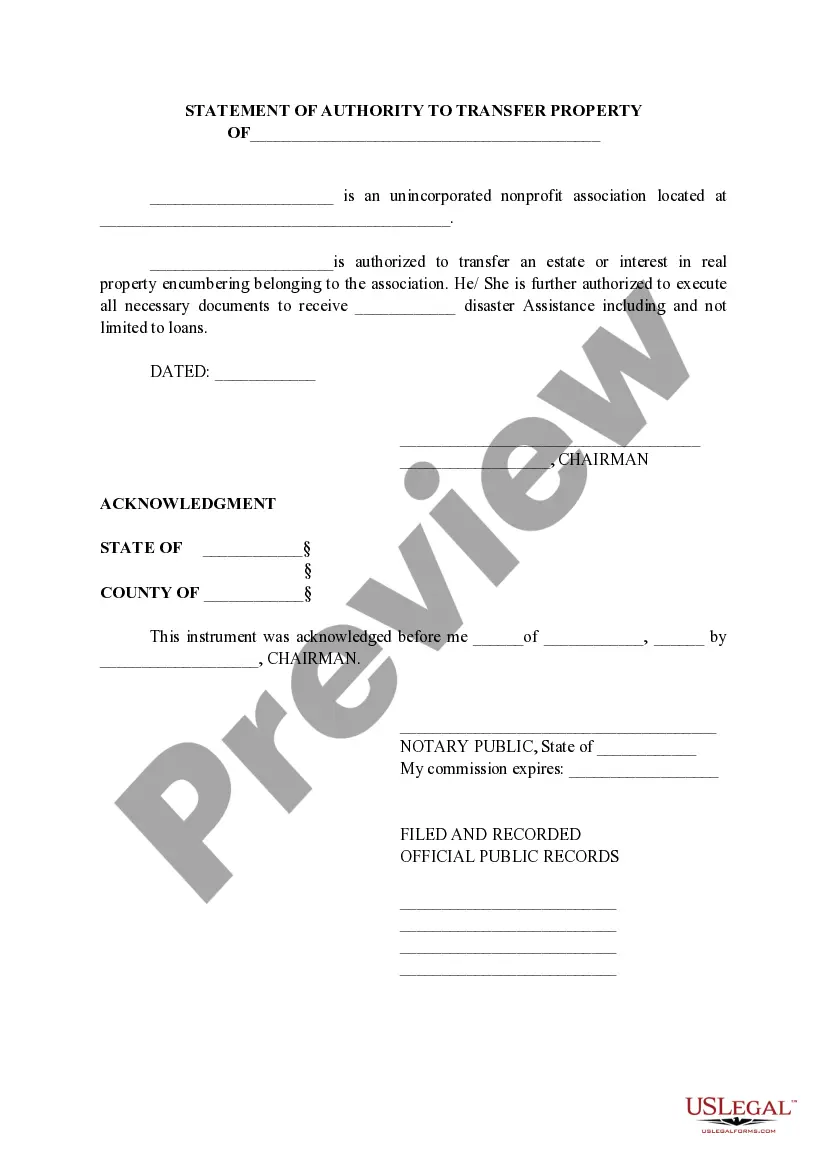

Texas Statement of Authority to Transfer Property

Description

How to fill out Texas Statement Of Authority To Transfer Property?

Get access to top quality Texas Statement of Authority to Transfer Property forms online with US Legal Forms. Avoid hours of misused time seeking the internet and dropped money on files that aren’t up-to-date. US Legal Forms provides you with a solution to exactly that. Get more than 85,000 state-specific legal and tax templates that you can download and submit in clicks within the Forms library.

To find the sample, log in to your account and click on Download button. The file is going to be stored in two places: on the device and in the My Forms folder.

