Computer software is a general term used to describe a collection of computer programs, procedures and documentation that perform some tasks on a computer system. Software is considered personal property and may be assigned.

Minnesota Assignment of Software

Description

How to fill out Assignment Of Software?

If you want to complete, retrieve, or print authorized document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or keywords. Use US Legal Forms to find the Minnesota Assignment of Software with just a few clicks.

Every legal document template you purchase is yours forever. You have access to every form you saved in your account. Select the My documents section and choose a form to print or download again.

Fill out and download, and print the Minnesota Assignment of Software with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Assignment of Software.

- You can also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

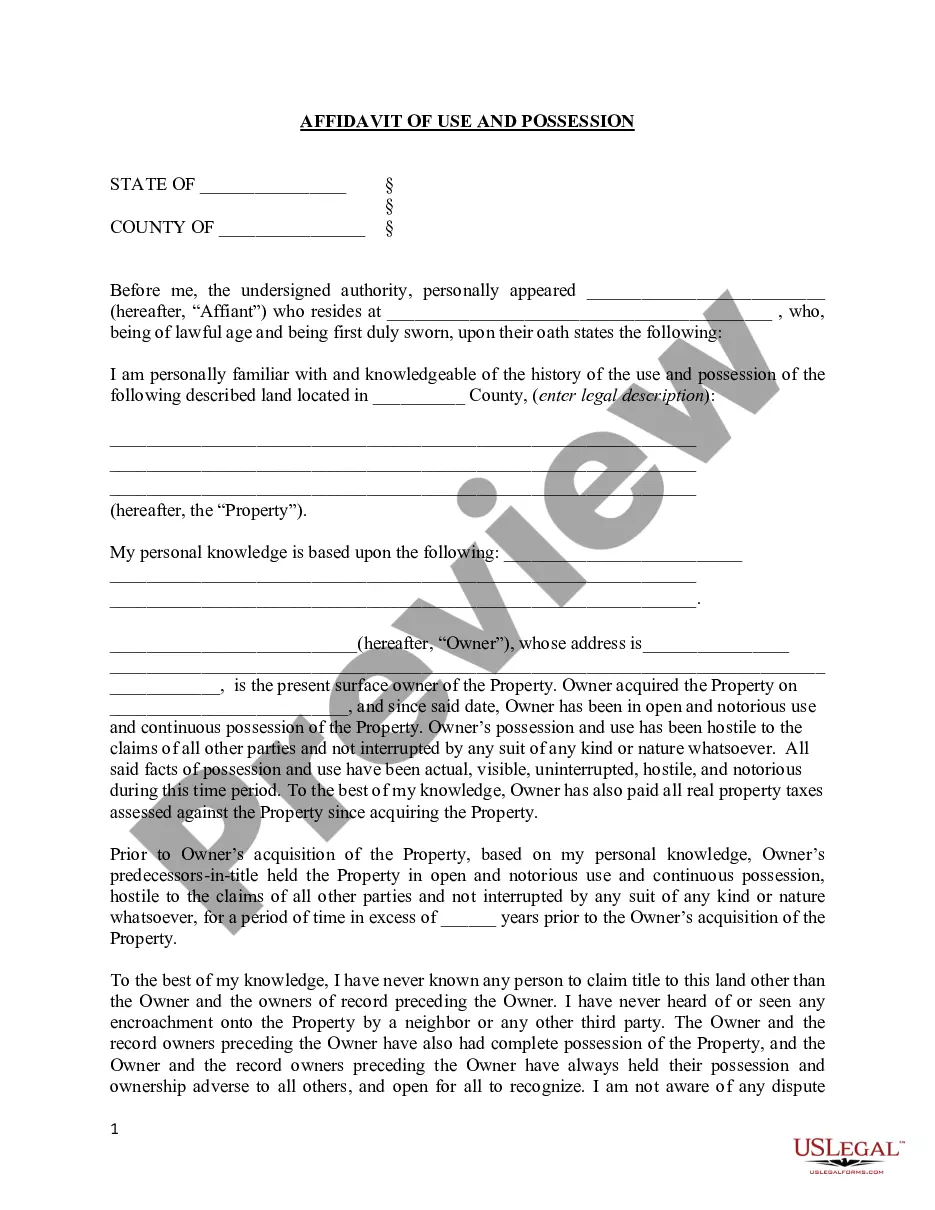

- Step 2. Use the Preview option to review the form’s details. Make sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you desire, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Minnesota Assignment of Software.

Form popularity

FAQ

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs.

Digital goods, which are nontangible versions of tangible goods, such as e-books, streaming music, and online video games, are not taxable unless specifically included. Intangible personal property, such as stocks and bonds, are not subject to the sales tax.

California is one of the few states to tax only physical goods. This means that digital goods and services, including SaaS, are generally not taxable in the state, unless the service includes creating a physical item. The way digital products are categorized can change from state to state and city to city.

If the maintenance contract is required by the vendor as a condition of the sale or rental of canned software, it will be considered as part of the sale, or rental of the canned software, and the gross sales price is subject to tax whether or not the charge for the maintenance contract is separately stated from the ...

Generally, sales tax in Minnesota is not imposed on most SaaS products. However, some digital goods are taxable in Minnesota. It's important to evaluate your product's specific functionality to understand whether it's taxable under Minnesota law.