Minnesota Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out Guaranty Of Promissory Note By Individual - Corporate Borrower?

US Legal Forms - one of the biggest collections of legal documents in the United States - provides a broad selection of legal paper templates that you can download or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can discover the latest versions of documents such as the Minnesota Guaranty of Promissory Note by Individual - Corporate Borrower in just seconds.

If you already have a subscription, Log In and obtain the Minnesota Guaranty of Promissory Note by Individual - Corporate Borrower from your US Legal Forms repository. The Download button will be visible on every form you view. You have access to all previously saved documents in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the saved Minnesota Guaranty of Promissory Note by Individual - Corporate Borrower.

Every template you added to your account remains without an expiration date and is yours permanently. Therefore, if you wish to download or produce another copy, simply navigate to the My documents area and click on the form you need.

Access the Minnesota Guaranty of Promissory Note by Individual - Corporate Borrower with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast number of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your region/county.

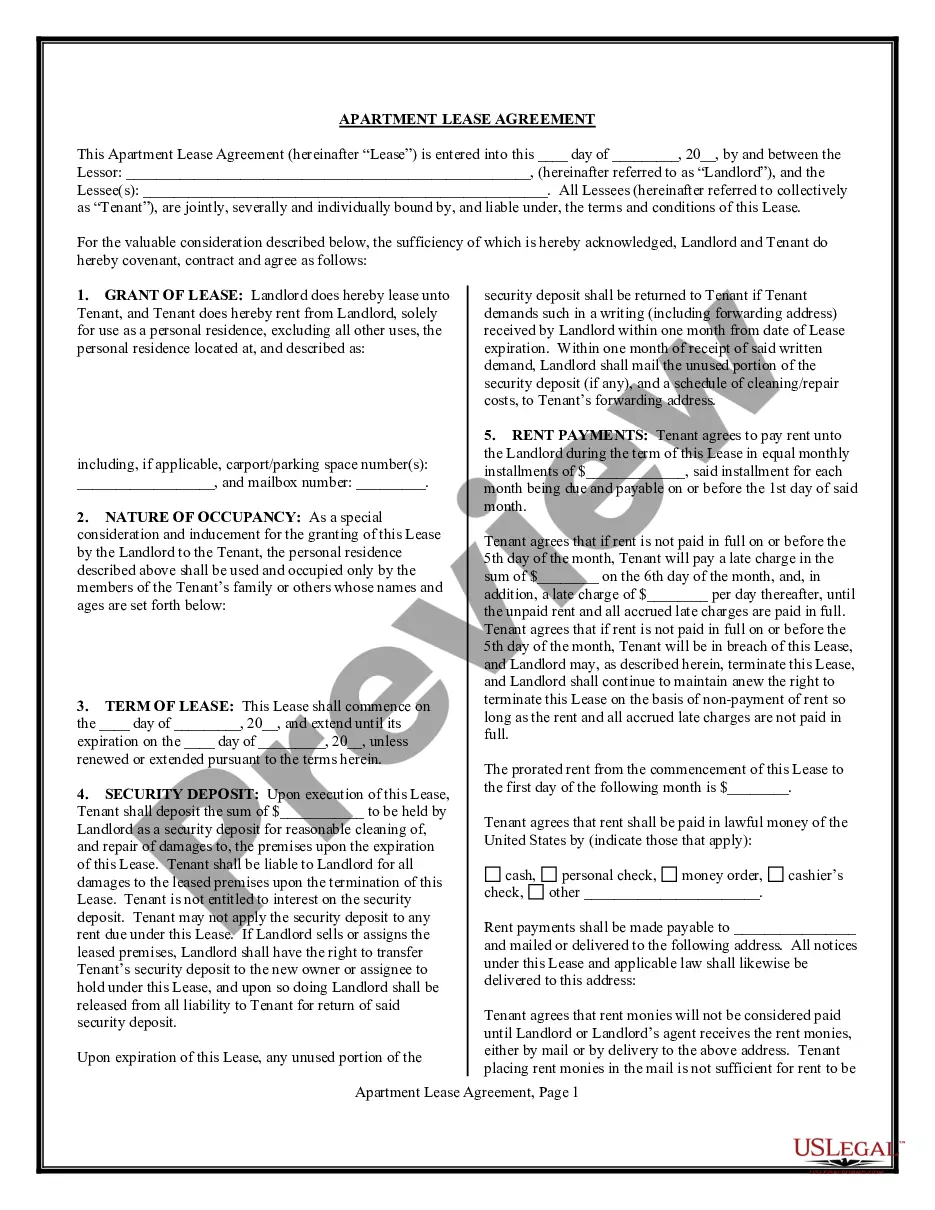

- Click on the Preview button to review the content of the form.

- Consult the form description to confirm you have chosen the appropriate form.

- If the form does not meet your needs, utilize the Lookup field at the top of the screen to find the suitable one.

- Once satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the pricing plan you prefer and provide your information to register for an account.

Form popularity

FAQ

Guaranteed promissory note means a written contract obligating a recipient to repay the funds received if the recipient does not fulfill the service obligation, which was a condition of the recipient's scholarship, or grant award.

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

Guarantee Obligation as to any Person (the guaranteeing person), any obligation, including a reimbursement, counterindemnity or similar obligation, of the guaranteeing Person that guarantees or in effect guarantees, or which is given to induce the creation of a separate obligation by another Person (including any

There is no legal requirement for promissory notes to be notarized in Minnesota. Still, the parties may decide to have the document certified by a notary public for protection in the event of a lawsuit.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

A promissory note is a legal document signed by a debtor who promises to pay a debt in a form and manner as described in the document. A personal guaranty, as defined at businessdictionary.com, is an agreement that makes one liable for one's own or a third party's debts or obligations.

The person or entity that guarantees the borrower's debt is called a guarantor. A guarantor is one whose promise 'is collateral to a primary or principal obligation on the part of another and which binds the obligor to performance in the event of nonperformance by such other, the latter being bound to perform

A Promissory note is essentially an unconditional written promise to repay a loan or other debts, at a fixed or determinable future date. Although it is legally enforceable, a promissory note is less formal than a loan agreement and is suitable where smaller sums of money are involved.

A bank can issue a promissory note, but so can an individual or a company or business. Anyone who lends money can do so. A promissory note isn't a contract, but you'll likely have to sign one before you take out a mortgage.

The Benefits of a Personal GuaranteeThe asset (promissory note) is protected by the collateral (the guarantor's promise to pay, and the ability to sue the guarantor personally for noncompliance with the terms of the promissory note). As with any collateral, a personal guarantee gives the asset more security.