Minnesota Notice of Default on Promissory Note Installment

Description

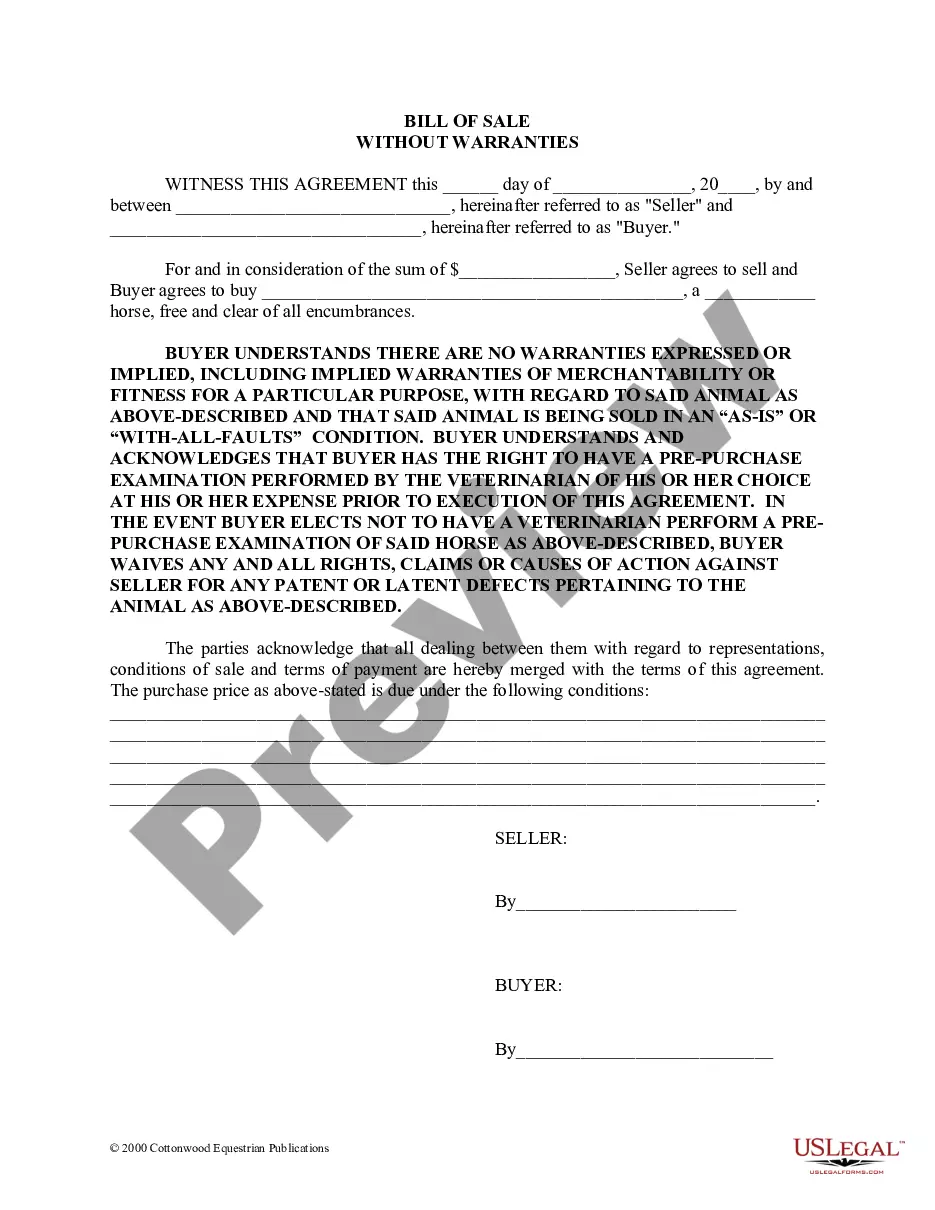

How to fill out Notice Of Default On Promissory Note Installment?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal paper templates that you can download or print.

