If you want to comprehensive, download, or printing lawful document layouts, use US Legal Forms, the largest variety of lawful varieties, that can be found on the web. Take advantage of the site`s basic and practical search to find the documents you will need. A variety of layouts for business and person uses are categorized by categories and says, or keywords and phrases. Use US Legal Forms to find the Minnesota Objection to Allowed Claim in Accounting within a couple of mouse clicks.

Should you be already a US Legal Forms consumer, log in for your accounts and then click the Down load button to get the Minnesota Objection to Allowed Claim in Accounting. You can even access varieties you formerly acquired inside the My Forms tab of your own accounts.

If you are using US Legal Forms the first time, refer to the instructions listed below:

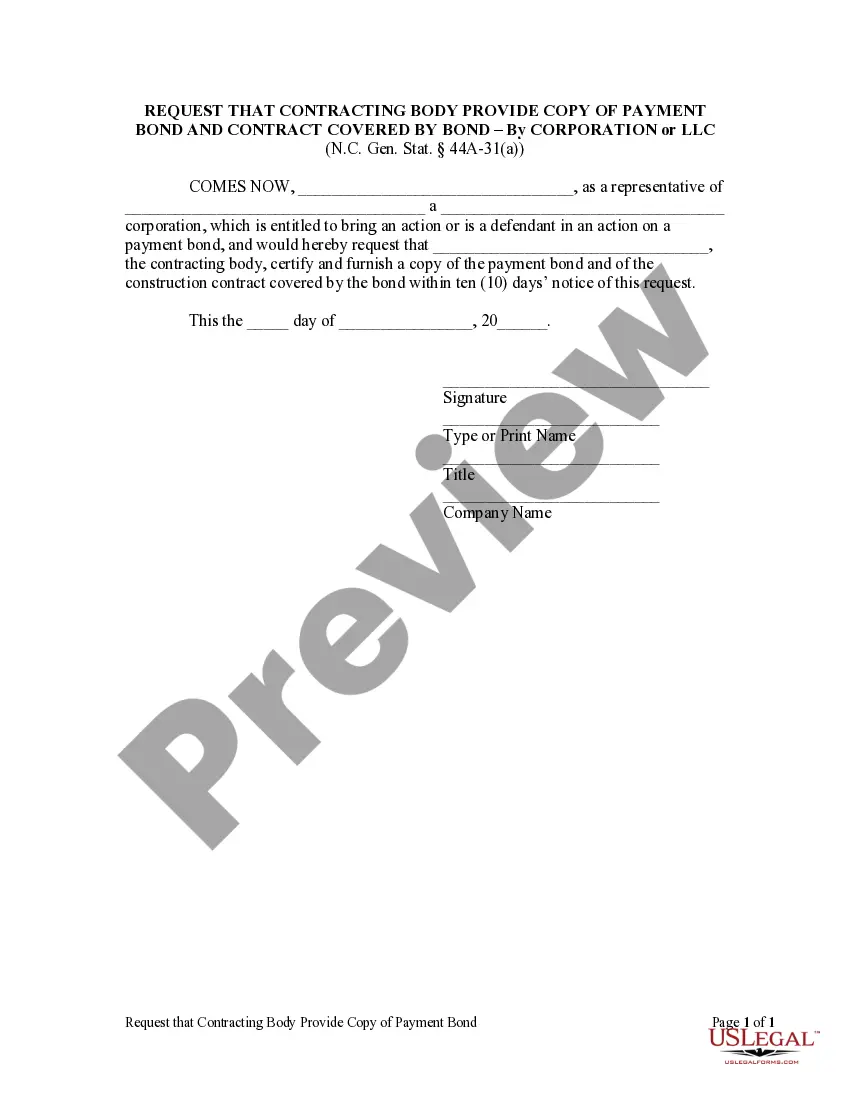

- Step 1. Be sure you have selected the shape for your right area/nation.

- Step 2. Make use of the Preview method to look over the form`s information. Don`t neglect to learn the outline.

- Step 3. Should you be not satisfied using the develop, take advantage of the Search discipline at the top of the screen to locate other models of the lawful develop format.

- Step 4. Upon having found the shape you will need, select the Purchase now button. Opt for the pricing prepare you like and include your qualifications to sign up on an accounts.

- Step 5. Method the deal. You can utilize your charge card or PayPal accounts to finish the deal.

- Step 6. Find the format of the lawful develop and download it on your own system.

- Step 7. Full, modify and printing or sign the Minnesota Objection to Allowed Claim in Accounting.

Each and every lawful document format you acquire is yours forever. You may have acces to each develop you acquired in your acccount. Go through the My Forms portion and choose a develop to printing or download once more.

Contend and download, and printing the Minnesota Objection to Allowed Claim in Accounting with US Legal Forms. There are thousands of specialist and express-particular varieties you can use for the business or person demands.