Minnesota Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Stock Dividend - Resolution Form - Corporate Resolutions?

Locating the appropriate legal document layout can present certain challenges.

Clearly, there are numerous templates accessible online, but how can you identify the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, including the Minnesota Stock Dividend - Resolution Form - Corporate Resolutions, which can be utilized for both business and personal purposes.

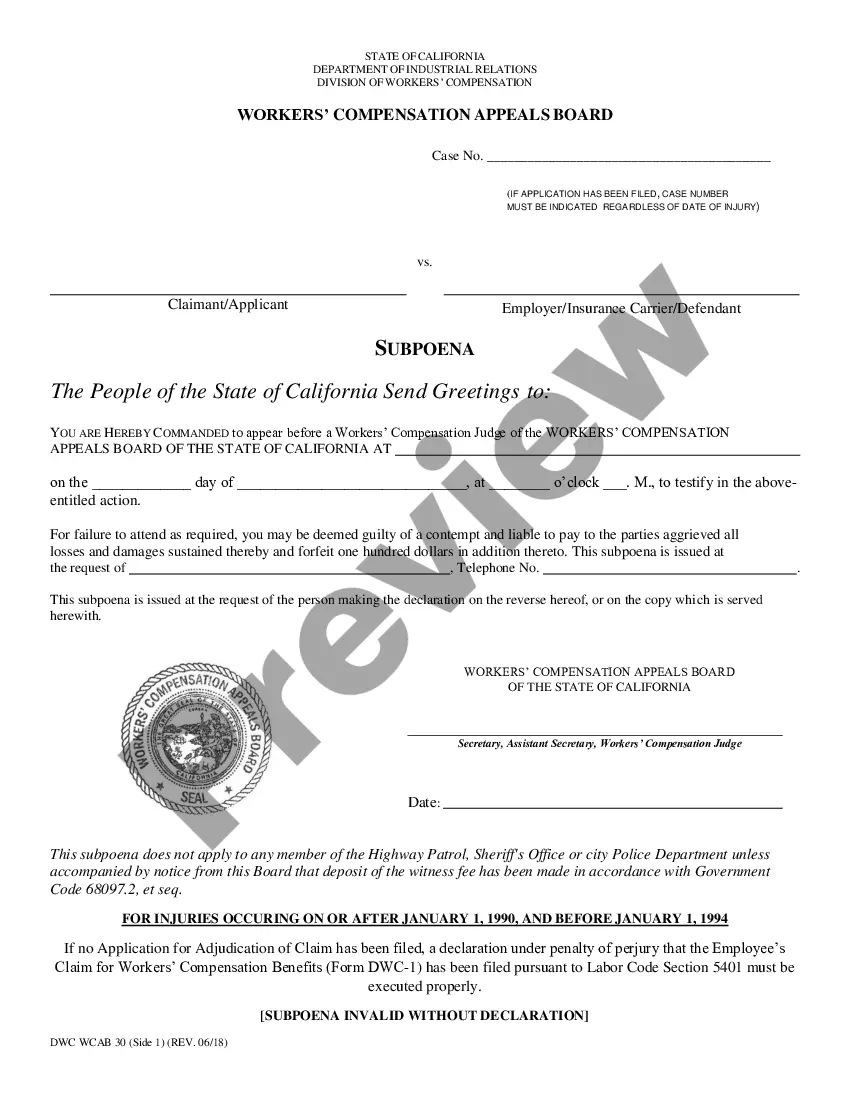

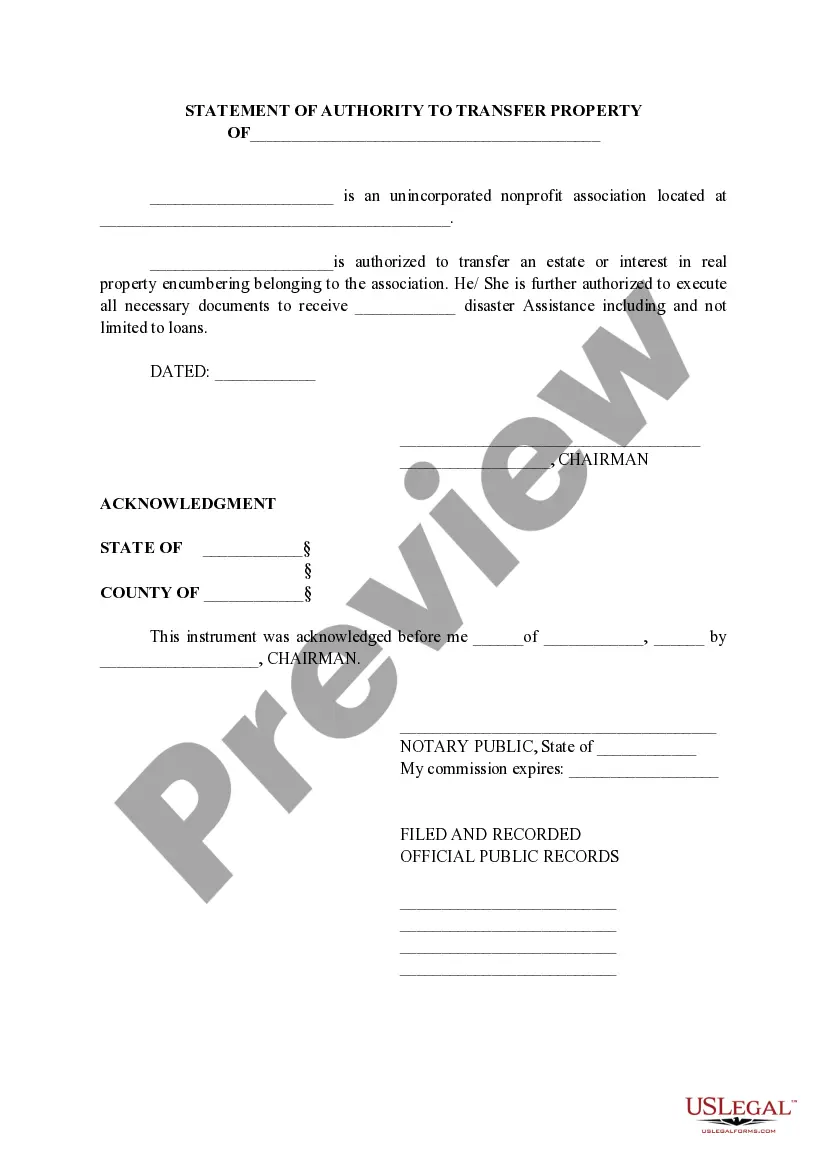

First, confirm that you have chosen the correct form for your specific city/county. You can browse the form using the Preview button and review the form description to ensure it suits your needs.

- All of the forms have been reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to get the Minnesota Stock Dividend - Resolution Form - Corporate Resolutions.

- Leverage your account to view the legal forms you have acquired in the past.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, follow these straightforward steps.

Form popularity

FAQ

A shareholder resolution for the sale of shares is a formal document that is adopted by shareholders to approve the sale of company shares. This resolution provides a clear authorization for the transaction and protects the rights of shareholders by documenting the decision. A well-prepared Minnesota Stock Dividend - Resolution Form - Corporate Resolutions can facilitate this process and provide legal assurance.

To create a shareholder resolution, start by drafting the proposal that outlines the intended action and reasons for it. Next, present this proposal to the shareholders for their approval, following the voting guidelines set forth in the company's bylaws. The Minnesota Stock Dividend - Resolution Form - Corporate Resolutions can provide a template that simplifies drafting and ensures you cover all necessary components.

A corporate resolution refers to a formal decision made by a corporation’s governing body, such as its board of directors or shareholders. These resolutions are crucial as they establish the authority for certain actions, such as issuing stock or executing contracts. Utilizing a Minnesota Stock Dividend - Resolution Form - Corporate Resolutions can simplify these processes and enhance legal compliance.

A corporate resolution form is a legal document that records decisions made by a corporation's board of directors or shareholders. This form captures the specifics of the resolution, ensuring clarity and legal standing for the actions taken. The Minnesota Stock Dividend - Resolution Form - Corporate Resolutions offers an organized way to manage these important documents.