By using the website, you can find thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can obtain the most recent forms like the Minnesota Notice of Default on Promissory Note Installment in just minutes.

If you already have an account, Log In and download the Minnesota Notice of Default on Promissory Note Installment from the US Legal Forms collection. The Download button will appear on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Make modifications. Fill out, edit, print, and sign the downloaded Minnesota Notice of Default on Promissory Note Installment.

Each template you added to your account does not have an expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Minnesota Notice of Default on Promissory Note Installment with US Legal Forms, the most extensive collection of legal paper templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements and standards.

- If you want to use US Legal Forms for the first time, here are simple instructions to get started.

- Make sure to select the correct form for your state/region. Click the Preview button to view the form's details. Review the form's summary to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you prefer and provide your information to sign up for an account.

- Process the transaction. Use your Visa or MasterCard or PayPal account to complete the purchase.

- Select the format and download the form to your device.

Form popularity

FAQ

Rule 77.04 of the Minnesota Civil Procedure pertains to the handling of judgments and orders. This rule specifies when and how judgments become effective and enforceable, which is important in situations like a Minnesota Notice of Default on Promissory Note Installment. Familiarity with this rule can help plaintiffs and defendants understand their rights and obligations in the legal process.

Rule 55 addresses the default process when a party fails to respond to a legal complaint within the set time frame. If a defendant does not answer a complaint regarding a Minnesota Notice of Default on Promissory Note Installment, the plaintiff can seek a default judgment. This means that the court may automatically rule in favor of the responding party, streamlining the resolution process.

The rule of Civil Procedure personal service in Minnesota requires that legal documents be delivered directly to the individual named in the suit. This rule ensures that defendants are adequately informed about the legal actions against them, which is critical when addressing cases like Minnesota Notice of Default on Promissory Note Installment. Ensuring proper personal service can significantly impact the outcome of a case.

In Minnesota, the rule for summary judgment allows a party to request the court to rule in their favor without a trial when there is no dispute about the important facts. This is particularly relevant in cases involving a Minnesota Notice of Default on Promissory Note Installment, where the evidence can often demonstrate a clear right to judgment. By obtaining a summary judgment, you can resolve issues more swiftly, saving time and resources.

The rules of civil procedure govern how civil lawsuits are conducted in the United States. They provide guidelines for filing a lawsuit, serving documents, and conducting trials, including those involving Minnesota Notice of Default on Promissory Note Installment. Understanding these rules is crucial for anyone involved in civil litigation, as they ensure fair processes and legal consistency.

Rule 4 of the Federal Rules of Civil Procedure outlines how a plaintiff may serve legal documents to a defendant. This process is essential when managing cases related to a Minnesota Notice of Default on Promissory Note Installment. Proper service ensures that defendants have notice of the lawsuit, which allows them to respond appropriately and protects their rights.

In the event of a default on a Minnesota Notice of Default on Promissory Note Installment, you have several remedies available. You could choose to demand full repayment of the outstanding balance or negotiate a repayment plan with the borrower. Alternatively, you may pursue legal action to recover the owed amount. Utilizing tools available through uslegalforms can assist you in navigating the process effectively.

To issue a Minnesota Notice of Default on Promissory Note Installment, you first need to draft the notice as described previously. Next, send it to the borrower through certified mail to ensure they receive the notification. Keeping a record of the mailing is vital, as it may be required later for legal purposes. This process helps establish your intention to enforce the terms of the promissory note.

To write a Minnesota Notice of Default on Promissory Note Installment, start with the date and the names of the parties involved. Clearly state the default condition, outlining the specific breach of the agreement. Include details such as the amount past due and any relevant dates. Ensure to sign and date the document before sending it to the borrower.

When facing a default on a promissory note, evaluate your options carefully. First, issue a Minnesota Notice of Default on Promissory Note Installment to formally address the issue. Next, consider reaching out to the borrower to discuss possible repayment plans or settlements. If these steps do not resolve the matter, consulting with a legal professional may be beneficial to understand your next actions.