Michigan Accredited Investor Suitability

Description

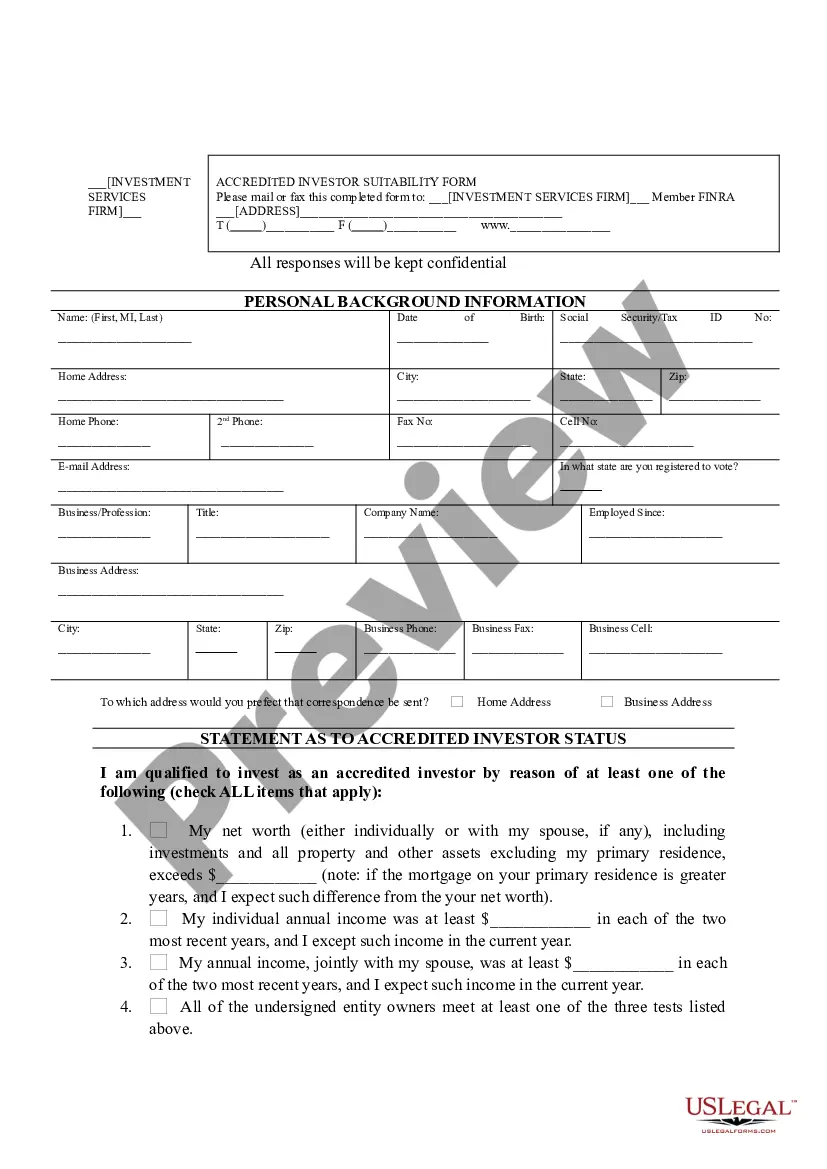

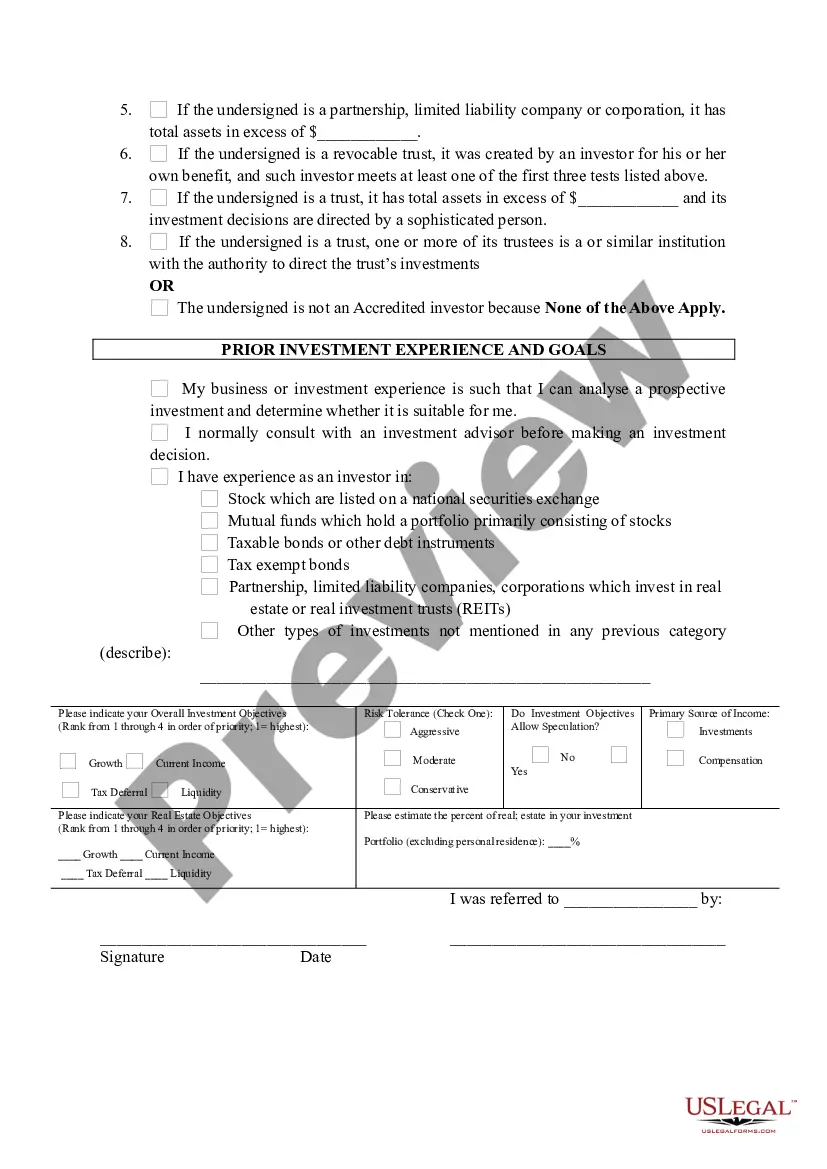

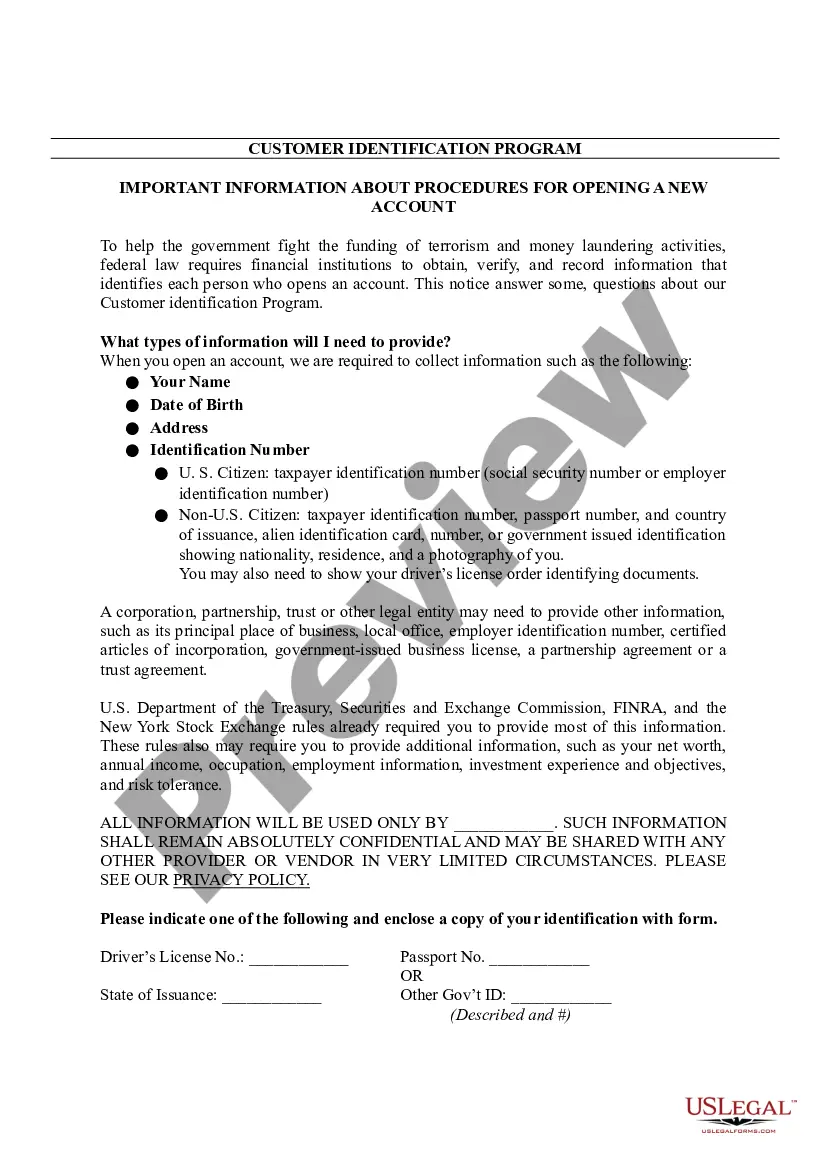

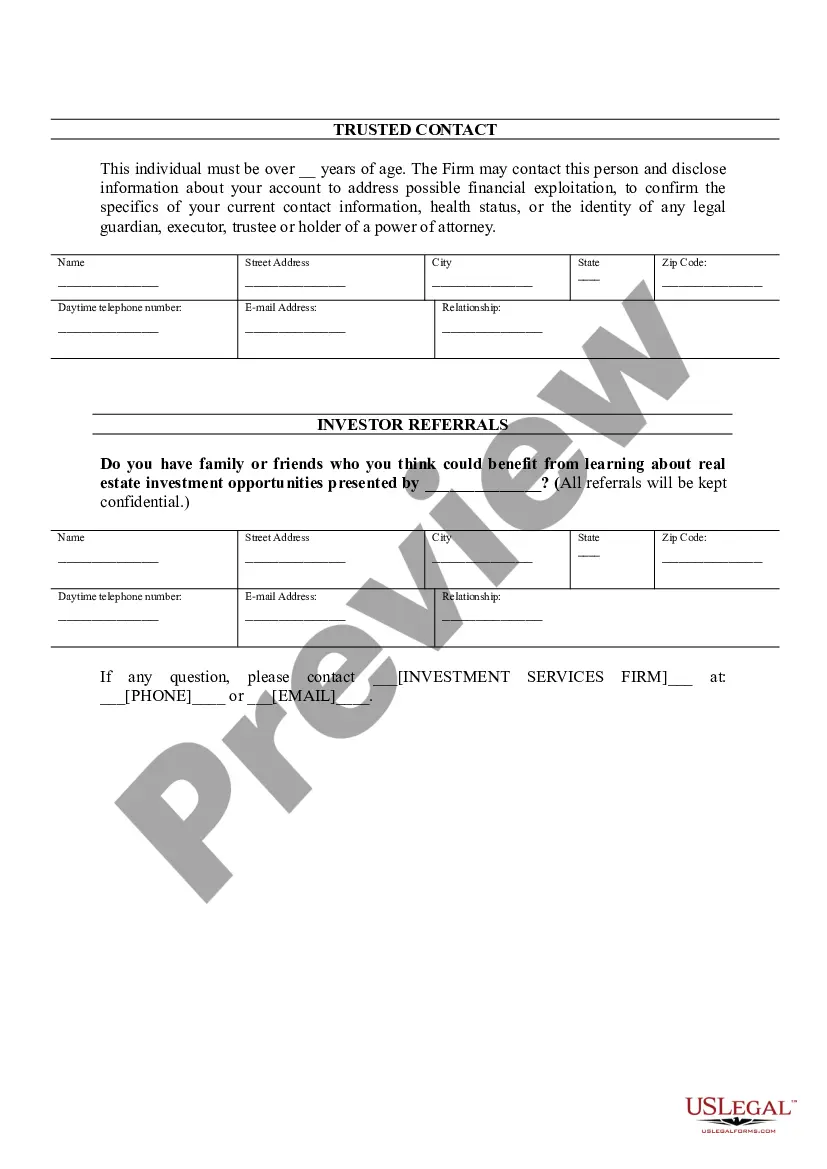

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

You may devote several hours on-line attempting to find the legitimate document web template that meets the state and federal requirements you require. US Legal Forms supplies thousands of legitimate kinds that are examined by experts. It is possible to download or print out the Michigan Accredited Investor Suitability from your services.

If you have a US Legal Forms bank account, you can log in and then click the Acquire option. After that, you can comprehensive, edit, print out, or indicator the Michigan Accredited Investor Suitability. Every single legitimate document web template you purchase is your own permanently. To get another duplicate for any obtained develop, check out the My Forms tab and then click the related option.

