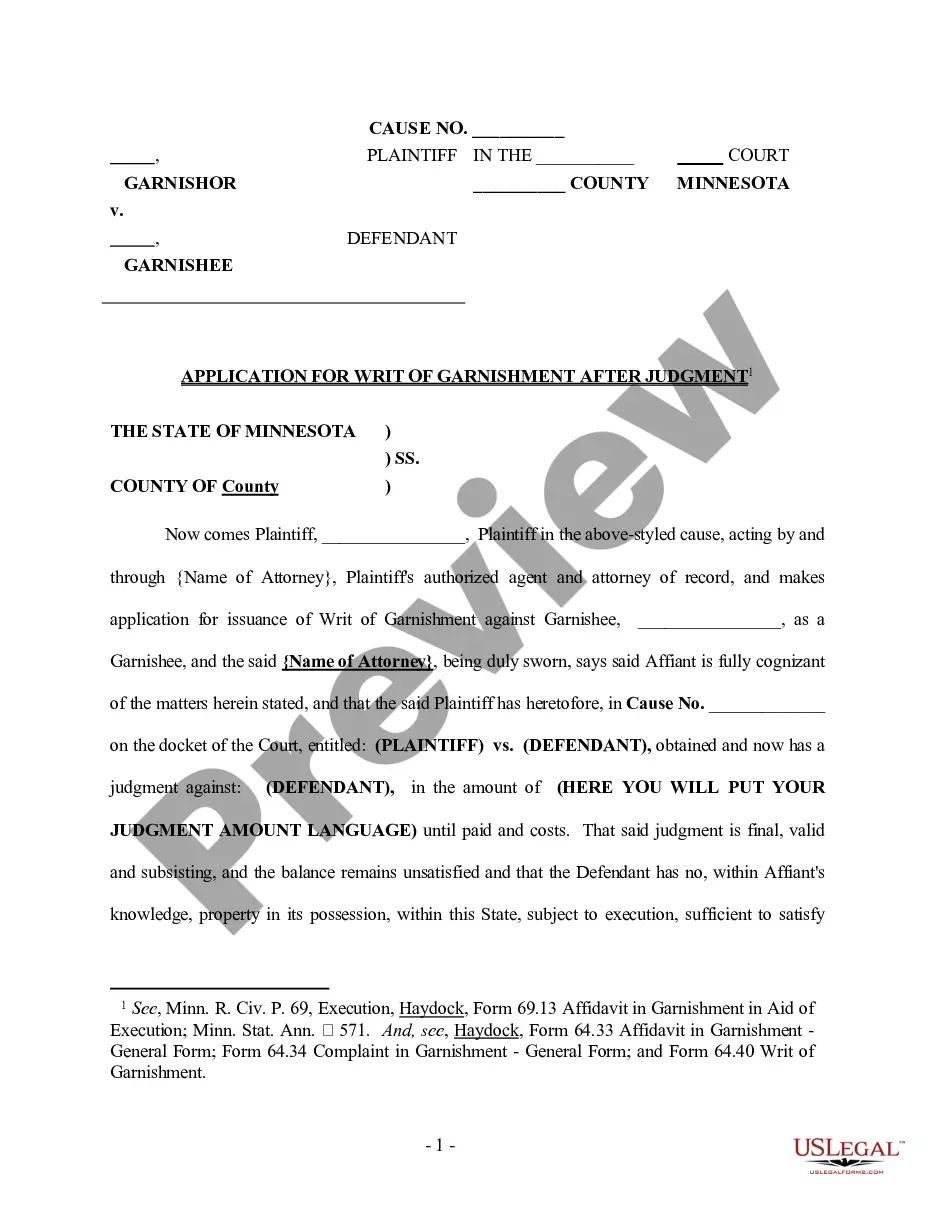

Minnesota Attorney Affidavit for Writ of Garnishment

Description

How to fill out Minnesota Attorney Affidavit For Writ Of Garnishment?

Have any template from 85,000 legal documents including Minnesota Attorney Affidavit for Writ of Garnishment online with US Legal Forms. Every template is prepared and updated by state-certified attorneys.

If you have already a subscription, log in. When you’re on the form’s page, click the Download button and go to My Forms to get access to it.

In case you have not subscribed yet, follow the steps below:

- Check the state-specific requirements for the Minnesota Attorney Affidavit for Writ of Garnishment you would like to use.

- Read description and preview the sample.

- As soon as you are sure the template is what you need, just click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay in a single of two appropriate ways: by card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- After your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have quick access to the right downloadable template. The platform gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Minnesota Attorney Affidavit for Writ of Garnishment easy and fast.

