Minnesota Letter to Creditors Notifying Them of Identity Theft of Minor

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor?

US Legal Forms - one of the largest libraries of legitimate varieties in the States - gives a variety of legitimate document layouts you are able to down load or produce. While using site, you can find a large number of varieties for business and personal uses, sorted by categories, says, or key phrases.You can find the most up-to-date types of varieties like the Minnesota Letter to Creditors Notifying Them of Identity Theft of Minor within minutes.

If you currently have a registration, log in and down load Minnesota Letter to Creditors Notifying Them of Identity Theft of Minor in the US Legal Forms local library. The Obtain key can look on each form you see. You have access to all earlier downloaded varieties from the My Forms tab of your respective accounts.

In order to use US Legal Forms the first time, listed here are basic directions to help you started out:

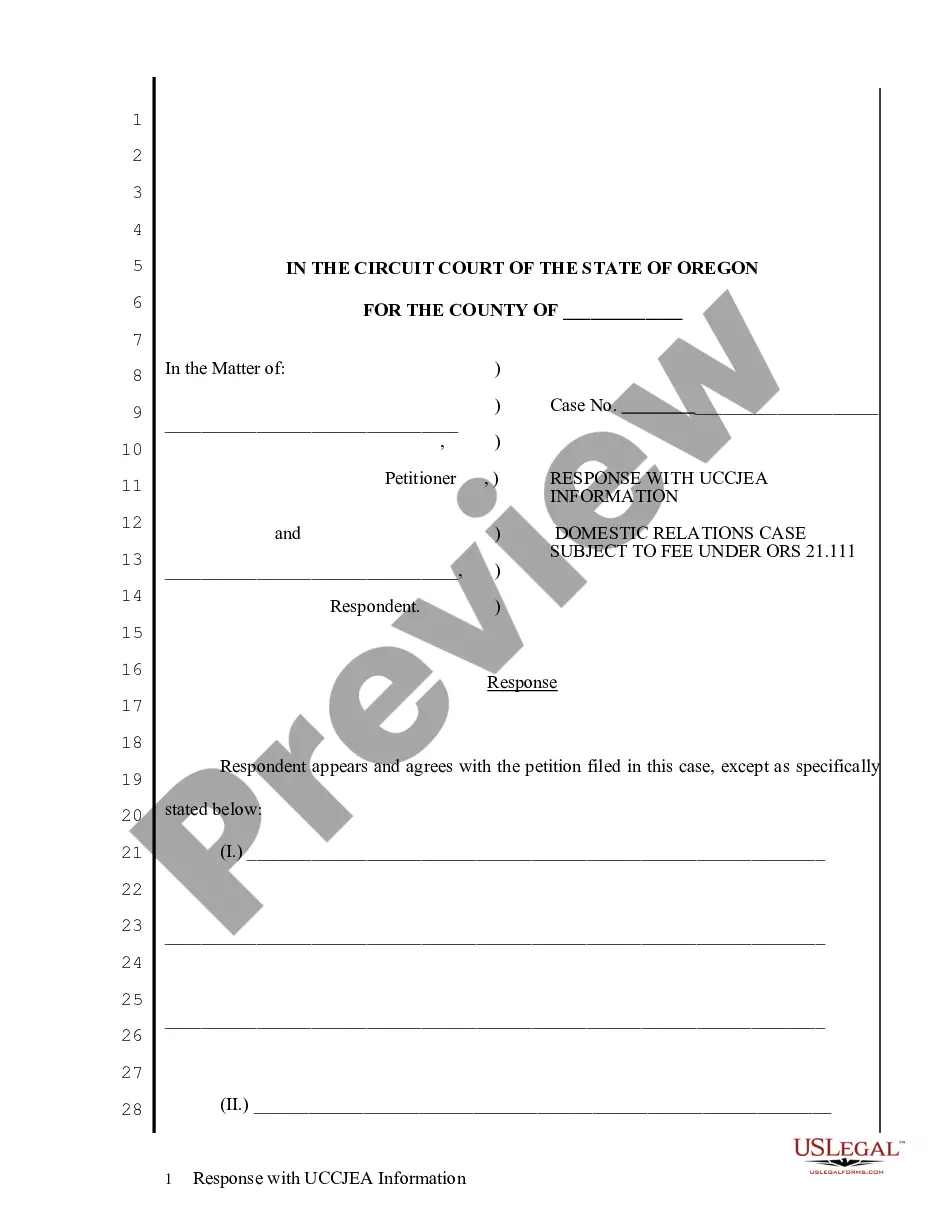

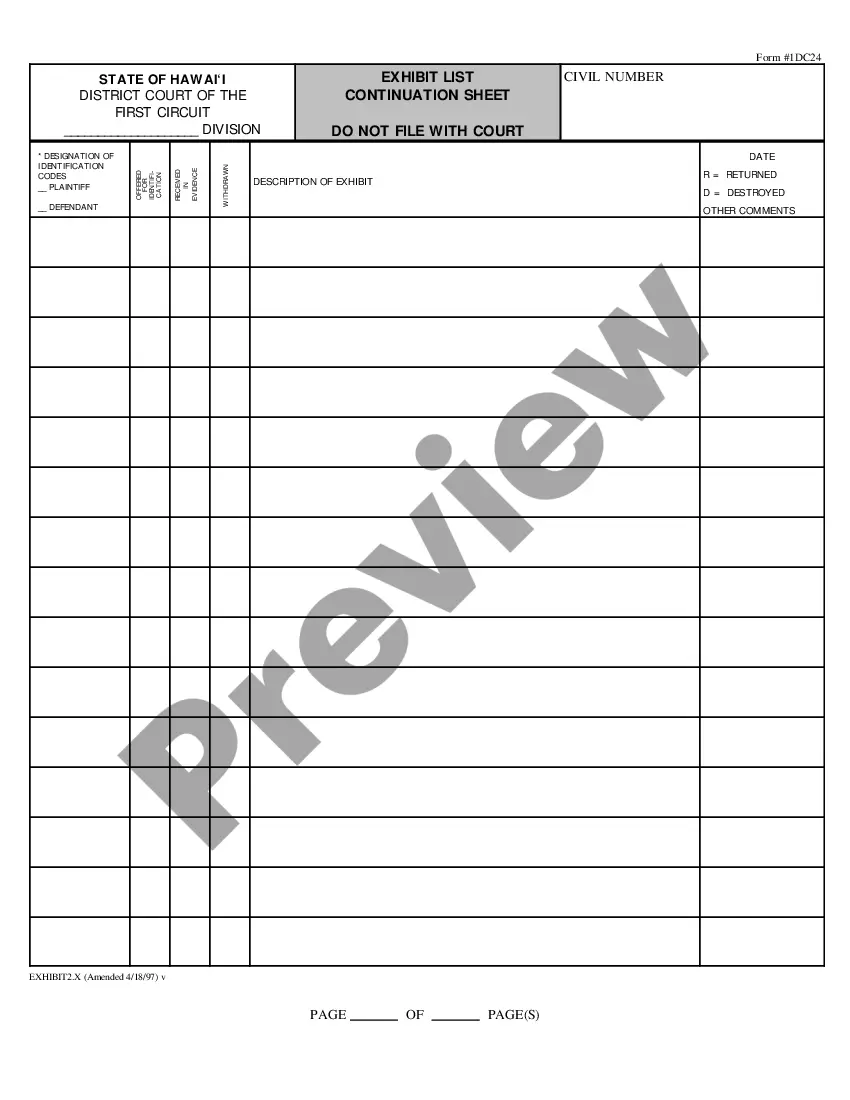

- Make sure you have selected the right form for the town/state. Click on the Review key to analyze the form`s articles. Read the form information to ensure that you have chosen the correct form.

- If the form doesn`t suit your needs, take advantage of the Look for area towards the top of the display to obtain the the one that does.

- When you are content with the shape, validate your choice by clicking on the Purchase now key. Then, select the costs prepare you like and supply your accreditations to sign up on an accounts.

- Approach the transaction. Make use of credit card or PayPal accounts to finish the transaction.

- Find the file format and down load the shape on the device.

- Make modifications. Fill out, change and produce and sign the downloaded Minnesota Letter to Creditors Notifying Them of Identity Theft of Minor.

