This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the standard lease form.

Michigan Shut-In Oil Royalty

Description

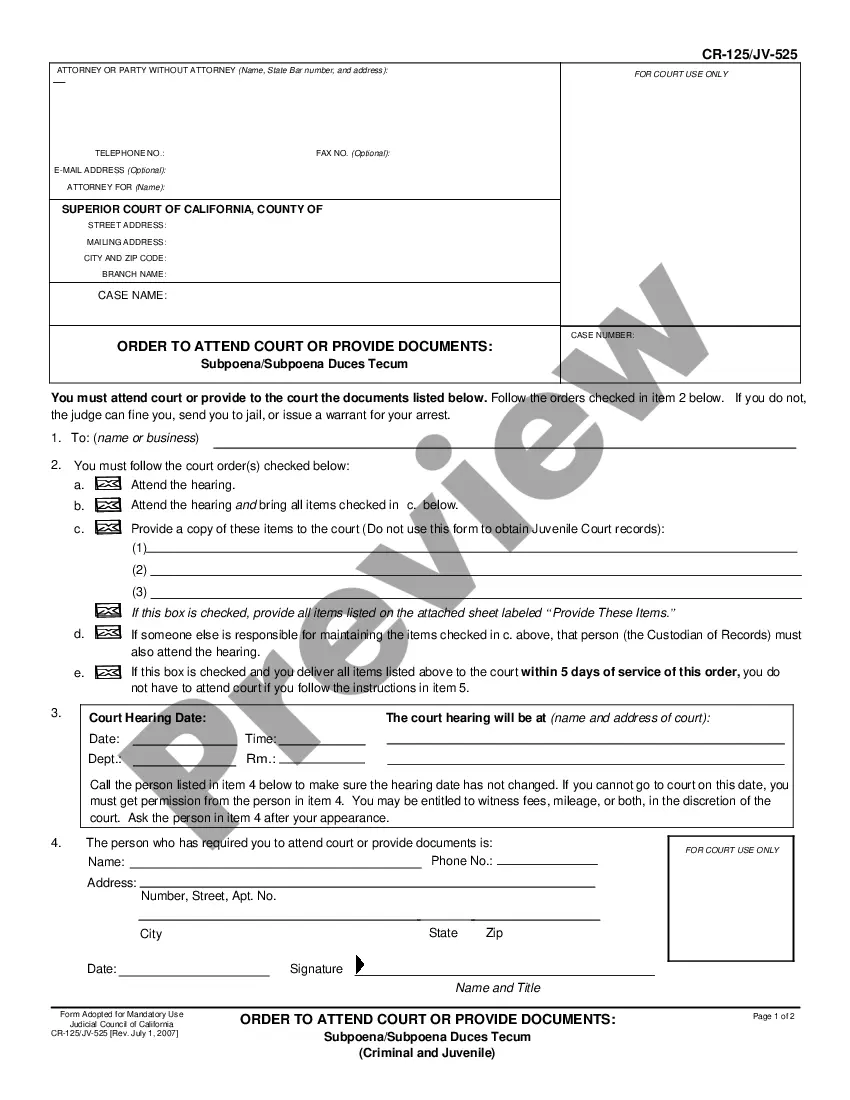

How to fill out Shut-In Oil Royalty?

You may devote hours on the Internet searching for the legal document template which fits the federal and state demands you will need. US Legal Forms provides a large number of legal forms which can be evaluated by experts. It is possible to download or printing the Michigan Shut-In Oil Royalty from my assistance.

If you already possess a US Legal Forms profile, it is possible to log in and then click the Acquire button. Afterward, it is possible to comprehensive, revise, printing, or indication the Michigan Shut-In Oil Royalty. Each legal document template you get is your own eternally. To have another backup for any bought form, go to the My Forms tab and then click the related button.

If you use the US Legal Forms site the first time, follow the straightforward guidelines beneath:

- Initially, make sure that you have chosen the correct document template for the state/metropolis of your choice. See the form outline to make sure you have picked out the appropriate form. If accessible, utilize the Review button to appear with the document template as well.

- In order to find another variation in the form, utilize the Look for area to discover the template that meets your needs and demands.

- Once you have discovered the template you need, click on Purchase now to continue.

- Choose the costs plan you need, enter your qualifications, and register for your account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal profile to fund the legal form.

- Choose the format in the document and download it for your product.

- Make alterations for your document if required. You may comprehensive, revise and indication and printing Michigan Shut-In Oil Royalty.

Acquire and printing a large number of document templates making use of the US Legal Forms web site, which offers the biggest variety of legal forms. Use expert and condition-distinct templates to tackle your company or personal requires.

Form popularity

FAQ

Mineral rights can expire if the owner does not renew them or if they go unclaimed for a certain period of time. Mineral rights can also be sold, fractionalized, or transferred through gifting or inheritance.

The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations. Types of Leases: There are different types of oil and gas leases, and they affect royalty calculations differently.

As the landowner, you own both your land and the minerals beneath your land. Therefore you have the right to negotiate an acceptable lease or to refuse an offer, unless the mineral rights were severed from the surface rights by a previous owner and were never purchased by you.

Transfer by deed. If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

The Dormant Mineral Act provides that any interest in oil or gas in any land owned by any person other than the surface owner that has not been sold, leased, mortgaged, or transferred by an instrument recorded in the office of the register of deeds for 20 years is deemed abandoned if (1) a drilling permit is not ...

A clause in an oil & gas lease that allows a lessee to keep the lease in effect past the primary term by substituting payment of shut-in royalty for actual production.

Mineral rights ownership information can be found with the register of deeds in the county where the land is located.

The Dormant Mineral Act provides that any interest in oil or gas in any land owned by any person other than the surface owner that has not been sold, leased, mortgaged, or transferred by an instrument recorded in the office of the register of deeds for 20 years is deemed abandoned if (1) a drilling permit is not ...