This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

Michigan Minimum Royalty Payments

Description

How to fill out Minimum Royalty Payments?

Are you presently inside a position the place you need to have documents for either company or person uses virtually every working day? There are a variety of lawful document web templates available on the Internet, but discovering ones you can rely on is not straightforward. US Legal Forms delivers 1000s of kind web templates, like the Michigan Minimum Royalty Payments, that are published to fulfill state and federal needs.

Should you be already knowledgeable about US Legal Forms website and have your account, merely log in. Following that, you are able to obtain the Michigan Minimum Royalty Payments web template.

Should you not come with an account and wish to begin to use US Legal Forms, abide by these steps:

- Get the kind you require and ensure it is to the proper area/region.

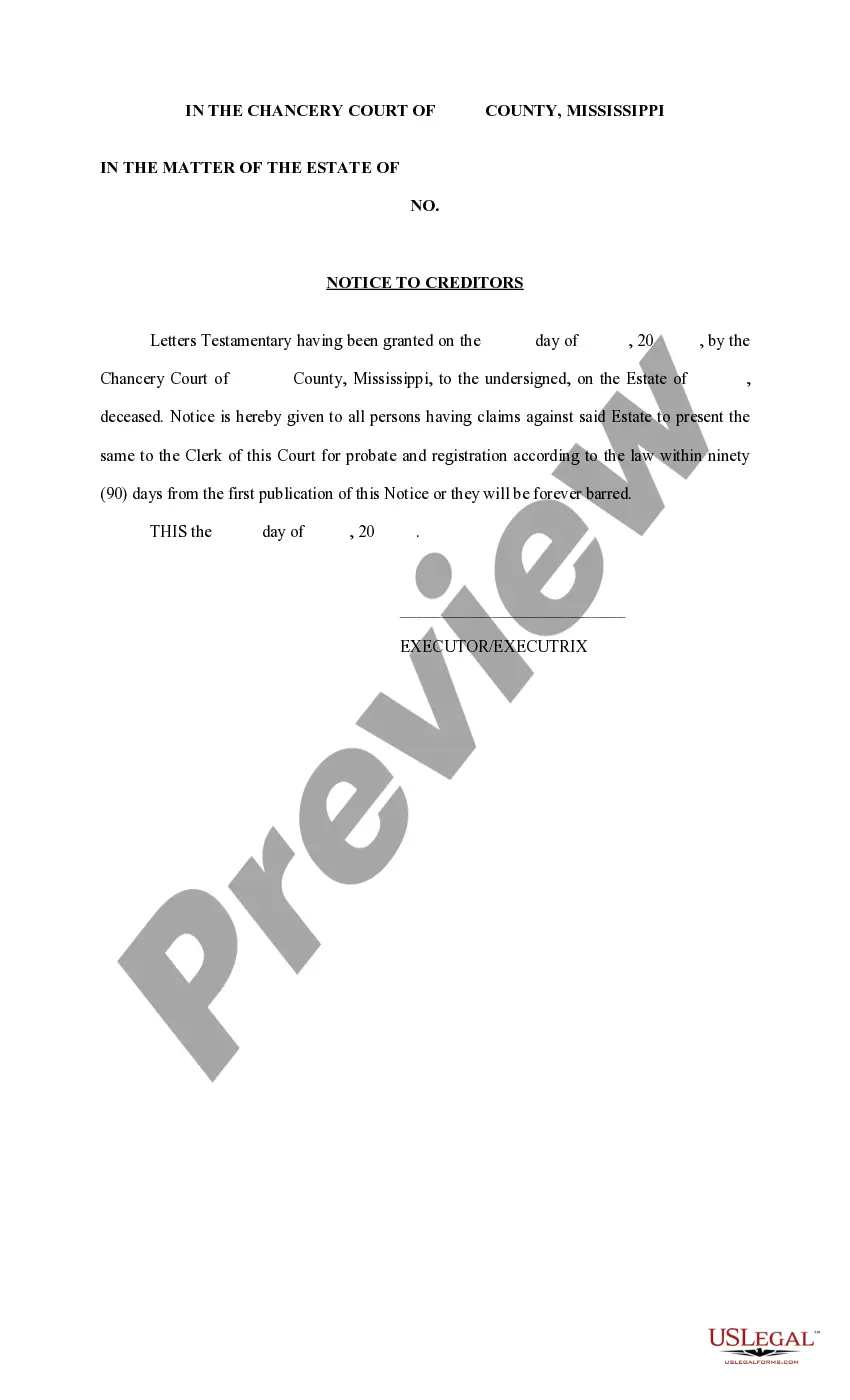

- Take advantage of the Review option to analyze the form.

- Browse the explanation to actually have selected the proper kind.

- When the kind is not what you are searching for, use the Research field to obtain the kind that fits your needs and needs.

- Once you get the proper kind, simply click Get now.

- Choose the pricing program you desire, fill in the desired information and facts to produce your bank account, and buy the transaction utilizing your PayPal or bank card.

- Pick a hassle-free file file format and obtain your backup.

Get each of the document web templates you possess purchased in the My Forms menus. You can get a extra backup of Michigan Minimum Royalty Payments whenever, if needed. Just go through the necessary kind to obtain or produce the document web template.

Use US Legal Forms, one of the most substantial selection of lawful varieties, in order to save time and prevent faults. The support delivers skillfully created lawful document web templates that can be used for a variety of uses. Generate your account on US Legal Forms and begin producing your life a little easier.