If you use the US Legal Forms web site for the first time, adhere to the straightforward guidelines listed below:

- Very first, be sure that you have chosen the best document web template for the area/town of your choice. Look at the develop outline to make sure you have picked the proper develop. If offered, take advantage of the Preview option to look from the document web template too.

- If you wish to locate another variation of the develop, take advantage of the Research industry to find the web template that fits your needs and requirements.

- Once you have discovered the web template you would like, just click Acquire now to move forward.

- Pick the prices plan you would like, enter your accreditations, and register for an account on US Legal Forms.

- Full the deal. You should use your Visa or Mastercard or PayPal bank account to cover the legitimate develop.

- Pick the structure of the document and download it to your product.

- Make modifications to your document if necessary. You may comprehensive, edit and indicator and print out Michigan Accredited Investor Suitability.

Acquire and print out thousands of document themes utilizing the US Legal Forms website, which provides the biggest variety of legitimate kinds. Use specialist and condition-certain themes to deal with your small business or individual needs.

Form popularity

FAQ

For the net worth test, you (or you and a spouse or spousal equivalent) must show enough assets to evidence a net worth of at least $1,000,000 USD ignoring the value of your primary residence and after discounting all your other liabilities (including liabilities exceeding the value of your primary residence and ...

Requirements to Be an Accredited Investor A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Accredited Individual Investor ? By Income IR8A/income tax form declaring personal income not less than S$300,000 (or an equivalent document) A copy of employment letter/contract stating position and income, salary payslip, and bank statement recording such income.

How to invest without being an accredited investor requires only that the investor has a net worth of less than $1 million. This includes the net worth of his or her spouse. The investor must also have earned $200,000 or more annually for the last two years.

To qualify as an accredited investor, you must have over $1 million in net worth, or more than $200,000 in earned income in the past two calendar years, with the expectation of the same earnings. Financial professionals with Series 7, 65 or 82 licenses also qualify.

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

The series 65 is an exam administered by the Financial Industry Regulatory Authority (FINRA) and provides individuals' license to act as investment advisers in the U.S. After you pass the test and receive your license, you also need to be in ?good standing? to meet the accredited investor definition as per the SEC.