Minnesota Sample Letter for Expense Account Statement

Description

How to fill out Sample Letter For Expense Account Statement?

Finding the appropriate legal document template can be challenging. Of course, there are numerous templates accessible online, but how do you find the legal form you require.

Use the US Legal Forms website. This platform provides a vast selection of templates, including the Minnesota Sample Letter for Expense Account Statement, which can be utilized for both business and personal purposes. All of the forms are reviewed by experts to ensure compliance with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Minnesota Sample Letter for Expense Account Statement. Use your account to search through the legal forms you have previously purchased. Visit the My documents section of your account to download another copy of the document you require.

US Legal Forms is the largest collection of legal templates where you can find various document models. Utilize the service to download professionally crafted documents that comply with state requirements.

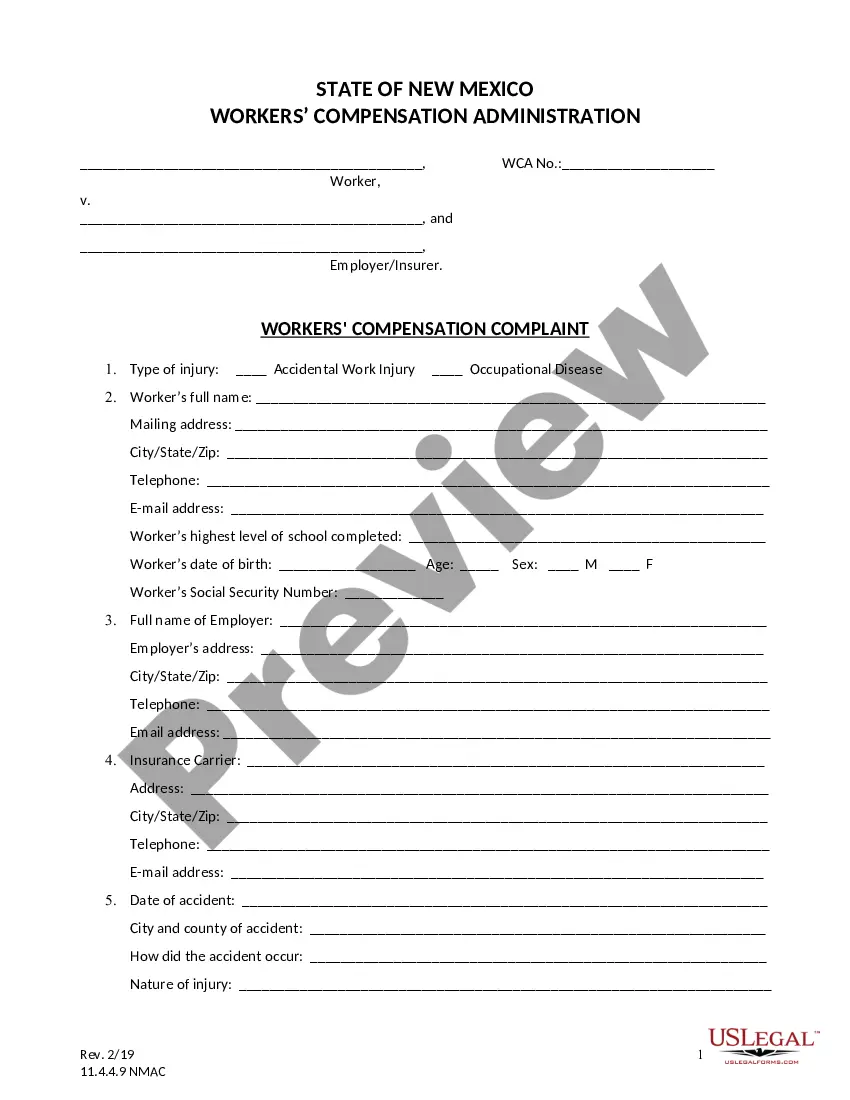

- First, ensure you have selected the correct form for your location/region. You can browse the document using the Preview button and review the form description to confirm it is suitable for your needs.

- If the form does not meet your requirements, use the Search field to find the right document.

- Once you are certain that the form is appropriate, click the Buy now button to acquire the document.

- Select the pricing plan you wish and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

- Fill out, modify, print, and sign the received Minnesota Sample Letter for Expense Account Statement.

Form popularity

FAQ

Receiving a letter from the Department of the Treasury may indicate a variety of issues, such as reminders about tax payments or notifications of potential audits. These letters are official communications and often require prompt attention. If you have questions or need to respond, a Minnesota Sample Letter for Expense Account Statement can serve as a template to guide you in addressing their concerns.

Minnesota allows certain unreimbursed employee expenses to be claimed as deductions on your tax return. Common examples include travel costs, supplies, and educational expenses directly related to your job. It's critical to keep detailed records and understand what is eligible. When documenting your expenses, a Minnesota Sample Letter for Expense Account Statement can be quite helpful.

The Minnesota Department of Revenue is responsible for collecting taxes, distributing aid, and ensuring compliance with tax laws. They manage various programs aimed at supporting residents, including tax return assistance and property tax refunds. Their work is essential for the state's funding and services. If you have specific inquiries, utilizing a Minnesota Sample Letter for Expense Account Statement might streamline your communication.

In Minnesota, tax write-offs can include various expenses such as mortgage interest, property taxes, and certain business expenses. Medical expenses and charitable contributions may also qualify. Review the state guidelines to ensure eligibility for deductions. If you’re compiling a Minnesota Sample Letter for Expense Account Statement, include all supportive documents for clarity.

The MN Department of Revenue may send you a letter to communicate important information regarding your tax obligations or rights. You might receive updates about tax law changes, payment plans, or reminders about deadlines. Understanding the contents of these letters is crucial for your financial management. Having a Minnesota Sample Letter for Expense Account Statement can assist in addressing any inquiries you might need to make.

The Department of Revenue sends letters for several reasons, including clarifying tax-related matters or notifying you about account adjustments. It could be related to an audit, a refund, or a payment due. Always read these letters carefully, as they provide essential details about your tax situation. If you are unsure, a Minnesota Sample Letter for Expense Account Statement can guide you in responding effectively.

In Minnesota, dance lessons can be considered a deductible expense if they relate directly to your profession or business. For example, if you are a dance instructor, these expenses may qualify. Always maintain thorough documentation to support your deductions, including receipts and a Minnesota Sample Letter for Expense Account Statement if needed. Checking with a tax professional can help ensure proper compliance.

Receiving a letter from the Minnesota Department of Revenue can happen for various reasons. It often relates to inquiries about your tax return, requests for additional information, or notices regarding amounts owed. Taking a moment to review the letter can clarify the next steps you need to take. If you need assistance with understanding these letters, consider using a Minnesota Sample Letter for Expense Account Statement.

To order tax forms in Minnesota, you can visit the Minnesota Department of Revenue website where you can find a variety of tax forms available for download. You can also request physical copies by calling their office or through mail. If you need specific forms, like the Minnesota Sample Letter for Expense Account Statement, using a reliable platform like USLegalForms can simplify the process and ensure you have the correct documents. By having access to a comprehensive library of forms, you can quickly fulfill your tax form requirements with ease.