Minnesota Proof of Residency for Mortgage

Description

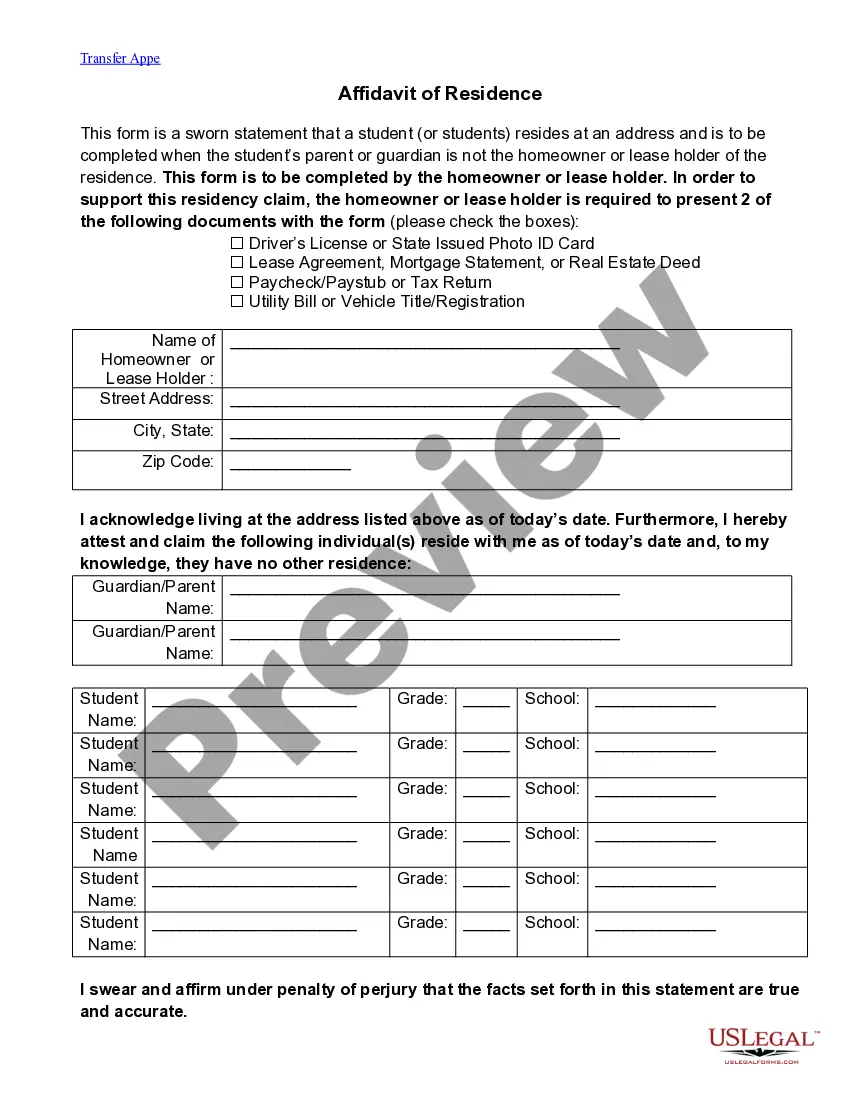

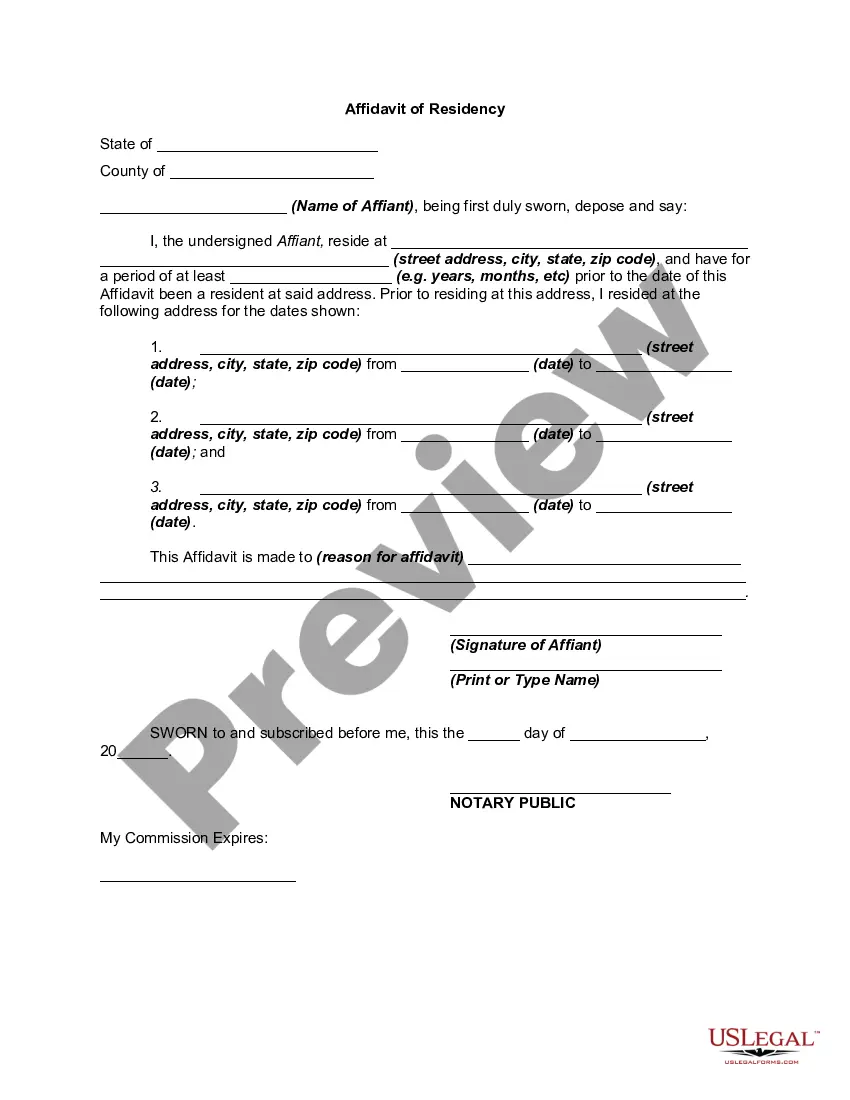

How to fill out Proof Of Residency For Mortgage?

Are you in the placement that you will need paperwork for sometimes organization or individual purposes virtually every time? There are plenty of legal file themes available online, but getting ones you can rely on isn`t straightforward. US Legal Forms delivers a large number of kind themes, much like the Minnesota Proof of Residency for Mortgage, that happen to be written to meet federal and state needs.

Should you be presently familiar with US Legal Forms website and have an account, merely log in. Afterward, you can acquire the Minnesota Proof of Residency for Mortgage format.

Unless you provide an account and wish to begin using US Legal Forms, follow these steps:

- Discover the kind you need and make sure it is to the correct metropolis/state.

