Minnesota Participation Agreement in Connection with Secured Loan Agreement

Description

Participations in the loan are sold by the lead bank to other banks. A separate contract called a loan participation agreement is structured and agreed among the banks. Loan participations can either be made with equal risk sharing for all loan participants, or on a senior/subordinated basis, where the senior lender is paid first and the subordinate loan participation paid only if there is sufficient funds left over to make the payments.

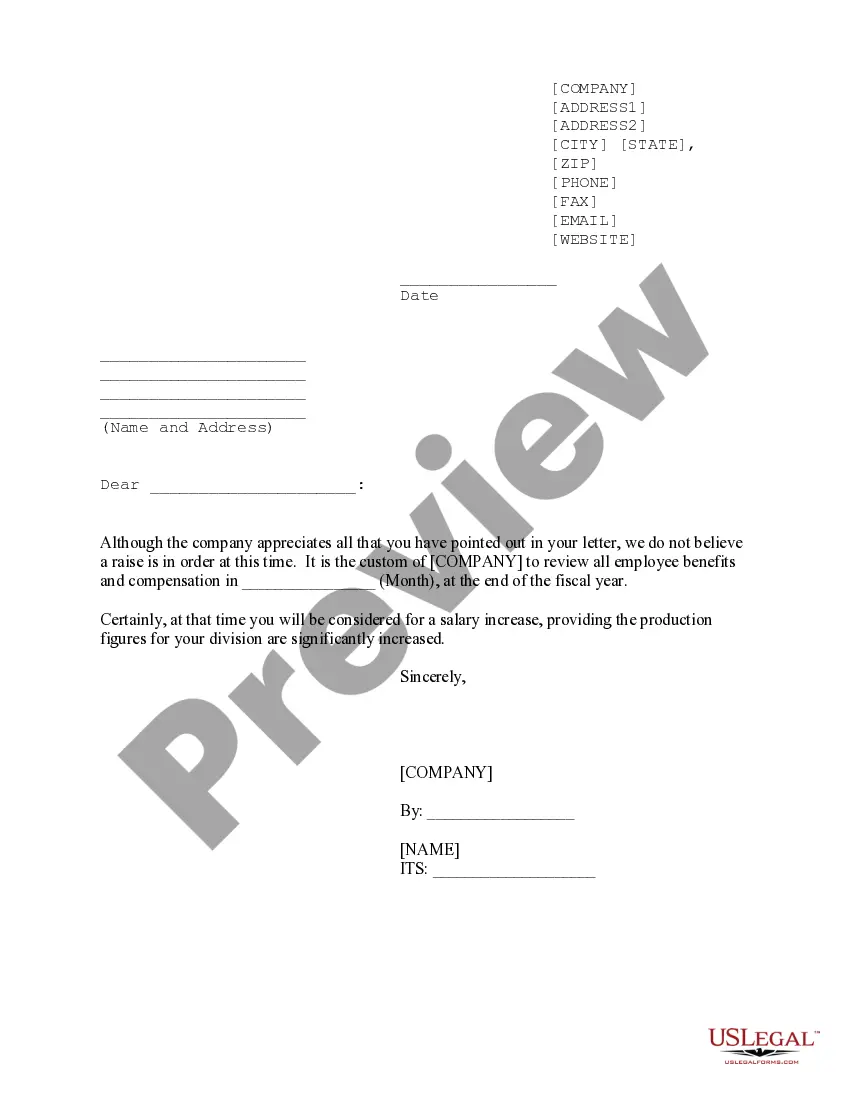

How to fill out Participation Agreement In Connection With Secured Loan Agreement?

If you desire to finalize, download, or create legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the website's straightforward and user-friendly search to find the documents you need.

Various templates for business and individual purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, make use of the Search bar at the top of the screen to find other variations of the legal form template.

Step 4. Once you have identified the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your information to register for an account.

- Use US Legal Forms to obtain the Minnesota Participation Agreement in Relation to Secured Loan Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Minnesota Participation Agreement in Relation to Secured Loan Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to inspect the content of the form. Be sure to read the details.

Form popularity

FAQ

Participation mortgages reduce the risk to participants and allow them to increase their purchasing power. Many of these mortgages, therefore, tend to come with lower interest rates, especially when multiple lenders are also involved.

The distinction is simple, but important. Generally, an assignment is the actual sale of the loan, in whole or in part. The assignee is now the owner of the loan (or the part assigned) and is considered the lender under the loan agreement.

Generally, participation agreements involve one or more participants who purchase an interest in the underlying loan, but a single lender, the lead lender, retains control over the loan and manages the relationship with the borrower.

Participation agreements, in the form promulgated by The Loan Syndications and Trading Association, Inc. (LSTA), are widely regarded as dependable vehicles for conveying loan ownership interests from a lender to a participant as true sales in the United States.

For a personal loan agreement to be enforceable, it must be documented in writing and signed by both parties.

A secured loan is a loan backed by collateralfinancial assets you own, like a home or a carthat can be used as payment to the lender if you don't pay back the loan. The idea behind a secured loan is a basic one. Lenders accept collateral against a secured loan to incentivize borrowers to repay the loan on time.

Disadvantages of Secured LoansThe personal property named as security on the loan is at risk. If you encounter financial difficulties and cannot repay the loan, the lender could seize the property. Typically, the amount borrowed can only be used to purchase a specific asset, like a home or a car.

A Secured Promissory Note is a legal agreement that requires a borrower to provide security for a loan. With this lending document, the borrower puts forth their personal property or real estate as collateral if the loan isn't repaid.

Participations are a long-established means by which both: Lenders can reduce their exposure to a borrower's credit risk by selling interests in their loans. An investor can acquire an interest in a borrower's loan without becoming a lender under the loan agreement.