Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor

Description

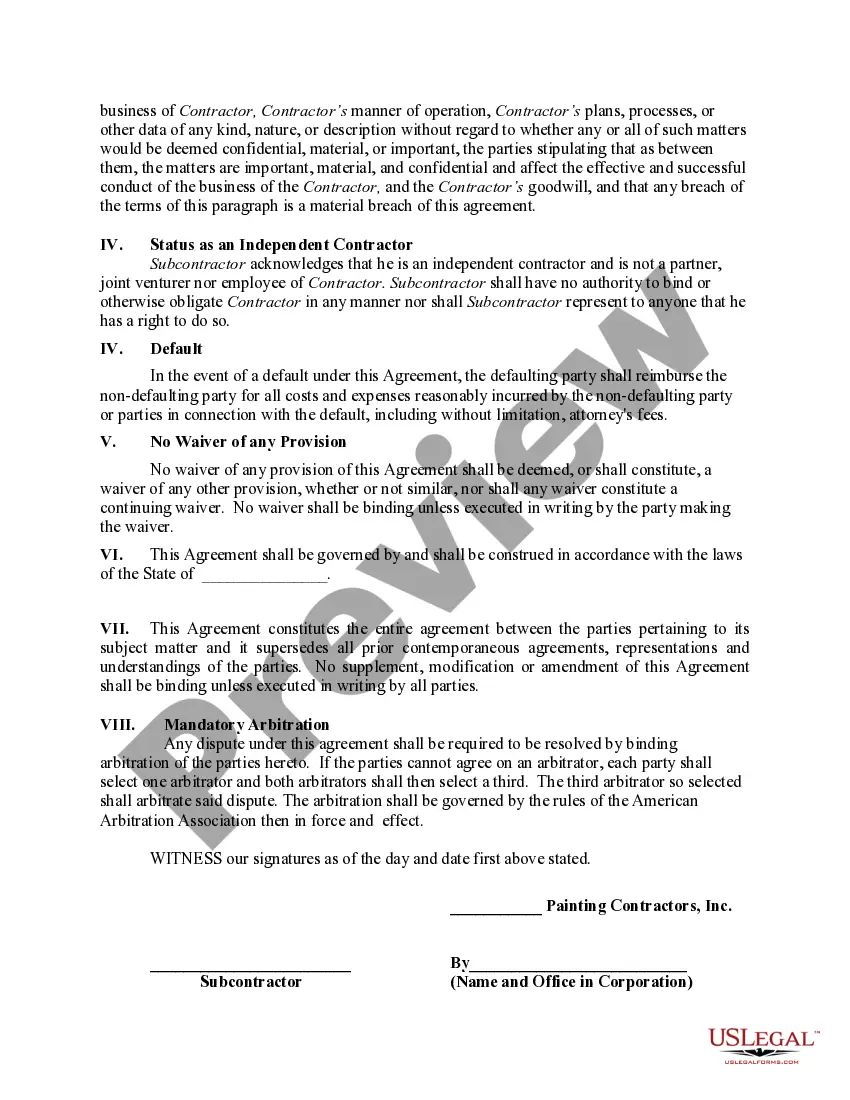

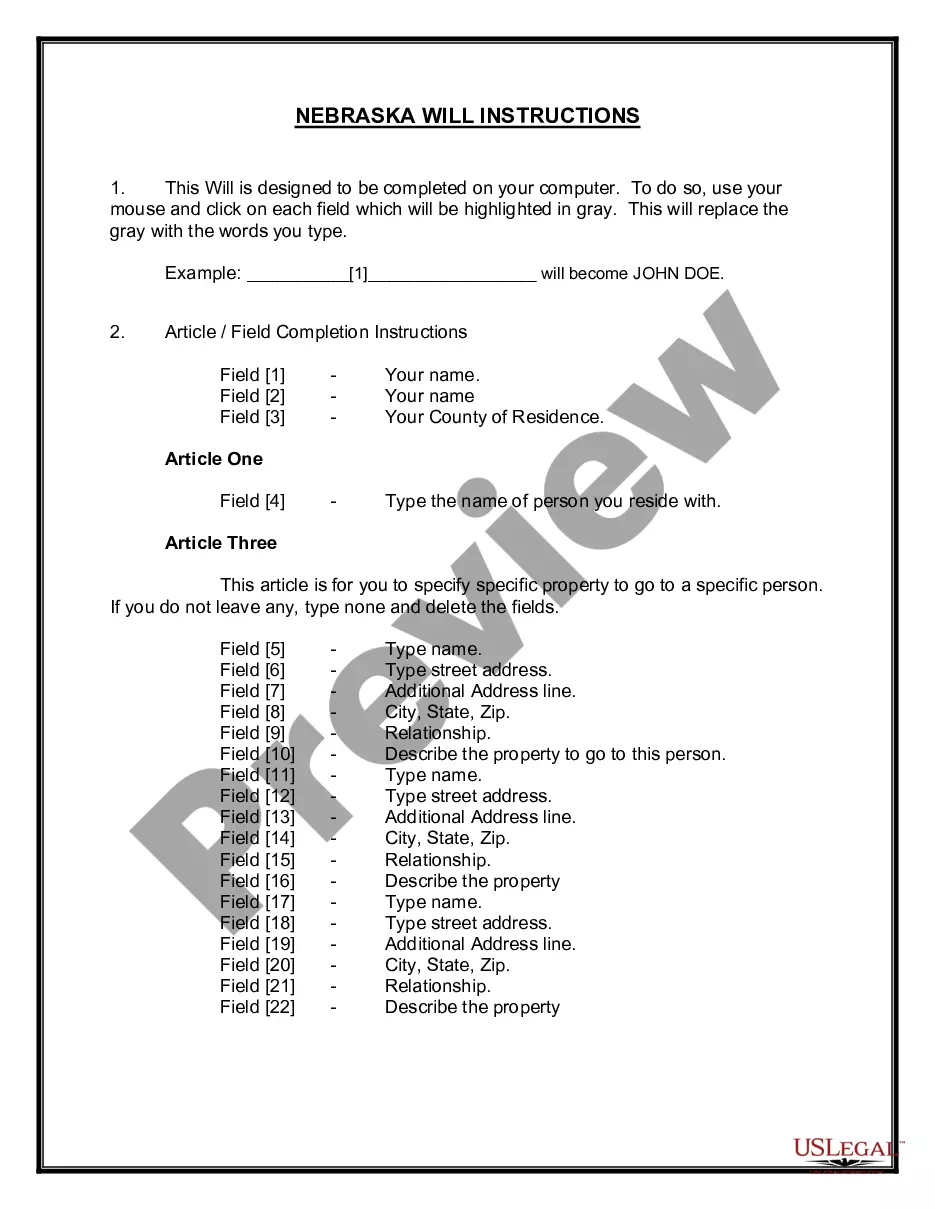

How to fill out Agreement By Self-Employed Independent Contractor Or Subcontractor Not To Bid Against Painting General Contractor?

If you wish to compile, obtain, or print verified document templates, utilize US Legal Forms, the leading assortment of official forms that can be accessed online.

Take advantage of the site’s straightforward and user-friendly search to discover the documents you need.

Many templates for business and personal uses are sorted by categories and states, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

Step 6. Choose the format of the official form and download it to your device. Step 7. Complete, modify, and print or sign the Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor.

- Utilize US Legal Forms to locate the Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor in just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and click the Obtain button to find the Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Preview function to review the form’s details. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternate versions of the official form template.

- Step 4. After finding the form you need, choose the Purchase now button. Select the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

In Minnesota, the primary difference between an employee and an independent contractor lies in the level of control and independence. Employees work under the direction of an employer, while independent contractors have the freedom to control how they perform their work. This distinction has significant implications for contracts, liability, and tax obligations. Establishing a clear Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can help delineate these differences effectively.

Self-employment tax comprises Social Security and Medicare taxes for individuals who work for themselves. The current rate for self-employment tax is 15.3%, which covers both employee and employer contributions. Keep in mind that filing a Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can help you navigate your self-employment tax obligations systematically.

Minnesota employment tax primarily includes Unemployment Insurance (UI) and Workers' Compensation costs. The UI tax rate can range from 0.1% to 9.8% depending on the employer's experience rating. As an independent contractor or subcontractor, you need to be aware of these costs when managing your finances. Having a solid Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can provide clarity on financial responsibilities.

