Minnesota Revocable Trust for Lottery Winnings

Description

How to fill out Revocable Trust For Lottery Winnings?

It is feasible to utilize hours on the web looking for the appropriate legal document template that conforms to the federal and state requirements you require.

US Legal Forms offers numerous legal templates that are reviewed by experts.

You can easily access or print the Minnesota Revocable Trust for Lottery Winnings from my services.

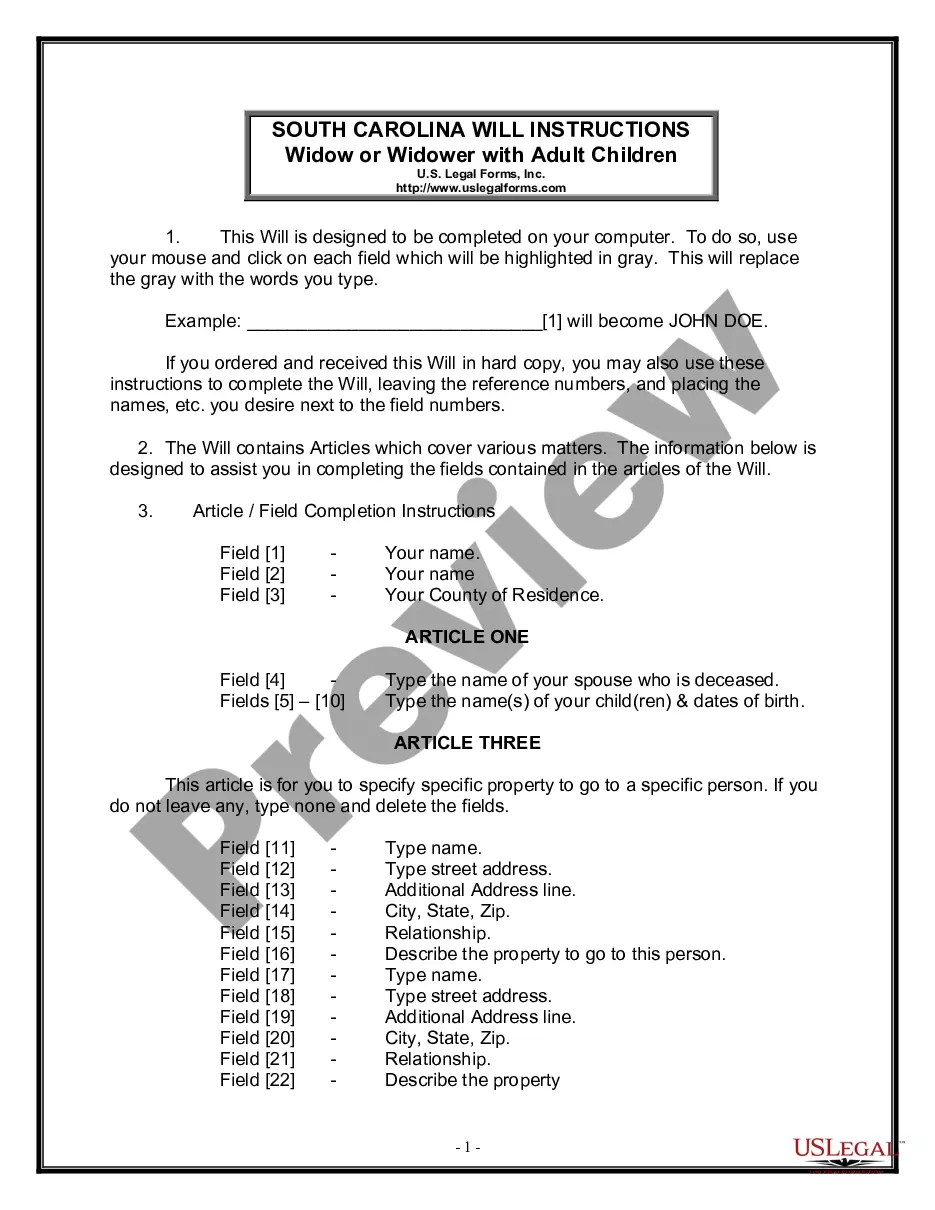

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Minnesota Revocable Trust for Lottery Winnings.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/town of choice.

- Check the form details to confirm you have selected the suitable template.

Form popularity

FAQ

Several states allow lottery winners to remain anonymous, but Minnesota does not offer complete anonymity. However, utilizing a Minnesota Revocable Trust for Lottery Winnings can provide a level of privacy while complying with state laws. States like Delaware and Kansas offer more comprehensive privacy protections for winners. If anonymity is essential to you, research your options carefully and consider seeking legal guidance.

In Minnesota, unclaimed lottery winnings are typically returned to the state after a certain period. These funds are often redirected to support state programs, including education and public services. To prevent losing your winnings, consider establishing a Minnesota Revocable Trust for Lottery Winnings, which can streamline your claim and safeguard your assets. Remember, timely action is essential in securing your lottery prize.

To claim your lottery winnings discreetly, you can consider creating a Minnesota Revocable Trust for Lottery Winnings. By placing your winnings into such a trust, you can maintain your privacy while still adhering to state regulations. This approach allows you to manage your assets without revealing your identity to the public. Always consult with a legal expert to ensure the process aligns with Minnesota's lottery laws.

If you win the lottery, the first step is to remain calm and consider your options carefully. Create a plan that includes consulting a financial advisor and a legal expert. Utilizing a Minnesota Revocable Trust for Lottery Winnings can be an effective way to manage your newfound wealth and ensure your long-term goals are met. Taking these steps can help you make informed decisions and protect your interests.

To claim lottery winnings using a trust, you should first establish a Minnesota Revocable Trust for Lottery Winnings. After you win, you can assign the winnings to this trust, allowing it to claim the prize on your behalf. This not only provides a layer of privacy but also facilitates effective management of your funds. Consulting with a legal expert can help ensure all procedures are followed correctly.

In Minnesota, claiming lottery winnings anonymously is generally not allowed. When you win a significant prize, your identity becomes public to comply with state laws. However, you can protect your privacy by using a Minnesota Revocable Trust for Lottery Winnings. This approach helps maintain some confidentiality while ensuring your winnings are managed appropriately.

Yes, Minnesota does tax lottery winnings. In fact, the state applies a flat income tax rate to lottery prizes, so it's essential to plan accordingly. Establishing a Minnesota Revocable Trust for Lottery Winnings can help you manage these taxes more effectively, allowing you to protect your assets while fulfilling your tax obligations. Seeking advice from tax professionals can provide clarity on the tax implications of your lottery win.

To avoid gift tax on your lottery winnings, utilizing a Minnesota Revocable Trust for Lottery Winnings can be beneficial. This trust allows you to transfer funds to family or friends without triggering gift tax, provided you follow the proper legal guidelines. Additionally, reviewing your distributions and other financial strategies with a tax professional can help ensure compliance and minimize tax liabilities. By planning wisely, you keep more of your winnings.

If you win the lottery, one of the best options is establishing a Minnesota Revocable Trust for Lottery Winnings. This type of trust allows you to manage your winnings effectively while maintaining control over how your assets are distributed. By setting up this trust, you can also provide for your loved ones and ensure your financial future is secure. Consulting with a legal expert can help you navigate the intricacies of the process.

The best place to deposit your lottery winnings is at a reputable bank that offers trust services. Choosing a bank that understands the intricacies of a Minnesota Revocable Trust for Lottery Winnings can provide assurance that your funds are managed appropriately. A bank with strong customer service will help you navigate the process and keep your assets secure.