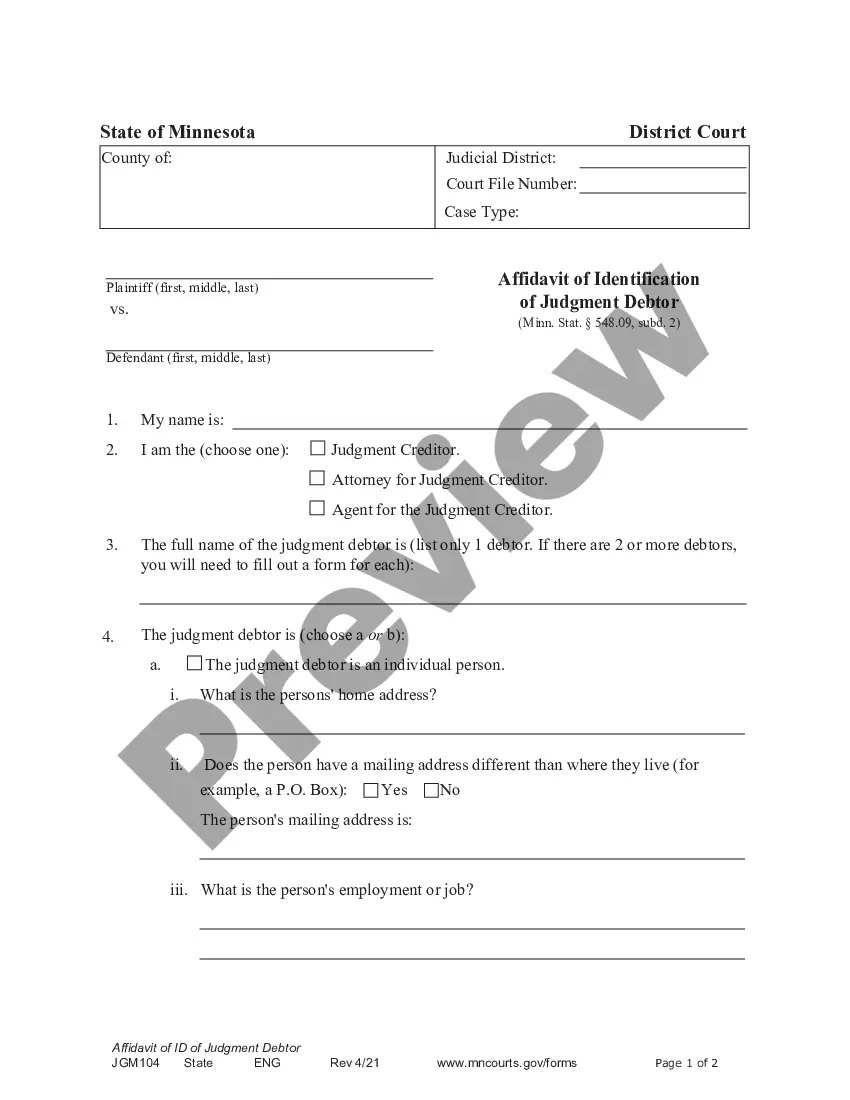

The Minnesota Affidavit For Identification of Debtor is a document used by creditors to verify the identity of an individual debtor in cases of debt collection. The document is an affidavit that the debtor must sign, verifying their name, address, phone number, and date of birth. The affidavit is used to establish the debtor’s identity and ensure the creditor is dealing with the correct individual. There are two types of Minnesota Affidavit For Identification of Debtor: 1. Minnesota Affidavit for Identification of Debtor for Personal Debt: This affidavit is used by creditors when collecting debts from an individual debtor. 2. Minnesota Affidavit for Identification of Debtor for Business Debt: This affidavit is used by creditors when collecting debts from a business debtor.

Minnesota Affidavit For Identification of Debtor

Description

How to fill out Minnesota Affidavit For Identification Of Debtor?

If you’re looking for a method to correctly prepare the Minnesota Affidavit For Identification of Debtor without engaging a lawyer, then you’re in the perfect place.

