Minnesota Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

If you require thorough, obtain, or create valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to access the Minnesota Accounts Receivable - Guaranty with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Minnesota Accounts Receivable - Guaranty with US Legal Forms. There are countless professional and state-specific forms you can utilize for your personal or business needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Minnesota Accounts Receivable - Guaranty.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

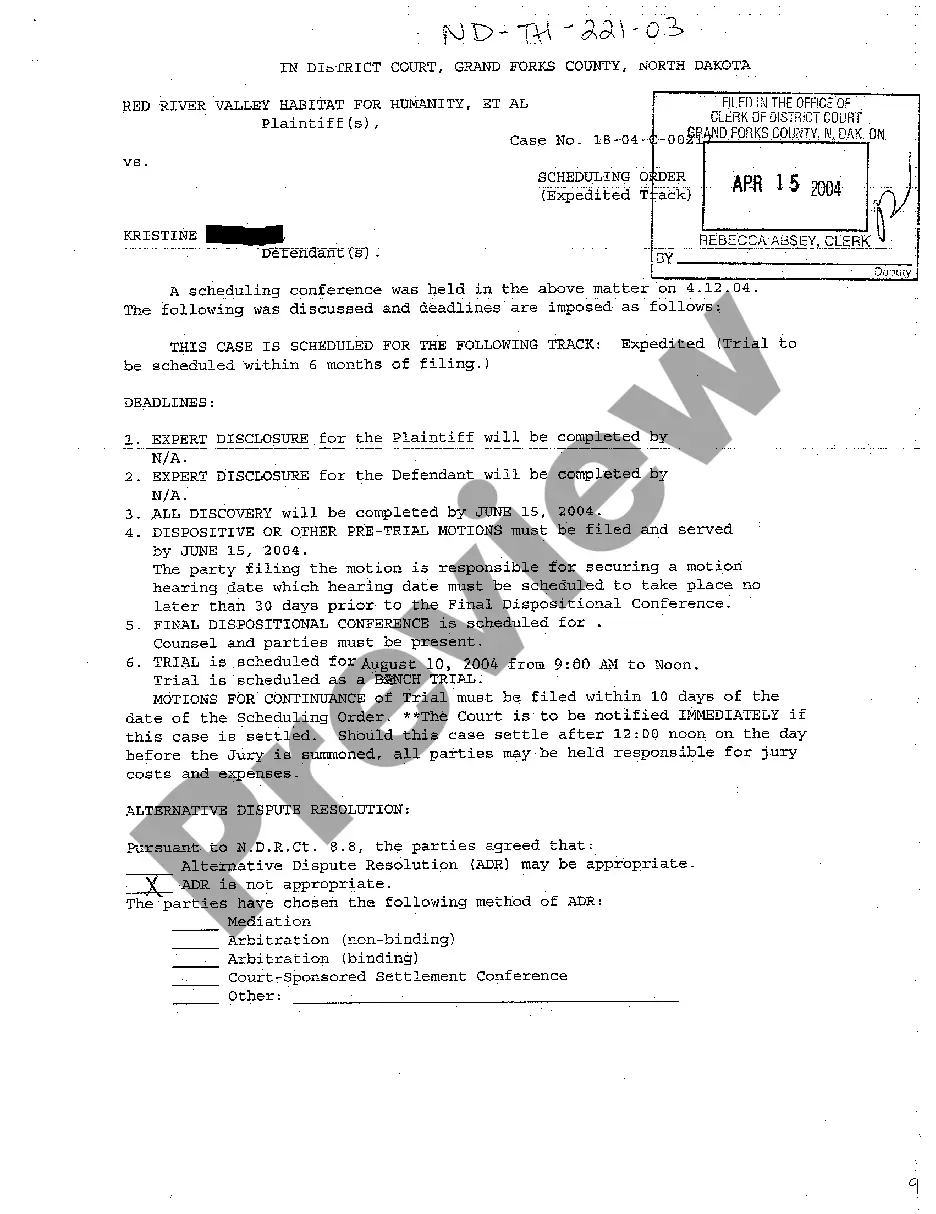

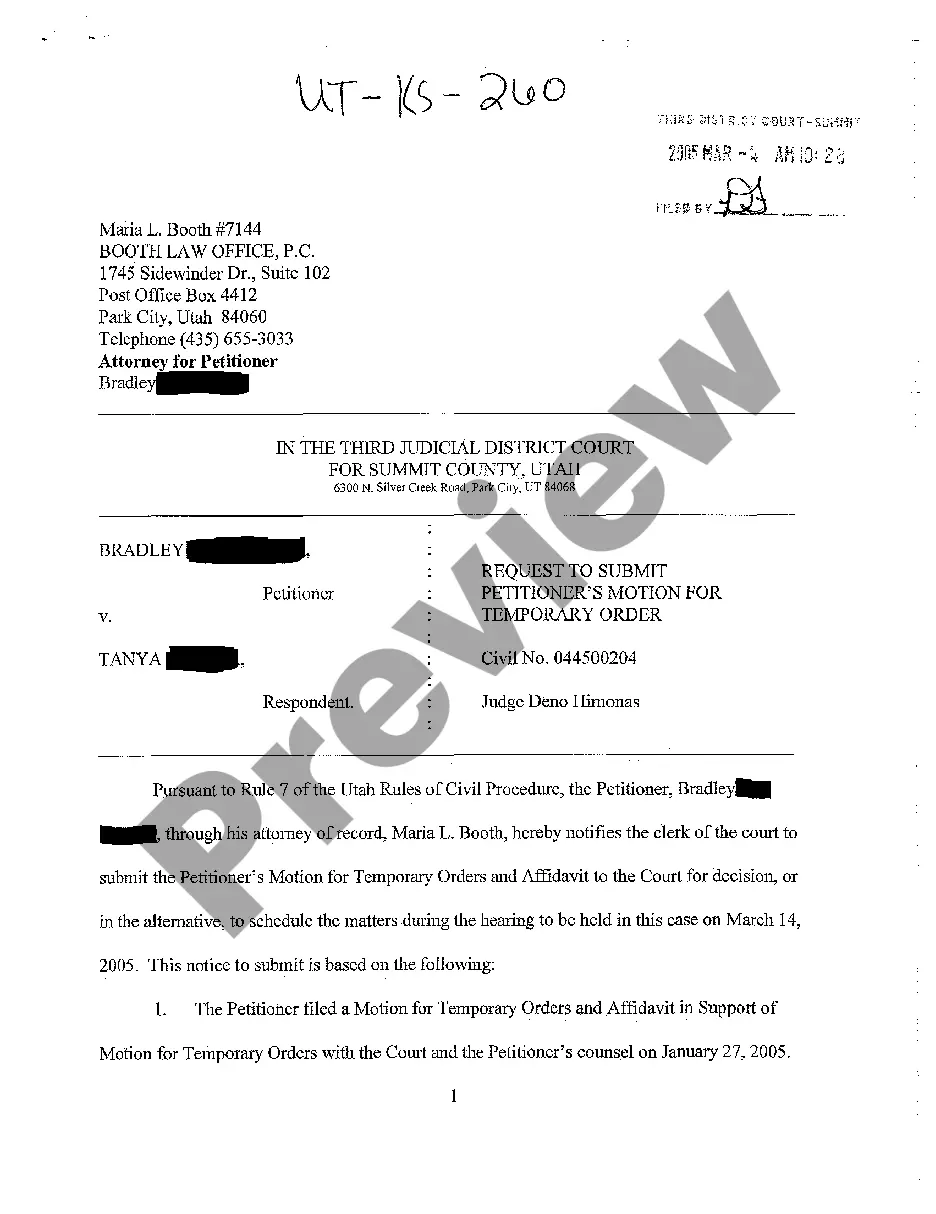

- Step 1. Ensure you have chosen the form for your specific region/state.

- Step 2. Use the Review option to check the form’s details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have located the form you need, click the Download now button. Select your preferred pricing plan and provide your credentials to register for an account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Minnesota Accounts Receivable - Guaranty.

Form popularity

FAQ

The accounts receivable coverage form provides protection for your business against losses related to unpaid invoices. This coverage includes losses from damaged or destroyed accounts receivable records, as well as protection against the inability to collect on sales due to various risks. By investing in Minnesota Accounts Receivable - Guaranty, you ensure that your business maintains financial stability even when faced with unforeseen challenges. This form is essential for any company looking to safeguard its revenue stream.

Filing a UCC requires you to gather the essential information related to your Minnesota Accounts Receivable - Guaranty. After preparing the UCC forms, you can submit them through the appropriate filing channel, such as online or via mail. Services like US Legal Forms can assist you in this process by offering clear instructions and access to required documents.

