Minnesota Extension of Contract

Description

How to fill out Extension Of Contract?

If you need to be thorough, download, or create sanctioned document templates, utilize US Legal Forms, the biggest assortment of legal forms, available online.

Take advantage of the site’s straightforward and user-friendly search function to find the documents you require.

A variety of templates for both business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the payment.

- Utilize US Legal Forms to access the Minnesota Extension of Contract within just a few clicks.

- If you are currently a US Legal Forms user, Log In to your account and click on the Download button to locate the Minnesota Extension of Contract.

- You can also access forms you previously saved in the My documents section of your account.

- If you're using US Legal Forms for the first time, adhere to the steps outlined below.

- Step 1. Confirm you have selected the form for the correct city/state.

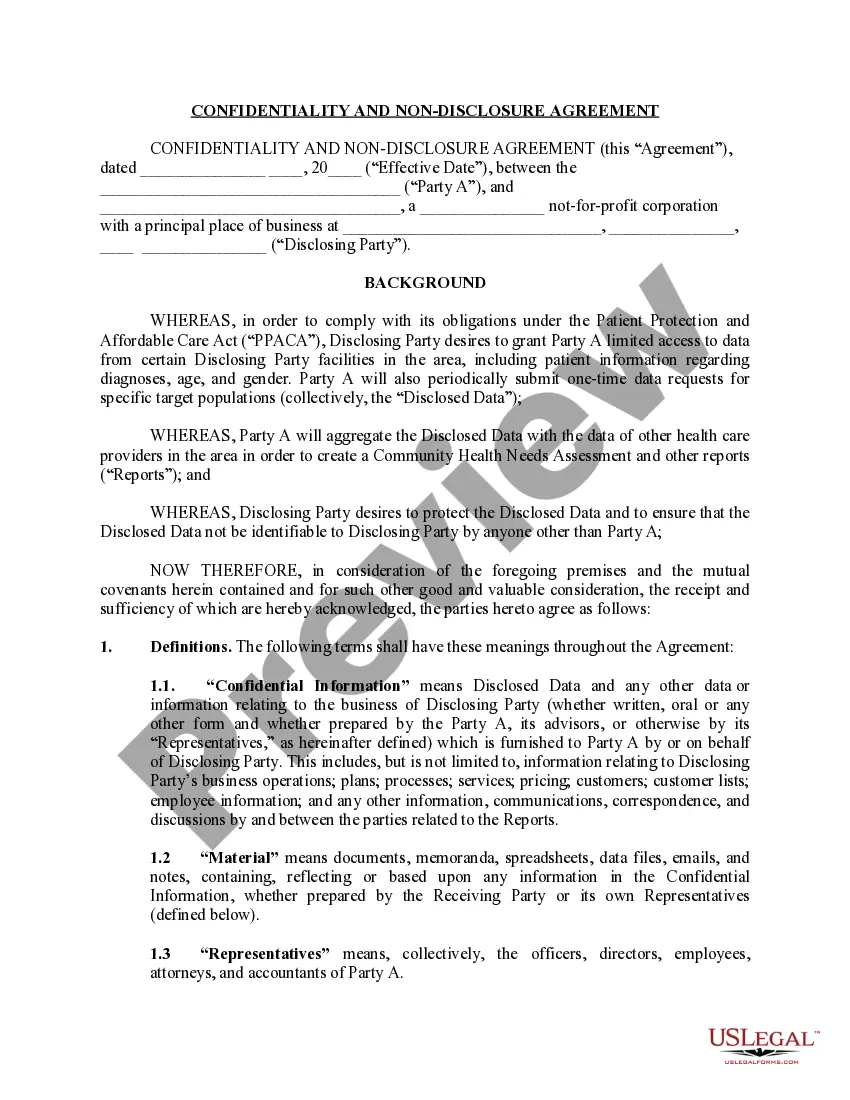

- Step 2. Use the Review option to examine the contents of the form. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other templates from the legal form collection.

Form popularity

FAQ

Filing for a Minnesota Extension of Contract involves completing specific forms and providing necessary information to the state. You can submit these forms online or via mail, ensuring they are filed by the deadline. If you need guidance through this process, USLegalForms provides step-by-step instructions and documentation to help you file correctly and on time. Expert assistance can simplify what might seem like a complex task.

An automatic state extension allows taxpayers additional time to file their Minnesota tax returns without needing to request an extension explicitly. This extension is often granted if you file the necessary forms on time, adhering to the Minnesota Extension of Contract guidelines. Keep in mind that this extension does not delay any payments due, so plan accordingly. USLegalForms offers resources to help you understand and apply for this type of extension easily.

No, a Minnesota Extension of Contract does not guarantee an automatic tax extension. You must file the proper forms by the deadline to receive any extension of time for your taxes. It is important to understand that even with an extension, you might still owe taxes. Consider using USLegalForms to simplify your filing process.

No, Minnesota does not grant an automatic extension for tax filings. You need to file the appropriate extension form actively. To ensure you meet the tax obligations in a timely manner, consider using resources such as USLegalForms to help you with your extension application.

Yes, you can apply for a Minnesota Extension of Contract online through the Minnesota Department of Revenue's website. Submitting your extension electronically is convenient and provides instant confirmation. If you prefer a guided approach, USLegalForms can help you navigate the online application smoothly.

Minnesota does accept the federal extension 1040; however, you must still file a separate Minnesota Extension of Contract. This helps to ensure that your state taxes are managed correctly. Remember to check for any specific requirements when filing your state extension to avoid unnecessary complications.

Minnesota does not offer an automatic extension for tax filings. You must actively submit Form M1EXT to request an extension and meet the specific deadline. Failing to do so means you could incur penalties for late filing. Using a service like USLegalForms can simplify this process by guiding you through the necessary steps.

You can file an extension in Minnesota by submitting Form M1EXT online or via mail. It’s important to ensure that you meet the deadline to avoid late fees. If you're looking for assistance, USLegalForms provides resources and guidance to make your filing experience smooth and efficient.

Yes, Minnesota recognizes the federal extension guidelines, allowing taxpayers to apply for a federal extension that can also cover Minnesota taxes. However, keep in mind that while the federal extension provides extra time for federal taxes, you still need to file a separate Minnesota Extension of Contract for state taxes. This coordination can help streamline your filing process.

To file for a Minnesota Extension of Contract, you must complete Form M1EXT and submit it to the Minnesota Department of Revenue. Ensure you file this form by the original due date of your tax return. If you owe taxes, paying at least 90% during this process can help avoid penalties. USLegalForms offers a straightforward way to access this form and ensure compliance.