Minnesota Disputed Accounted Settlement

Description

How to fill out Disputed Accounted Settlement?

Have you been in a situation where you require documents for possibly business or personal uses just about every day time? There are a lot of legal record templates accessible on the Internet, but getting types you can depend on isn`t simple. US Legal Forms delivers 1000s of type templates, such as the Minnesota Disputed Accounted Settlement, that happen to be published in order to meet federal and state needs.

When you are previously informed about US Legal Forms website and also have your account, simply log in. After that, you are able to obtain the Minnesota Disputed Accounted Settlement design.

Unless you come with an accounts and wish to begin to use US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is for your correct area/state.

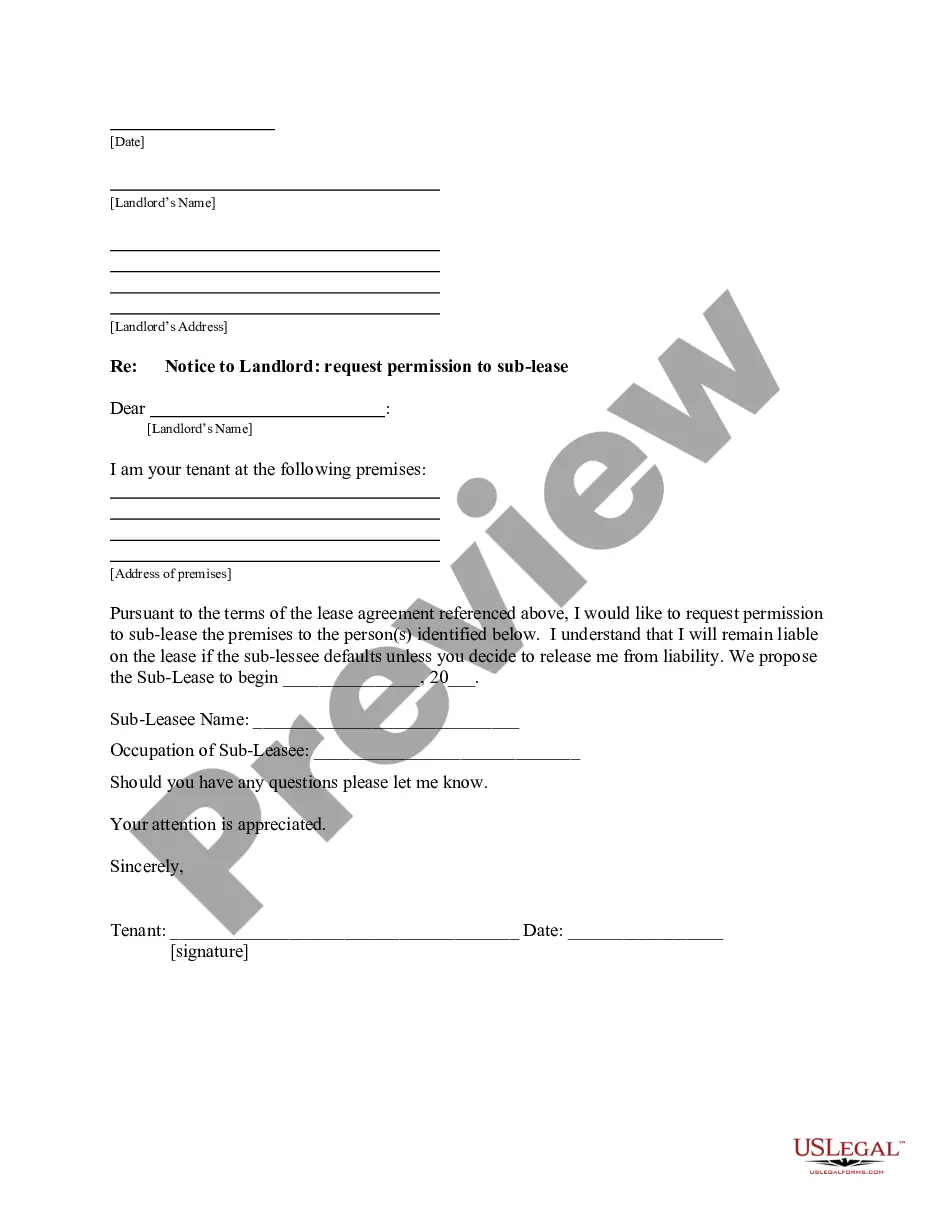

- Take advantage of the Review switch to review the form.

- See the outline to ensure that you have selected the appropriate type.

- When the type isn`t what you`re seeking, use the Look for industry to discover the type that meets your requirements and needs.

- When you find the correct type, click on Buy now.

- Choose the prices program you would like, submit the necessary information and facts to create your account, and buy your order with your PayPal or credit card.

- Pick a practical data file formatting and obtain your copy.

Find all of the record templates you have bought in the My Forms menu. You can get a extra copy of Minnesota Disputed Accounted Settlement anytime, if needed. Just click the required type to obtain or produce the record design.

Use US Legal Forms, probably the most substantial variety of legal kinds, to save lots of time as well as stay away from faults. The services delivers professionally produced legal record templates which you can use for a range of uses. Create your account on US Legal Forms and initiate producing your daily life a little easier.

Form popularity

FAQ

If you've already paid the debt If you're sure that you're talking with a legitimate debt collector, you can send copies of documents that prove you made the payments, including cancelled checks or credit card statements. You may also include copies of any correspondence about settling the debt.

Summary: You can pay off a debt to the original creditor if they haven't sold the account to a debt collection agency yet. There is a chance the debt may have been transferred to collections, but that doesn't mean it's too late to reach out to your creditor and settle the debt once and for all.

Here are a few suggestions that might work in your favor: Write a letter disputing the debt. You have 30 days after receiving a collection notice to dispute a debt in writing. ... Dispute the debt on your credit report. ... Lodge a complaint. ... Respond to a lawsuit. ... Hire an attorney.

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

Until the debt is either paid or forgiven, you still owe the money. This is true even if it's a credit card debt that is sold to a collection agency and even if you think it's unfair.

If a collection is on your report in error, dispute it But that doesn't always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

A parent or custodian who fails to pay without good reason may be proceeded against for contempt, or the court may inform the county attorney, who shall proceed to collect the unpaid sums, or both procedures may be used.

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.