Minnesota Revocable Trust for Asset Protection

Description

How to fill out Revocable Trust For Asset Protection?

If you aim to finish, obtain, or print authentic document templates, utilize US Legal Forms, the largest assortment of authentic forms, which can be accessed online.

Make use of the site’s straightforward and user-friendly search to locate the documents you require.

A range of templates for both business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Purchase now button. Choose your preferred payment plan and enter your details to register for an account.

Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Utilize US Legal Forms to find the Minnesota Revocable Trust for Asset Protection in just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Download button to retrieve the Minnesota Revocable Trust for Asset Protection.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the form for your correct town/region.

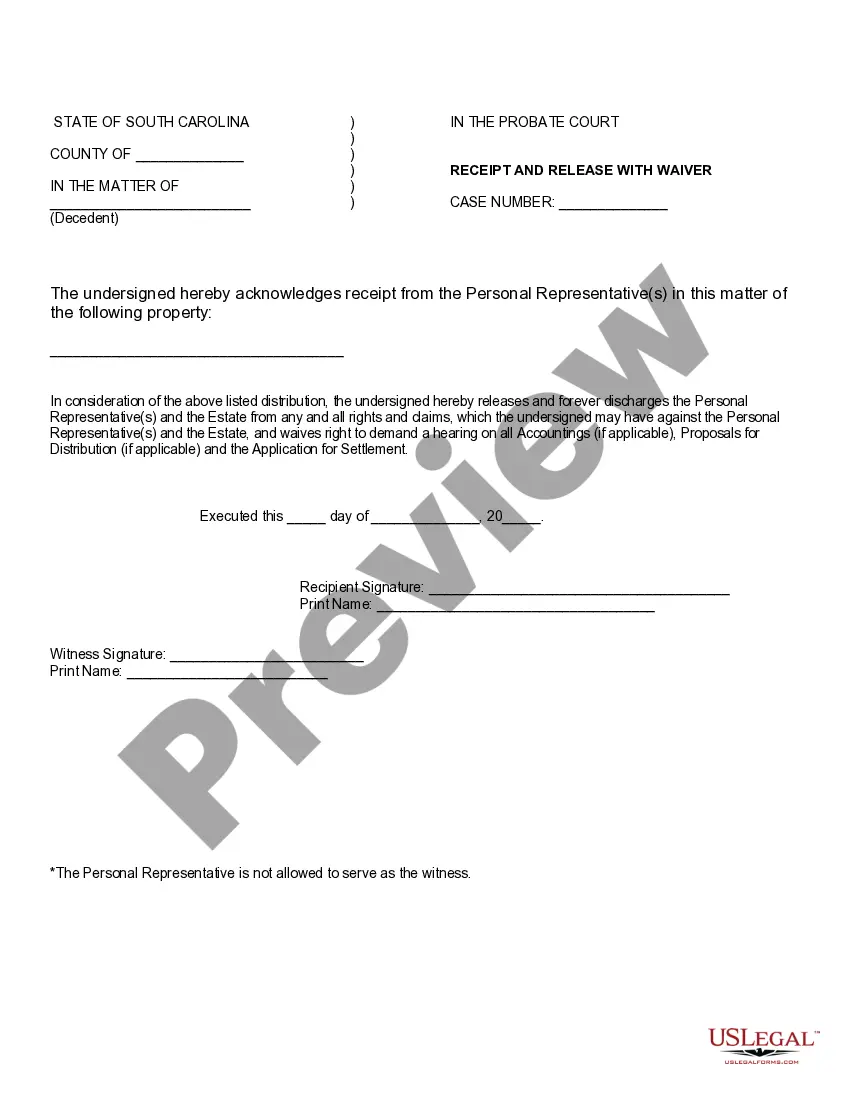

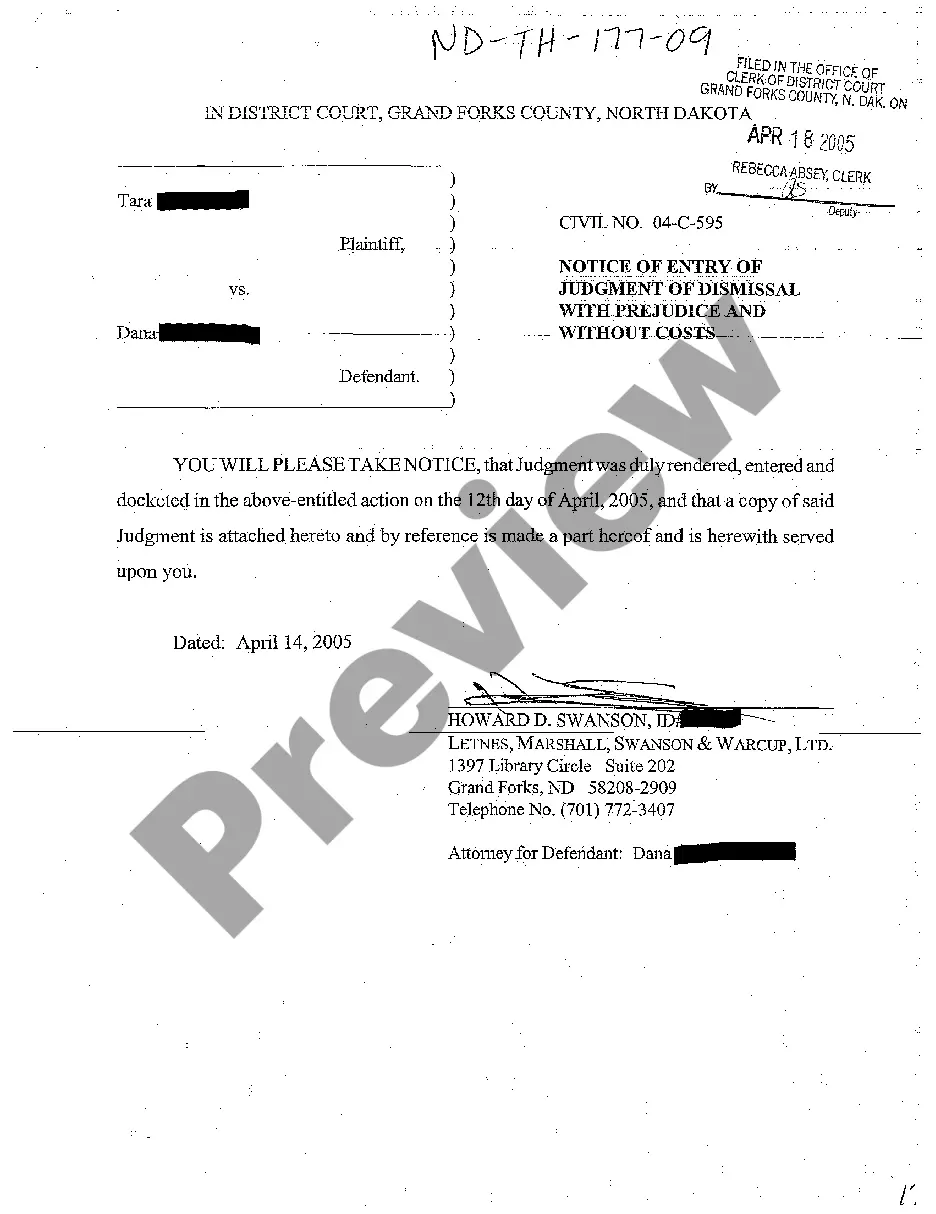

- Step 2. Use the Review option to review the form's details. Don’t forget to check the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

A Minnesota Revocable Trust for Asset Protection primarily protects assets through effective management and streamlined transfer upon death. This trust allows you to dictate how assets are handled and allocated, minimizing the potential for disputes among heirs. While it does not shield assets from all claims, it simplifies the estate settling process and keeps your affairs private.

For optimal asset protection, many consider using an irrevocable trust alongside a Minnesota Revocable Trust for Asset Protection. Irrevocable trusts remove assets from your ownership, providing a higher level of protection from creditors. However, every situation is unique, so discussing your specific needs with a legal professional is vital.

Certain assets, like retirement accounts and health savings accounts, should typically remain outside your Minnesota Revocable Trust for Asset Protection. These accounts often have their own beneficiary designations that maintain tax advantages and protect them from probate. Real estate with existing mortgages might also require careful consideration before transferring into a trust.

While a Minnesota Revocable Trust for Asset Protection does not offer complete immunity from creditors, it can serve a crucial role in estate planning. This trust allows you to maintain control over your assets during your lifetime, potentially simplifying the transfer of those assets upon your passing. However, consult a legal advisor to understand the extent of protection available and explore complementary strategies.

