A Line of Credit refers to the maximum borrowing power that a lender extends to a borrower. The borrower may draw required amounts from the fixed amount. Usually, it is a credit source extended to any credit-worthy business by a bank or any financial institution. A line of credit includes cash credit, overdraft, demand loan, export packing credit, term loan, discounting or purchase of commercial bills, etc. The borrower may use the line of credit to overcome liquidity problems. Requisite amounts may be withdrawn from the account as and when required. The borrower pays interest only for the amount withdrawn.

Minnesota Line of Credit Promissory Note

Description

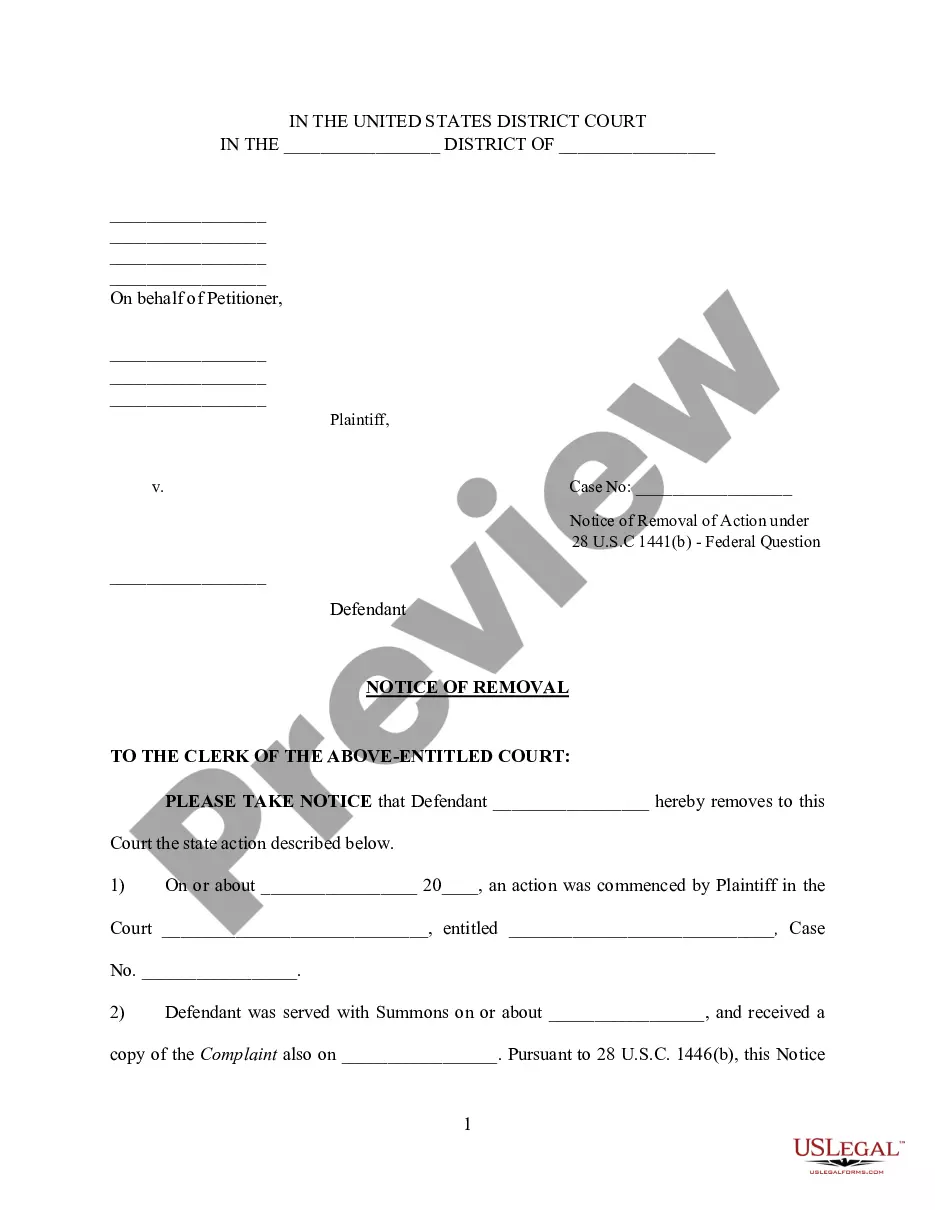

How to fill out Line Of Credit Promissory Note?

Selecting the ideal legal document template can be a challenge. Naturally, there are numerous designs available online, but how do you locate the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Minnesota Line of Credit Promissory Note, which you can use for both business and personal purposes. All documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Get option to obtain the Minnesota Line of Credit Promissory Note. Use your account to view the legal documents you have purchased previously. Navigate to the My documents section of your account to retrieve another copy of the document you need.

Choose the document format and download the legal document template to your device. Fill it out, modify, print, and sign the completed Minnesota Line of Credit Promissory Note. US Legal Forms is the largest repository of legal documents where you can find numerous file templates. Utilize the service to obtain professionally crafted paperwork that adheres to state requirements.

- First, confirm that you have chosen the correct form for your jurisdiction/state.

- You can review the form using the Preview option and examine the form details to ensure it is suitable for you.

- If the form does not meet your standards, utilize the Search area to find the right document.

- Once you are certain that the form is appropriate, click on the Get now button to acquire the form.

- Select the pricing plan you need and enter the required information.

- Create your account and complete your purchase using your PayPal account or credit card.

Form popularity

FAQ

To obtain a Minnesota Line of Credit Promissory Note, you can start by identifying the specific terms and conditions you need. You may consider drafting it yourself using online resources, or you can utilize the services offered by platforms like US Legal Forms, which provide standardized templates. Always review your promissory note to ensure it meets state laws and your particular circumstances. Consulting with a legal professional can also help you navigate any complexities involved.

A promissory note, including a Minnesota Line of Credit Promissory Note, is generally enforceable if it meets certain legal requirements. It should include clear terms regarding the amount borrowed, the interest rate, and the repayment schedule. Both parties must also have the capacity to enter into the agreement. Using a template from US Legal Forms can help ensure that your promissory note complies with Minnesota laws, increasing its enforceability.

In Minnesota, a promissory note does not legally require notarization to be valid. However, having a Minnesota Line of Credit Promissory Note notarized can provide an extra layer of protection and can help in case of disputes. Notarization helps establish the authenticity of the signatures involved and confirms the identity of the parties to the agreement.

Typically, a line of credit does include a promissory note, such as the Minnesota Line of Credit Promissory Note. This note details the borrower's promise to repay any amounts borrowed against the line of credit. It is important to understand the terms outlined in the note to ensure compliance and avoid potential issues in repayment.

No, a credit note serves a different purpose than a promissory note. A credit note is typically issued by a seller to a buyer acknowledging a return of goods or a reduction in an invoice. In contrast, a Minnesota Line of Credit Promissory Note establishes a borrower's commitment to repay borrowed funds, highlighting a debt relationship rather than a return of payment.

A line of credit is not a promissory note on its own, but it often involves one, specifically the Minnesota Line of Credit Promissory Note. This note details the borrower's promise to repay the funds drawn from the line of credit. While the line of credit provides access to funds, the promissory note formalizes the borrower's obligation to repay these amounts according to specified terms.

To properly file a Minnesota Line of Credit Promissory Note, you typically need to record it with your county's recorder's office. Filing helps establish the note's validity and provides public notice of the obligation. This step is crucial in protecting the lender’s interest in the property. If you have questions about filing, consider using US Legal Forms for guidance and ready-to-use templates.