Michigan Drafting Agreement - Self-Employed Independent Contractor

Description

How to fill out Drafting Agreement - Self-Employed Independent Contractor?

It is feasible to spend numerous hours online searching for the legitimate document format that meets the federal and state requirements you desire.

US Legal Forms offers thousands of legal templates that are reviewed by experts. You can easily download or print the Michigan Drafting Agreement - Self-Employed Independent Contractor from the platform.

If you already have a US Legal Forms account, you can Log In and click on the Acquire button. After that, you can fill out, modify, print, or sign the Michigan Drafting Agreement - Self-Employed Independent Contractor. Each legal document format you obtain is yours permanently. To get another copy of the purchased form, go to the My documents section and click on the corresponding button.

Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can fill out, modify, sign, and print the Michigan Drafting Agreement - Self-Employed Independent Contractor. Obtain and print thousands of document templates using the US Legal Forms site, which provides the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document format for your area/city of preference. Review the form summary to confirm you have selected the right form.

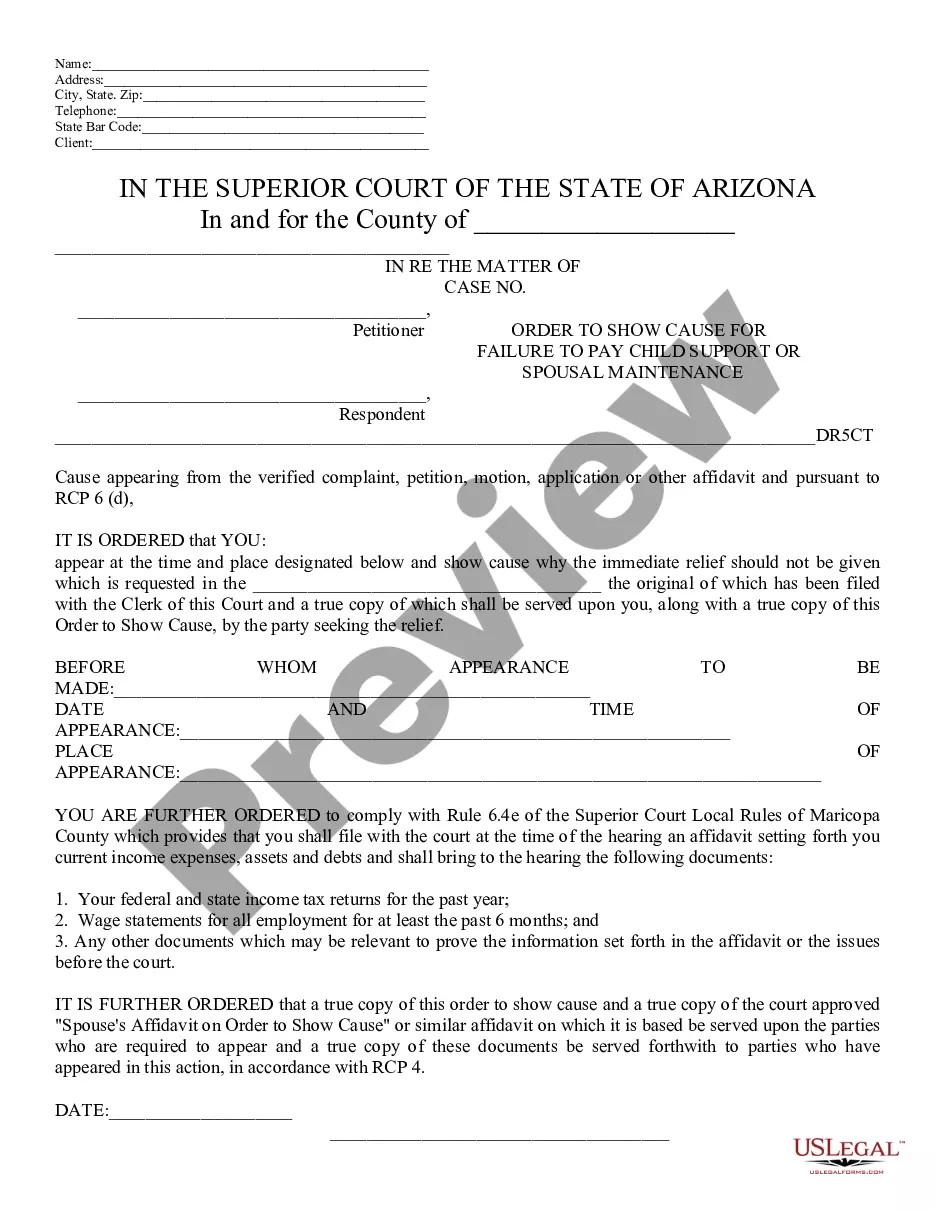

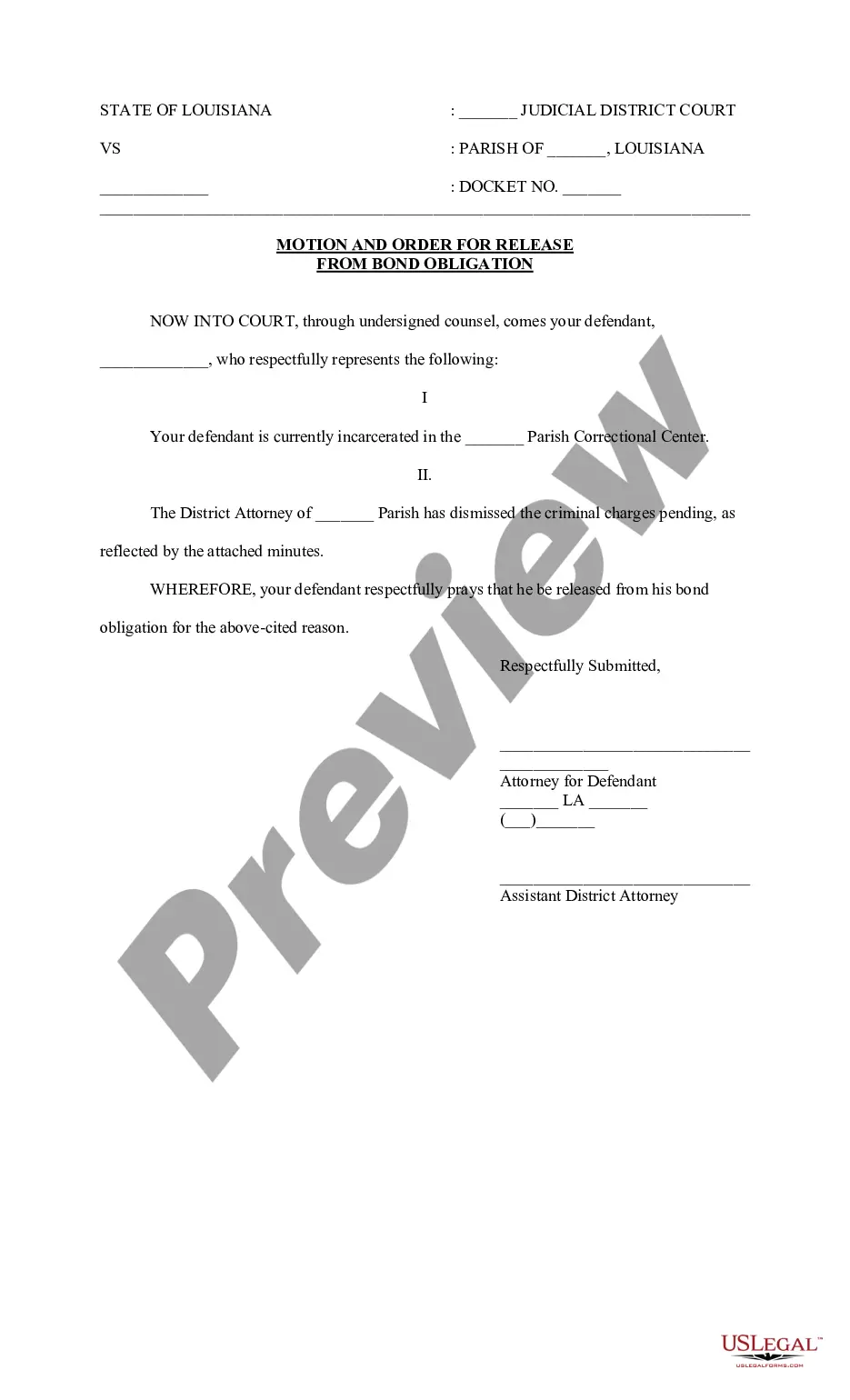

- If available, use the Preview button to glance at the document format as well.

- If you wish to obtain another version of the form, utilize the Search box to locate the format that meets your needs and requirements.

- Once you have found the format you require, click Get now to proceed.

- Select the payment plan you desire, enter your details, and create an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

