US Legal Forms - one of many greatest libraries of legitimate varieties in the States - gives an array of legitimate record web templates it is possible to download or print. Utilizing the site, you may get a huge number of varieties for organization and specific uses, categorized by categories, states, or search phrases.You can find the most recent versions of varieties much like the Minnesota Participating or Participation Loan Agreement in Connection with Secured Loan Agreement in seconds.

If you currently have a registration, log in and download Minnesota Participating or Participation Loan Agreement in Connection with Secured Loan Agreement from the US Legal Forms catalogue. The Obtain option will appear on every form you look at. You get access to all previously acquired varieties from the My Forms tab of your respective account.

If you wish to use US Legal Forms for the first time, allow me to share basic recommendations to help you get started out:

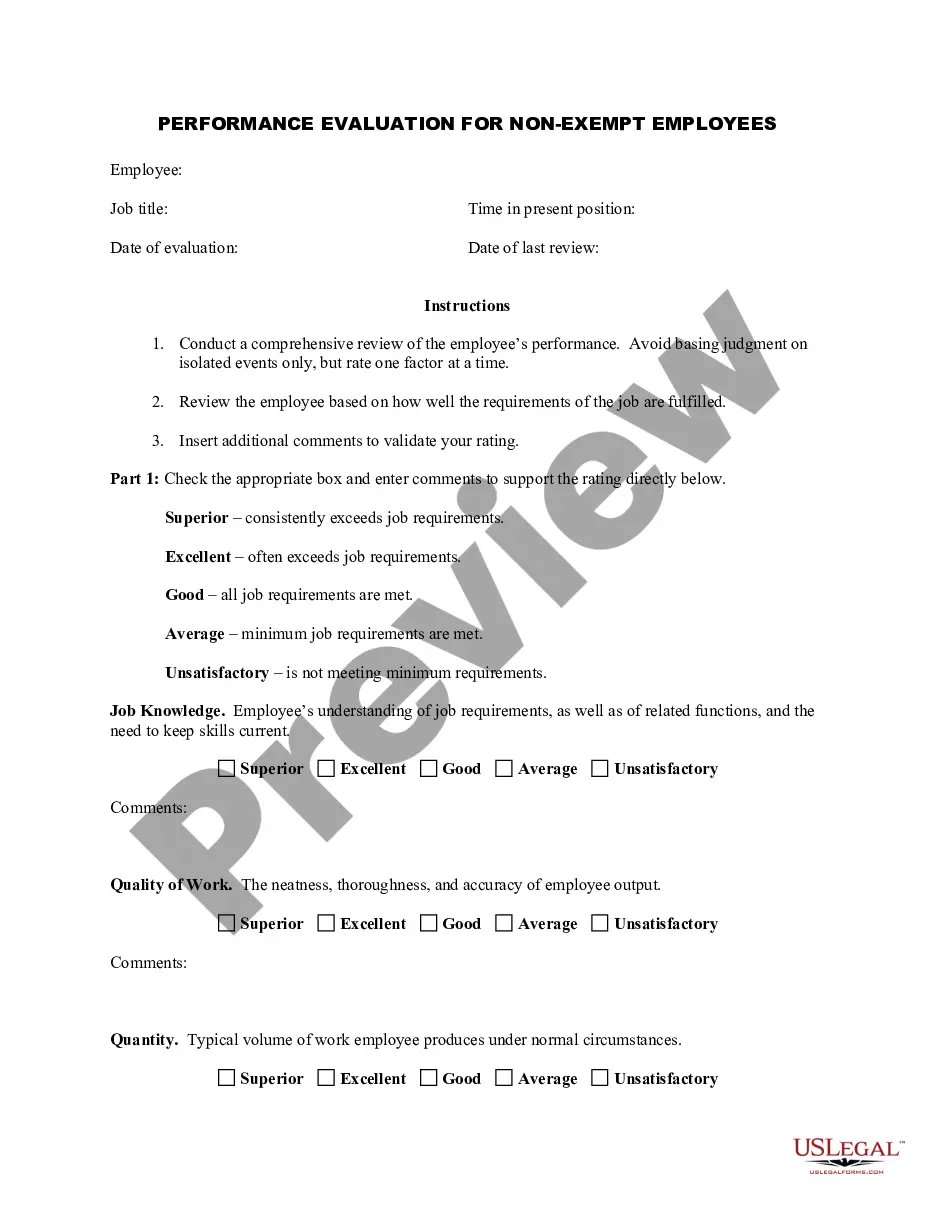

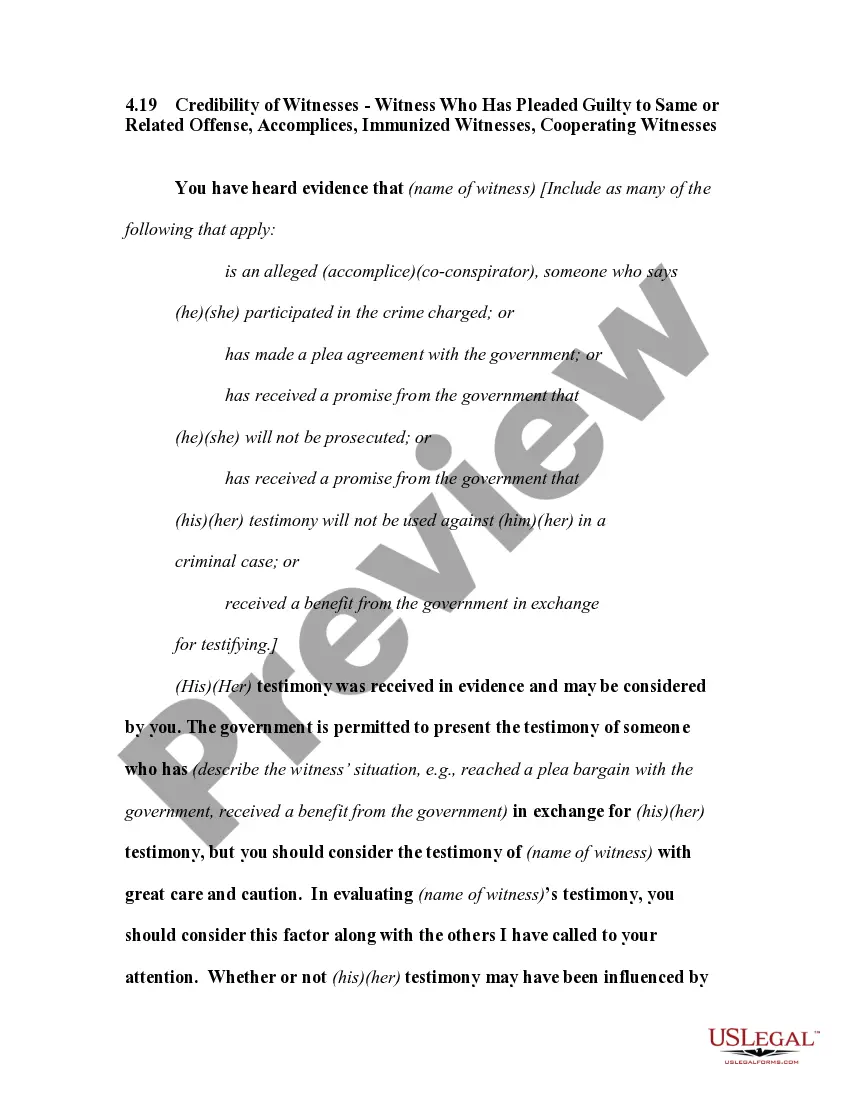

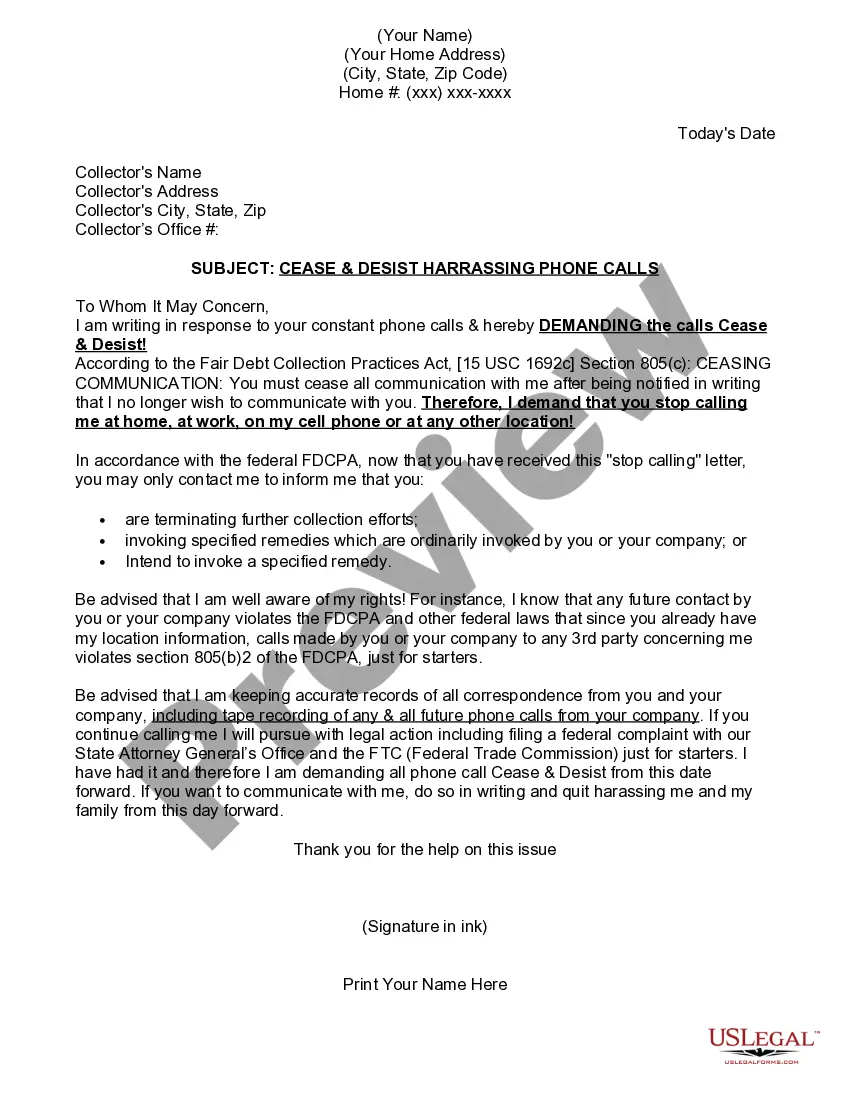

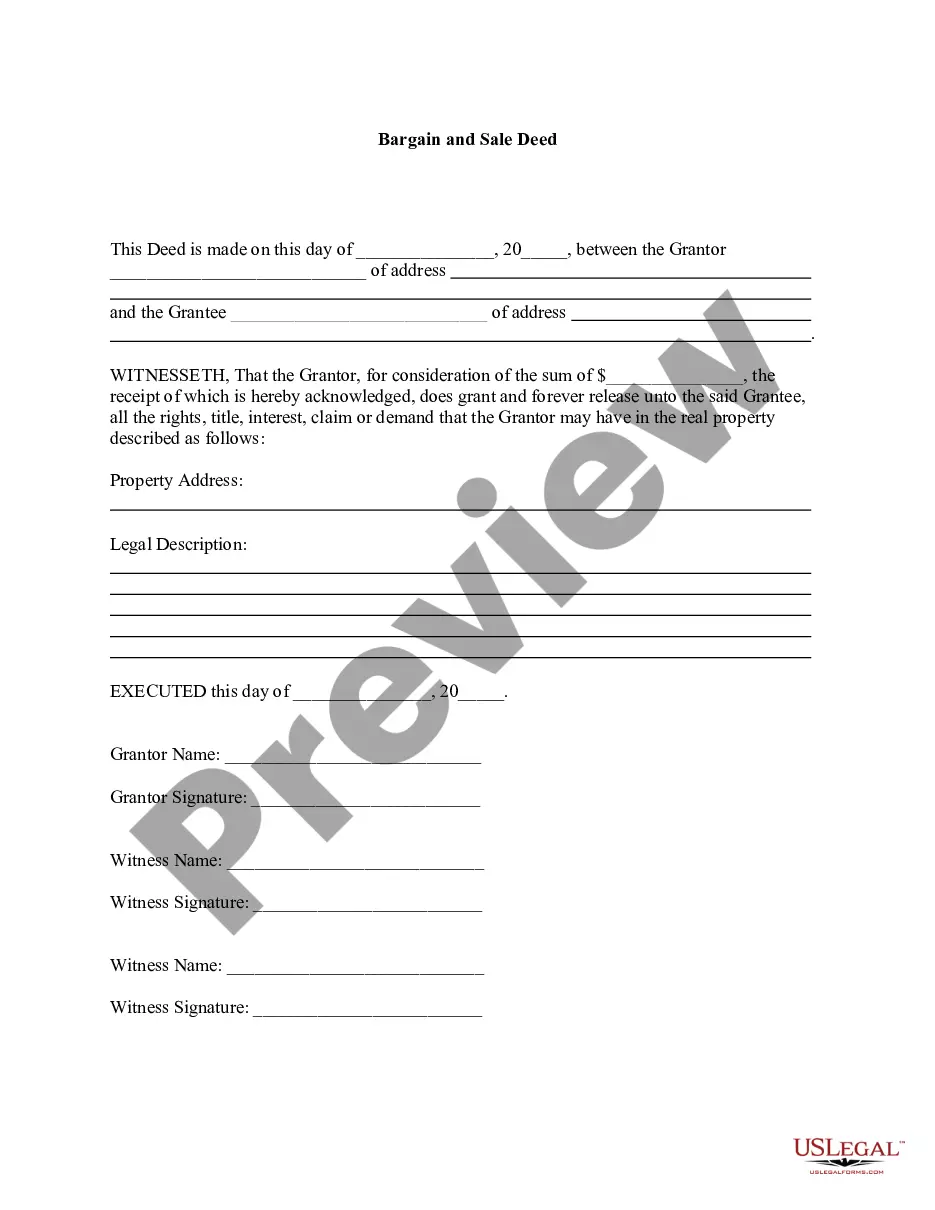

- Ensure you have selected the best form to your metropolis/region. Select the Review option to examine the form`s content material. Browse the form information to ensure that you have chosen the proper form.

- In case the form does not fit your specifications, use the Search discipline near the top of the monitor to discover the one who does.

- If you are happy with the form, confirm your selection by clicking the Purchase now option. Then, pick the pricing plan you like and offer your qualifications to sign up for the account.

- Procedure the financial transaction. Make use of bank card or PayPal account to accomplish the financial transaction.

- Find the structure and download the form on your own gadget.

- Make changes. Load, modify and print and indicator the acquired Minnesota Participating or Participation Loan Agreement in Connection with Secured Loan Agreement.

Every web template you included with your money does not have an expiration date and it is the one you have for a long time. So, if you wish to download or print another backup, just check out the My Forms portion and click in the form you will need.

Get access to the Minnesota Participating or Participation Loan Agreement in Connection with Secured Loan Agreement with US Legal Forms, one of the most substantial catalogue of legitimate record web templates. Use a huge number of skilled and condition-particular web templates that meet your small business or specific requirements and specifications.