Minnesota Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

If you need to compile, obtain, or produce valid document templates, use US Legal Forms, the largest collection of legal forms available online.

Utilize the website's simple and convenient search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

- Use US Legal Forms to find the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions.

- You can also view forms you have previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the correct area/state.

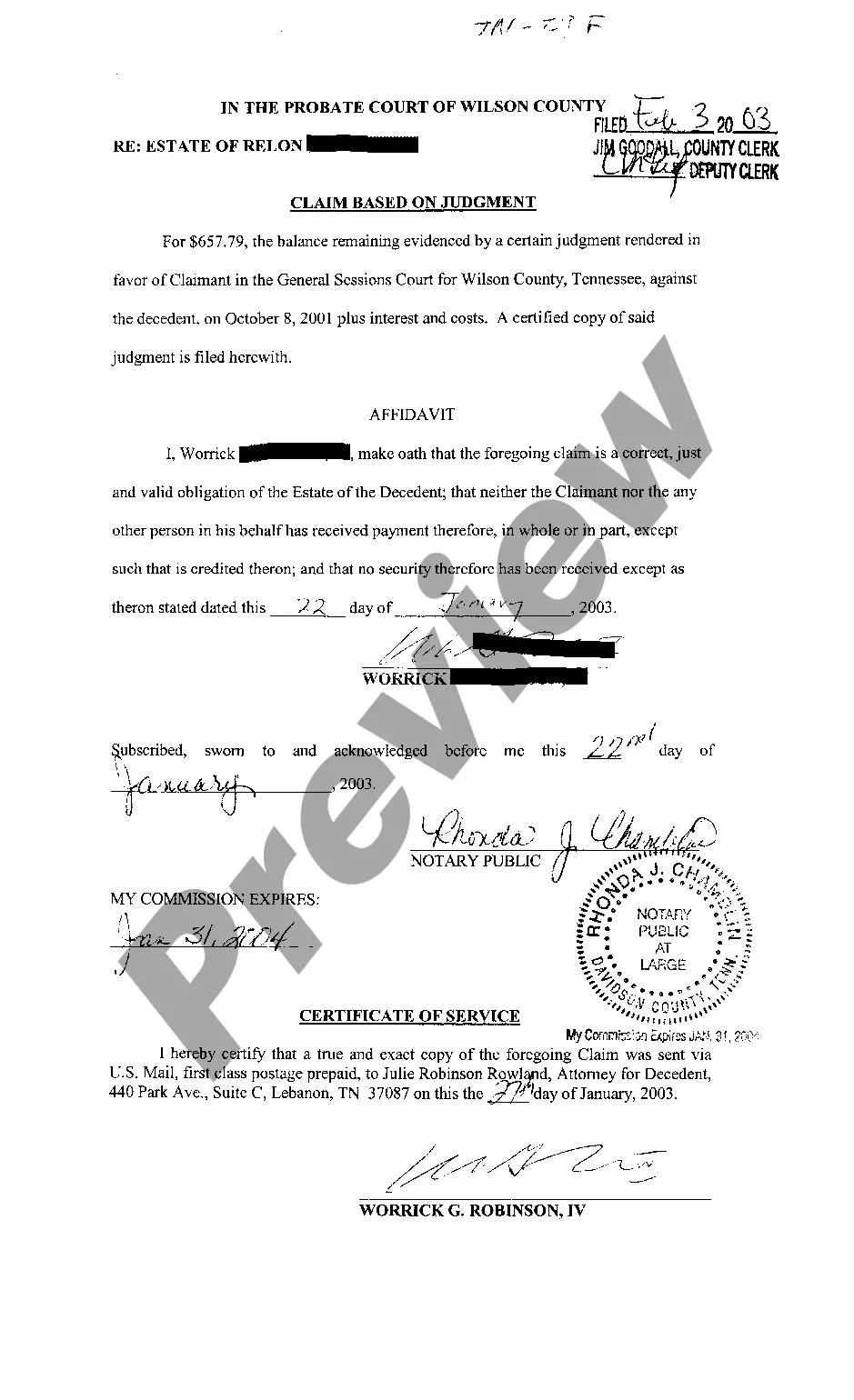

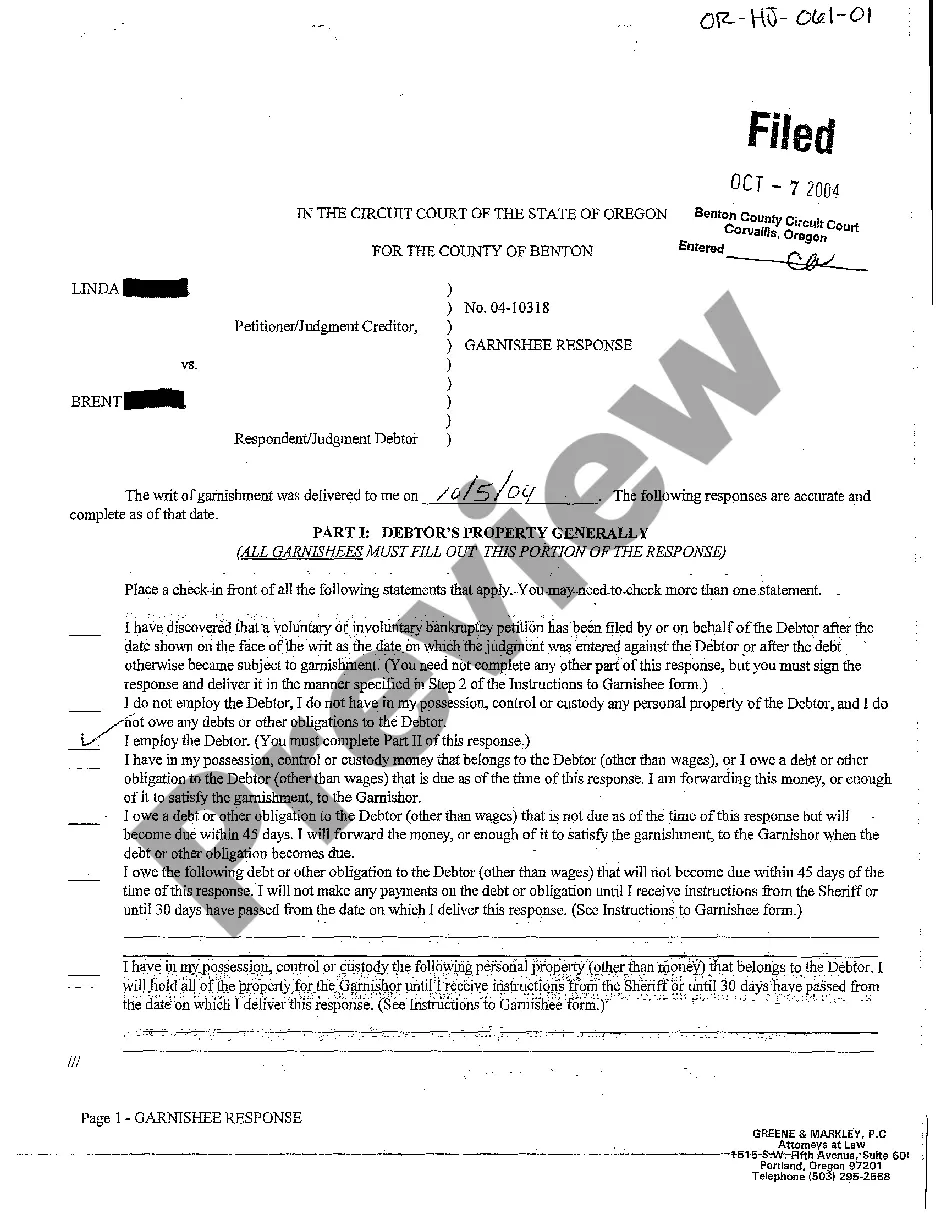

- Step 2. Utilize the Review option to examine the form's content. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other types from the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Select the pricing package you want and input your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions.

- Every legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

- Compete and obtain, and print the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

A corporate resolution for signature grants authority to specific individuals to sign documents on behalf of the corporation. This type of resolution ensures that only authorized personnel engage in binding agreements or contracts. Utilizing the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions streamlines this authorization process and provides legal clarity in corporate governance.

The purpose of a corporate resolution is to document and formalize decisions made by a corporation's board or management. These resolutions provide clarity, support legal compliance, and serve as an official record of actions taken. By using the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions, corporations can ensure that all decisions are appropriately documented and easily accessible.

A corporate resolution for a bank account authorizes specific individuals to manage the corporation's banking transactions and administration. This resolution is necessary for opening accounts, signing checks, and approving financial matters. Incorporating the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions ensures compliance and clarity in these financial decisions.

