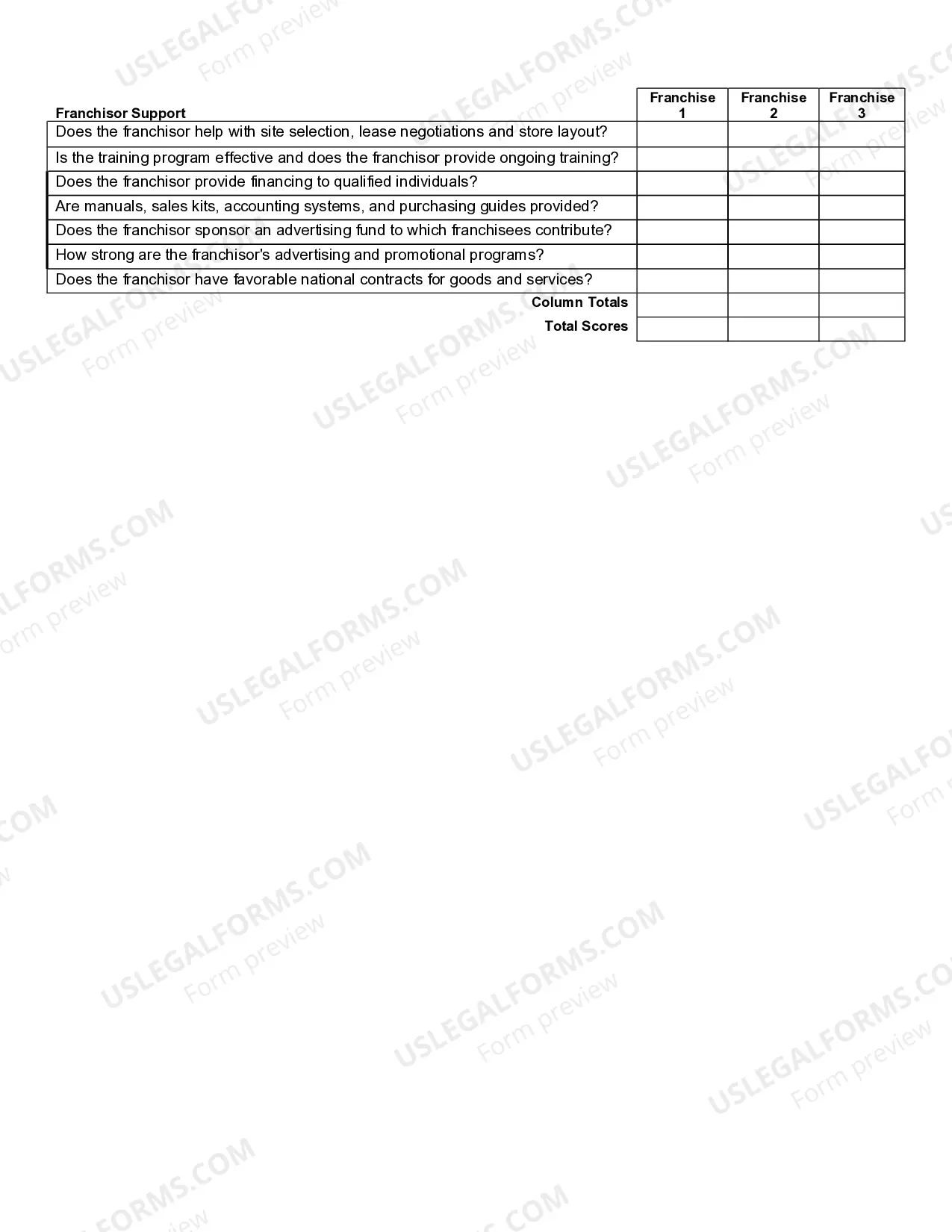

Minnesota Franchise Comparison Worksheet

Description

How to fill out Franchise Comparison Worksheet?

US Legal Forms - among the greatest libraries of legitimate varieties in the USA - offers a wide array of legitimate file layouts you may acquire or produce. Making use of the site, you can get a large number of varieties for enterprise and specific reasons, categorized by categories, suggests, or key phrases.You can get the most up-to-date types of varieties much like the Minnesota Franchise Comparison Worksheet within minutes.

If you already possess a subscription, log in and acquire Minnesota Franchise Comparison Worksheet in the US Legal Forms collection. The Down load option will show up on each and every form you perspective. You get access to all previously downloaded varieties in the My Forms tab of your bank account.

If you would like use US Legal Forms initially, here are simple directions to help you started out:

- Be sure you have picked out the proper form for your metropolis/county. Select the Preview option to examine the form`s information. Read the form outline to actually have chosen the right form.

- When the form doesn`t suit your demands, make use of the Search industry on top of the display to find the one who does.

- In case you are happy with the form, confirm your selection by simply clicking the Buy now option. Then, select the costs strategy you like and supply your references to sign up for an bank account.

- Approach the purchase. Make use of credit card or PayPal bank account to perform the purchase.

- Select the file format and acquire the form on the system.

- Make changes. Fill out, revise and produce and signal the downloaded Minnesota Franchise Comparison Worksheet.

Every single design you added to your bank account lacks an expiry date and is the one you have forever. So, if you want to acquire or produce yet another backup, just visit the My Forms segment and then click about the form you need.

Obtain access to the Minnesota Franchise Comparison Worksheet with US Legal Forms, the most comprehensive collection of legitimate file layouts. Use a large number of expert and condition-particular layouts that fulfill your organization or specific requirements and demands.

Form popularity

FAQ

Qualified dividends are taxed at a maximum rate of 20%. Ordinary dividends are taxed at the same rate as federal income taxes, or between 10% and 37%. State income taxes also may apply. Be cautious when considering investments that pay a high dividend.

The dividends received deduction (DRD) is a federal tax deduction in the United States that is given to certain corporations that get dividends from related entities. The amount of the dividend that a company can deduct from its income tax is tied to how much ownership the company has in the dividend-paying company.

Dividends received deduction (DRD) reduced starting in 2023 The DRD was 70% for ownership under 20%. Applicable to tax years beginning after December 31, 2022, the 80% DRD is reduced to 50% and the 70% DRD is reduced to 40%.

A flat tax rate of 9.8 percent applies to Minnesota taxable income. Many corporations operate in more than one state. Under the U.S. Constitution, a state can legally tax only the income of a business that is ?fairly apportioned? to its activity in the state.

Nonbusiness income is defined as ?income of the trade or business that cannot be apportioned by this state because of the United States Constitution or the Constitution of the state of Minnesota and includes income that cannot constitutionally be apportioned to this state because it is derived from a capital ...

Dividends-Received Deduction The deduction equals 50 percent of dividends received if the corporation receiving the dividend owns less than 20 percent of the distributing corporation (IRC § 243(a)(1)).

Standard DeductionSingle or Married Filing Separately$12,900Head of Household$19,400Married Filing Jointly$25,800

Corporation Franchise Tax applies to companies that file annual federal income tax returns as C corporations and meet at least one of the following: Located in Minnesota. Have a business presence in Minnesota. Have Minnesota gross income.