Form popularity

FAQ

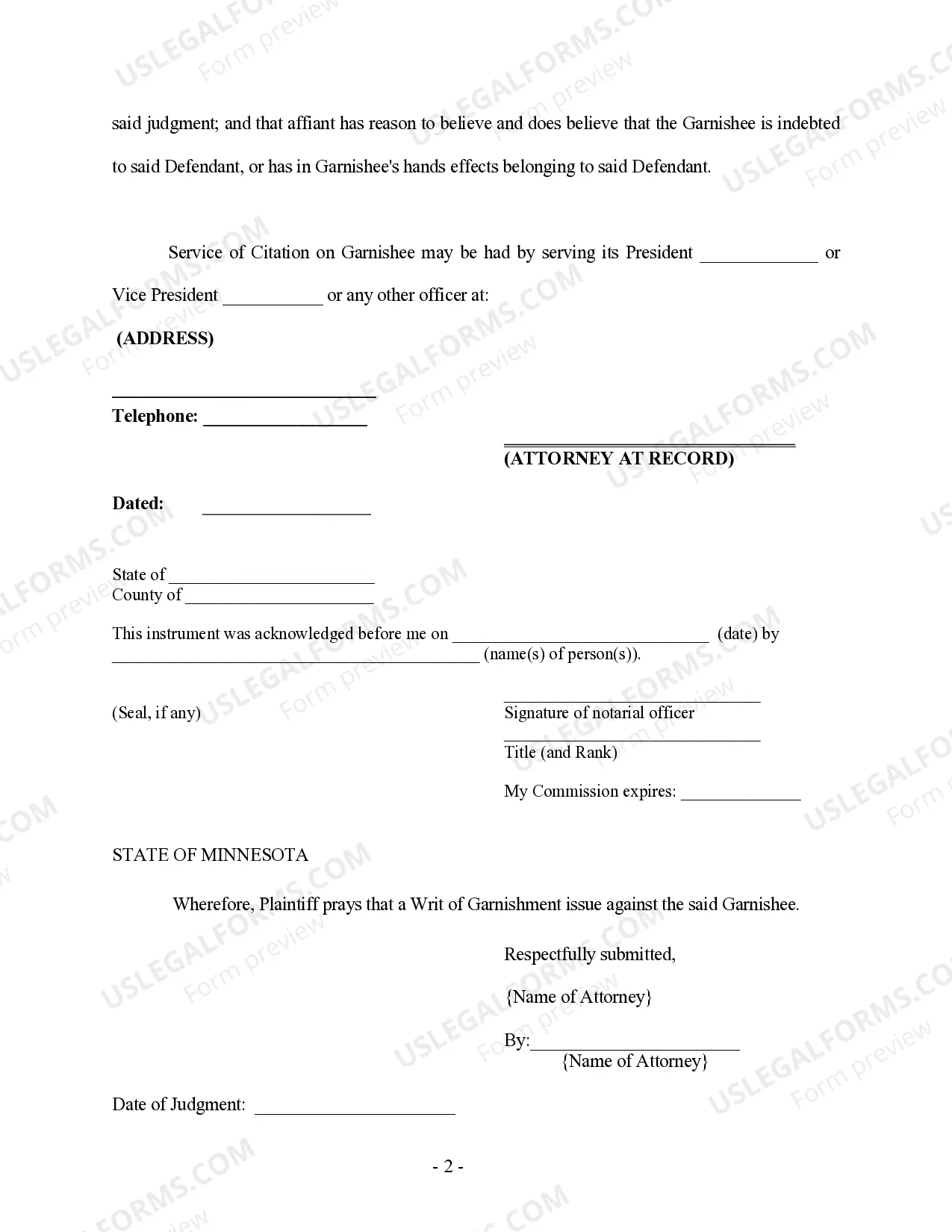

Yes, in Minnesota, an affidavit generally must be notarized to be valid. This requirement applies to the Minnesota Attorney Affidavit for Writ of Garnishment as well. Notarization ensures that the affidavit is executed properly and adds a layer of authenticity to the document. It is advisable to consult with a legal expert or utilize platforms like US Legal Forms to ensure all paperwork meets legal standards.

In Minnesota, wage garnishment typically requires a court order and a completed Minnesota Attorney Affidavit for Writ of Garnishment. The law limits the amount that can be garnished to 25% of disposable earnings or the amount by which weekly earnings exceed 40 times the federal minimum wage, whichever is less. Additionally, certain types of income, like Social Security and unemployment benefits, are exempt from garnishment. Understanding these rules can help you navigate the garnishment process effectively.

