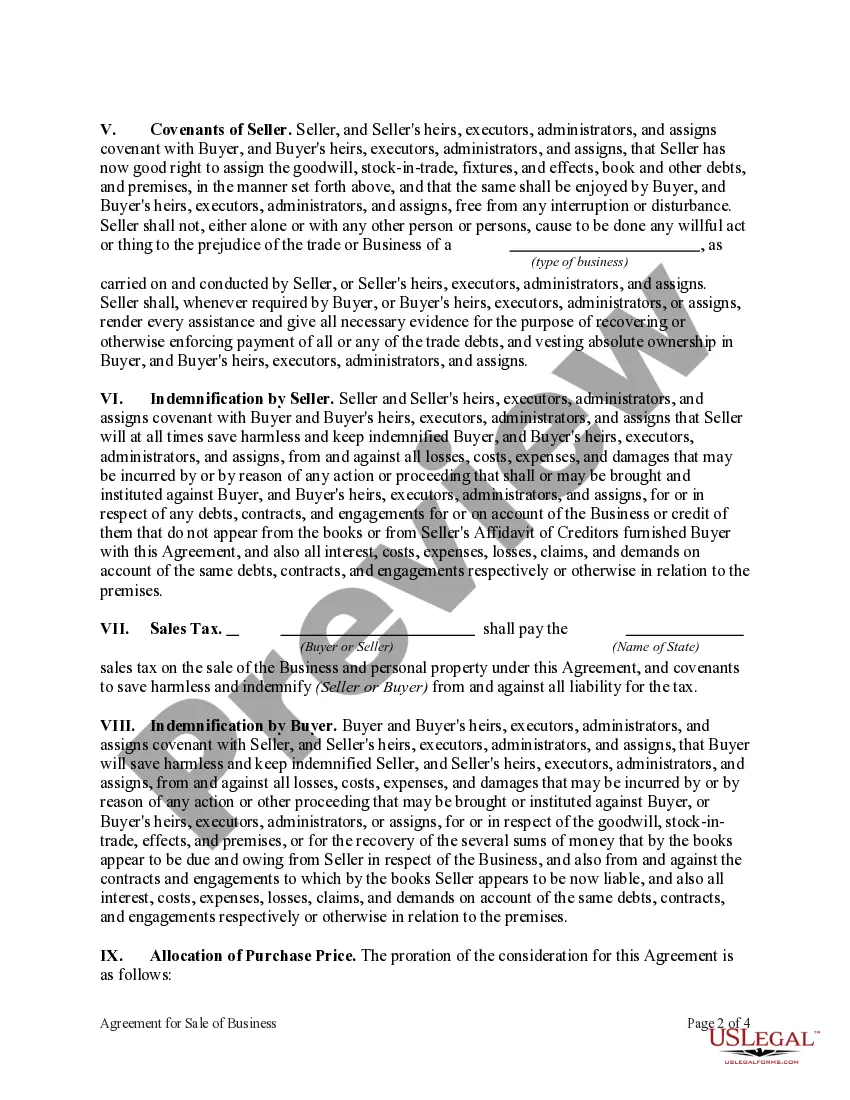

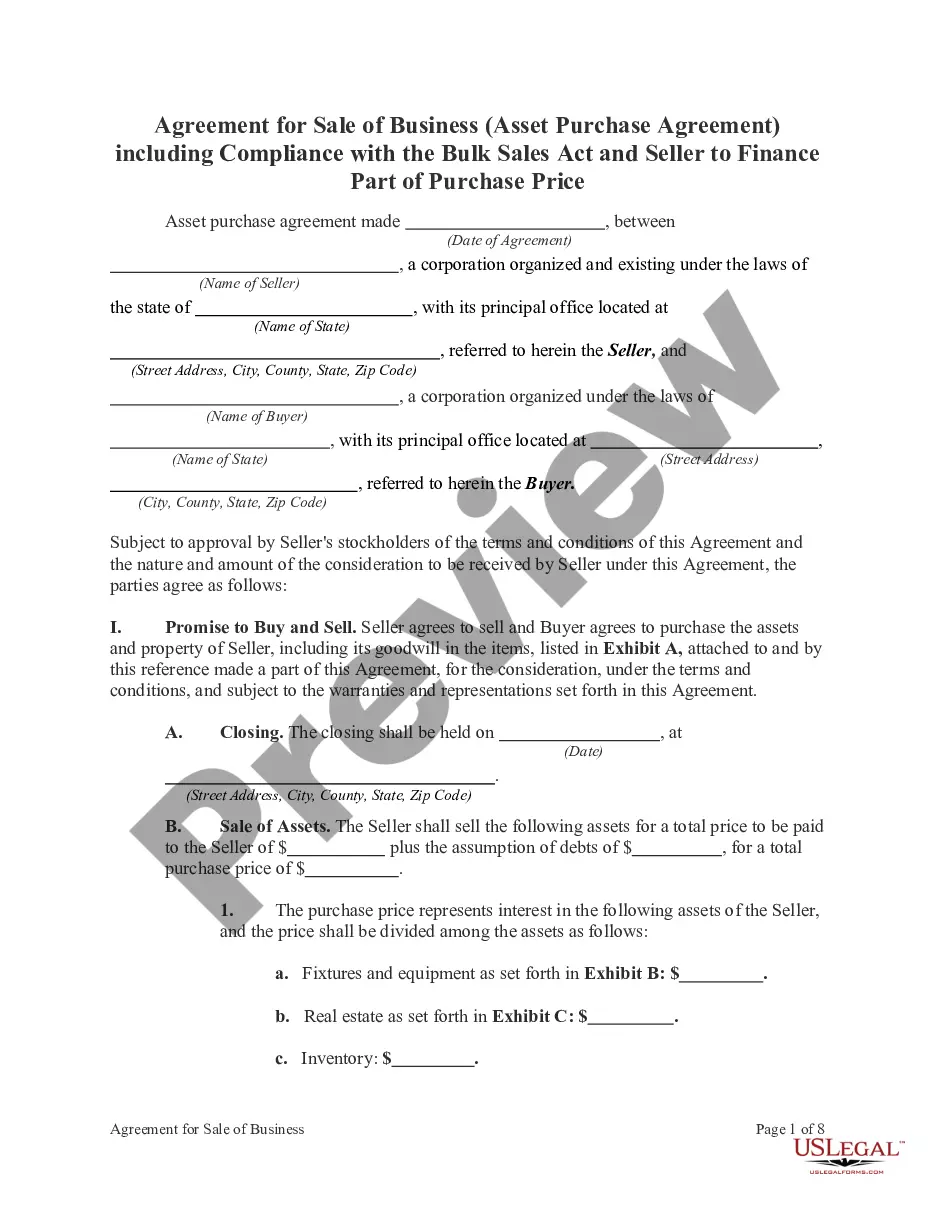

Minnesota Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law

Description

How to fill out Agreement For Sale Of Business By Sole Proprietorship With Closing In Escrow To Comply With Bulk Sales Law?

Selecting the optimal authorized document format can pose challenges.

Certainly, there are numerous templates available online, but how can you locate the authorized form you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Minnesota Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law, suitable for both business and personal requirements.

You can browse the form using the Preview option and read the form description to confirm it is suitable for you.

- All forms are verified by specialists and adhere to federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to obtain the Minnesota Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law.

- Use your account to review the authorized forms you may have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your location.