Each design you added to your money lacks an expiration date and it is the one you have for a long time. So, if you wish to down load or produce an additional backup, just visit the My Forms segment and then click around the form you need.

Get access to the Minnesota Letter to Creditors Notifying Them of Identity Theft of Minor with US Legal Forms, by far the most extensive local library of legitimate document layouts. Use a large number of professional and condition-specific layouts that meet your company or personal requirements and needs.

Form popularity

FAQ

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

The penalties for identity theft range from a misdemeanor to a 20-year felony. The offense level correlates with the amount of loss incurred, the number of direct victims involved, or the related offense. Loss is defined as the value obtained and the expenses incurred as a result of the crime.

Steps to take if your identity was stolen Alert your bank or credit card companies immediately. ... Change your passwords and enable two-factor authentication. ... Continue monitoring your financial statements and accounts. ... Google yourself. ... Notify law enforcement. ... Set up a fraud alert or credit freeze.

First, contact the companies or banks where you know the fraudulent activity occurred. Stop any accounts that have been opened without your permission or tampered with. Then, file a report with the Federal Trade Commission (FTC).

Inform your bank, building society and credit card company of any unusual transactions on your statement. Request a copy of your credit file to check for any suspicious credit applications. Report the theft of personal documents and suspicious credit applications to the police and ask for a crime reference number.

Explain that someone stole your identity and ask them to close or freeze the compromised account. Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report.