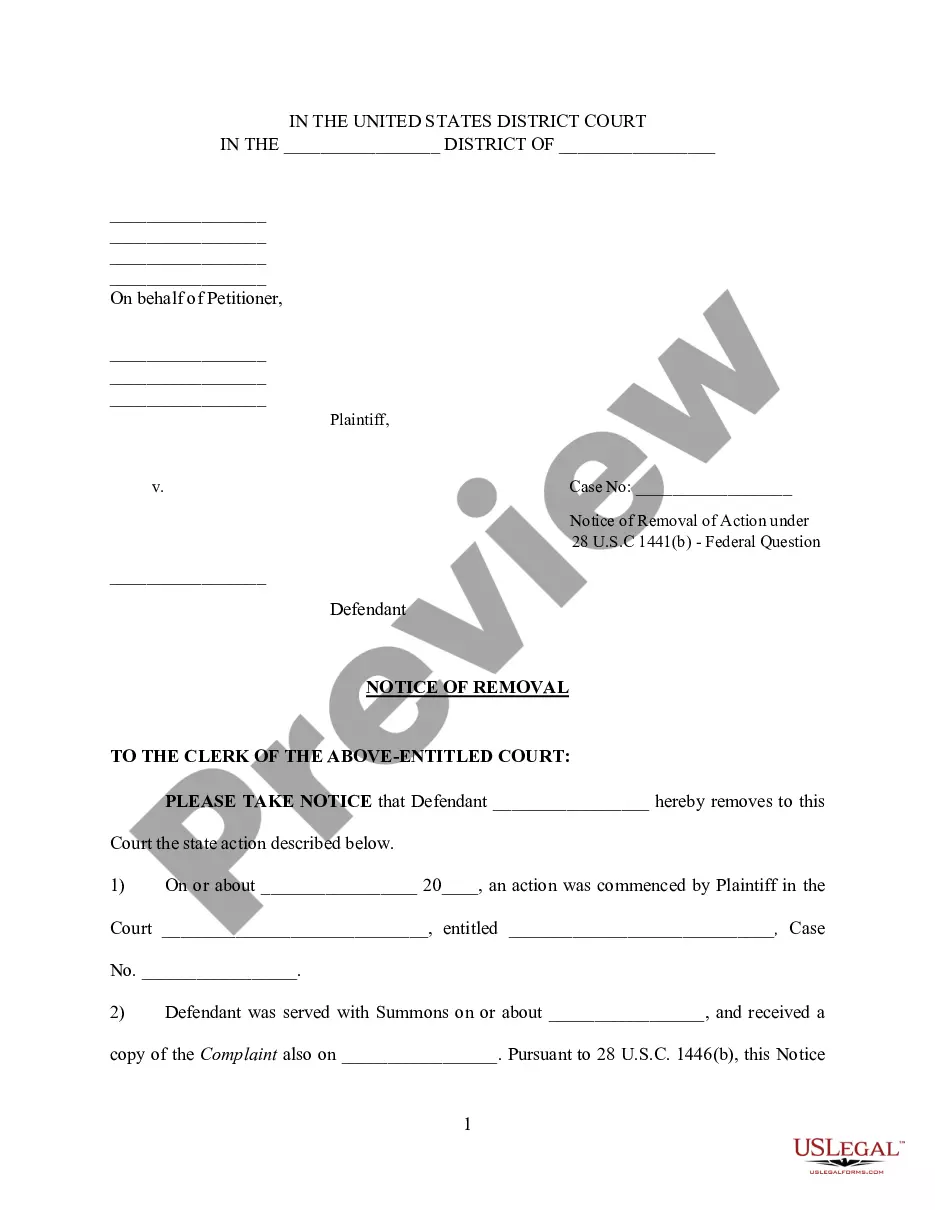

Garnishment is a proceeding by a creditor (a person or entity to whom money is owed) to collect a debt by taking the property or assets of a debtor (a person who owes money). Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order to pay a creditor.

In most states, employers answer a writ of garnishment by filling out the paperwork attached to the judgment and returning it to the creditor or the creditor's attorney.

Step 1: Serve Notice of Garnishment. You must serve the debtor with a Garnishment Exemption Notice and Notice of Intent to Garnish Earnings Within 10 Days upon the debtor at least 10 days before attempting to garnish wages. Step 2: Garnishment Summons and Disclosure Form. Step 3: More Notice of Garnishment to the Debtor.

If you have found the judgment debtor's assets such as an active bank account or employment, collection can be made by a levy on the bank account or garnishment of wages. This is done by obtaining a Writ of Execution from the Court for a fee of $55.00.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

How to Protect Your Wages From Garnishment. If you receive a notice of a wage garnishment order, you might be able to protect or "exempt" some or all of your wages by filing an exemption claim with the court or raising an objection.