To set up a Minnesota Revocable Trust for Asset Protection, begin by identifying your assets and determining how you want them managed. Next, consult with an experienced attorney who specializes in trusts and estate planning. They can guide you through the paperwork, ensure your trust aligns with your wishes, and help you transfer your assets into the trust.

An asset protection trust in Minnesota is designed to safeguard your assets from potential claims and creditors. A Minnesota Revocable Trust for Asset Protection falls under this category, offering the ability to manage your assets while reducing vulnerability to legal actions. This form of trust allows for greater flexibility in how assets are handled throughout your lifetime. Utilize the resources from US Legal Forms to understand how to establish this type of trust properly.

Revocable trusts, such as a Minnesota Revocable Trust for Asset Protection, offer limited asset protection. While they allow you to maintain control over your assets, they do not completely shield those assets from creditors or lawsuits. To fully protect your assets, integration with other planning strategies is often necessary. Consult US Legal Forms for detailed guidance on combining trust options effectively.

The best type of trust for asset protection varies based on individual needs, but many people find a Minnesota Revocable Trust for Asset Protection effective. This trust provides a balance between control and protection, allowing you to revise the trust as your situation changes. By placing assets within this trust, you can enhance your financial security. For comprehensive trust options, US Legal Forms provides additional insights and templates.

The purpose of an asset protection trust is to shield your assets from creditors and legal claims. In the case of a Minnesota Revocable Trust for Asset Protection, this trust allows you to manage and control your assets while ensuring they are less vulnerable to potential litigation. It provides flexibility in your financial planning, offering peace of mind. Utilizing US Legal Forms can help you navigate the setup process effectively.

To protect your assets from nursing home costs in Minnesota, consider establishing a Minnesota Revocable Trust for Asset Protection. This trust allows you to retain control over your assets while safeguarding them from costly long-term care. By transferring ownership of your assets into the trust, you can effectively limit the estate's exposure to nursing home claims. For tailored guidance, explore the resources available on the US Legal Forms platform.