The Uniform Commercial Code (UCC) has been adopted in whole or in part by the legislatures of all 50 states.

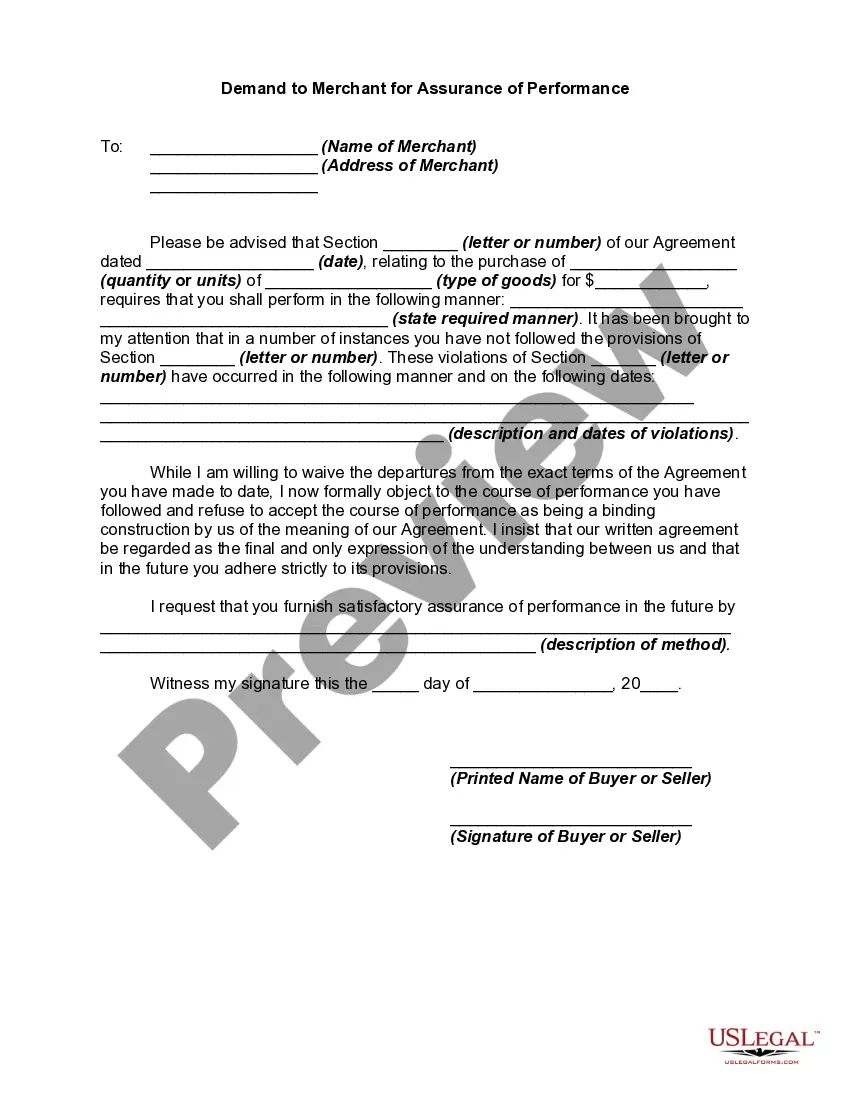

If a party has reasonable grounds to believe that another will not perform, he or she may demand in writing an assurance of performance. While waiting for a response, the party may suspend his or her own performance. If an assurance is not given within thirty days, this can be considered repudiation of the contract. This same rule applies if cooperation is needed and not given [UCC 2-311(3)(b)].