Yes, you can write your own legally binding contract as long as you include essential elements. These elements typically include an offer, acceptance, consideration, and mutual agreement on the terms. However, it’s crucial to ensure that the contract complies with Michigan laws and adequately protects your interests. Tools such as the Michigan Drafting Agreement - Self-Employed Independent Contractor from US Legal Forms can guide you through this process and ensure the document is valid.

Creating an independent contractor agreement requires clear understanding of the terms of work. First, outline the scope of work, including specific tasks and deadlines. Next, define payment terms and any relevant conditions, such as confidentiality or non-compete clauses. For a comprehensive and legally sound agreement, consider using resources like the Michigan Drafting Agreement - Self-Employed Independent Contractor from US Legal Forms.

When filling out an independent contractor agreement, clearly state the names and addresses of both the contractor and the client at the top. Then, describe the services to be provided and include the payment terms. Finally, both parties should sign the document to finalize the Michigan Drafting Agreement - Self-Employed Independent Contractor, ensuring that the agreement is legally binding.

To write an independent contractor agreement, begin by defining the roles and responsibilities of both parties. Include important clauses such as payment amounts, deadlines, and confidentiality terms. By creating a comprehensive Michigan Drafting Agreement - Self-Employed Independent Contractor, you protect your interests and provide clear expectations for the work to be completed.

An independent contractor in Michigan typically needs to complete a W-9 form, which provides taxpayer information to the client. Additionally, having a clear Michigan Drafting Agreement - Self-Employed Independent Contractor is vital, detailing the nature of the work, payment terms, and project timelines. This paperwork ensures both parties understand their rights and responsibilities.

