Minnesota Sample Letter for Advertising Rates

Description

How to fill out Sample Letter For Advertising Rates?

You have the capacity to dedicate time online searching for the valid document template that meets both state and federal requirements that you require.

US Legal Forms provides a vast selection of valid forms that are reviewed by experts.

It is easy to obtain or create the Minnesota Sample Letter for Advertising Rates from my service.

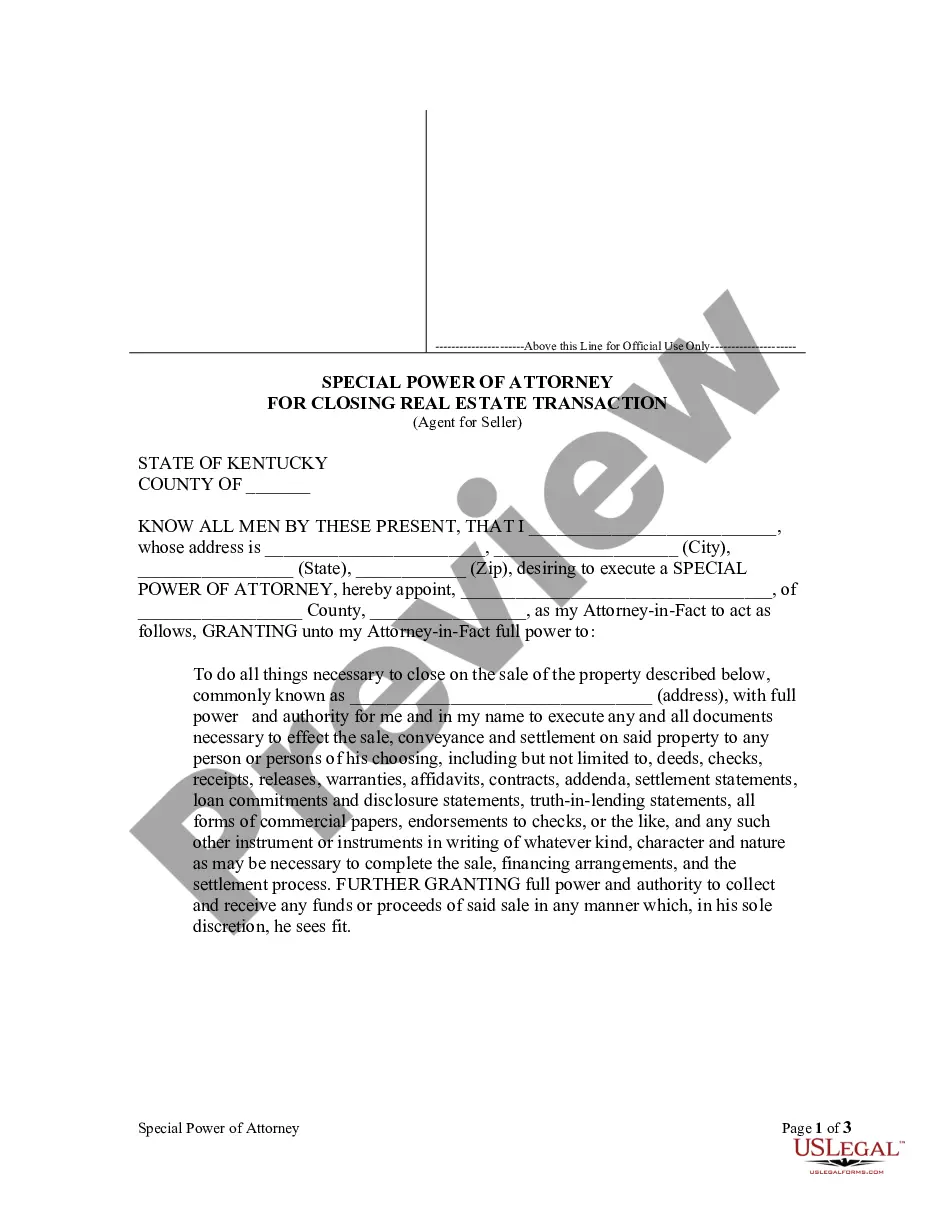

If possible, utilize the Preview button to examine the document template as well.

- If you possess a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the Minnesota Sample Letter for Advertising Rates.

- Every valid document template you acquire is yours permanently.

- To retrieve another copy of a purchased form, navigate to the My documents tab and click the related button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions provided below.

- First, confirm that you have selected the correct document template for your chosen region/town.

- Review the form description to ensure you have selected the appropriate template.

Form popularity

FAQ

Advertising rates are generally determined by various factors, including audience size, placement, and demand. In specific cases, such as those involving Minnesota Sample Letter for Advertising Rates, geographic targeting and industry benchmarks also play a significant role. To get a clearer picture, consider using platforms like uslegalforms, which provide guidance and templates to help you navigate advertising rates effectively.

While $100 can be a start for Facebook ads, it may not cover a comprehensive advertising campaign. The effectiveness largely depends on your target audience and the competition in your niche, especially if you require Minnesota Sample Letter for Advertising Rates. It's important to assess your goals and possibly consider higher budgets to achieve better results over time.

Various items are exempt from Minnesota sales tax, including certain health care items, residential utilities, and some purchases for non-profits. It’s essential to identify these exemptions for effective business planning. If you are drafting communications related to advertising or promotions, a Minnesota Sample Letter for Advertising Rates can help you inform clients about exemptions that may be applicable.

Minnesota’s Nexus rules determine a business's obligation to collect sales tax based on its presence in the state. This could include having physical locations, employees, or even significant sales within Minnesota. Businesses need to be aware of these rules to ensure compliance and avoid penalties. Utilizing tools like a Minnesota Sample Letter for Advertising Rates can help clarify your business obligations and protect your interests.

Calculating sales tax in Minnesota is straightforward. You'll need to identify the applicable sales tax rate, which can vary depending on the location and type of product or service. Once you have this rate, multiply it by your sale amount to arrive at the total sales tax due. Creating a Minnesota Sample Letter for Advertising Rates can also help communicate these calculations more effectively with clients.

Minnesota taxes a variety of services, including but not limited to, telecommunications, landscaping, and even certain repair services. Understanding what's taxable will save you from potential pitfalls when planning your financial strategy. As a business owner, you may want to reference a Minnesota Sample Letter for Advertising Rates to outline taxable services specifically related to your business operations.

In Minnesota, advertising services are generally taxable. This means that if you provide advertising services or materials, you may need to collect sales tax. However, there are specific exemptions based on the type of advertising or the client. Having a clear understanding of these rules can help avoid any unintended tax issues, which may lead you to explore a Minnesota Sample Letter for Advertising Rates for accurate communication.

In Minnesota, certain items and services are exempt from sales tax. Typically, this includes items such as food, clothing, and prescription medications. Additionally, you might find that some purchases for charitable organizations could qualify for tax exemption. If you are unsure, you can check with your advisor who may suggest using a Minnesota Sample Letter for Advertising Rates to clarify tax status.

In Minnesota, advertising services are typically not subject to sales tax. However, tangible goods sold along with advertising, such as printed materials, may incur tax. Businesses should understand the nuances of sales tax regulations to accurately apply charges. Utilizing a Minnesota Sample Letter for Advertising Rates can help clarify these details for your clients.

In Minnesota, postage is generally not subject to sales tax when it is separately stated on the invoice. However, if you include postage as part of a bundled service, it may be taxed. For businesses using a Minnesota Sample Letter for Advertising Rates, it is crucial to itemize postage clearly to avoid tax implications. Always consult with a tax advisor to ensure compliance with state regulations.