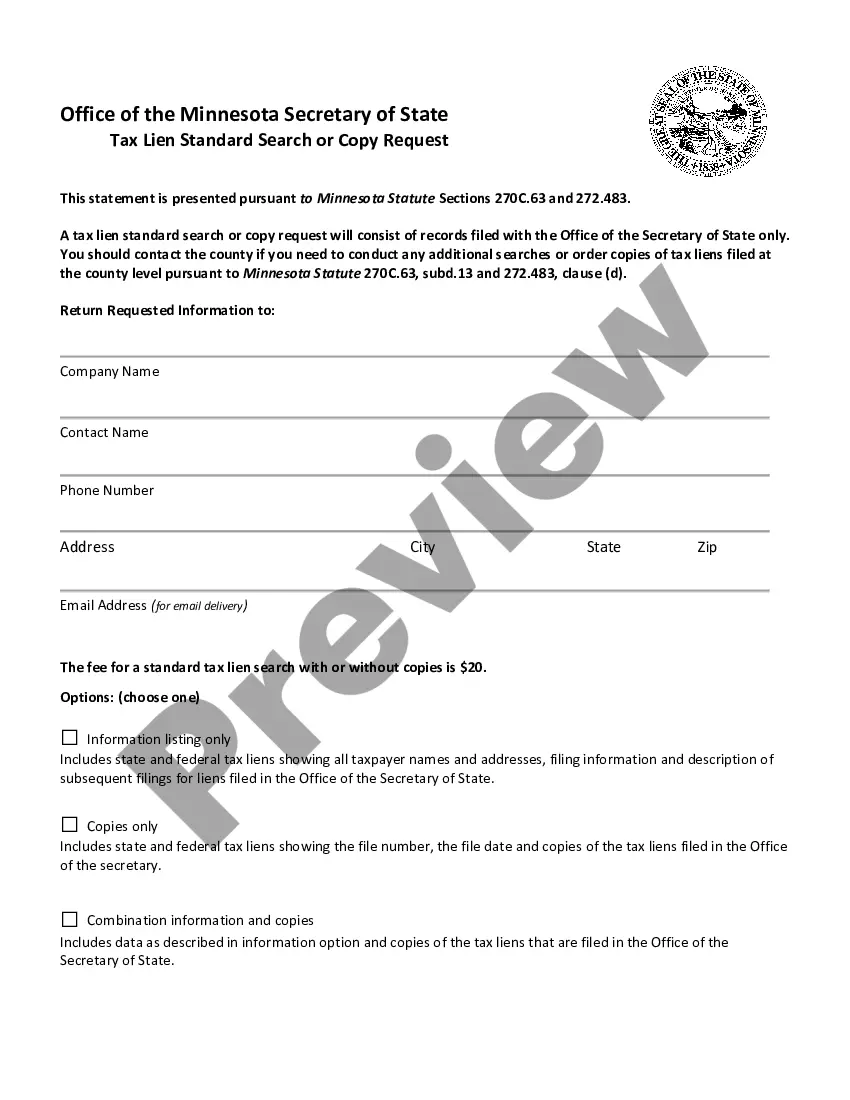

The Minnesota Tax Lien Standard Search or Copy Request Form is a document that must be completed and signed by an individual or entity requesting access to Minnesota's Tax Lien Records. The form requires the requester to provide their name, address, phone number, email address and the purpose of their request. There are two types of Minnesota Tax Lien Standard Search or Copy Request Form: 1. Minnesota Tax Lien Standard Search Request Form: This form is used by individuals or entities to search for tax liens that have been filed against a given property. The requester must provide the address of the property they are searching, as well as the date range of the search and the search type (i.e. all liens, liens with a certain status, etc.). 2. Minnesota Tax Lien Copy Request Form: This form is used by individuals or entities to request copies of tax liens that have been filed against a given property. The requester must provide the address of the property they are searching, as well as the date range of the search and the type of documents they are requesting. The requester can also specify whether they would like to receive the documents in a digital or hard copy format.

Minnesota Tax Lien Standard Search or Copy Request Form

Description

How to fill out Minnesota Tax Lien Standard Search Or Copy Request Form?

Preparing official paperwork can be a real burden if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you find, as all of them comply with federal and state regulations and are verified by our experts. So if you need to prepare Minnesota Tax Lien Standard Search or Copy Request Form, our service is the perfect place to download it.

Obtaining your Minnesota Tax Lien Standard Search or Copy Request Form from our catalog is as easy as ABC. Previously registered users with a valid subscription need only log in and click the Download button after they find the correct template. Later, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a brief instruction for you:

- Document compliance check. You should attentively examine the content of the form you want and make sure whether it suits your needs and fulfills your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab above until you find an appropriate template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your Minnesota Tax Lien Standard Search or Copy Request Form and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic version faster and more effectively.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

The tax lien removal form is a document that allows property owners to request the removal of a tax lien from their property. This form is crucial for clearing any outstanding tax obligations and restoring your property's title. By using the Minnesota Tax Lien Standard Search or Copy Request Form, you can easily access the information needed to complete the tax lien removal process. Make sure to submit your request to the appropriate county office to expedite the removal.

To file a property lien in Minnesota, you must complete the necessary forms and submit them to the appropriate county office. Begin by gathering the required information about the property and the lien. You can use the Minnesota Tax Lien Standard Search or Copy Request Form to ensure you have all the details you need. Once completed, file the form with your county recorder or registrar of titles.

In Minnesota, the lien process typically starts with the filing of a lien statement with the appropriate county office. This process ensures that the lien is publicly recorded, giving notice to potential buyers or creditors. For a thorough understanding and access to necessary forms, including the Minnesota Tax Lien Standard Search or Copy Request Form, you can rely on US Legal Forms to guide you through every step.

To conduct a UCC lien search in Minnesota, you can visit the Secretary of State’s website, which provides searchable databases of UCC filings. Alternatively, using US Legal Forms can simplify your search process, where you can access the Minnesota Tax Lien Standard Search or Copy Request Form, facilitating your inquiries into existing liens on property.

You can obtain Minnesota state tax forms directly from the Minnesota Department of Revenue's website. They offer a comprehensive selection of forms for various tax needs, including income, sales, and property taxes. For a more streamlined process, consider using US Legal Forms, where you can easily find the Minnesota Tax Lien Standard Search or Copy Request Form and other essential documents.

To request a lien discharge in Minnesota, you typically use Form M-1, which is the Minnesota Individual Income Tax Return. This form allows you to address any outstanding tax liabilities and initiate the discharge process. For convenience, you can also find the Minnesota Tax Lien Standard Search or Copy Request Form on platforms like USLegalForms to assist you in managing your tax obligations.

You can find Minnesota tax forms on the official Minnesota Department of Revenue website. Additionally, various online platforms, like USLegalForms, provide easy access to a wide range of tax forms, including the Minnesota Tax Lien Standard Search or Copy Request Form. These resources help you quickly locate the specific forms you need for tax-related processes.