Minnesota Cash Flow Statement

Description

How to fill out Cash Flow Statement?

Are you in a situation where you frequently need documents for potential business or personal use.

There are numerous legal document templates accessible online, but finding reliable ones is not easy.

US Legal Forms offers thousands of form templates, such as the Minnesota Cash Flow Statement, designed to meet state and federal requirements.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete your purchase using PayPal or credit card.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Minnesota Cash Flow Statement template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

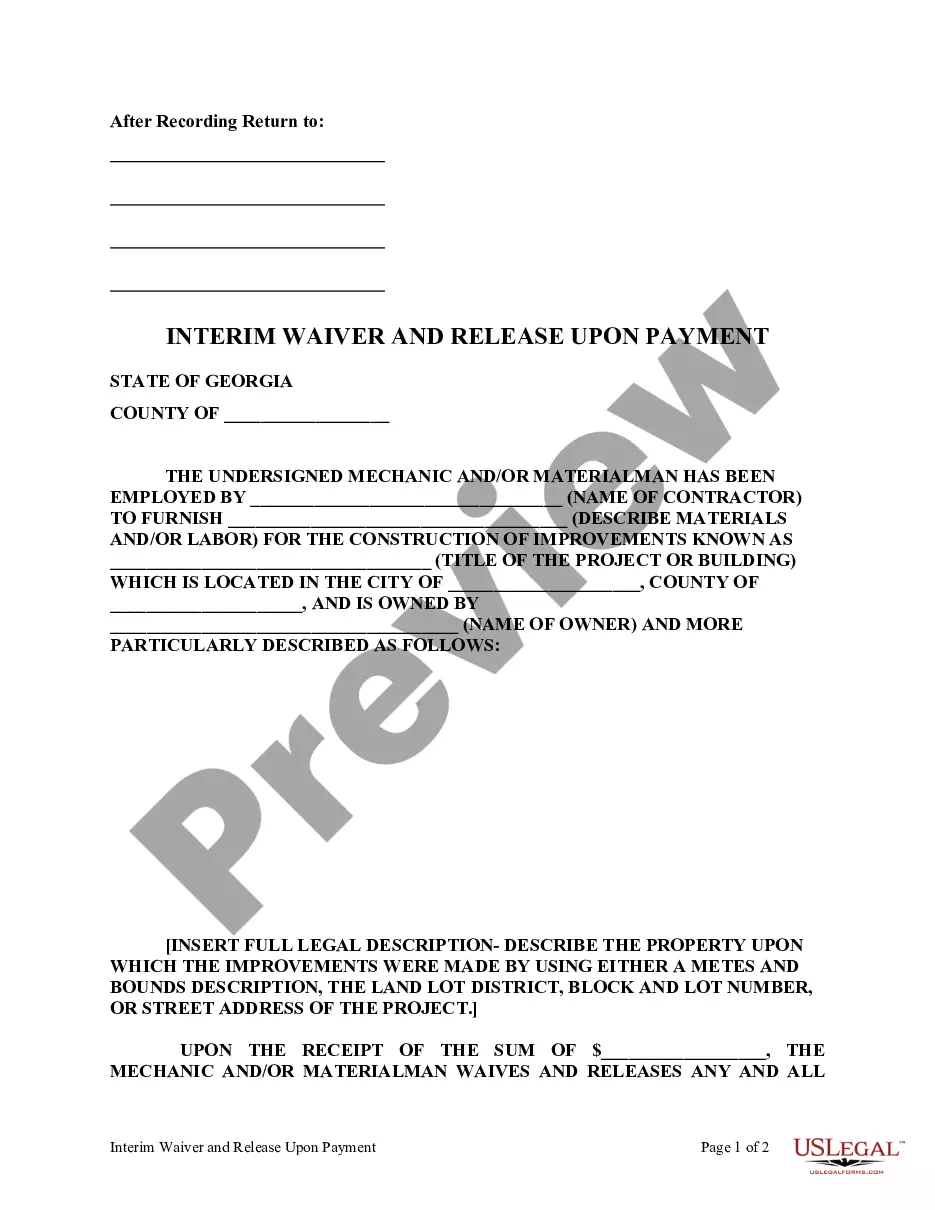

- Use the Preview button to review the form.

- Read the details to confirm you have selected the correct form.

- If the form does not meet your needs, use the Search field to find a form that suits your requirements.

- When you locate the right form, click Get now.

Form popularity

FAQ

You'll also notice that the statement of cash flows is broken down into three sectionsCash Flow from Operating Activities, Cash Flow from Investing Activities, and Cash Flow from Financing Activities.

A typical cash flow statement comprises three sections: cash flow from operating activities, cash flow from investing activities, and cash flow from financing activities.

The cash flow statement differs from the balance sheet and income statement in that it excludes non-cash transactions required by accrual basis accounting, such as depreciation, deferred income taxes, write-offs on bad debts and sales on credit where receivables have not yet been collected.

Format Of The Statement Of Cash FlowsCash involving operating activities. Cash involving investing activities. Cash involving financing activities. Supplemental information.

The main components of the cash flow statement are:Cash flow from operating activities.Cash flow from investing activities.Cash flow from financing activities.Disclosure of non-cash activities, which is sometimes included when prepared under generally accepted accounting principles (GAAP).

Preparation of Cash Flows statements for all companies (except one person Company, Small Co and Dormant Co.) are mandatory as per Companies Act 2013.

The cash flow statement records the company's cash transactions (the inflows and outflows) during the given period. It shows whether all of the revenues booked on the income statement have been collected.

The cash flow statement differs from the balance sheet and income statement in that it excludes non-cash transactions required by accrual basis accounting, such as depreciation, deferred income taxes, write-offs on bad debts and sales on credit where receivables have not yet been collected.

A cash flow statement is a financial statement that provides aggregate data regarding all cash inflows a company receives from its ongoing operations and external investment sources. It also includes all cash outflows that pay for business activities and investments during a given period.