US Legal Forms has established itself as the most comprehensive and trustworthy collection of official templates for every individual and business scenario. Every document you find on our online platform is crafted in accordance with national and state laws, ensuring that your paperwork is accurate.

Another excellent feature of US Legal Forms is that you will never lose the documents you obtained - you can access any of your downloaded forms in the My documents section of your profile whenever you need them.

- Confirm that the document displayed on the page aligns with your legal circumstances and state laws by reviewing its text description or utilizing the Preview mode.

- Enter the form title in the Search tab at the top of the page and select your state from the list to discover another template in case of any discrepancies.

- Repeat the content verification and click Buy now when you are certain that the paperwork meets all requirements.

- Log in to your account and click Download. Create an account with the service and select a subscription plan if you do not already have one.

- Use your credit card or the PayPal option to pay for your US Legal Forms subscription. The document will be ready for download immediately after.

- Choose the format in which you wish to receive your Minnesota Affidavit For Identification of Debtor and download it by clicking the appropriate button.

- Add your template to an online editor for quick completion and signing or print it out to prepare your physical copy manually.

Form popularity

FAQ

An affidavit of identity and survivorship in Minnesota serves to confirm the identity of a deceased person and the rights of their survivors. This document can simplify the transfer of assets without going through probate, making it an essential tool for heirs. By utilizing the Minnesota Affidavit For Identification of Debtor, you can help ensure a smooth transition of ownership, thus protecting the interests of the beneficiaries involved. Understanding this affidavit can provide peace of mind during a difficult time.

Filling out an affidavit of service form requires clear and accurate information. First, identify the parties involved, including the name and address of the person being served. Next, provide details of the service, such as the date, time, and method used. Finally, ensure that you sign the form, as this confirms the authenticity of your service, making it a crucial step in the process associated with the Minnesota Affidavit For Identification of Debtor.

Yes, in Minnesota, an affidavit must be notarized to be considered valid. This requirement applies to the Minnesota Affidavit For Identification of Debtor, as notarization adds a layer of authenticity and legal weight to the document. Notarized affidavits are often necessary when presenting them to courts or other entities. US Legal Forms can assist you in preparing the affidavit correctly, ensuring you meet all legal requirements.

In Minnesota, the order for disclosure involves a systematic process where creditors are informed about the estate's assets. The Minnesota Affidavit For Identification of Debtor plays a crucial role in this process by identifying all relevant debts and assets of the debtor. It is essential to follow the order outlined by Minnesota law to ensure all parties are treated fairly. For more detailed guidance, consider using resources from US Legal Forms.

To file a small estate affidavit in Minnesota, you must first complete the Minnesota Affidavit For Identification of Debtor form. Make sure you gather all necessary documentation, such as proof of the deceased's assets and debts. Once the form is filled out, submit it to the probate court in the county where the deceased lived. Using a reliable online platform like US Legal Forms can simplify this process, ensuring you have the correct documents and guidance.

The statute of limitations for bringing a lawsuit for breach of contract under Minnesota law is six (6) years. This means that a creditor or debt collector can sue you anytime within six (6) years from the date of your last purchase or last payment, whichever was later.

How long does a judgment last? Judgments last for ten years and then can be renewed for another ten years. There is no limit to how many times a judgment can be renewed as long as the creditor takes the appropriate steps every ten years. So a judgment against you will potentially last forever.

Step 1: Docket the judgment.Step 2: Request an Order for Disclosure.Step 3: Request an Order to Show Cause.Step 4: Send the judgment debtor notice that you plan to start collecting.Step 5: Request a Writ of Execution from court administration.Step 6: Take the paperwork to the sheriff's office.

A district court issues a writ of execution directing the sheriff to satisfy a judgment: The creditor must identify and locate the debtor's assets. The sheriff can levy upon or seize those assets to satisfy the judgment. The Hennepin County sheriff can only collect on assets located in Hennepin County.

Writs of Execution are orders issued by district court directing the sheriff to satisfy a judgment. They must be directed to the Sheriff of the county in which the assets to satisfy the judgment are located and they may be for personal or real property.