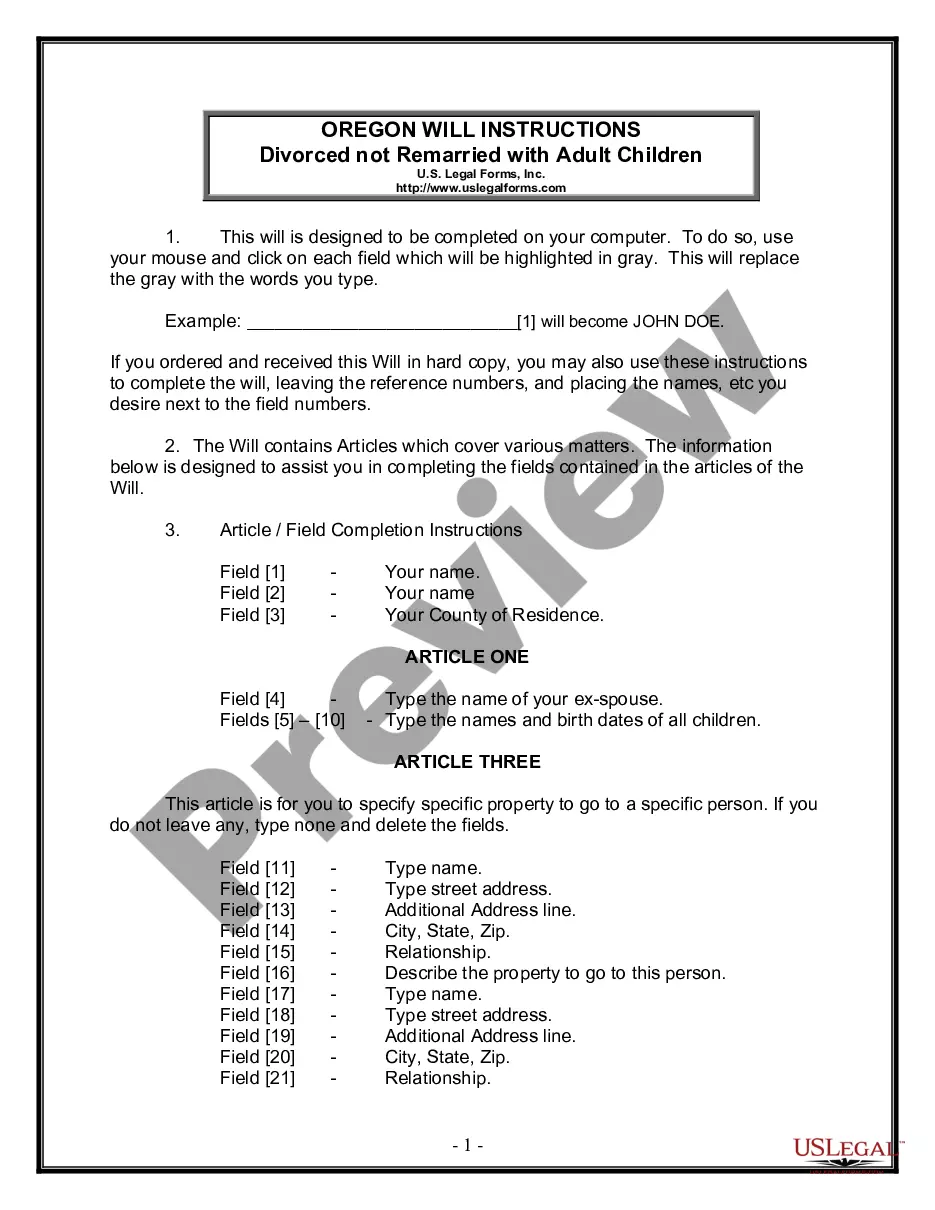

For those who don’t have a subscription yet, have a look at our how-guide below to make getting started simpler:

- Find out if the Texas Statement of Authority to Transfer Property you’re looking at is suitable for your state.

- View the form making use of the Preview option and read its description.

- Go to the subscription page by simply clicking Buy Now.

- Select the subscription plan to keep on to register.

- Pay out by card or PayPal to finish making an account.

- Choose a preferred format to download the document (.pdf or .docx).

Now you can open the Texas Statement of Authority to Transfer Property sample and fill it out online or print it out and get it done yourself. Take into account sending the document to your legal counsel to make sure all things are completed correctly. If you make a error, print out and complete sample again (once you’ve created an account every document you save is reusable). Create your US Legal Forms account now and access more templates.