To fill out an independent contractor form in Michigan, start by providing your personal information, including your name and address. Next, outline the scope of work you will perform and the payment terms you agree upon. Finally, ensure you sign and date the document to validate the Michigan Drafting Agreement - Self-Employed Independent Contractor.

Writing an independent contractor agreement involves outlining the specific terms of the working relationship, including project details and compensation. It's beneficial to start with a template that addresses key elements like confidentiality and dispute resolution. By using a Michigan Drafting Agreement - Self-Employed Independent Contractor from uslegalforms, you can ensure your agreement is comprehensive and legally sound, reducing the chances of misunderstanding.

In Michigan, an independent contractor agreement functions similarly to agreements in other states but must comply with local laws. This document specifies the arrangement between the contractor and the client, covering key areas like deliverables and payment expectations. Crafting a Michigan Drafting Agreement - Self-Employed Independent Contractor specifically tailored to state guidelines ensures legitimacy and reliability.

An independent contractor must earn at least $600 within a tax year to qualify for a 1099 form, allowing the IRS to track their earnings. It is crucial for contractors to keep detailed records of their income. Utilizing a Michigan Drafting Agreement - Self-Employed Independent Contractor can also help clarify payment terms to ensure accurate reporting come tax season.

Recently, federal regulations regarding independent contractors have changed, affecting how these workers are classified. Businesses must now carefully evaluate the relationship they have with their contractors to ensure compliance. Understanding this through a Michigan Drafting Agreement - Self-Employed Independent Contractor can help freelancers and businesses maintain a proper working relationship without misclassification.