Michigan Shareholder Agreements - An Overview

Description

How to fill out Shareholder Agreements - An Overview?

Choosing the best lawful document design might be a struggle. Needless to say, there are a variety of layouts available on the net, but how would you get the lawful form you need? Take advantage of the US Legal Forms web site. The support gives 1000s of layouts, for example the Michigan Shareholder Agreements - An Overview, which you can use for company and private requirements. Each of the types are examined by specialists and satisfy state and federal demands.

In case you are already registered, log in in your accounts and click on the Obtain option to find the Michigan Shareholder Agreements - An Overview. Make use of accounts to appear throughout the lawful types you might have bought earlier. Go to the My Forms tab of your own accounts and get an additional backup of the document you need.

In case you are a brand new consumer of US Legal Forms, allow me to share easy recommendations that you should adhere to:

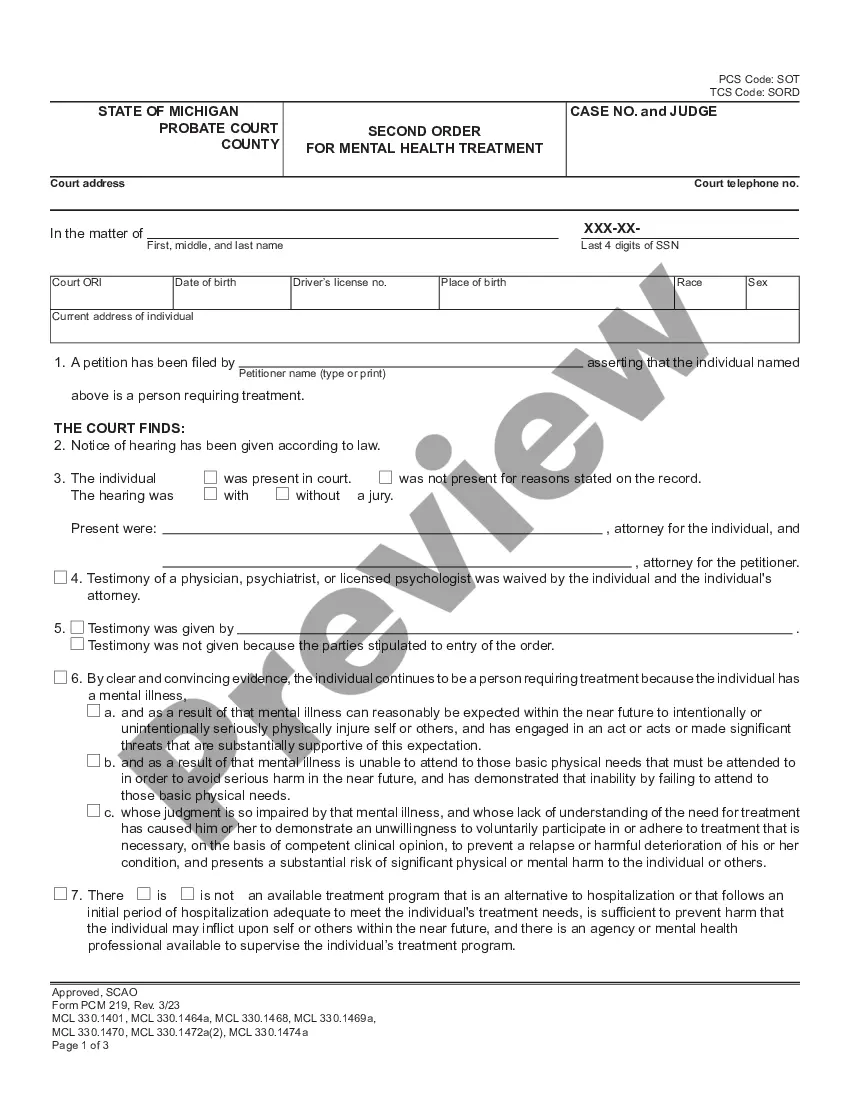

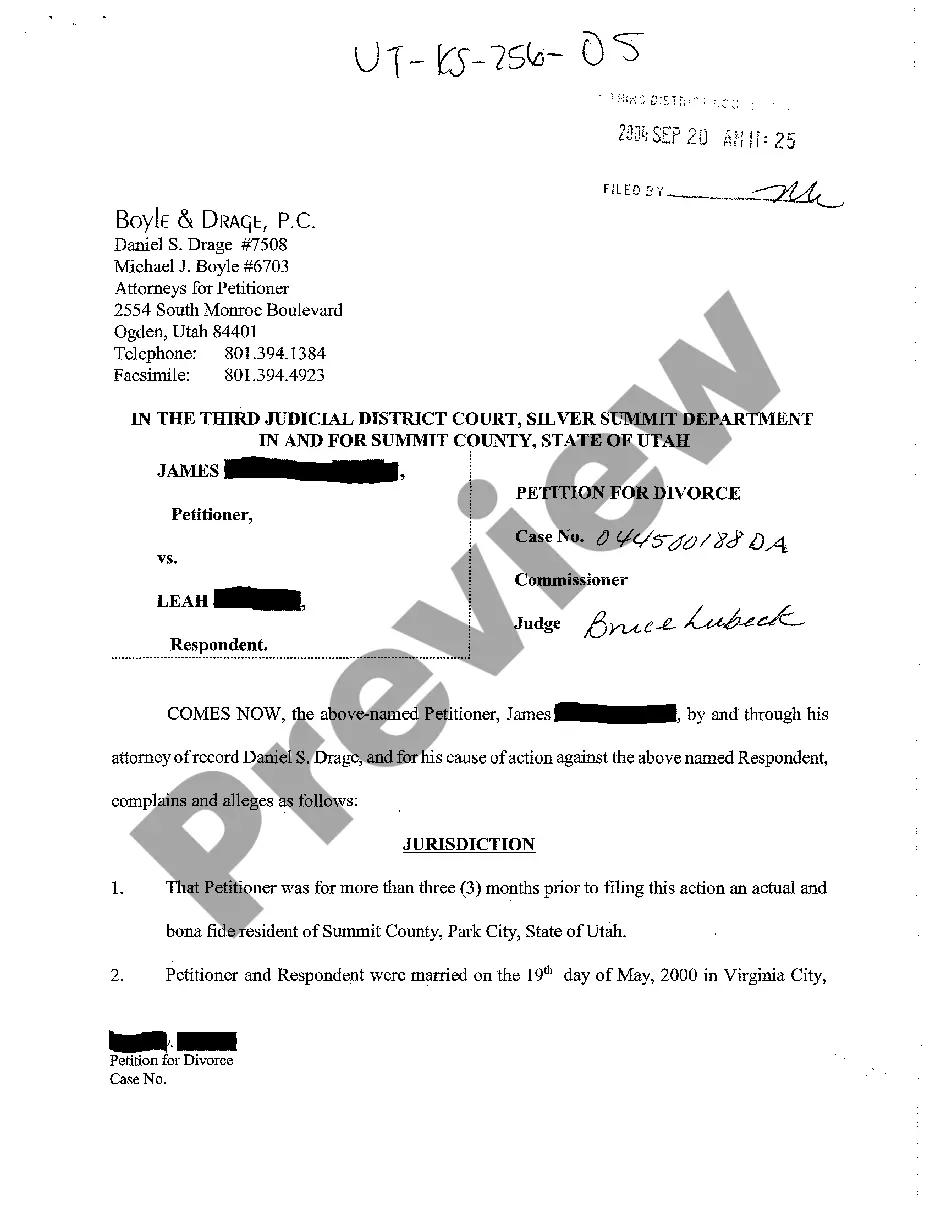

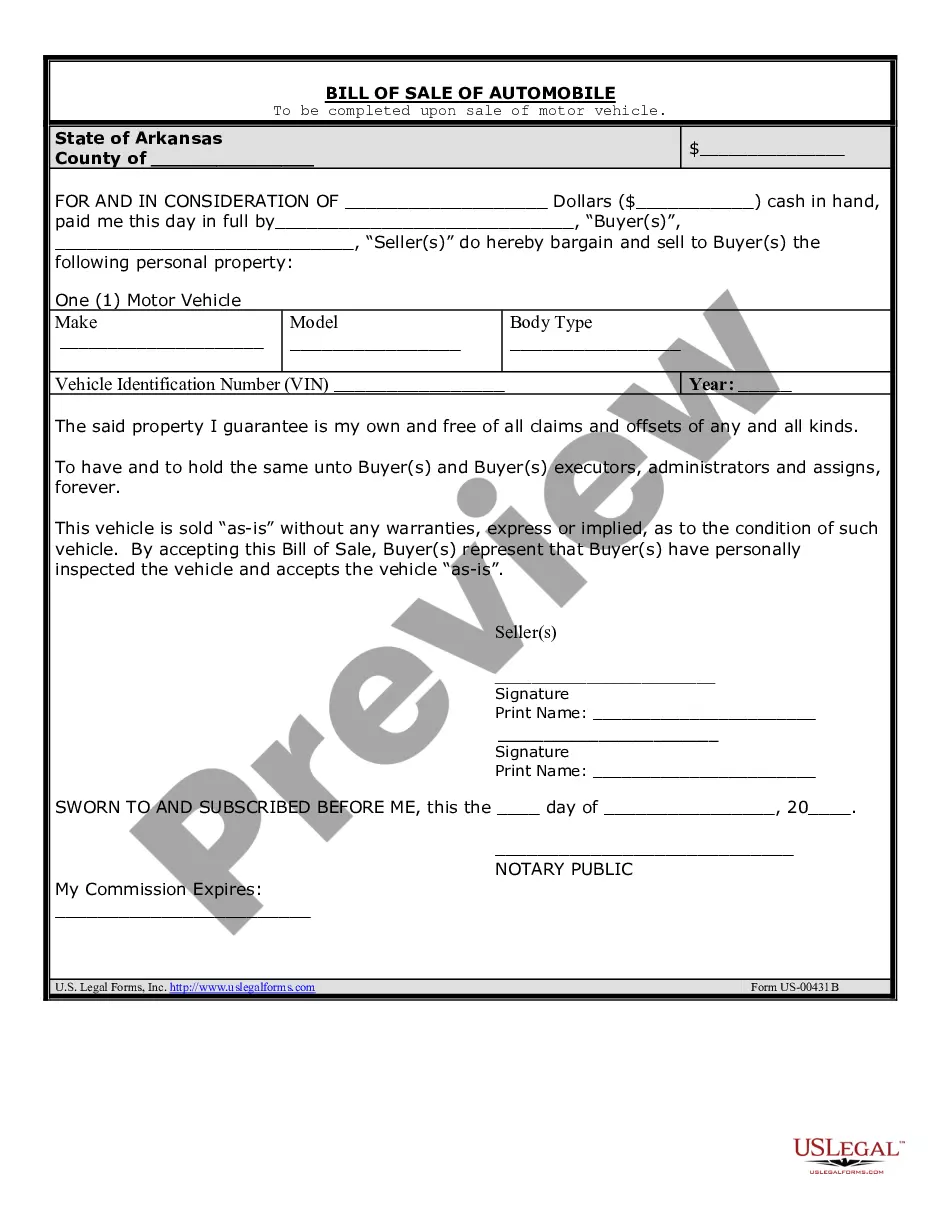

- Initial, be sure you have selected the correct form for your personal city/state. It is possible to look over the form using the Review option and look at the form description to guarantee it is the best for you.

- In the event the form fails to satisfy your expectations, take advantage of the Seach industry to obtain the proper form.

- When you are certain that the form is suitable, click on the Purchase now option to find the form.

- Choose the pricing plan you need and enter in the needed information. Create your accounts and purchase an order with your PayPal accounts or credit card.