Form popularity

FAQ

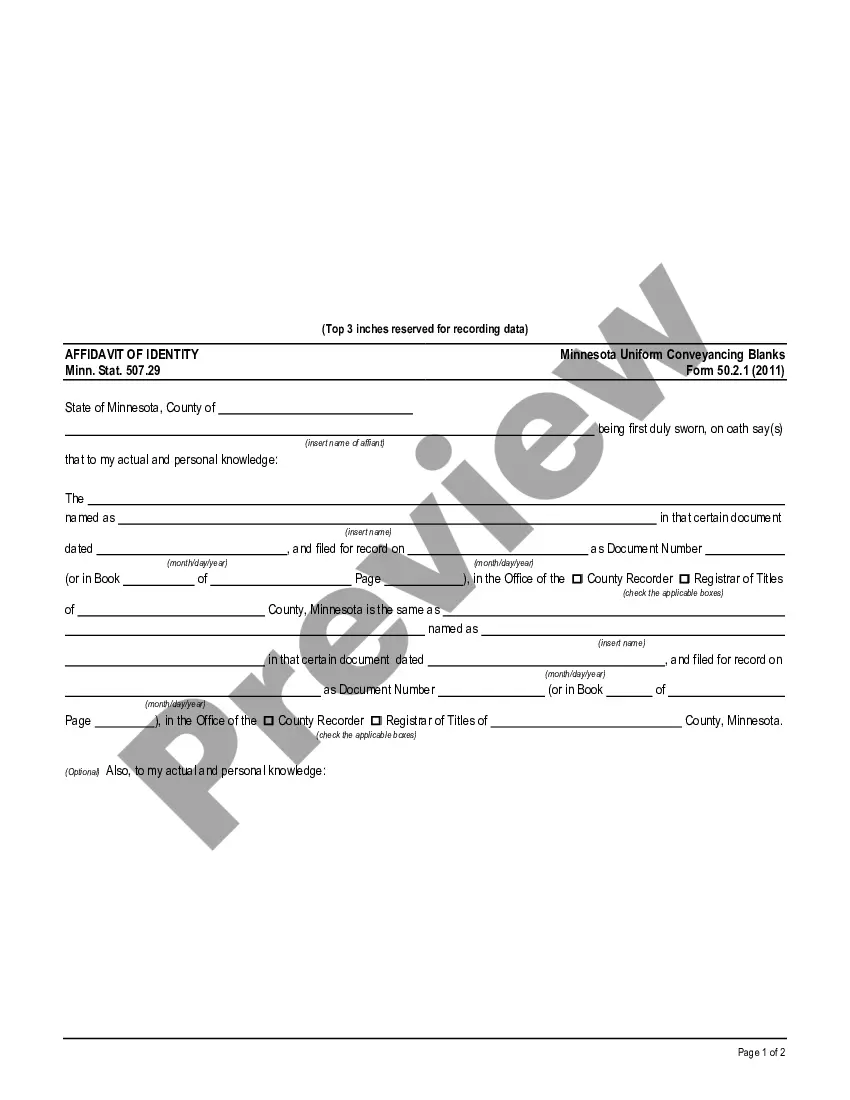

Does an affidavit of heirship need to be recorded in Texas? Yes, after the affidavit is signed and executed, it must be filed with the county deed records where the decedent's real property is located.

An affidavit is a sworn statement, made in front of a notary or other officer authorized to administer oaths. An affidavit of deed confirms delivery and acceptance of a deed by the grantee, and thereby its validity.If the grantor is protected by an affidavit of deed, these issues are generally easier to resolve.

To create a transfer on death designation, the owner must submit an Application for Title (available at your local DMV) which contains a designation of beneficiary, to be effective upon the owner's death. After the transfer on death designation is submitted, the owner retains full rights in the vehicle.

TEXAS IS A NOTICE STATE As mentioned above, conveyances and agreements concerning real property must be in writing to be enforceable between the parties to a transaction.

An Affidavit of Heirship is a sworn statement that heirs can use in some states to establish property ownership when the original owner dies intestate. Affidavits of Heirship are generally used when the decedent only left real property, personal property, or had a small estate.

It does not transfer title to real property. However, Texas Estates Code chapter 203.001 says it becomes evidence about the property once it has been on file for five years. The legal effect of the affidavit of heirship is that it creates a clean chain of title transfer to the decedent's heirs.

The affidavit is a sworn statement of fact that specifies the seller of a property holds the title to it. In other words, it's proof that the seller owns the property. It also attests that certain other facts about the property are correctas sworn to by the seller and duly notarized.

Find the most recent deed to the property. It is best to begin with a copy of the most recent deed to the property (the deed that transferred the property to the current grantor). Create a new deed. Sign and notarize the deed. File the documents in the county land records.

Heirship Proceedings in Texas An heirship proceeding is a court proceeding used to determine who an individual's heirs are.This process involves a court-appointed attorney who investigates the deceased individual's family history and confirms to the court the identity of the heirs.