Minnesota Agreement to Assign Lease to Incorporators Forming Corporation

Description

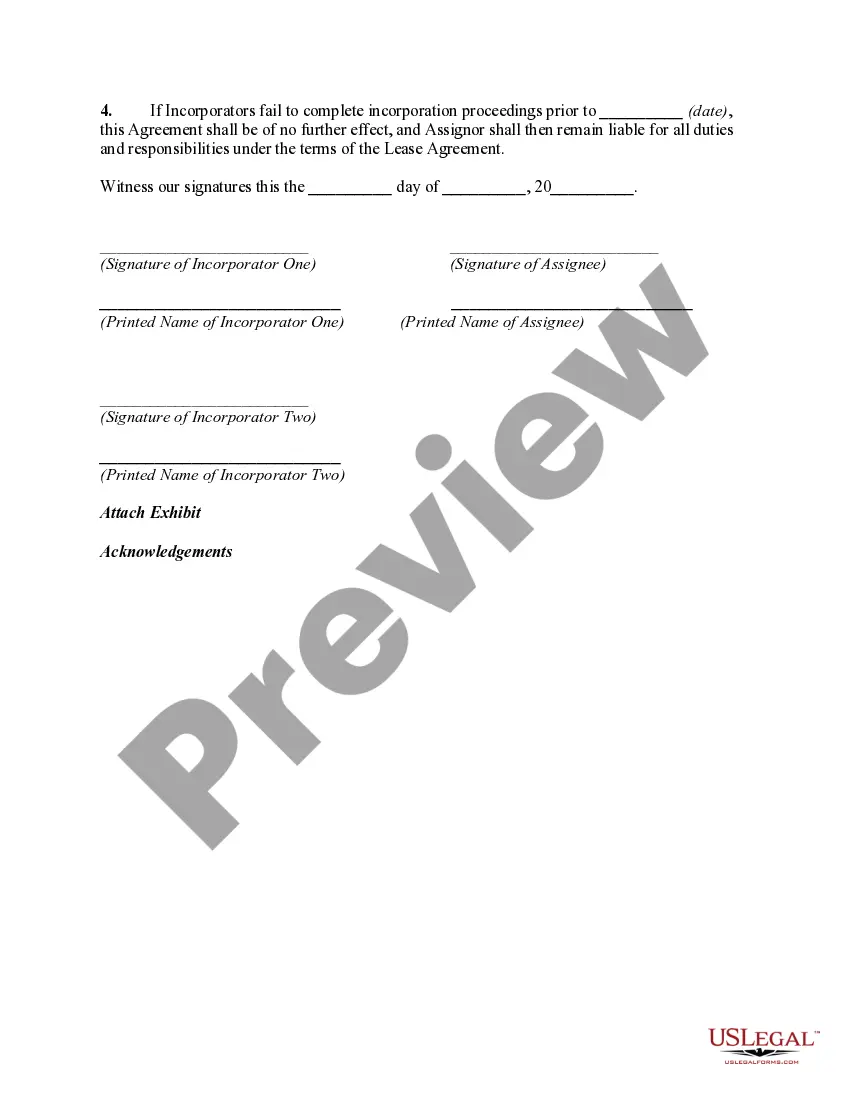

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

It is feasible to invest multiple hours online attempting to locate the valid document format that complies with the federal and state requirements needed.

US Legal Forms provides thousands of valid forms that are evaluated by experts.

It is easy to obtain or print the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation from the service.

If available, utilize the Review button to examine the document as well. If you want to find another version of the document, use the Search field to locate the format that suits your requirements and necessities. Once you have found the format you desire, click Buy now to proceed. Select the pricing plan you wish, enter your details, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to purchase the valid document. Access the document from the file and download it to your device. Make modifications to your document if necessary. You can complete, revise, sign, and print the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation. Obtain and print thousands of document templates using the US Legal Forms website, which offers the largest collection of valid forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can Log In and then click the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation.

- Every valid document format you purchase is yours indefinitely.

- To get another copy of the acquired document, visit the My documents tab and then click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the appropriate format for the county/city of your choice.

- Check the document description to confirm you have chosen the correct document.

Form popularity

FAQ

To change your registered agent in Minnesota, you must file an updated Registration of Agent form with the Secretary of State. You will also need to inform your current registered agent. Consider using the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation to assist you in making the necessary updates while maintaining compliance.

To switch from an LLC to an S Corp in Minnesota, you usually start by dissolving your LLC and reinvesting the assets in a newly formed corporation. You must then file Articles of Incorporation and elect S Corp status through IRS Form 2553. The Minnesota Agreement to Assign Lease to Incorporators Forming Corporation can also help streamline any lease handling during this transition.

A 322C in Minnesota refers to the Minnesota Statutes that govern limited liability companies. Specifically, it provides the framework for the operation and formation of LLCs. Understanding these regulations is crucial, especially when considering the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation when structuring your corporation.

Issuing stock in an S Corp involves preparing and issuing certificates to shareholders, as well as recording their ownership in a ledger. Ensure you follow Minnesota corporate law requirements while complying with federal regulations. Using the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation may assist you in managing lease-related records if your S Corp holds property.

Starting an S Corp in Minnesota requires filing Articles of Incorporation through the Secretary of State's office. It’s essential to designate your corporation as an S Corporation by completing IRS Form 2553. This process can be simplified by using platforms like uslegalforms, which offer tools for handling the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation.

To set up an S Corp in Minnesota, you first need to establish a corporation by filing Articles of Incorporation with the Secretary of State. Once your corporation is formed, you will make an election with the IRS to be taxed as an S Corporation. This process involves submitting Form 2553. Remember, utilizing the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation can facilitate the lease assignments necessary for your new entity.

In Minnesota, if a landlord chooses not to renew a lease, they must provide written notice at least one full rental period in advance. This means if your lease runs monthly, you will need a full month's notice. Always consider your rights and obligations related to lease assignments with tools like the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation.

Minnesota recently enacted new renters laws that enhance tenant protections, including restrictions on late fees and requirements for landlords to seek mediation before eviction. Familiarizing yourself with these changes is essential for both landlords and tenants. The Minnesota Agreement to Assign Lease to Incorporators Forming Corporation can be a useful tool in navigating lease agreements under these new regulations.

To form an S Corporation in Minnesota, you must first create a standard corporation by filing Articles of Incorporation with the state. After that, you can elect S Corporation status by submitting Form 2553 to the IRS. During this process, ensure you understand any lease agreements, including the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation, that might affect your operations.

Minnesota does not require an operating agreement for LLCs, but it is highly recommended. An operating agreement outlines the management structure and operating procedures, providing clarity for all members. If you are forming an LLC and considering multiple agreements, the Minnesota Agreement to Assign Lease to Incorporators Forming Corporation can assist in streamlining the necessary documentation.