- Opt for the document format and download the lawful document design in your device.

- Comprehensive, modify and produce and indication the received Michigan Shareholder Agreements - An Overview.

US Legal Forms is definitely the most significant collection of lawful types for which you can find a variety of document layouts. Take advantage of the service to download expertly-produced documents that adhere to status demands.

Form popularity

FAQ

Operation and management of the company. ... The Board of Directors and rights to appoint another Director. ... Share transfers (Pre-emptive rights and drag along / tag along) ... Protection of the business' interests (restraint provisions) ... Deadlocks and disputes. ... Meetings of the Board and Shareholders. ... Decision making.

They typically consist of provisions on: notices and how they are to be sent; severability as to illegal or unenforceable terms and rectification; how the SHA may be amended (unanimity, majority or supermajority); governing law; dispute resolution; merger and integration that makes the SHA the final manifestation of ...

Pre-emptive rights and right of first refusal clause These clauses protect existing shareholders from the involuntary dilution of their stake in the company. Pre-emption rights provide the company's existing shareholders first offer on an issue of new shares; or first refusal over the sale of existing shares.

A shareholders' agreement is an arrangement among a company's shareholders that describes how the company should be operated and outlines shareholders' rights and obligations. The shareholders' agreement is intended to make sure that shareholders are treated fairly and that their rights are protected.

