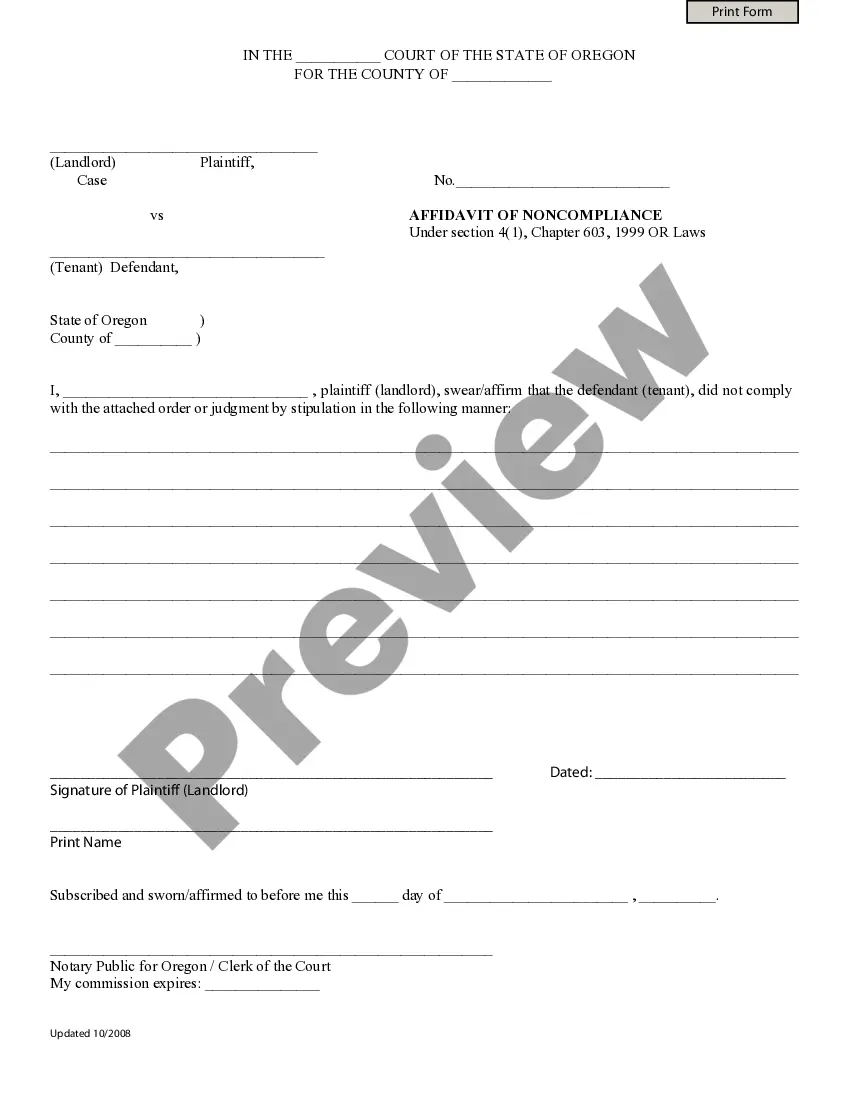

This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Minnesota Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Finding the correct authorized document format can be challenging.

It goes without saying that numerous templates are accessible online, but how do you obtain the legal form you require? Utilize the US Legal Forms website.

The service provides thousands of templates, including the Minnesota Notice of Default in Payment Due on Promissory Note, suitable for business and personal needs. All the documents are reviewed by professionals and comply with state and federal regulations.

If the form does not meet your requirements, use the Search field to find the appropriate document. Once you are confident the form is correct, click the Purchase now button to obtain it. Choose the payment method you prefer and enter the required information. Create your account and complete your order using your PayPal account or credit card. Select the file format and download the legal document to your device. Finally, complete, modify, print, and sign the acquired Minnesota Notice of Default in Payment Due on Promissory Note. US Legal Forms is the largest collection of legal templates where you can find various document formats. Utilize the service to obtain properly crafted paperwork that adheres to state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Minnesota Notice of Default in Payment Due on Promissory Note.