Typically, a shareholder resolution can be filed by any shareholder or group of shareholders who meet specific ownership requirements set by the corporation's bylaws. This can include individual investors, institutional investors, or even related parties. By understanding the guidelines and utilizing the Minnesota Stock Dividend - Resolution Form - Corporate Resolutions, shareholders can effectively influence corporate governance.

A shareholder resolution is necessary for making significant decisions within a corporation, such as approving stock sales or changes to corporate policy. This resolution ensures that all shareholders have a voice in important corporate matters and that their votes are formally recorded. When you use a Minnesota Stock Dividend - Resolution Form - Corporate Resolutions, you streamline this process, making it efficient and compliant.

A corporate resolution for share transfer specifies the terms under which shares are being transferred from one party to another. This resolution must be documented to ensure that the transaction is recognized legally and that ownership is properly recorded. Using a Minnesota Stock Dividend - Resolution Form - Corporate Resolutions makes this process easier and helps maintain accurate records.

A corporate resolution to sell stock is a formal decision made by a company's board or shareholders that approves the sale of its stock. This document outlines the terms and conditions of the sale and ensures that the process complies with all legal requirements. When drafting a Minnesota Stock Dividend - Resolution Form - Corporate Resolutions, it is essential to capture these details to facilitate a transparent transaction.

To write a corporate resolution, start by clearly stating the purpose of the resolution at the top of the document. Then, specify the details of the action being authorized, such as issuing a Minnesota Stock Dividend through a Resolution Form for Corporate Resolutions. Next, include the date, the names of the directors or shareholders approving the resolution, and their signatures. This structured approach ensures clarity and compliance within your corporate records.

To form a corporation in Minnesota, you must first choose a unique business name that complies with state laws. After selecting your name, you need to file Articles of Incorporation with the Minnesota Secretary of State, which can be done online. Once your application is approved, adopt corporate bylaws and appoint a board of directors. You can also reference the Minnesota Stock Dividend - Resolution Form - Corporate Resolutions to ensure proper documentation for dividend decisions that support your corporation's financial strategy.