Form popularity

FAQ

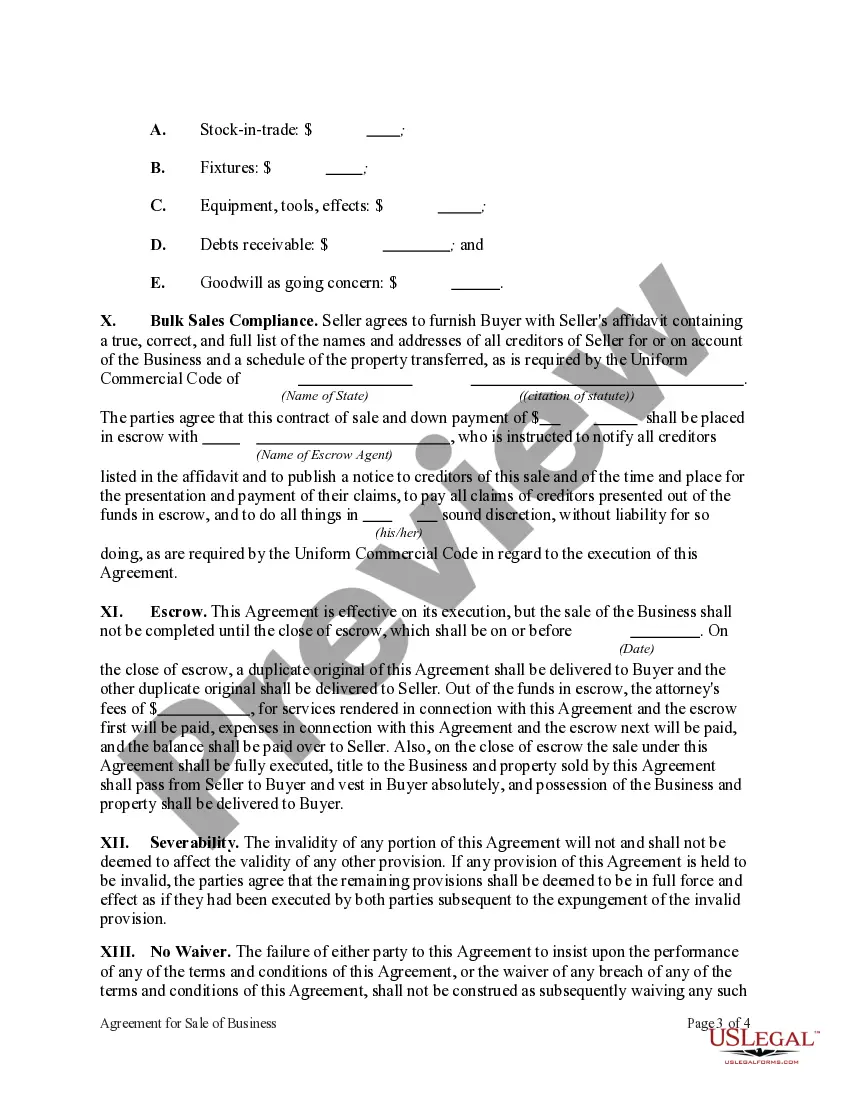

Yes, Minnesota has provisions that address bulk sales, outlined in its Uniform Commercial Code. This law is designed to protect creditors by ensuring they are notified when a business sells its assets en masse. To comply with these laws, using a Minnesota Agreement for Sale of Business by Sole Proprietorship with Closing in Escrow to Comply with Bulk Sales Law ensures you effectively navigate these requirements.

Where the statute requires the vendor, transferor, mortgagor or assignor to notify personally or by registered mail every creditor "at least ten days before transferring possession" of any stock of goods, wares, merchandise, provisions or materials, in bulk, it is sufficiently complied with by sending notice by