A corporate representative resolution is a document that officially appoints a designated representative to act for the corporation in specific matters. This resolution details the scope of authority, providing clarity and legal backing for the representative's actions. The Minnesota Dividend Policy - Resolution Form - Corporate Resolutions can be used to simplify and support this appointment effectively.

A corporate resolution for authorized signers designates particular individuals who have the authority to act on behalf of the corporation in financial matters. This resolution is essential for ensuring that only approved individuals can execute documents related to company finances. Utilizing the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions can simplify this process and provide a clear record.

A corporate resolution form is a written document that outlines decisions made by a corporate board or members during a meeting. It serves as a record of actions taken, such as approving transactions or authorizing representatives. Using the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions helps streamline and formalize these important corporate decisions.

The resolution to sell corporate shares is an official document that allows a corporation to sell its shares to investors or the public. This resolution is crucial for compliance and typically includes details about the transaction, ensuring alignment with the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions. This process protects the company's integrity while allowing it to raise capital.

A corporate representative acts on behalf of the corporation to make decisions and sign documents necessary for its operation. They often handle important tasks, such as executing contracts or filing resolutions like the Minnesota Dividend Policy - Resolution Form - Corporate Resolutions. This role ensures that all corporate actions align with the company’s policies and legal requirements.

To form a corporation in Minnesota, start by choosing a unique name for your business that complies with state regulations. Next, you need to file Articles of Incorporation with the Minnesota Secretary of State, providing essential details like your corporation's name, registered agent, and purpose. After your incorporation is approved, consider establishing a Minnesota Dividend Policy - Resolution Form - Corporate Resolutions to guide your distribution of dividends. Using US Legal Forms can greatly simplify this process by providing ready-to-use templates and helpful resources.