Minnesota Corporate Resolution Authorizing a Charitable Contribution

Description

The RMBCA even authorizes a corporation to make charitable contributions. The following form is a sample of a corporate resolution authorizing a charitable contribution.

How to fill out Corporate Resolution Authorizing A Charitable Contribution?

Are you presently in a situation where you frequently require documents for either business or personal purposes.

There is a wide range of legal document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a multitude of form templates, such as the Minnesota Corporate Resolution Authorizing a Charitable Contribution, designed to comply with state and federal regulations.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient file format and download your copy. You can review all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Minnesota Corporate Resolution Authorizing a Charitable Contribution at any time, if necessary. Simply select the required form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Next, you can download the Minnesota Corporate Resolution Authorizing a Charitable Contribution template.

- If you do not have an account and wish to get started with US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct region/locality.

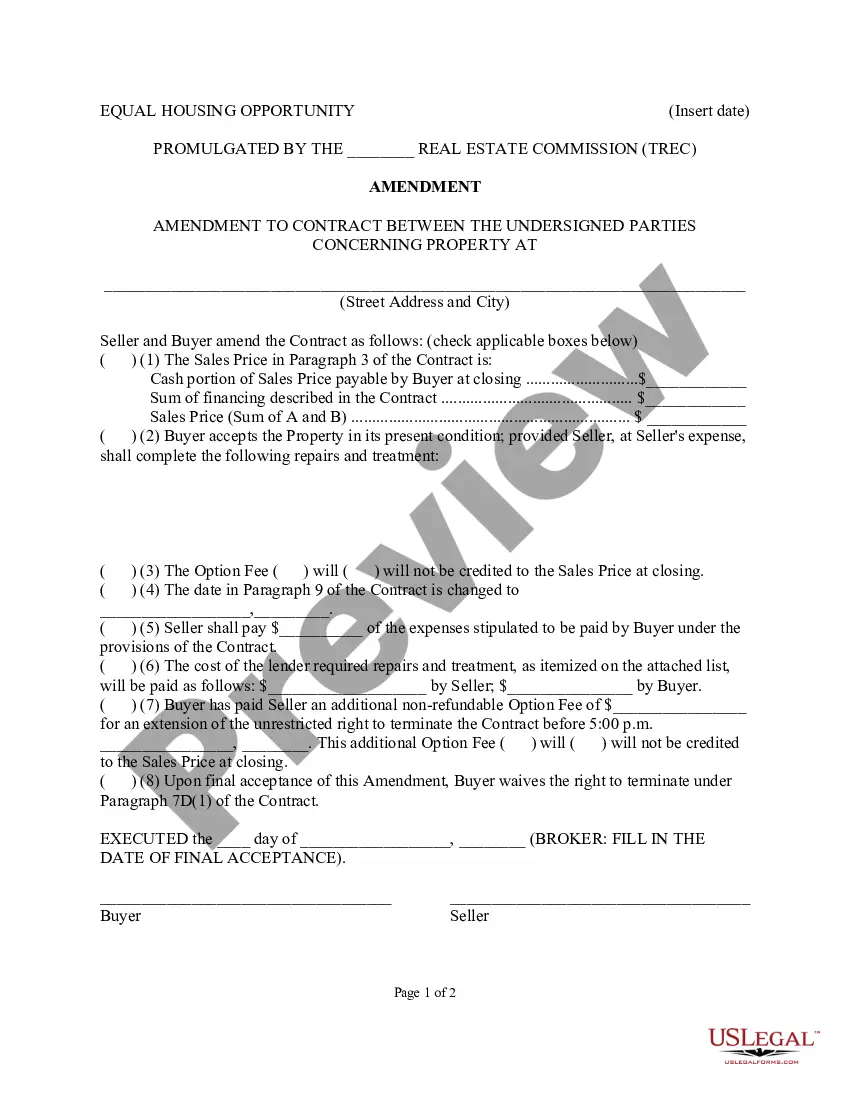

- Utilize the Review option to examine the form.

- Check the description to confirm that you have selected the appropriate document.

- If the form is not what you’re looking for, use the Search field to find the form that suits your needs.

- Once you find the correct form, click on Acquire now.

Form popularity

FAQ

Solicitation becomes illegal when it involves misleading information, coercion, or harassment. When individuals or businesses pressure potential clients or fail to disclose necessary facts, they may cross legal boundaries. To avoid issues during the process of creating a Minnesota Corporate Resolution Authorizing a Charitable Contribution, it’s vital to follow ethical guidelines and ensure transparent communication.

The rules governing professional conduct solicitation in Minnesota ensure that attorneys and other professionals maintain ethical standards when seeking clients. They set guidelines for communication, advertising, and direct contact. When a Minnesota Corporate Resolution Authorizing a Charitable Contribution is prepared, adherence to these rules is crucial for maintaining integrity and trust in legal practices.

Statute 336.2 in Minnesota deals with the Uniform Commercial Code (UCC) and outlines the rules associated with the sale of goods. It provides essential guidelines for agreements, warranties, and delivery of products. Businesses may need to integrate this statute when creating a Minnesota Corporate Resolution Authorizing a Charitable Contribution to ensure compliance with legal sales strategies.

The Romeo and Juliet law in Minnesota provides certain legal protections for young adults who engage in consensual sexual relationships. This law aims to prevent severe penalties for individuals close in age, particularly when one partner is below the age of consent. Understanding this law is important for those who may need to establish a Minnesota Corporate Resolution Authorizing a Charitable Contribution related to youth advocacy organizations.

Yes, you can deduct charitable contributions in Minnesota, provided you meet certain conditions. Donations made to qualified organizations can be deducted from your taxable income, reducing your overall tax liability. Employing a Minnesota Corporate Resolution Authorizing a Charitable Contribution not only formalizes your intent but also supports your eligibility for these deductions. To ensure you maximize your benefits, consult a tax professional for specific advice tailored to your situation.

The Minnesota Charitable Trust Act governs the establishment and management of charitable trusts in the state. This law ensures that contributions given for charitable purposes are used as intended. It is important for organizations looking to make donations using a Minnesota Corporate Resolution Authorizing a Charitable Contribution to understand their responsibilities under this Act. By following the guidelines, you can ensure compliance and promote transparency in your charitable activities.

In Minnesota, the laws for solicitation require nonprofits to register with the Secretary of State, especially if they aim to solicit funds from the public. Compliance with these regulations is essential to avoid legal issues and maintain transparency. Incorporating a Minnesota Corporate Resolution Authorizing a Charitable Contribution can empower your organization to conduct solicitations confidently and within legal guidelines.

Yes, many nonprofits can qualify for tax-exempt status in Minnesota, particularly those recognized under IRS 501(c)(3). This status allows organizations to receive tax-deductible donations, which can significantly boost funding. Leveraging a Minnesota Corporate Resolution Authorizing a Charitable Contribution can help solidify your charitable intentions and support your application for tax exemption.

Nonprofits in Minnesota generate a wide range of income depending on their size and focus. Some organizations may earn a modest revenue through fundraising, grants, and donations, while larger nonprofits can generate substantial income. Understanding financial insights, including the importance of having a Minnesota Corporate Resolution Authorizing a Charitable Contribution, can enhance revenue streams and impact fundraising efforts.

To start a non-profit in Minnesota, you need to create a clear mission statement and incorporate your organization. You will file articles of incorporation with the Minnesota Secretary of State, while also drafting bylaws that govern your organization. Once established, pursuing a Minnesota Corporate Resolution Authorizing a Charitable Contribution can help formalize your funding strategies, guiding your organization towards successful initiatives.