In Minnesota, independent contractors are subject to both federal and state tax rates. The federal income tax rate varies based on income level, while Minnesota's state income tax has progressive rates from 5.35% to 9.85%. It is crucial to consider your income and deductions to determine your effective tax rate. Understanding the tax implications of a Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor can help you plan effectively.

In Minnesota, a contractor is generally responsible for their work for a duration of two years after project completion. This timeframe can vary based on the specific contract terms. To avoid disputes, include a clear statement about this duration in your Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor.

Writing an independent contractor agreement starts with clearly outlining the terms of your engagement. Include specifics like project scope, payment terms, and deadlines. Be sure to incorporate the Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor to provide a structured guide to your arrangement and protect both parties.

In Minnesota, the independent contractor rule defines the criteria for determining whether a worker is classified as an independent contractor or an employee. This classification affects tax obligations and liability issues. Understanding this rule is essential for contractors, particularly when drafting the Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor.

As an independent contractor, you need to fill out a variety of forms to ensure legal compliance. Start with your Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor. This document outlines the terms of your working relationship, including payment details and project expectations, making it easier for all parties involved.

In Minnesota, construction defect law primarily falls under the realm of the Minnesota Statutes. In general, homeowners and contractors have a period of two years from the time they discover a defect to file a claim. If you are using a Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, this law is particularly relevant. You should document any issues thoroughly and seek legal advice to navigate potential claims effectively.

In Minnesota, the statute of limitations for a written contract is six years. This means that if you want to enforce a written agreement, such as a Minnesota Agreement by Self-Employed Independent Contractor or Subcontractor Not to Bid Against Painting General Contractor, you must initiate legal action within this time frame. It is important to keep track of your contract date to ensure your rights are protected. Consulting with a legal professional can help clarify your options if you face potential disputes.