To file a UCC in Minnesota, you first need to prepare the necessary documents that detail your Minnesota Accounts Receivable - Guaranty. After completing the forms, you can file them either online or by mail with the Minnesota Secretary of State's office. Utilizing platforms like US Legal Forms can simplify this process, providing you with the right forms and guidance to ensure compliance.

Yes, you can file a UCC online to secure your Minnesota Accounts Receivable - Guaranty. Many states, including Minnesota, offer online platforms for filing, making the process convenient and efficient. By using services like US Legal Forms, you can easily navigate the online filing system and ensure that your documents are properly submitted.

Accounts receivable (AR) are the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Accounts receivable are listed on the balance sheet as a current asset. Any amount of money owed by customers for purchases made on credit is AR.

What is accounts receivable insurance? Accounts receivable insurance?which is also referred to as Trade Credit Insurance?protects a company's valuable accounts receivable assets from risks of a political and commercial nature that are beyond an organization's ability to control.

The cost of accounts receivable insurance largely depends on your business's total sales. Accounts receivable insurance premiums are often around $1 to $1.50 per $1,000 of sales. So, a small business that does $700,000 in sales per year can expect to pay at least $700 per year for coverage.

Accounts receivable (AR) are funds the company expects to receive from customers and partners. AR is listed as a current asset on the balance sheet. Lenders and potential investors look at AP and AR to gauge a company's financial health.

Credit insurance guarantees a lender will be repaid if a borrower is unable to pay his or her debt due to, for example, death or disability. Although credit insurance is solely for the benefit of the lender, it is purchased and paid for by the borrower.

What is accounts receivable insurance? Accounts receivable insurance?which is also referred to as Trade Credit Insurance?protects a company's valuable accounts receivable assets from risks of a political and commercial nature that are beyond an organization's ability to control.