A shareholders' agreement includes a date; often the number of shares issued; a capitalization table that outlines shareholders and their percentage ownership; any restrictions on transferring shares; pre-emptive rights for current shareholders to purchase shares to maintain ownership percentages (for example, in the ...

The shareholders' agreement should specify the chosen dispute resolution mechanism, the process for initiating the dispute resolution, and the forum for the resolution of the dispute. The agreement should also specify the law that will govern the agreement and the dispute resolution process.

The shareholders agreement should set out matters that are reserved for the board and those matters that will require shareholder approval. It will also set out the level of majority required to pass a particular resolution. Decisions reserved for the board typically relate to the day?to?day management of the company.

Set out below are the most common types of clauses we see in shareholders agreements. Director and Management Structure. ... Buy-Sell Provisions. ... Financing. ... Share Transfer Restrictions. ... Dispute Resolution. ... Confidentiality. ... Company Contracts. ... Meetings of Directors and/or Shareholders.

Restrictions on Transfers and Ownership of Shares Restrictions on who can become a shareholder is an important aspect of a shareholders' agreement. Especially in smaller businesses, it is important to have shareholders who get along with each other and can make decisions together regarding the business.

Exit Strategy: The agreement should include an exit strategy for each shareholder, including what happens if a shareholder wants to sell their shares, retire or die. Dispute Resolution: The agreement should outline a process for resolving disputes between shareholders, such as mediation or arbitration.