Minnesota Boarding Stable Agreement - Horse Equine Forms

Description

How to fill out Minnesota Boarding Stable Agreement - Horse Equine Forms?

Obtain any template from 85,000 legal records such as Minnesota Boarding Stable Agreement - Horse Equine Forms online with US Legal Forms. Each template is crafted and refreshed by state-authorized attorneys.

If you already possess a subscription, Log In. Once you are on the form’s page, click the Download button and proceed to My documents to access it.

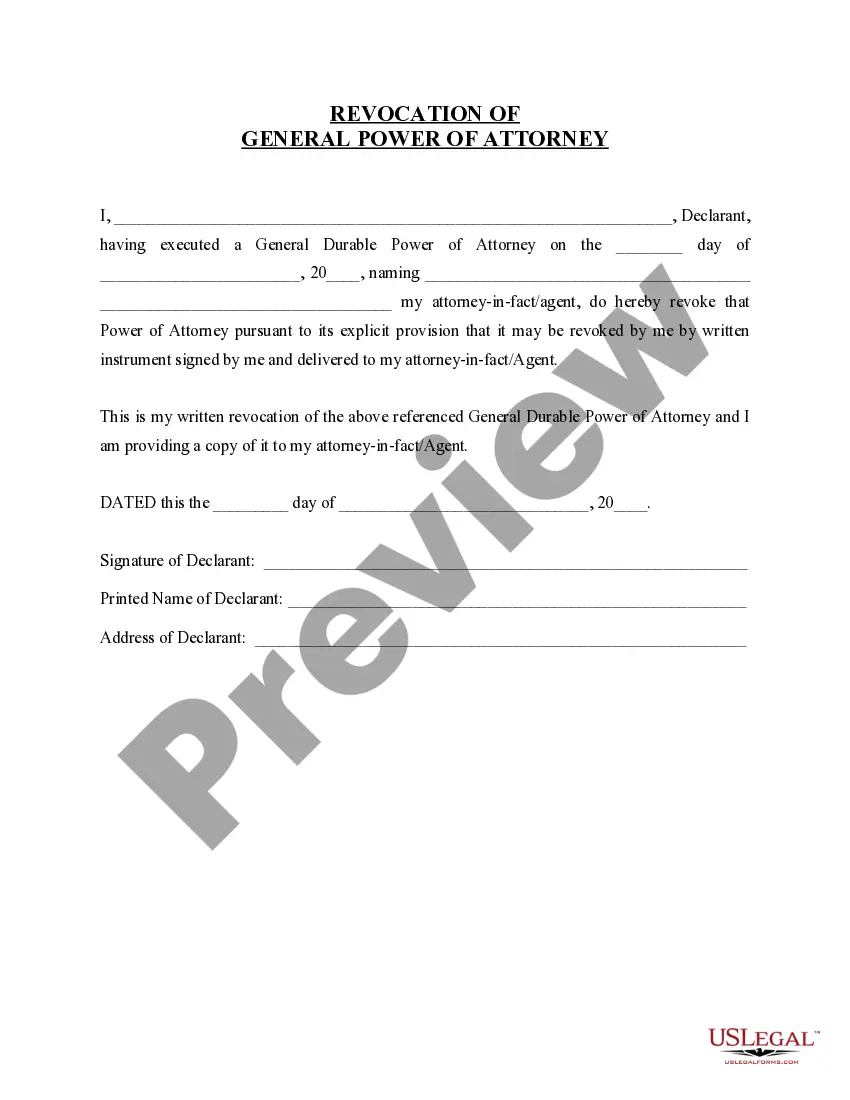

If you have yet to subscribe, follow the steps below: Check the state-specific criteria for the Minnesota Boarding Stable Agreement - Horse Equine Forms you wish to utilize. Review the description and preview the sample. When you are confident the sample meets your needs, click Buy Now. Choose a subscription plan that fits your budget. Create a personal account. Make payment in one of two suitable methods: by credit card or through PayPal. Choose a format to download the document in; two options are available (PDF or Word). Download the document to the My documents section. When your reusable form is prepared, print it out or save it to your device.

- With US Legal Forms, you will consistently have prompt access to the appropriate downloadable template.

- The platform grants you access to documents and categorizes them to facilitate your search.

- Utilize US Legal Forms to acquire your Minnesota Boarding Stable Agreement - Horse Equine Forms swiftly and effortlessly.

Form popularity

FAQ

In Minnesota, the general guideline is to have at least one to two acres of land per horse for adequate space and grazing. This amount allows for proper management of the horse's health and well-being, as well as the maintenance of the land. However, keep in mind that factors such as the quality of the pasture and the horse's activity level can affect these needs. For those looking to formalize their horse boarding arrangements, a Minnesota Boarding Stable Agreement - Horse Equine Forms can provide valuable insights into managing space and resources effectively.

To write a horse boarding contract, start by clearly defining the terms of the agreement, including services provided, fees, payment schedules, and duration. You should detail the responsibilities of both the horse owner and the stable owner, ensuring all aspects are covered. Utilizing a Minnesota Boarding Stable Agreement - Horse Equine Forms can streamline this process, as it contains essential clauses and provisions tailored for your needs. This form not only simplifies the drafting process but also helps protect both parties by outlining their rights and responsibilities.

When you earn income from horse boarding, it is essential to report this income on your tax return. Typically, you will need to report it as self-employment income, especially if you operate a boarding stable as a business. To ensure you comply with tax regulations, consider using the Minnesota Boarding Stable Agreement - Horse Equine Forms available on the US Legal Forms platform. This resource can help streamline your documentation and provide clarity on your obligations.

Self-care board is what it sounds like: housing your horse at someone else's facility but feeding and managing him yourself.

Housing. If you don't own enough land to support a horse, boarding at a barn or stable is the next best option. A horse is assigned a stall and you're given access to trails, a pasture or arena. The cost of boarding averages $400 to $500 per month but can go as high as $1,200 to $2,500 in metropolitan areas.

In this day and age of law suits and precarious economies the right boarding agreement can offer you substantial support and protection. Horse owner has signed and agrees to require each of his or her guests to sign a LIABILITY RELEASE (exhibit "A").

In most stables, each horse is kept in a box or stall of its own. These are of two principal types: Boxes allowing freedom of movement Horses are able to turn around, choose which way to face and lie down if they wish. These can also be known as a loose box (BrE), a stable (BrE), a stall (AmE) or box stall (AmE).