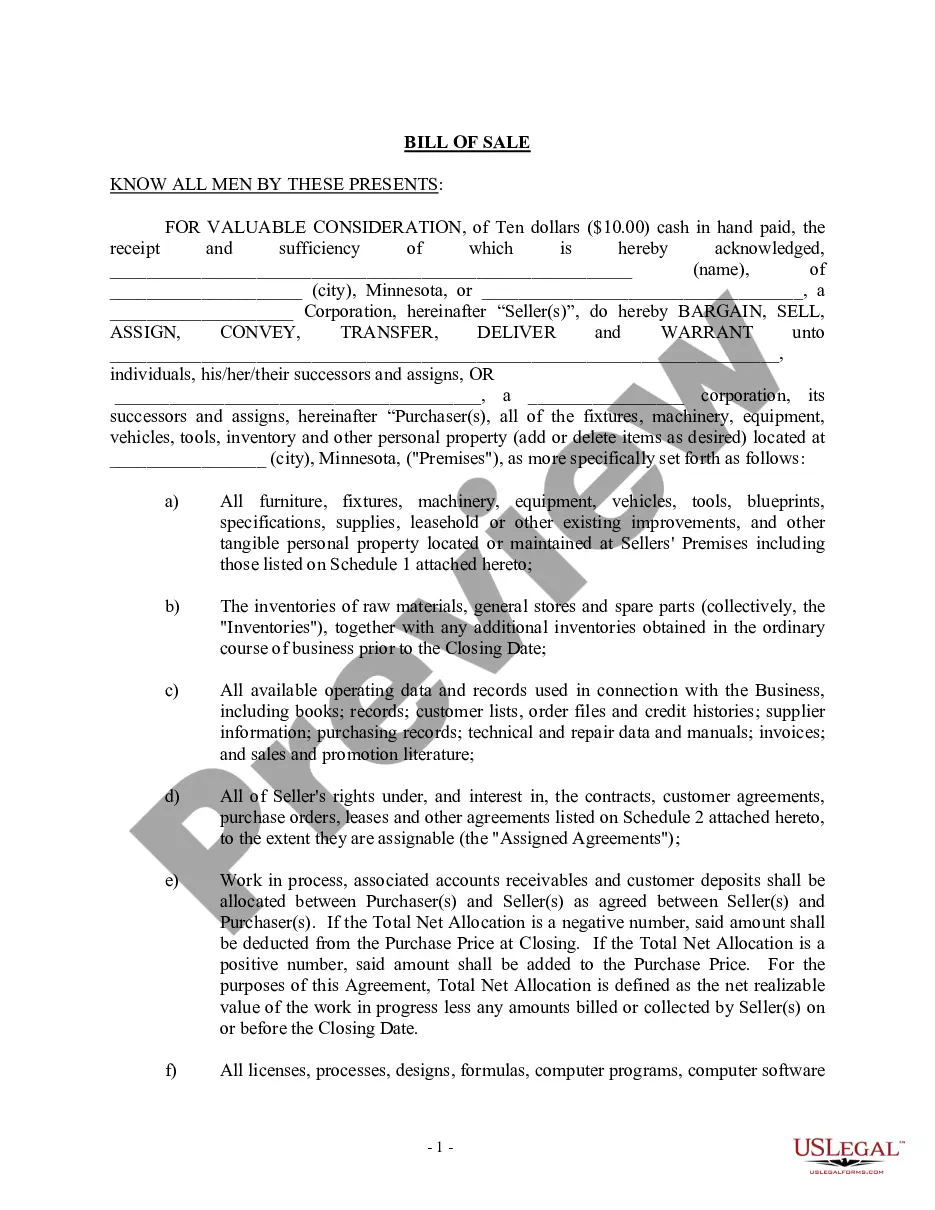

The purpose of the Bulk Sale Statute is to protect a purchaser from inheriting any tax debt from a seller of business assets. A bulk sale is the sale (or transfer or assignment) of an individual's or company's business asset/s, in whole or in part, outside of the ordinary course of business.

Ontario's Bill 27: An Act to reduce the regulatory burden on business, to enact various new Acts and to make other amendments and repeals (the Burden Reduction Act) received Royal Assent on March 22, 2017. Schedule 3 of the Burden Reduction Act repeals the Bulk Sales Act.

A bulk sale, sometimes called a bulk transfer, is when a business sells all or nearly all of its inventory to a single buyer and such a sale is not part of the ordinary course of business.

The bulk transfer law is a law to protect business creditors. It provides that if a buyer of a business notifies the creditors of the seller in advance that it is buying the seller's assets, then the buyer will not be liable to those creditors for the debts and obligations of the seller.

The key elements of a Bulk Sale are: any sale outside the ordinary course of the Seller's business. of more than half the Seller's inventory and equipment. as measured by the fair market value on the date of the Bulk Sale Agreement (Agreement).

Under California law, a bulk sale is defined as a sale of more than half of a business' inventory and equipment, as measured by fair market value, that is not part of the seller's ordinary course of business. In order for the law to apply, the seller has to be physically located in California.

The bulk transfer law is designed to prevent a merchant from defrauding his or her creditors by selling the assets of a business and neglecting to pay any amounts owed the creditors. The law requires notice so that creditors may take whatever legal steps are necessary to protect their interests.