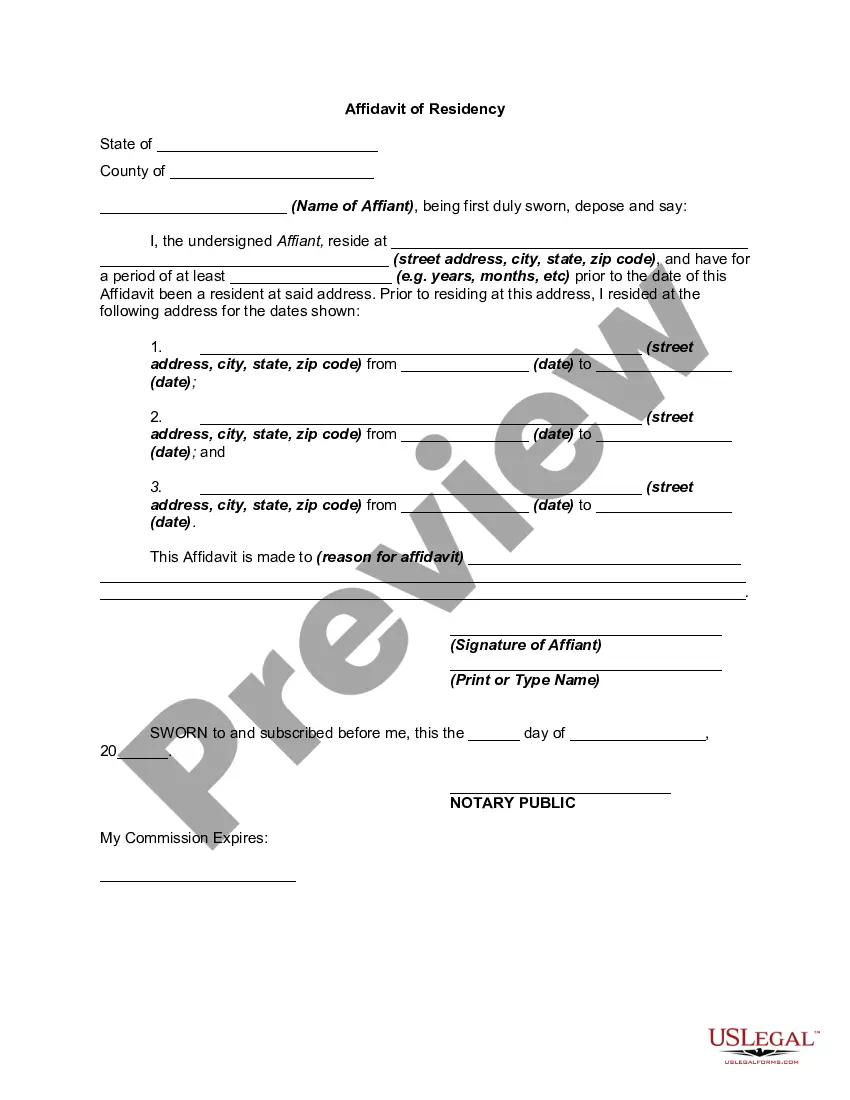

- Take advantage of the Review switch to analyze the form.

- Look at the description to ensure that you have chosen the appropriate kind.

- In the event the kind isn`t what you are trying to find, take advantage of the Look for field to find the kind that meets your needs and needs.

- When you discover the correct kind, simply click Get now.

- Pick the pricing program you want, fill out the specified details to create your money, and pay for an order utilizing your PayPal or credit card.

- Select a handy document formatting and acquire your copy.

Get all the file themes you might have purchased in the My Forms food selection. You can aquire a additional copy of Minnesota Proof of Residency for Mortgage anytime, if needed. Just go through the necessary kind to acquire or printing the file format.

Use US Legal Forms, probably the most comprehensive selection of legal kinds, to conserve some time and stay away from blunders. The assistance delivers skillfully produced legal file themes which can be used for a variety of purposes. Produce an account on US Legal Forms and commence creating your way of life easier.

Form popularity

FAQ

You are considered a Minnesota resident for tax purposes if both apply: You spend at least 183 days in Minnesota during the year. Any part of a day counts as a full day. You or your spouse rent, own, maintain, or occupy an abode.

You're not REAL ID ready! Important: if you want to board domestic flights or visit federal facilities beginning you must have a REAL ID or another acceptable form of identification.

An enhanced driver's license or identification card is REAL ID compliant and offers the additional benefit of travel by land or sea to Mexico, Canada and some Caribbean countries.

Minnesota residency is generally defined by domicile (permanent residency) or the 183-day rule. In determining residency, we will consider both your words and actions, with actions carrying more weight than words.

Do I Need a Passport to Go to Canada If I Have an Enhanced ID? If you plan to fly into Canada, you will need a passport. If you plan to cross into Canada via a land border, however, a qualifying enhanced license can work as long as you do not have a DUI arrest in your past.

An EDL will allow you to make quick trips across the border to Canada or Mexico by car or by boat. However, you should be aware that an EDL cannot be used for travel to countries other than Canada, Mexico, or the Caribbean nations included in the Western Hemisphere Travel Initiative.

Valid, unexpired Minnesota ID card. (Current address must be listed). Home utility services bill issued no more than 3 months from date of renewal.

The REAL ID is what is required at minimum to fly domestically. The Enhanced meets the REAL ID requirements, with the addition of land or sea border crossing.