- Use your account to view the legal documents you have obtained previously.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your specific location.

- You can review the document using the Preview button and check the form details to confirm it is suitable for you.

Form popularity

FAQ

A motion for immediate default is a request for the court to grant a judgment without delay when the defendant fails to respond. This motion aims to quickly resolve cases where payment is overdue, such as with a Minnesota Notice of Default in Payment Due on Promissory Note. By filing this motion, creditors can gain quicker access to the remedies intended for them. It serves as a powerful tool to enhance collection efforts.

A motion for default to appear is a legal request made to a court when a party fails to respond or appear in a case. This motion asks the court to enter a default judgment due to the other party's inaction. In the context of a Minnesota Notice of Default in Payment Due on Promissory Note, this motion can simplify the legal process for lenders seeking repayment. It can expedite resolution and ensure that rightful claims are addressed promptly.

The 36 hour rule in Minnesota dictates the time frame for filing certain motions after an event, such as receiving a notice of default. This can significantly impact your ability to respond to a Minnesota Notice of Default in Payment Due on Promissory Note efficiently. Being aware of this rule helps you act swiftly and ensures adherence to legal timelines. Consult resources like US Legal Forms to stay on top of your obligations and rights.

The 55.01 rule in Minnesota requires that a party must serve a notice of default upon failing to fulfill a payment obligation. This rule is particularly relevant when dealing with a Minnesota Notice of Default in Payment Due on Promissory Note as it initiates the legal reminder of payment responsibilities. It is essential to understand this rule to avoid missteps in the collection process. Knowing how and when to issue this notice can protect your rights.

Rule of Civil Procedure 69 in Minnesota deals with the enforcement of judgments. It specifies how a judgment creditor can collect payment on a Minnesota Notice of Default in Payment Due on Promissory Note through garnishment or seizing assets. Understanding this rule ensures that creditors can effectively pursue owed payments while complying with legal standards. Accessing information on this rule can help you navigate the collection process more smoothly.

To vacate a default judgment in Minnesota, you must typically file a motion to reopen the judgment and present a valid reason for missing your court date. The court will consider factors such as the reason for your absence and whether the default judgment resulted from a Minnesota Notice of Default in Payment Due on Promissory Note. Quick action is key, as there are time limits to this process. Utilizing resources like US Legal Forms can aid in properly drafting your motion.

Rule 68 is a strategic tool in Minnesota civil procedures that allows a party to make an offer of judgment. If the opposing party does not accept this offer and fails to achieve a better outcome later, they may face costs. This can be particularly relevant in cases involving Minnesota Notice of Default in Payment Due on Promissory Note. Familiarizing yourself with Rule 68 can help you make informed decisions during settlement discussions.

Rule 65 in Minnesota governs injunctions and restraining orders. It outlines the procedures for obtaining a temporary restraining order when dealing with a Minnesota Notice of Default in Payment Due on Promissory Note. This rule ensures that parties can secure their rights quickly in urgent situations. Understanding Rule 65 is crucial for individuals facing possible financial loss.

Statute 548.101 in Minnesota pertains to the Minnesota Notice of Default in Payment Due on Promissory Note. This statute outlines the procedures and requirements for notifying a borrower when they have defaulted on payment obligations. Understanding this statute can help you navigate potential legal issues related to defaults on promissory notes. For those facing this situation, utilizing resources from US Legal Forms can provide valuable guidance and templates to ensure compliance.

The statute of limitations on debt in Minnesota varies depending on the type of debt, but generally, it is six years for written contracts, including promissory notes. This means creditors have six years to file a lawsuit to collect any unpaid debt. Knowing this timeframe is crucial when dealing with the Minnesota Notice of Default in Payment Due on Promissory Note, as it influences your ability to take legal action. If you're uncertain about your situation, consider leveraging resources like USLegalForms to find clarity.