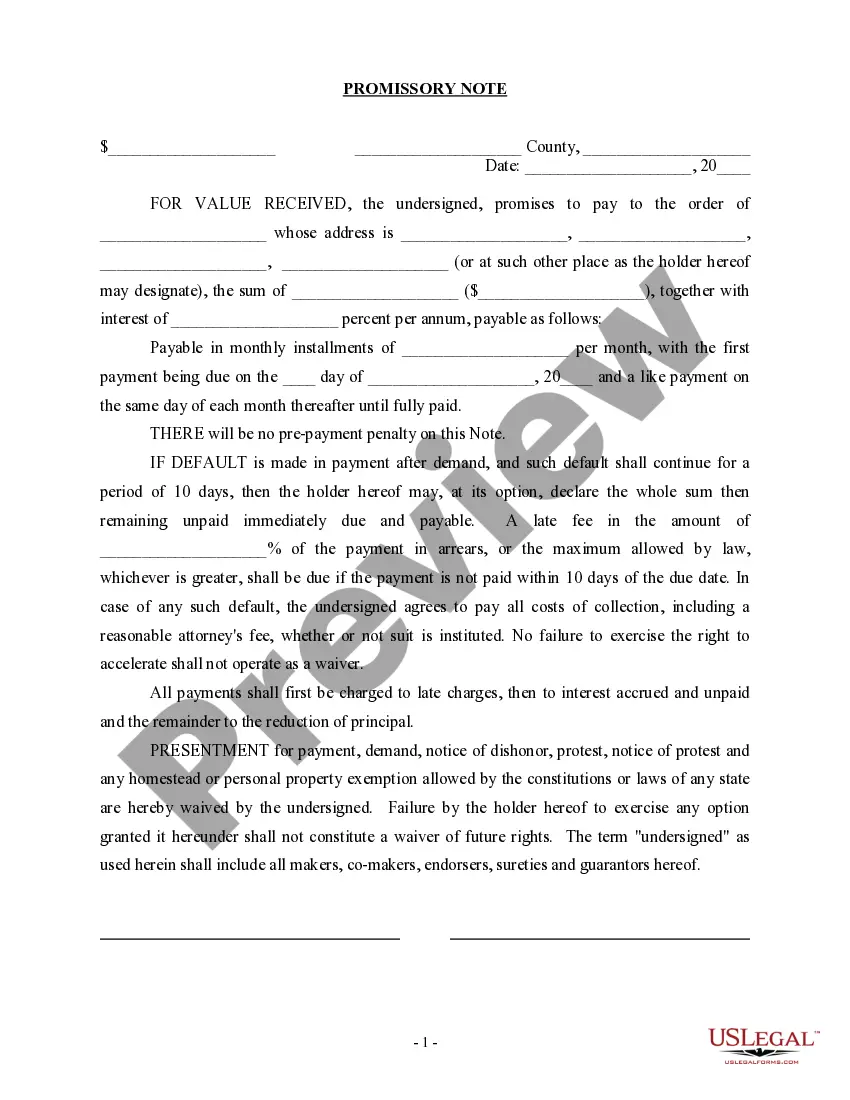

A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person A promissory note should have several essential elements, including the amount of the loan, the date by which it is to be paid back, the interest rate, and a record of any collateral that is being used to secure the loan. Default terms (what happens if a payment is missed or the loan is not paid off by its due date) should also be spelled out in the promissory note.

Minnesota Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments in Connection with a Purchase of a Business

Description

How to fill out Promissory Note Secured By Real Property With A Fixed Interest Rate And Installment Payments In Connection With A Purchase Of A Business?

Selecting the ideal legal document web template can be quite a challenge.

It goes without saying, there is a plethora of templates accessible online, but how will you obtain the legal form you require.

Utilize the US Legal Forms website. The service offers an extensive collection of templates, for instance, the Minnesota Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase, which you can utilize for both business and personal needs.

You can examine the form using the Review button and read the form description to confirm it's suitable for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- Once you're registered, Log In to your account and click the Obtain button to download the Minnesota Promissory Note secured by Real Property with a Fixed Interest Rate and Installment Payments related to a Business Purchase.

- Use your account to review the legal forms you have purchased previously.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have chosen the correct form for your locality/region.

Form popularity

FAQ

Writing a simple promissory note involves a few straightforward steps. Start with the names and addresses of both parties, followed by the promised amount along with the agreed-upon interest rate and payment terms. Keep it clear and concise, mention any collateral if applicable, like real property, and conclude with signatures from both parties. Using the uslegalforms platform can help you create a legally sound note tailored to your specific needs.

The document that secures the Minnesota Promissory Note to real property is known as a mortgage or a deed of trust. This legal instrument provides a security interest in the property, ensuring that the lender has a claim against the property in case of default. This security arrangement helps protect both the borrower and the lender, particularly when installment payments are involved.

Most people finance their purchase of real estate through a mortgage. The two main parties involved in this financial agreement are a mortgagor and a mortgagee. A mortgagor is someone who borrows money to pay for their home. The mortgagor is often referred to as the borrower or client.

Homeowners frequently use mortgage escrow accounts to make property tax and mortgage insurance payments, and sometimes homeowners insurance premiums, in monthly installments. Federal regulations do not require custodians to pay interest on escrow accounts.

Secured loans are loans that are protected by collateral. This means that when you apply for a secured loan, the lender will want to know which of your assets you plan to use to back the loan. The lender will then place a lien on that asset until the loan is repaid in full.

Q. What are Real Estate Secured loans? A. Often referred to as private money, hard money, or bridge financing, these short-term loans offer greater flexibility than traditional bank financing.

As used in this section, "loan secured by real estate" means an obligation executed or assumed by the borrower that is secured by mortgage, deed of trust, or similar instrument, encumbering real estate that is owned by the borrower and upon which the bank relies as the principal security for the loan.

A mortgagee is an entity that lends money to a borrower (also known as a mortgagor) for the purpose of purchasing real estate. In order to limit its risk, a mortgagee creates a priority legal interest in the value of the mortgaged property, allowing it to seize it if the mortgagor defaults on the loan.

The title of the property is held as security for the loan and held by the trustee for the benefit of the lender. The title is released from the trust once the loan is paid. Contrastingly, a Security Deed or mortgage only involves two parties, the borrower and the lender.

In lending agreements, collateral is a borrower's pledge of specific property to a lender, to secure repayment of a loan.